China’s economic worries are affecting some markets

As a commodity trading advisor and meteorologist, keeping a close eye on China is essential. I’m growing increasingly concerned about the economic headwinds facing the country. Their latest GDP numbers show growth screeching to a halt after harsh zero-COVID lockdowns. Between the deepening real estate crisis, rising inflation, and waning confidence in Beijing’s policies, China seems to be downshifting fast.

China’s long-term growth estimates have been lowered, and it’s clear the post-COVID rebound has fizzled out and resulting weakness could become entrenched.

With growth potentially slowing to just 1% by 2050, China’s economic challenges could really dampen global prospects as well. For us investors, it seems the heyday of explosive Chinese growth is likely over. Monitoring how Beijing manages this slowdown will be key going forward. While the US still faces its own demographic and debt challenges, China’s downturn shows that even emerging markets can rapidly lose steam.

The combination of investors running to safety and having Fed interest hikes mostly behind us, the U.S. dollar heads towards breaking over-head resistance. In addition, Chinese economic concerns weighed on the yuan, which fell to a 10-month low against the dollar.

Dollar breaks resistance on China economic woes and ideas US interest rates have peaked (WeatherWealth newsletter)

This is hurting many commodities and offsetting (for now) some bullish weather developments especially in cotton, cocoa, and potentially later this month-coffee and wheat.

One of my more consistent bullish weather plays this summer in options or futures (ETFs were retired) has been in cotton and cocoa. Of course, sugar, with global weather problems, is probably the most recent major bull weather move.

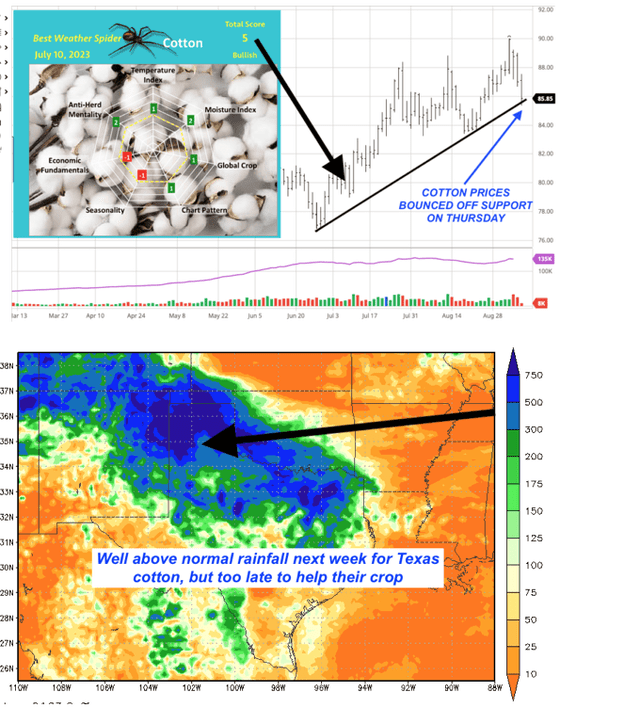

This is a very old cotton Weather Spider from July 10th. Since then, the economic fundamental score has gone to a (-4 which is very bearish) from (-1 which is slightly bearish) back in July. However, the global crop score has gone to (+3 reflecting a bullish shift) due to weather problems in NW India, the U.S., and now China.

Cotton fundamentals (WeatherWealth newsletter)

Rains for west Texas next week have also pressured cotton, but though it has helped create a psychological sell-off in this market, rains will do little to greatly help their crop. Following a great summer move due to weather problems, this market looks technically weak.

