Founded in 2006, 23andMe (NASDAQ:ME) has a mission to help people access, understand, and benefit from their genetic makeup. The company operates in two segments: Consumer & Research Services and Therapeutics. The Consumer & Research Services sector offers direct-to-consumer personal genome services (think of it as a home DNA test kit), while the Therapeutics sector is all about leveraging human genetics to develop innovative new therapies.

23andMe is nearing $1 per share, down over 40% in the last year and nearly 90% since its IPO in Q2 2021. The company has not been able to generate profitability from any of its business segments despite a rapidly growing market. In addition, the company is quickly running down its cash balance from the IPO, and management isn’t making much progress on slowing the burn.

With the company’s current state, I feel there are two ways this turns out. In the downside scenario, the company cannot sustain its business and is sold for parts to a competitor or healthcare conglomerate. In the upside scenario, the company has a major breakthrough by inventing a unicorn and can monetize this breakthrough and make the company profitable rapidly.

Given the complexity of genetics and the number of competitors in the space, I believe that the downside scenario is significantly more likely than a sudden, monetizable breakthrough and rate this stock a sell with a price target of $0.67 – $0.78 per share.

No Clear Path To Growth

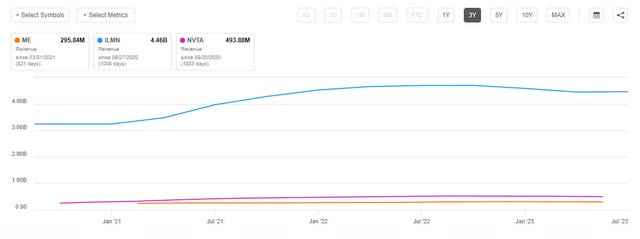

Genetics is a rapidly growing field. The direct-to-consumer genetics market is expected to grow more than 24% annually from 2023 to 2030. Genetic counseling jobs are expected to grow by 29%. However, 23andMe has been struggling to capitalize on that growth. Revenue was down for two years post-IPO. After a slight recovery, Q2 FY24 revenue was down from the prior year. In the earnings call, management mentioned they were focused on margin expansion at the expense of total sales.

The overall industry has an awareness issue, as public awareness lags the growth in the market. But beyond that, 23andMe doesn’t stand out from its competitors. Its closest competitor, Ancestry.com, is a profitable, billion-dollar company. Companies doing similar work are also in a different league. Illumina is a $4 billion company that has added $1 billion in revenue since 2021, and Invitae is a half-billion dollar company that has doubled its business since 2021. Contrast that with 23andMe, which has been largely stagnant since its IPO.

Genetics Revenue Comparison (Seeking Alpha)

In Q2 FY24, 23andMe spent more on R&D than it made in revenue. While it makes sense that 23andMe needs significant R&D investment, they don’t have any profitable business to fund R&D or even SG&A. The therapeutics business is pre-revenue and operated at a loss of $31 million. The personal genetics business shrunk year-over-year from a sales standpoint and operated at a loss of $6 million. The typical high R&D business has a cash cow that can fund losses in other parts of the company. Without a profitable business, I worry about management’s ability to right the ship.

In fact, 23andMe is so far from profitability that it would take exceptional growth rates to turn things around. Revenue would need to grow 20-25% to turn the core business profitable. To turn the core business profitable and cover corporate expenses, revenue would need to grow 60-80%. And to cover R&D and all other costs, revenue would need to nearly triple. Considering the business’s slow growth since its IPO, I feel this is unlikely.

Cash Flow Isn’t Improving

Management made a lot of noise in Q2 earnings about a 9% reduction in G&A costs and a focus on margin improvement. While I see the margin improvement in the services segment, I don’t see the cash flow improvement in the results or the FY24 guidance.

Revenue guidance is between $255 and 275 million, just slightly ahead of Q2’s $60 million in revenue, annualized. AEBITDA guidance is a loss of $180 to 160 million, just slightly ahead of Q2’s $50 million AEBITDA loss. All of this is to say management doesn’t expect a significant turnaround or material growth in FY24.

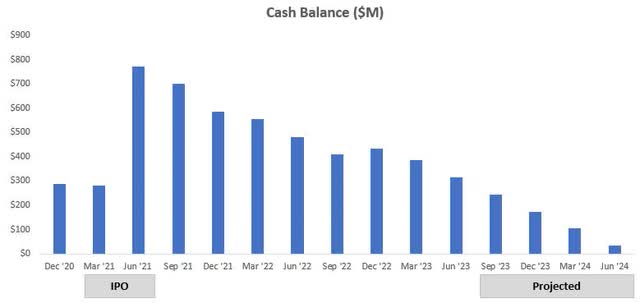

That leaves us with the cash flow issue. 23andMe is quickly burning through IPO cash. Cash is decreasing by roughly $70 million with no end in sight.

23andMe Cash Over Time (Data: Seeking Alpha; Chart: Author)

They would burn through the $322 million of cash on hand in 4.6 quarters at that rate. We know that things won’t improve in the next two quarters. That leaves two and a half quarters to reverse the cash flow issue completely. Given the company’s current state, I don’t see a high chance of that happening.

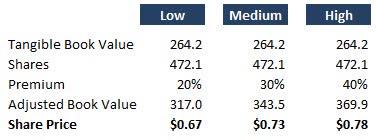

Stock Is Overvalued If Sold For Parts

In a downside scenario, I believe 23andMe would be sold for parts to a competitor or a healthcare conglomerate as they run out of cash. As a proxy for the value of parts, I used tangible book value and ranged the purchase premium from 20-40% on top of assets.

23andMe Valuation (Data: Seeking Alpha; Analysis: Author)

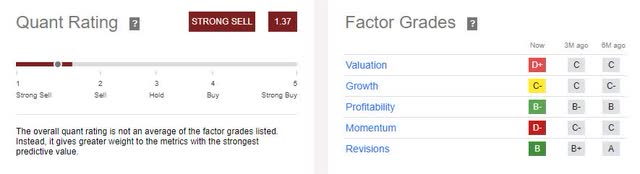

My thesis is supported by the quant ratings, which provide a strong sell recommendation.

ME Quant Ratings (Seeking Alpha)

A Major Breakthrough Could Right The Ship

The best chance of success for 23andMe is a major breakthrough in the therapeutics business. They have set their sights on several ambitious projects:

- Launching new treatments for serious diseases

- Developing gene therapies to treat rare disorders

- Testing new drugs in clinical trials

If any of these initiatives succeed, it could help 23andMe break even and turn the company around. However, such breakthroughs require multiple rounds of testing and government approvals. While the upside potential can be massive, monetizing a breakthrough is slow. I don’t believe that 23andMe has the time to wait.

Verdict

With an underperforming core business that is far from profitability, the company would need to ramp up its growth rates by hundreds of percent to drive profitability. Management’s Q2 earnings report focused on cost reductions and margin improvements, but the cash flow improvements are not materializing fast enough to stop the cash issue. Furthermore, the company’s FY24 guidance does not inspire confidence.

Even if the company were to be sold for parts in a downside scenario, I believe the stock appears overvalued. Tangible book values do not justify current prices, even with a 20-40% purchase premium. Quant ratings also support this view with a strong sell recommendation. Of course, a significant breakthrough in the therapeutics business could alter the situation, but I feel it is low probability relative to the company running out of cash.

With all this in mind, I rate the stock a sell and recommend investors exit their positions before the price falls below $1.

Read the full article here