Vanguard Financials Index Fund ETF Shares (NYSEARCA:VFH) is a passively managed sector specific ETF. I believe this fund offers some opportunities as well as some risk factors in the short term and I generally see it as a mixed bag as I’ll explain in the remainder of the article.

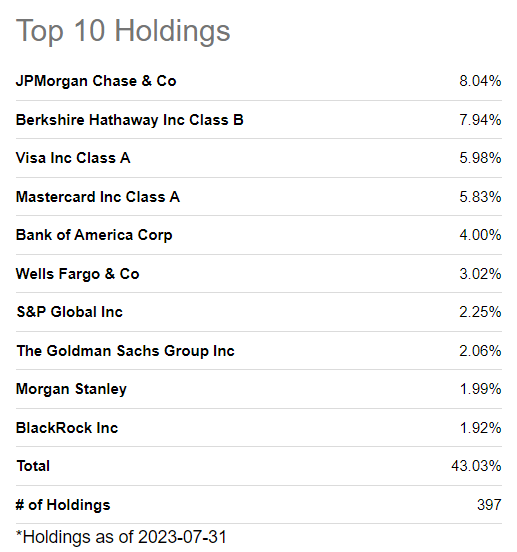

The fund invests in close to 400 stocks in financials sector but its assets aren’t limited to just banks. As a matter of fact, some of the fund’s largest holdings include Visa (V), Mastercard (MA), Berkshire (BRK.A), S&P Global (SPGI) and Blackrock (BLK) so it has a good mix of banks and other financial sub-sectors. The fund is top-heavy as its top 10 holdings account for 43% of its total weight which means the remaining 390 stocks account for only about 57% of its total weight.

Top 10 Holdings (Seeking Alpha)

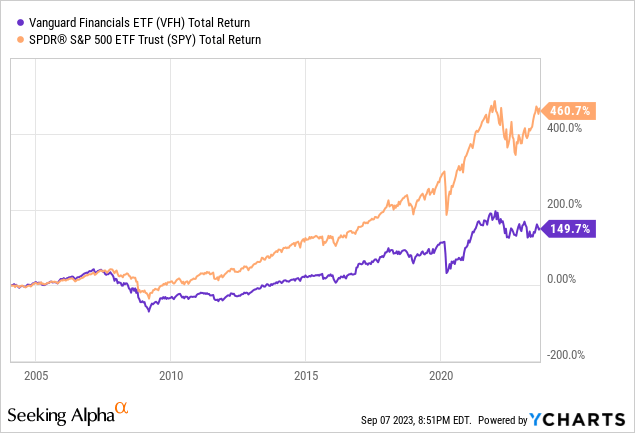

In the last two decades, the fund resulted in total returns of 150% which fell significantly below the performance of the overall market (SPY) whose performance has been mostly fueled by technology and growth stocks during this period.

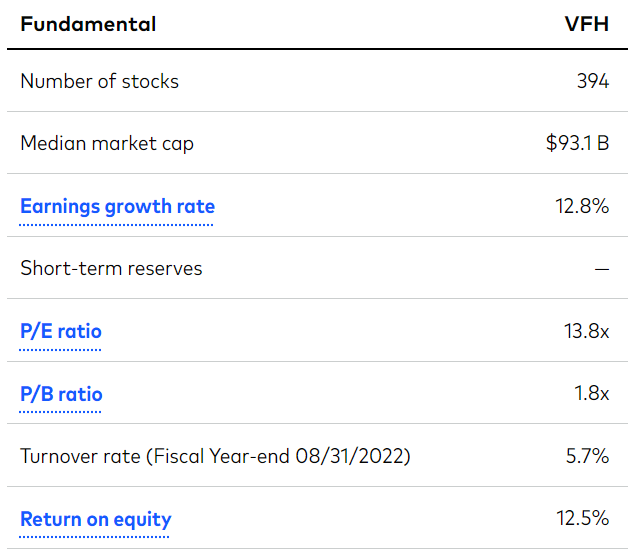

One could call the fund fundamentally cheap as its holdings are enjoying an average earnings growth rate of almost 13% and average Return on Equity of 12.5% while only trading for 14 times earnings and 1.8 times book values. Then again one could also say that the fund is cheap for a good reason because it has a history of underperformance and financial stocks tend to have low valuations as compared to many other sectors especially in terms of price to book values. While banks are likely fundamentally cheap right now, some other financial stocks probably aren’t. For example Mastercard’s and Visa are currently enjoying P/E ratios of 37 and 32 respectively which not many people would consider cheap. Then we have many banks trading in P/E ratios around 10-15 range.

