While Ardmore Shipping (NYSE:ASC) has returned about 5% since my last write-up in May, the stock is still down -15% since my initial write-up in April. Let’s catch up on the name and how product tanker spot rates are holding up.

Company Profile

As a refresher, ASC operates a fleet of 27 mid-sized refined products and chemical tankers. It owns 20 vessels, leases two, operates one ship under a commercial management agreement, and has four vessels under time charter-in contracts. It has 20 MR tankers in operation and 6 chemical tankers, while the vessel it manages is also a chemical tanker

Of the vessels it owns, 19 are built with an eco-design to improve fuel efficiency, while the other ship was upgraded to an eco-mod design in 2014. The average age of the ships it owns is just over 9 years.

Q2 Results

For the quarter, the company reported a -14% decrease in revenue from $107.1 million a year ago to $91.9 million. The company operated one more vessel a year ago. Analysts were looking for revenue of only $60.9 million.

ASC recorded adjusted EPS of 57 cents, topping the consensus by 2 cents. Adjusted earnings were 81 cents in the prior-year period.

Adjusted EBITDA for the quarter came in at $35.0 million, down from $42.3 million a year ago.

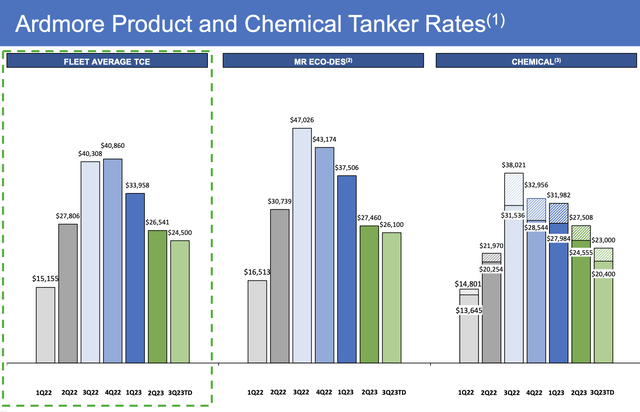

The average time charter equivalent (TCE) rate for the firm’s fleet was $26,541 per day, down -4.5% from $27,806 per day a year ago. In Q1, the TCE rate was $33,958 per day, 28% higher than in Q2.

The company’s MR Eco-Design tankers earned $27,456 a day in Q2, while on a capital adjusted basis its chemical tankers earned $27,555 a day in the quarter. Cash breakeven is $14,000 a day.

Company Presentation

The average number of operating vessels for the quarter was 26 compared to 27 a year ago. ASC had 12 drydocking days in the quarter.

Voyage expenses were down -23.5% to $31.5 million. Lower bunker prices accounted for 65% of the decrease, while less spot revenue days accounted for the rest.

ASC generated $42.1 million in operating cash flow in the quarter. It ended the quarter with net debt of $109.6 million, down from $323.1 million a year ago.

The company announced a quarterly dividend of 19 cents per share. Its policy is to pay out a third of its adjusted earnings as dividends, which it thinks will be sustainable through the shipping cycle. The dividend will be paid on September 15th to shareholders of record on August 31st.

With ASC booking about 50% of its rates at much higher levels when it discussed its outlook last quarter, TCE rates for both MR and chemical tankers continued to feel pressure in the quarter, hurt by increased refinery turnaround activity late in the quarter. Lower bunker fuel costs helped mitigate some of that, but overall results were down both year over year and sequentially. That said, the company has used the spot market’s strength over the past year to greatly reduce its debt, setting itself up nicely when the market improves.

Outlook

ASC said that for Q3 it has fixed approximately 45% of its total MR tanker revenue days at an average TCE rate of approximately $26,100 per day. Its chemical tankers are 63% booked at a rate of $23,000 per day.

The company expects 89 drydocking days in Q3.

