Written by Nick Ackerman, co-produced by Stanford Chemist.

The Calamos Long/Short Equity & Dynamic Income Trust (CPZ) does exactly as its name would imply. The fund takes both long and short positions while also incorporating fixed-income exposure dynamically. This approach is designed to be a more defensive fund and could be a fund worth taking some tactical positions in. The discount certainly doesn’t hurt either, as we are looking at a fund trading at quite a deep discount relative to its net asset value per share.

However, this long/short approach generally means that one side of the fund’s portfolio might be doing fine, but that nearly guarantees the other side is doing poorly. So a fund where it’s always winning but it’s always losing as well as what has generally kept me away. If you suspect the Calamos management can successfully navigate when they have to and time the market as they need to, then you may have a different opinion.

The Basics

- 1-Year Z-score: 0.04

- Discount: -12.84%

- Distribution Yield: 10.95%

- Expense Ratio: 1.96%

- Leverage: 25.73%

- Managed Assets: $466.45 million

- Structure: Term (anticipated liquidation date November 25, 2031)

CPZ’s investment objective is to “seek to provide current income and risk-managed capital appreciation.” They also add that the fund “seeks to provide hedged market exposure built around Calamos’ time-tested global long/short equity strategy.” The portfolio fit they mention, “the fund may be appropriate for risk-conscious investors who want to put capital to work in pursuit of income and capital appreciation.”

Given the fund’s strategy, it can be more complex to run the fund, which means a higher expense ratio. The fund also has to pay short position expenses, which include the dividends and interest expenses on those positions. When including the fund’s borrowing expenses, the fund’s total expense ratio goes up to 4.27%.

The fund’s leverage entire $120 million in debt is from the notes that get charged at OBFR plus 0.80%. At the end of April 30, 2023, that cost was 5.37%. OBFR is now up to 5.31% at the time of writing, bringing up the borrowing cost to 6.11%.

Performance – Always Winning, But Always Losing, Too

Given the fund’s approach, as would be expected to be the case, it generally means that one side of their portfolio is going to be lagging or the other. In this current climate, as the S&P 500 Index has performed strongly this year, the large short position against the SPDR S&P 500 ETF (SPY) certainly hasn’t been a major drag in terms of performance on the fund.

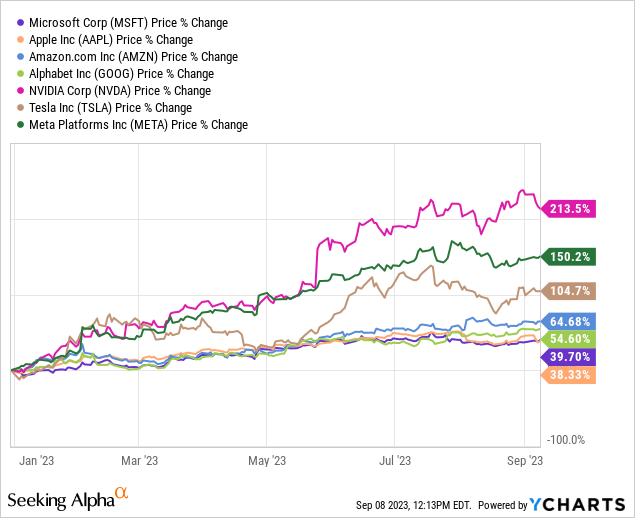

We know the largest driver of the broader market barometer results has been thanks to the mega-cap growth names called the Magnificent 7 this year. This Magnificent 7 includes the names Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Alphabet (GOOG), NVIDIA (NVDA), Tesla (TSLA) and Meta Platforms (META). On a YTD basis, these names have soared, which has driven most of the S&P 500’s performance. These names account for nearly 28% of the Index’s weightings.