VFH Fundamentals (Vanguard)

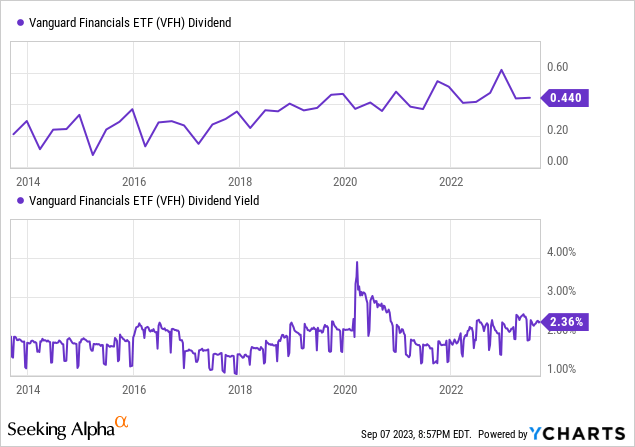

The fund has no leverage and it simply passes the dividends it receives from its holdings to investors. In the last decade the fund’s dividends saw a slow but steady increase from about 20 cents to 44 cents per share per quarter. The fund’s current yield of 2.36% may seem low but it’s closer to the higher end of the fund’s 10-year range of 1% to 3% than the lower end.

In the beginning of 2022, when the Fed started hiking short term interest rates (also known as the Fed’s funds rates), many people thought this would be very bullish on banks because banks would be able to collect higher interest rates and make bigger profits. Then we saw bond prices drop significantly including risk-free government bonds and we’ve also witnessed the yield curve inversion which often signals that a recession is on the horizon. This led to panic in the banking sector, especially regional banks but some larger banks like JPMorgan (JPM) also saw it as an opportunity to acquire some smaller banks on discount.

Banks like high interest rates but they also like growing economy. If the economy starts showing signs of weakness this can hurt banks in more than one way. First, demand for bank loans drop significantly. Second, many loans fail as people and companies are unable to pay them. Third, asset prices which banks use as collateral take a hit and banks need additional liquidity to reduce their leverage.

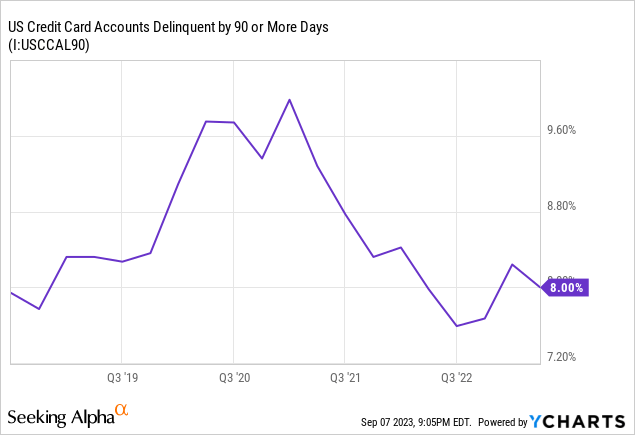

So far we haven’t seen much trouble in the financial sector with the exception of a small tick in credit card delinquency rates but there could be other signs of trouble in the future especially if we see employment market weakening. The big question is how soon the Fed will come to the rescue if we start seeing real signs of trouble. Back in March the Fed was very quick to respond to the failure of several regional banks which most likely helped avoid contagion but it is difficult to tell how much flexibility the Fed would even have in the event of a larger bank failure (which is very unlikely at the moment unless we get a very severe black swan event or if there is something wrong with a large bank that is not visible to us).

