Klabin (OTCPK:KLBAY) is a major Brazilian pulp and paper company that has faced challenges in recent quarters due to the decline in pulp and paper prices, primarily resulting from reduced operating capacity.

However, being a vertically integrated company, Klabin may be more susceptible to the adverse effects of the downturn in the pulp market. The company’s performance in the second quarter was lackluster, mainly due to the decline in pulp prices and unexpectedly high maintenance costs.

Despite these challenges, I believe Klabin is better positioned for resilience than its industry peers due to its less cyclical exposure to the pulp sector. The ongoing deleveraging process of the Puma II project should lead to enhanced operational efficiency, ultimately resulting in improved profitability and more substantial dividend payouts in the upcoming years.

Klabin as a long-term investment

First, I’d like to highlight some critical aspects of the company’s fundamentals that make me optimistic about long-term investment in Klabin.

Competitive advantages:

Klabin is a vertically integrated company, controlling a significant portion of the production chain, from planting to transforming raw materials into final products. This vertical integration provides several advantages, including economies of scale, enhanced cost control, and protection against new competitors. Klabin’s constant pursuit of innovation and the development of new products diversify its offerings beyond pulp, making it less vulnerable to price fluctuations.

Puma II project:

The Puma II project is a pivotal initiative for Klabin. It involves the implementation of two new paper machines, Machine 27 (MP27) and Machine 28 (MP28), which will substantially increase the company’s production capacity. This project is expected to boost cash generation significantly, with a projected 40% EBITDA gain over the next few years. Notably, the project has already been completed, allowing Klabin to focus on improving productivity and operational efficiency, which should positively impact production costs.

Consistent dividend distribution:

Klabin maintains a strong culture of consistently distributing profits to its shareholders. The company announces dividends four times a year following the release of its financial results. The payout ratio (the percentage of profits distributed) ranges from 20% to 25% of adjusted net profit. Moreover, Klabin has the potential to increase its dividend payouts over time, offering investors the prospect of growing income.

Despite the favorable outlook for Klabin, it is crucial to acknowledge potential risks. A global economic slowdown could lead to a reduced demand for packaging. Production interruptions and unplanned maintenance pose challenges. Inflation in service and labor costs may also result in increased expenses. Furthermore, the growth in financial leverage warrants attention as it entails additional financial risks. Hence, investors should remain mindful of these factors when evaluating their investment in Klabin.

Klabin’s latest results

In a mixed operating environment, Klabin’s second-quarter results for 2023 showed resilience. Notably, the pulp unit achieved positive price realizations despite declining the Chinese benchmark due to a more robust connection with the European benchmark, which experienced a slight decrease. Additionally, Klabin’s diversification among three types of fiber (hardwood, softwood, and fluff) contributed to the company’s overall resilience, with a particular highlight on the performance of fluff.

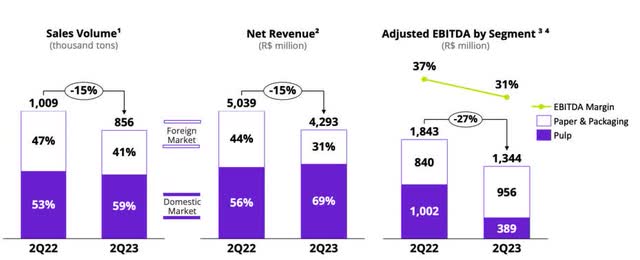

During the second quarter of 2023, Klabin reported a net income of R$971 million, remaining nearly stable compared to the previous year’s period. However, the adjusted EBITDA decreased by 32% year-on-year to R$1.344 billion, resulting in an 8 percentage point drop in the adjusted EBITDA margin, which now stands at 31%.

Klabin’s IR

One of the significant factors affecting Klabin’s results was the maintenance shutdown at Puma I, which incurred an additional cost of R$542 per ton due to a double-digit decline in sales, reduced dilution capacity per ton, and increased usage of inputs and auxiliary materials during the stoppage. This led to total sales of 334kt, with a decrease of 10.5% quarter-over-quarter and 21.2% year-over-year.

Another notable point was the gradual recovery in sales of paper and packaging products. Both units reported increased sales volumes, with the paper business unit reaching 268kt in Q2 2023 (1.9% quarter-over-quarter; 17.0% decline year-over-year). Total packaging volume reached 252kt, a rise of 3.3% year-over-year, driven by increased sales of corrugated paper, the category representing the most substantial percentage of sales at 216kt, a 5.4% year-over-year and a decline of 1.8% year-over-year, while industrial sacks recorded a volume of 36kt, down by 7.7% year-over-year.

Despite notable declines in prices for hardwood and softwood on international markets, Klabin’s unique characteristics supported better-than-expected price realizations. This includes the company’s exposure to fluff pulp and markets with pricing concentrated in Europe, which experienced less significant price reductions than those in China.