Ycharts

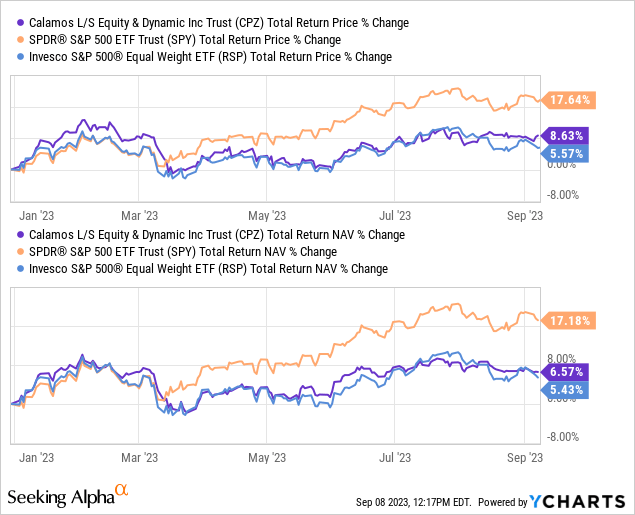

CPZ, to counteract being short the SPY and seeing that ETF return ~17% YTD, the fund is invested in several of the Magnificent 7 itself on the long side of its portfolio. Still, as we would anticipate, the results are going to be mediocre with this type of approach. It requires to be invested in the right way at the right time.

Here’s a look at the performance on a YTD basis between CPZ and SPY. However, what might also be interesting to include is the Invesco S&P 500 Equal Weight ETF (RSP). In this case, the fund’s performance certainly wouldn’t be too much of a letdown.

Ycharts

An additional aspect of the fund is the other defensive positioning in the fund. That would be a dynamic allocation to preferreds and debt investments. This weighting would also look to fluctuate between various security types in the fixed-income space, such as high yield, investment grade or syndicated loans.

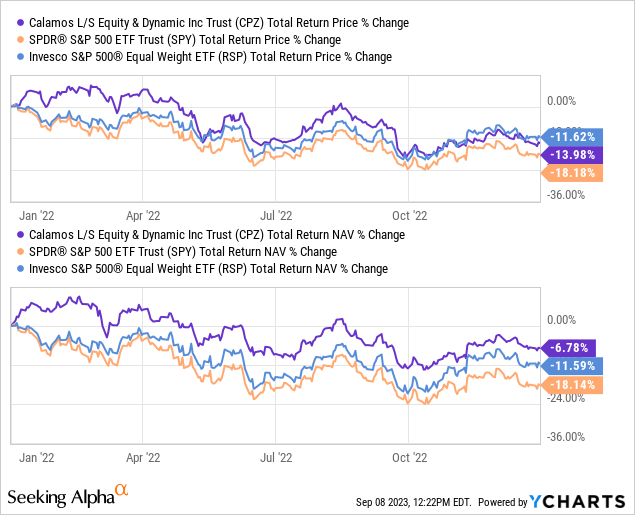

So we wouldn’t necessarily anticipate this fund to perform as well as the S&P 500 Index even if it didn’t have its short positions on. However, what it should do is provide a hedge during a bear market. 2022 is a perfect example of that; as we can see, CPZ did hold up significantly better than the SPY. However, we also see that RSP also dampened the results in a relatively respectable manner as well.

Ycharts

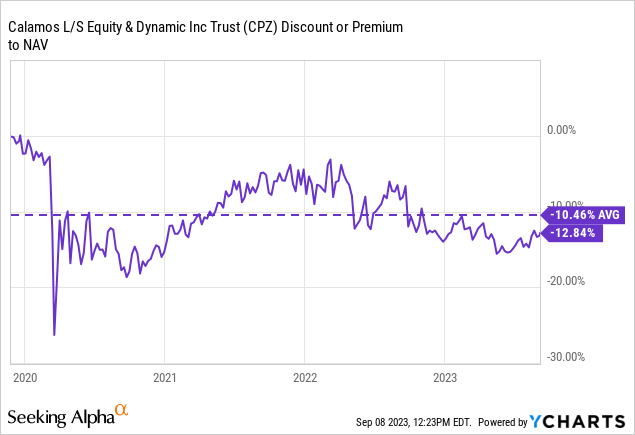

Where CPZ could get a leg up is also with its discount that the fund is currently trading at. Similar to CEFs across the board, the fund saw its discount widen through 2022 and into 2023. This was from the 2021 levels, where discounts were historically narrow. The fund currently sports a discount wider than its average discount since the fund’s launch.

Ycharts

Distribution – Attractive Rate, But Looking Elevated

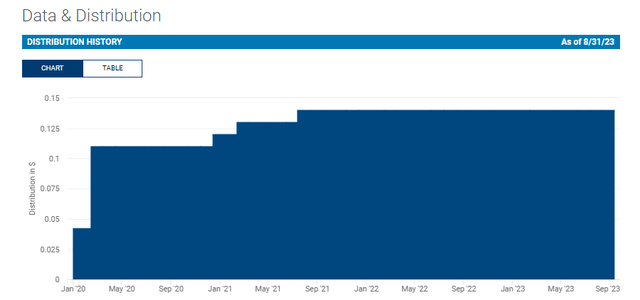

CPZ has been able to raise its distribution several times since its initial launch, so that’s certainly been positive for the fund. The cumulative amount paid out since the fund’s launch is $5.812.