In America the economy is holding on fine but elsewhere we are seeing signs of a slowdown or even a possible recession. In Europe, retail sales were down 0.2% in July, factory orders were down almost -12% and service PMI dropped to 47 along with other metrics. In China there are concerns of a deflation as the economy failed to pick up after the country’s lockdowns ended a few months ago. This fund doesn’t invest in any foreign banks or financial institutions but a slowdown or recession that could potentially occur in global scale would definitely affect the American economy and this would have severe effects on American financial institutions even if the problems didn’t originate in the US.

On one side, bank deposits in America fell for the 5th quarter in a row while on the other side, American banks have been hoarding up cash of up to $3.3 trillion in anticipation of future troubles. Inflation forced many people to dive into their savings accounts and even use some of their emergency cash in order to afford basic necessities like rent, food and medicine. We are seeing savings depleting while debt is rising even as inflation has been slowing down lately. Major banks are well-capitalized and they are less likely to be affected from a black swan event and I find it positive that they are preparing. They absolutely don’t want to get caught off guard like they did in 2008 and many of them had to be bailed out by the government which didn’t look good on them.

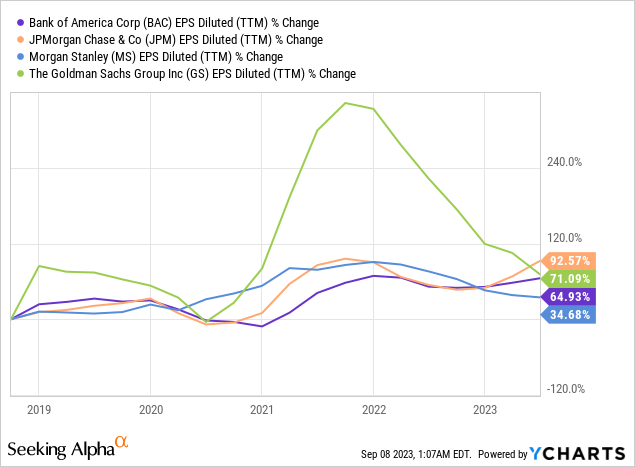

This time banks are better capitalized and better prepared but you never know. Meanwhile, not all is in trouble as banks are actually very profitable right now. In the last 5 years, the big 4 banks saw their net income (per share) rise anywhere from 35% to 93%, so it’s not like banks are currently in trouble or anything. We could even see bank profits keep growing if we can avoid worst case scenarios.

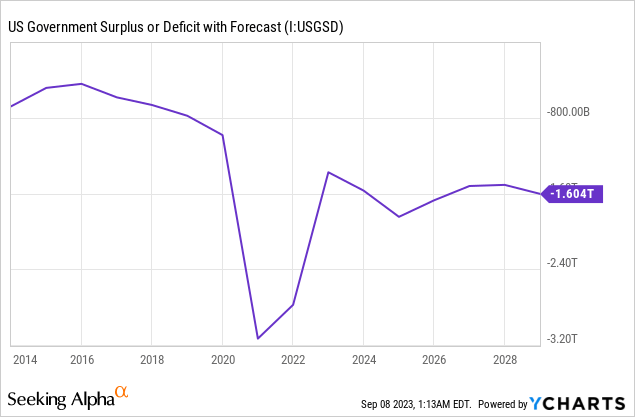

Do I expect a recession to occur soon? It’s really difficult to tell. Even the world’s leading economists aren’t able to predict recessions with good accuracy. There are signs of a global slowdown and there are other factors such as inverted yield curve that has predicted recessions in the past with some degree of accuracy. We also have the fact that the US government is still running a large deficit which provides an artificial (but perhaps unsustainable) boost to the economy. Currently the government is running a $1.6 trillion deficit, without which the economy would have been in a recession.

Having said that, this fund could be bought and hold by people who want to diversify their portfolio towards financial plays. Since it has a long history of underperforming against the S&P 500 index, some investors would be better served by remaining invested in the S&P 500 index instead. If you are buying this fund, keep in mind that this is a long-term play and you are unlikely to see a lot of boost in the short term.

Read the full article here