The inflation fantasy ended mid-July when the June CPI report printed at 3.0% year-over-year. The August report will serve as a reminder that the nightmare of dealing with inflation is not over, and each day that oil and gasoline prices rise, the worse it will get for September and October.

Unfortunately, stocks will have to learn the hard way that inflation ebbs and flows and that sticky core inflation has been telling us for months that the inflation problem was not over. Falling energy prices have driven the majority of the decline in headline inflation. Well, guess what? Gasoline and oil prices have gone from a disinflation tailwind to an inflationary tailwind as prices turn positive year-over-year. Therefore, the further these prices rise, the more additive it will be towards inflation going forward. There should be no surprise here; it was well-telegraphed by the market back in July and written about.

Bloomberg

A Surge In Headline CPI

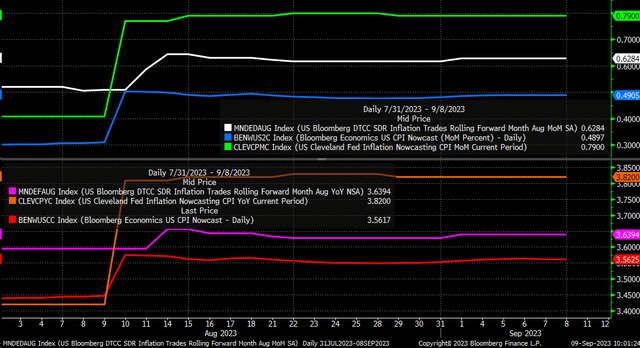

In August, analysts forecast the headline Consumer Price Index (CPI) to increase by 0.6% month-over-month (m/m), up from 0.2% in July. On a year-over-year (y/y) basis, it is expected to rise 3.6%, compared to July’s 3.2%. Meanwhile, Core CPI is expected to rise by 0.2% m/m, in line with July, while climbing by 4.3% y/y, down from 4.7%.

The market sees a chance that CPI comes in a bit hotter, and right now, it is pricing CPI at 3.64% y/y while rising by 0.63% m/m. Some models, such as those from Bloomberg Economics, forecast a 3.56% y/y and 0.5% m/m increase, while Cleveland Fed estimates a 3.8% y/y and 0.8% m/m increase.

Bloomberg

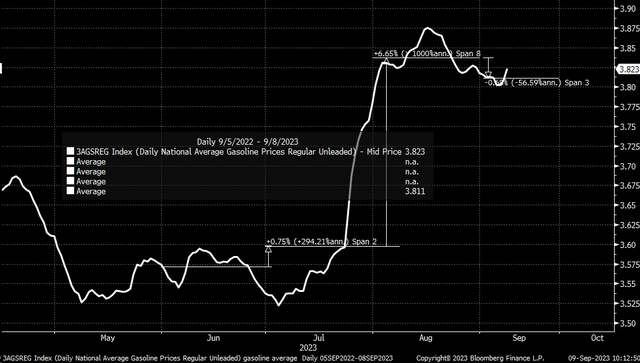

The rise in oil and gasoline is driving the inflation in August. Oil prices have surged in July and August, with the average price of the commodity jumping by almost 7.5% from July 31 to August 31.

Bloomberg

This has driven the average price of gasoline higher in August by 6.6%, which will add to inflation considering that gasoline carries a 3.41% weighting in the CPI report. This means that a rise in gasoline prices alone could have added a 0.2% bps increase to the month-over-month change in the August CPI report.

Bloomberg

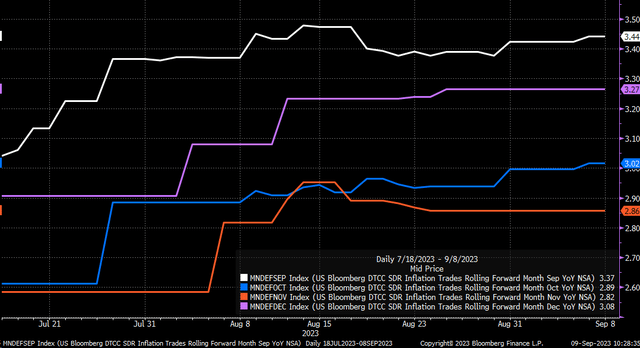

The Inflation Outlook Grows Worse

Swaps don’t see the outlook getting much better, and the problem is that the more gasoline and oil prices rise, the worse the inflation outlook gets. Currently, the swaps market sees inflation in September at 3.45%, up from 3.0% on July 18, while October has risen to 3.02% from 2.6%, November has risen to 2.86% from 2.61%, and December has risen to 3.27% from 2.91%. Generally speaking, the inflation outlook has gotten worse over the past two months, not better.

Bloomberg

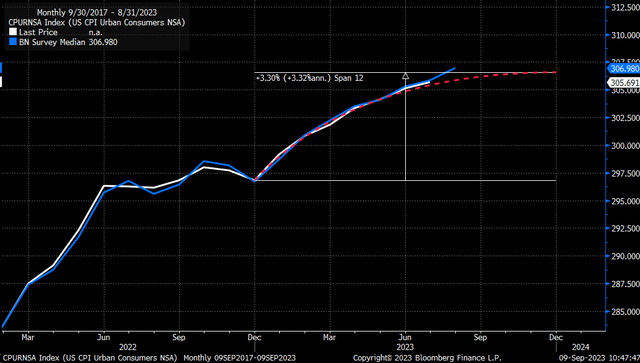

At least, at this point, the outlook for a December 2023 CPI increase of 3.3% will be harder to achieve than it may seem. The CPI data, when looked at on the non-seasonally adjusted index level, shows us that analysts expect the index to rise 306.98 in August. For CPI to rise by 3.3% y/y by December, the index must fall to around 306.60. It is certainly possible to have deflation in the year’s final three months, but it would probably also mean that everything goes according to plan and oil prices don’t keep rising from here. Otherwise, December expectations seem too low and must be adjusted upward.