CPZ Distribution History (Calamos)

The unfortunate news is this was mostly when times were better after the COVID-19 market crash. The distribution rate has risen to 10.95% on a market price basis. However, the fund’s NAV has also dropped since the fund’s launch, and that has now pushed the fund’s distribution rate on the NAV to 9.55%. This certainly isn’t the highest rate, even for a Calamos fund. That said, any fund that is invested heavily in equities with a near 10% rate should at least be seen with some skepticism that it can earn it going forward.

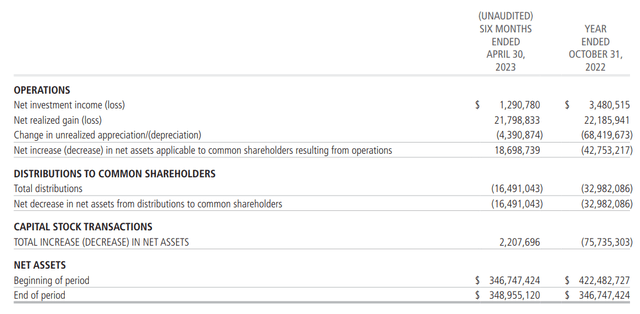

In their last semi-annual report, net investment income coverage came to 7.83%. That was slightly down from the 10.55% in the previous fiscal year due to rising borrowing costs.

CPZ Semi-Annual Report (Calamos)

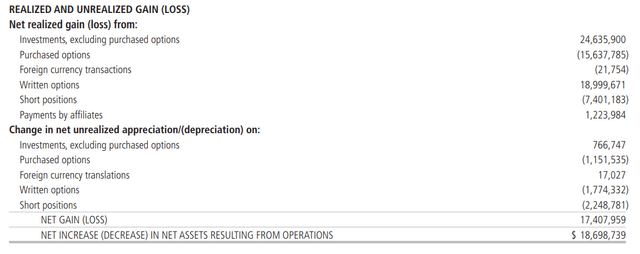

This means that the fund will require nearly the whole distribution to be covered with capital gains from their strategy. In the first six months of their latest fiscal year, we see that they had been able to realize some significant gains from their underlying long positions and form their written options strategy as well.

However, a large portion of those gains were offset by a sizeable amount of losses due to the options they purchased and their short positions. Therefore, when you put it all together, the fund had covered its distributions in the first half of the year, which is reflected in the NAV rising during this time. However, it also really reflects the notion that there is always one side winning, but that also means the other side of their portfolio is losing.

CPZ Realized/Unrealized Gains/Losses (Calamos)

For tax purposes in 2022, the fund has a mixture of ordinary income, short and long-term capital gains and return of capital distributions. A portion of the ordinary income was considered qualified, which is a positive for investors holding in a taxable account. However, this fund may be more appropriate for a tax-sheltered account.

CPZ’s Portfolio

As would be expected, there are a lot of different metrics to look at for this fund in terms of looking at its portfolio. Additionally, the fund’s turnover rate has been incredibly high over the years. In this last report, for a six-month period, the turnover rate came to 127%. Last fiscal year, it was 222%, and in fiscal 2021, the turnover rate came to 213%.

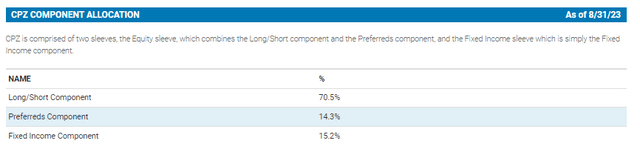

First, the fund is carrying more of its portfolio in its long/short strategy relative to the more minor weightings of the preferred and fixed-income exposure. This has been fairly normal since the fund’s launch.

CPZ Components Weighting (Calamos)

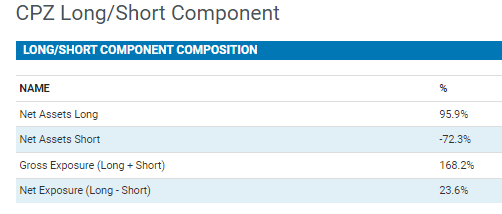

If we look at how long the fund is, they do tend to be more long than short, with a net exposure coming in at 23.6% at this time.