However, Klabin faced challenges in the Kraftliner (cardboard) segment on international markets. This was due to corrections in international prices, with the European reference curve (FOEX) dropping to US$785/t (compared to US$873/t in Q1 2023). Klabin’s realized price for Kraftliner fell by 11.9% quarter-over-quarter and 19.2% year-over-year, reaching R$3.950/t.

The most positive aspect of the quarter was the cost of goods sold per ton (COGS/t), which did not experience the anticipated double-digit increase mentioned by Klabin itself. This resulted in a short-term cost advantage. However, cautious assumptions should prevail concerning cost increases in the medium term. COGS/t, excluding stoppages, reached R$1.363/t, up by 0.6% quarter-over-quarter and 7.1% year-over-year.

Dividends announced, progress expected

In line with Klabin’s dividend policy, a minimum of 25% of adjusted net profit is distributed annually to shareholders. However, it’s common practice for the company to pay 20% of adjusted EBITDA dividends.

Klabin recently announced a dividend distribution of R$269 million, equivalent to R$0.24 per unit, representing approximately 1% of its market value and translating to a yield of roughly 6%. However, market consensus for year-end 2023 is more optimistic, with a projected yield of 6.77% and an even higher yield of around 8.93% expected for 2024.

Seeking Alpha

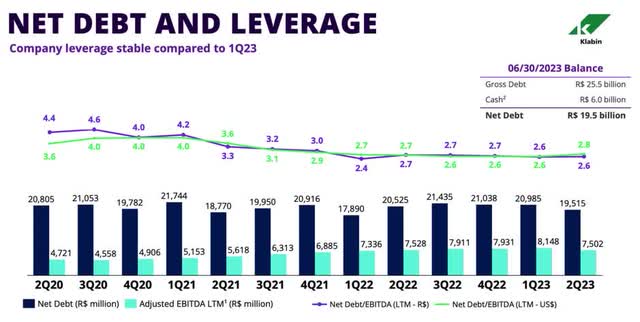

As the company continues to reduce its debt through the deleveraging process following the completion of the Puma II project, Klabin is poised to improve its profitability over the next few years and decrease its net debt/EBITDA ratio, which currently stands at 2.8x. This improvement should pave the way for a more substantial dividend distribution, aligning with the company’s established distribution policies.

Klabin’s IR

The bottom line

In my analysis, the significant sequential reduction in Klabin’s net income can be attributed to two main factors. First, the impact of maintenance stoppages had a more substantial effect on COGS/t than anticipated. Second, the results were pressured by the dynamics of the pulp market, which accounts for approximately 30% of the company’s revenues, and the slowdown in consumption, making it challenging to realize favorable prices in Kraftliner.

Despite the 30% decline in EBITDA in the second quarter, I believe Klabin will likely maintain resilient results as a player in the pulp and paper industry. This expectation is based on the anticipated stabilization in the paper and packaging segment, which should mitigate the impact of pulp prices. The temporary scheduled maintenance and its associated costs are expected to be overcome. Furthermore, the commencement of operations at MP28 (Puma 2 Project) should lead to cost reduction in the latter half of this year, aligning with increased production.

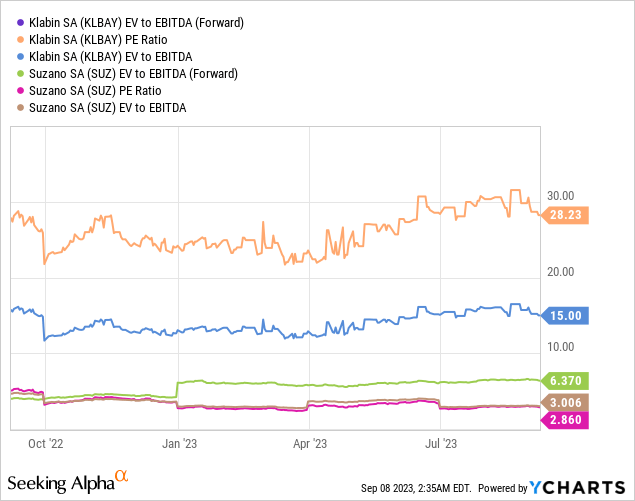

It’s worth noting that Klabin trades at a forward EV/EBITDA ratio of 7.5x, below by 5% its historical average and at a premium compared to its prominent Brazilian peer, Suzano (SUZ). Despite having fewer competitive advantages and less vertical integration than Klabin, Suzano’s valuation discount can also be justified as a less attractive investment opportunity for those seeking dividend income.

Nevertheless, investors need to set their expectations realistically. I believe Klabin is a stock suitable for inclusion in a dividend portfolio rather than for active trading. In this context, my outlook for Klabin is bullish.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here