The Market Is Still Pessimistic About FS KKR

Leading upper middle market business development company or BDC, FS KKR Capital (NYSE:FSK) stock experienced a recent pullback at a critical resistance zone, as investors took a break after a strong performance from its mid-August lows.

As such, it’s apt for investors who missed adding FSK at steep selloffs in the first half of 2023 to reassess another opportunity to gain exposure. FS KKR is a well-managed BDC whose stock still trades well below its net asset value or NAV despite its recovery from last year’s lows. Based on its most updated NAV per share of $24.69 for Q2, FSK last traded at a 17.5% discount against its NAV, providing impetus for further upside. While it has closed the gap from last year’s hammering, I believe FSK’s attractive valuation suggests pessimistic market sentiments and isn’t a “trap,” which I discussed in my previous update.

The company’s second quarter or FQ2 earnings release corroborated my thesis in FSK, suggesting that the market could continue to perform well even as the Fed approaches the peak of its unprecedented rate hike regime over the past year. Supported by the expected structural changes in capital requirements in the banking industry, it places leading BDCs like FS KKR in an enviable position to benefit from the expected market activity levels.

Moreover, while the higher interest rates have also raised FS KKR’s weighted average effective interest rate to 5.2%, the company also benefited from an increase in weighted average annual yield on all debt investments of 11.8%, up from 11.4% in Q1. With the resilient US economy likely to keep the Fed on a higher-for-longer policy position, FS KKR should remain well-primed to leverage the higher interest rates in driving net investment income or NII for holders.

Despite my optimism, it’s also crucial for investors to reflect a substantial discount against its average valuation, as the company’s NII per share is expected to fall from Q3. Based on FS KKR’s updated guidance, it anticipates a lower NII per share of $0.79 for Q3, down from Q2’s $0.82 metric. As such, the market may likely discount the risks that NII per share could have topped out in the most recently reported quarter.

Furthermore, with the Fed likely close to its peak rates, I anticipate that the growth tailwinds from the Fed’s rapid rate hikes will decelerate. With that in mind, the company needs to bolster its activity levels to drive NII accretion as the market conditions improve, bolstered by reticent bank lending sentiments.

FS KKR’s commentary suggests that the company sees improved activity levels, further underpinned by asset-based lending or ABL. ABL exposure for Q2 accounted for 12% of the company’s target range of between 12% and 15%. Management anticipates a further increase in the near to medium term, reaching closer to the high end of its target range. As such, I urge investors to pay closer attention to FS KKR’s ABL metrics over the next four quarters to assess its improving momentum.

Is FSK A Buy?

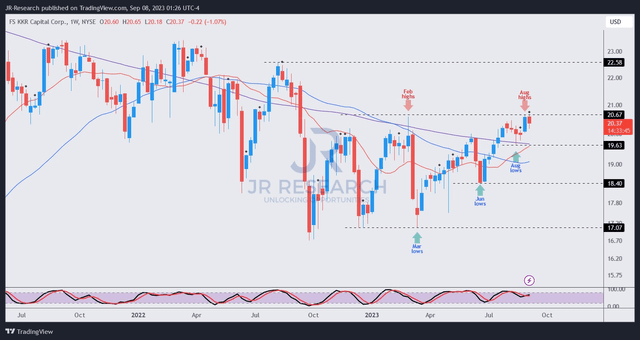

FSK price chart (weekly) (TradingView)

FSK has regained its medium-term uptrend convincingly, suggesting buying sentiments have remained robust. Therefore, it strengthens my conviction that investors buying FSK’s dips aren’t drawn into a value trap, even though there’s a resistance zone at the $20.5 level.

Despite that, I anticipate a subsequent breakthrough of the current levels as more momentum investors return, taking advantage of FSK’s best-in-class “A+” valuation grade assigned by Seeking Alpha Quant. Supported by its highly attractive forward dividend yield of 14%, FSK’s valuation and price action align remarkably well.

Dip buyers should capitalize on its near-term downside or unanticipated volatility and shouldn’t wait till it possibly breaks through and recovers further toward its August 2022 highs.

Rating: Maintain Buy. Please note that a Buy rating is equivalent to a Bullish or Market Outperform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here