CPZ Long/Short Weighting (Calamos)

However, nearly a year ago, the fund’s net exposure was 51.8%. The last time we saw the weightings for this fund was last year, and the holdings were from October 31, 2022. That just so happened to coincide with when the market hit the lows.

So, fortunately, it would appear that they were less short previously. However, they have become increasingly shorter, meaning they have tended to trend more towards a bearish stance. This hasn’t worked out this year, depending on when they started to go even shorter.

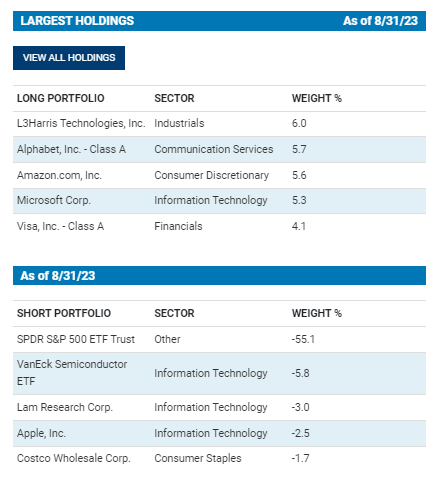

The largest position to their shorting strategy is the SPY. That seems to be their main tool in timing the market. Last October, they were short -22.9%, and we can see that’s exactly where it has been ramped up since.

CPZ Long/Short Top Five Weightings (Calamos)

At that time, though, they were also short the iShares Russel 2000 ETF (IWM) and SPDR S&P Oil & Gas Exploration & Production ETF (XOP). This year, we see that they are shorting VanEck Semiconductor ETF (SMH) but also shorting Lam Research (LRCX). Interestingly, they are also shorting AAPL well while being long a few of the other Magnificent 7 names: GOOG, AMZN and MSFT. Shorting AAPL is also like shorting SPY, so it’s basically just an indirect extension of that.

Visa (V) is also in there, and it was a large long position last year as well. GOOG was also in the portfolio as a long position last October 2022.

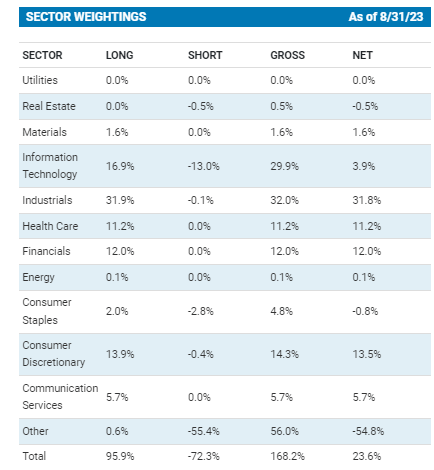

What might be interesting here is that despite the names we are seeing in terms of the fund’s largest holdings, the fund is actually significantly overweight to the industrial sector. Tech would be the second largest weighting, but for what they are long in terms of tech exposure, they are almost offsetting that entirely by being short.

CPZ Sector Weighting (Calamos)

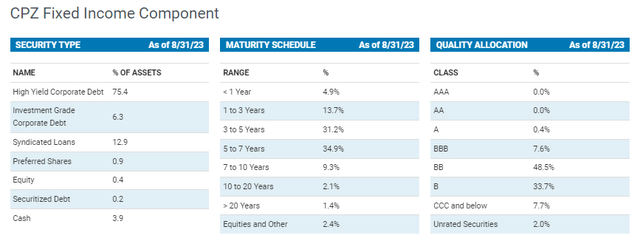

If we look at the fund’s fixed-income sleeve of its portfolio, it is mostly positioned in the high-yield debt space. Naturally, we see that means a relatively sizeable amount is on a short maturity while also carrying mostly BB and lower debt. In fact, one of the highlights in the fund’s latest fact sheet is that they have exposure to low duration, which generally comes from higher-yield debt instruments with shorter maturities.

CPZ Fixed-Income Stats (Calamos)

Conclusion

CPZ is a fairly unique fund with its long/short strategy. It isn’t the only fund to take this approach, but they all suffer from one of the same problems. That is, when one side of the portfolio is doing well, the other side could be doing poorly. The fund is designed to be more defensive and a hedge, so it really isn’t doing anything unexpected or out of character. This fund is put together exactly as advertised, but it is more of a fund that one would probably want to use in a more tactical manner rather than a long-term set-and-forget type of position.

Read the full article here