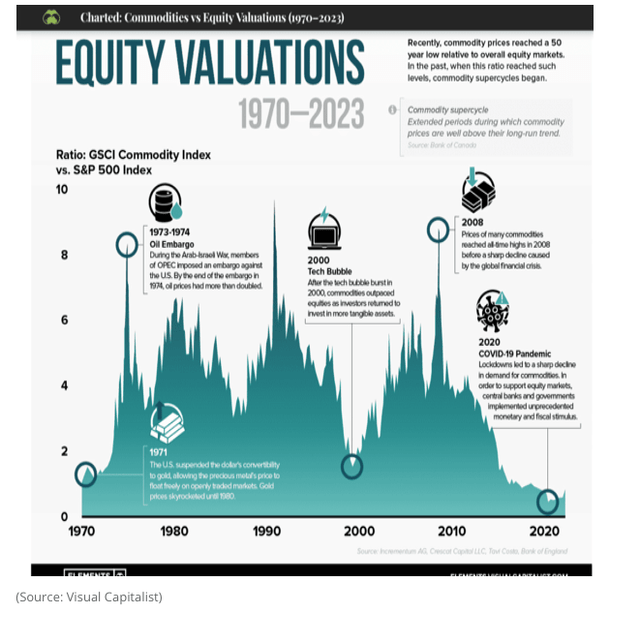

Many commodities are still historically cheap vs. equities

commodities vs equities (Visual Capitalist)

Yes, this is true, but we need to see more El Niño type weather problems and the dollar to weaken to see markets from soybeans to coffee, etc. rally.

Cocoa prices do have a chance to go to $4,000 by next year. Also, the weather will be super important in a few weeks for the coffee market. I address all of this in my newsletter.

What about South American weather and grains? Here, too, stay tuned. I do think there is a reasonable chance for wheat prices to rally this fall given the Australian drought and once the massive Russian wheat crop is finished hitting the market.

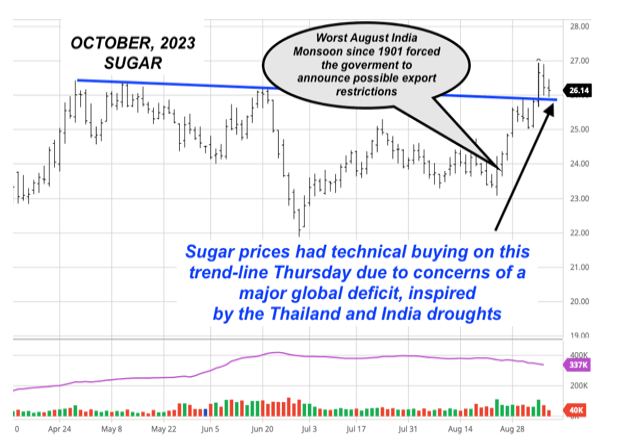

The biggest weather market: Sugar, so why are we recommending taking profits?

Sugar’s bull move on global weather problems and higher crude prices (WeatherWealth newsletter)

No question, a major SUGAR squeeze situation with lower India and Thailand crops and higher crude prices have helped sugar prices rally more than 20% this summer.

A few weeks ago, I wrote an SA article about my bullish feeling in sugar based on an expected major global sugar deficit and the worst August Indian Monsoon since 1901.

Big time rains are coming to India shortly. While It is possible the rains are too late to help the Indian sugar crop, the highs in sugar prices could be near. A lot depends on how the Indian government responds with export restrictions, or not in the coming months (a bit confusing for sure).

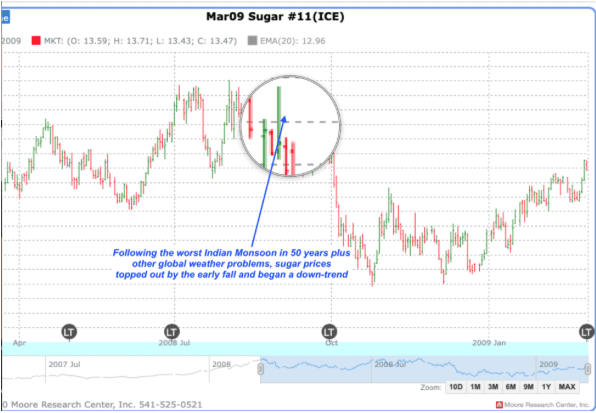

Notice how sugar prices topped out in the late summer-early fall, the last time India had a poor Monsoon (2009)

Last time sugar prices soared on a poor India Monsoon and El Nino (Barcharts/WeatherWealth newsletter)

Conclusion

Some soft commodity ETFs/ETNs, such as cotton (BAL), coffee (JO), and cocoa (NIB) were, unfortunately, retired last June. The sugar ETF (CANE), however, is active. If you followed my advice and bought this commodity a few weeks ago, I would take profits based on seasonality and the Indian drought easing somewhat.

Weather will remain friendly on breaks for cocoa due to El Niño, with the potential by October for weather problems for coffee and cotton. However, we need the dollar to ease somewhat and China economy to stabilize to warrant major bull markets.

Read the full article here