Bloomberg

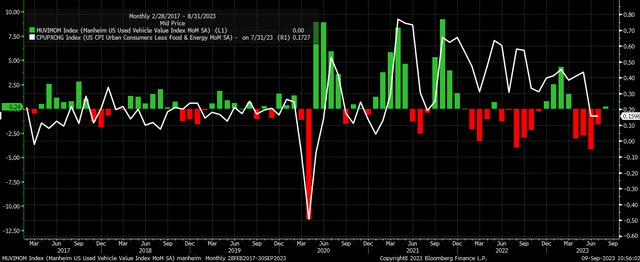

It may not only be oil and gasoline that present problems because there may have been a turn in the used auto market. The Manheim used vehicle value index rose on a m/m basis in August, the first time in 4 months. This is something that needs to be watched closely in September.

Bloomberg

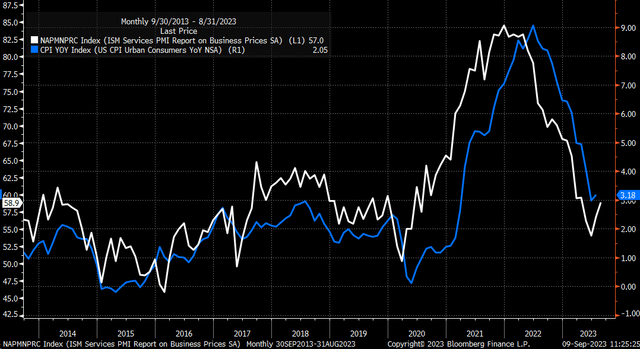

Additionally, this past week, the ISM services report showed that the prices paid index rose for the second month in a row and to its highest level since April 2023. The ISM prices paid index tends to be a leading indicator for the CPI report. While the report doesn’t suggest an immediate surge in inflation, it certainly suggests that inflation is likely sticking around for some time longer.

Bloomberg

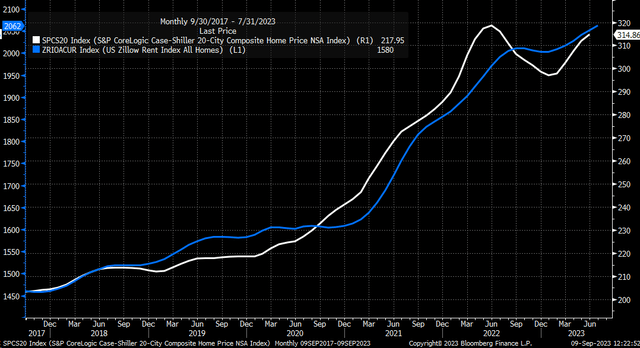

Additionally, many investors are counting on the shelter inflation falling and providing a deflationary tailwind, and that may be over the short term. But the latest data from Case-Shiller and Zillow suggest that home and rental prices are either at or very close to passing their 2022 highs and once again, could begin to add to inflation in 2024.

Bloomberg

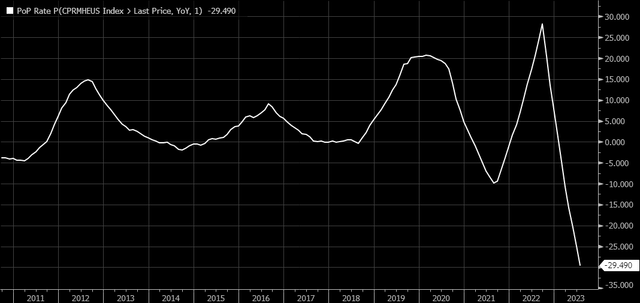

Additionally, in October, there will likely be a reset in how the CPI calculates health insurance. This could mean that instead of CPI falling by 29.5% on a y/y basis, it may start to rise again.

Bloomberg

The Bond Market Seems To Have Caught On

While the equity market dreams about rate cuts and money printing, the bond market has been paying attention. 2-year breakeven inflation expectations have risen sharply to 2.16% as of Friday, from 1.98% on August 31, and are approaching their highest levels since the middle of June. The rise in 2-year breakevens sends two important signals: First, the bond market expects that inflation is going to continue to be a problem. The second is that monetary policy is not restrictive enough.

Bloomberg

If the bond market viewed monetary policy as being restrictive, breakeven inflation expectations should be falling and falling back below pre-pandemic levels. Instead, they are bouncing off pre-pandemic levels, and again, the higher oil and gasoline prices rise, the more likely it is that inflation expectations will rise. It serves as a reminder that the Fed may be slowing the pace of rate hikes but that unless the data starts to change materially, the Fed probably isn’t finished raising rates.

The bond market has accepted that inflation will likely be here for some time longer, resulting in rates on the back of the curve rising back to their October 2022 highs. It has led to a resurgence in the dollar due to the expectation of a stronger US economy and the need for tighter Fed monetary policy. Again, none of this should be a surprise as it had been very telegraphed and written about.

The equity market has been fantasizing about slowing economic growth, and the Fed rushing to its rescue by cutting rates and starting the money printers again. It seems unlikely that the Fed will do QE again anytime soon, and if the Fed does cut rates, it will only attempt to make adjustments due to the inflation outlook and not go back to accommodative policy. There is a big difference between rate cuts and easing policy to make it accommodative, very big difference.

Read the full article here