Discussing the company’s outlook on its Q2 earnings call, CEO Anthony Gurnee said:

“Our entire fleet is exposed to the spot market, including our time charter in vessels, allowing Ardmore to fully capture the benefits of the elevated market and seasonal strength we anticipate in the coming months. … The near-term outlook continues to be very positive. Based on existing and anticipated conditions, we expect the market to build through the second half of the year. The EU embargo is continuing to positively impact the charter market with the reordering of trade, adding significantly to tonne miles. Notably, an increased number of product tankers carrying Russian cargo resulting in fewer ships trading in the global fleet, we believe this bifurcation of trade is persistent and ultimately creates more inefficiencies in the product tanker market, thus supporting stronger rates. In addition, near-term demand drivers are robust. Global oil demand is forecast to grow by 2% this year with a lot of that coming in the second half. Refineries around the world are ramping back up following above-normal maintenance activity. And we’re seeing resilience in U.S. refined product exports and believe that product exports from China will also increase in the second half. … EU diesel inventory is built up ahead of the implementation of the embargo in February of this year. And as a consequence, imports subsequently declined as these stocks have run off. As inventory levels now normalize, we believe that product tanker tonne-mile demand from this important region is poised to increase significantly, particularly given that EU product imports are now sourced very far away as compared to before the war.”

Q2 likely marked the near-term bottom for product tanker rates, as the Baltic Clean Tanker Index has soared off its June and July lows. The Atlantic trade has helped fuel results, as U.S. gasoline inventories were falling ahead of peak driving season. Throw in stockpiled European inventories running off and China reopening, as well as the continued disruptions from the Russian embargo, and ASC should see stronger TCE rates in Q3 and beyond.

Investing.com

Note, however, that it does have a significant amount of expected drydocking days in Q3, which will negatively impact results compared to Q1 and Q2. The company had no drydock days a year ago in Q3, and rates were very strong, so the year-over-year comparison will be a tough one.

Valuation

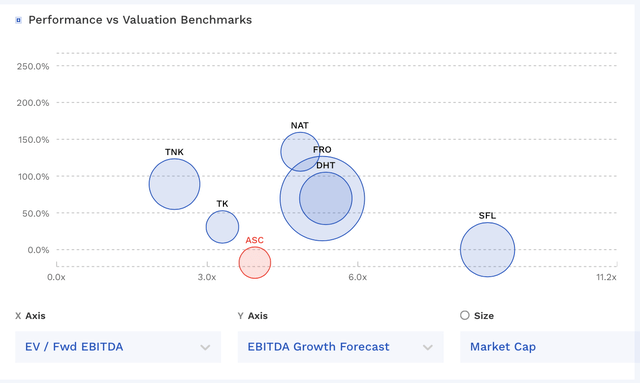

ASC trades at 3.9x the 2023 EBITDA of $158.1 million and 4.4x the 2024 EBITDA consensus of $139.5 million.

On a PE basis, it trades at 4.6x EPS estimates of $2.73. Based on the 2024 consensus for EPS of $2.31, it trades at 5.4x.

ASC stock trades towards the lower end of other marine shipping companies.

ASC Valuation Vs Peers (FinBox)

Conclusion

With product tanker rates looking like they have troughed in the June-July period, ASC looks well positioned to benefit from stronger rates moving forward, although a larger amount of drydocking days in Q3 and Q4 will mute results somewhat. The company has said that a $10,000 per day increase in TCE rates equals about $95 million in free cash flow. With the Baltic Clean Index up about 25% from Q2 levels and spot rates for MR product tankers hitting a 4-month high in mid-August, the company should see considerably better results in the second half compared to Q2.

Given that ASC pays a variable dividend, I would expect a similar payout in Q3 to the 19-cents it paid out based on its Q2 results, and a higher payment in Q4. It will lose the equivalent of one ship due to drydocking days, or about $1.3 million in adjusted EBITDA, but the higher rates should offset that, especially in Q4 if the momentum continues.

Trading at mid-single digit valuations based on EV/EBITDA and PE, I think ASC looks attractively priced given the current rebound in the spot market. I continue to rate the stock a “Buy.”

Read the full article here