The OPRA Investment Thesis Is More Convincing After The Deep Correction

We previously covered Opera Limited (NASDAQ:OPRA) in July 2023, discussing the drastic decline in its stock prices as the news of the mixed shelf offering was released. We believed that the correction had been warranted, since the stock had traded at eye-watering valuations then, well exceeding its Big Tech peers.

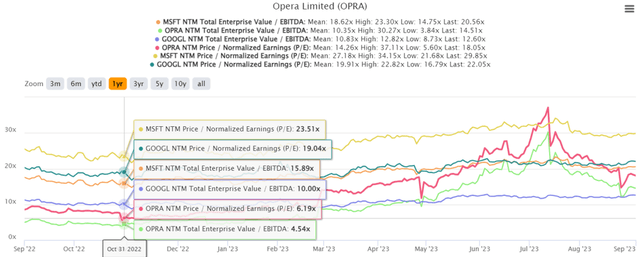

OPRA 1Y EV/EBITDA and P/E Valuations

S&P Capital IQ

For now, it appears that the over optimism embedded in OPRA’s valuations have been well corrected, with its NTM EV/ EBITDA and NTM P/E valuations already halved since the recent peak in July 2023, though still elevated compared to the October 2022 bottom.

Perhaps part of the optimism is attributed to OPRA’s exemplary FQ2’23 earnings call, with revenues of $94.13M (+8.2% QoQ/ +20.9% YoY) and GAAP EPS of $0.15 (-17.6% QoQ/ +333.3% YoY).

Most importantly, the company has been able to grow its annualized advertising revenues to $215.28M (+10.9% QoQ/ +24.9% YoY), while expanding its global browser market share to 2.74% by August 2023 (-0.24 points MoM/ +0.54 YoY).

Then again, if we are to look closer, we are concerned by the sustained decline in OPRA’s gross margins to 53.4% (-4.2 points QoQ/ -6.9 YoY) by the latest quarter, down drastically by -14.6 points from its peak of 68% in FQ4’21.

This is on top of the expanding operating expenses of $37.71M (+4.3% QoQ/ +6.9% YoY), naturally impacting its operating margins to 13.3% (-2.7 points QoQ/ -1.8 YoY), down by -5.7 points from its peak of 19% in FQ3’22.

OPRA’s performance on user metric remains mixed as well, with expanding annualized ARPU of $1.17 (+8.3% QoQ/ +25.8% YoY) but declining Monthly Active User [MAU] base to 315.9M (-3.5M QoQ/ -14.2M YoY) in FQ2’23.

Then again, while part of the MAU headwind is attributed to the management’s pivot to higher monetization regions, it appears that the results have been net positive, with expanding search revenues to $38.85M (+2.8% QoQ/ +15.1% YoY).

Most importantly, since the Western Europe/ North American users only comprise 15% of its current user base, we believe that there is still an immense adoption tailwinds ahead.

This is partly attributed to its intensified marketing expenses of $27M (+10.6% QoQ/ +6.7% YoY) by the latest quarter, with a full year guidance of approximately $120M (+4.3% YoY).

Perhaps this is why the OPRA management is confident enough to raise its FY2023 revenues guidance to $385M (+16.3% YoY) and adj EBITDA to $82M (+20.4% YoY) at the midpoint, compared to the previous guidance of $381.5M (+15.2% YoY) and $80M (+17.5% YoY), respectively.

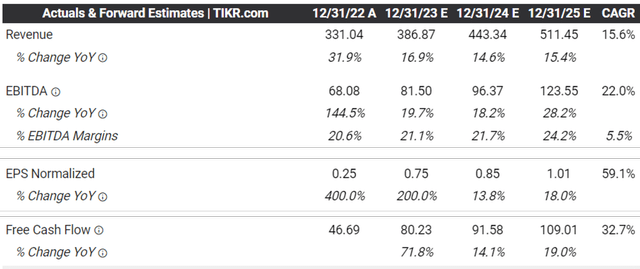

Consensus FY2025 Estimates

Tikr Terminal

As a result, it is unsurprising that OPRA’s forward consensus estimates appear to be highly promising as well, implying a high growth cadence for both its top and bottom line through FY2025.

These estimates are not overly ambitious as well, based on its normalized top-line expansion at a CAGR of +20.8% between FY2017 and FY2022.

Thanks to its improved profitability, investors now also enjoy recurring bi-annual dividend payouts of $0.40 from H1’23, with an annualized yield of approximately 5.4%, based on its stock prices at the time of writing.

Assuming that OPRA is able to sustain this cadence ahead, it appears that the stock has a great potential to offer both capital and income returns in the long run. Interesting indeed.

So, Is OPRA Stock A Buy, Sell, or Hold?

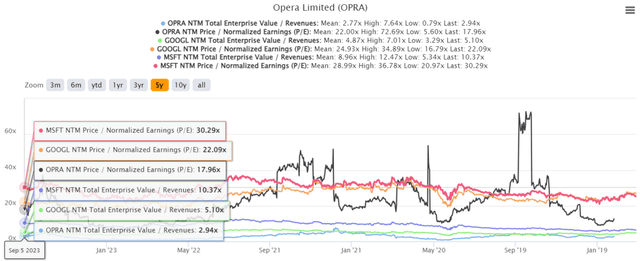

OPRA 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

For now, OPRA trades at NTM EV/ Revenues of 2.94x and NTM P/E of 17.96x, elevated compared to its 1Y mean of 2.11x/ 14.26x, though moderated against its pre-pandemic mean of 3.29x/ 28.20x, respectively.

While OPRA may appear to be undervalued against its Big Tech peers, such as Microsoft (MSFT) at NTM EV/ Revenues of 10.37x/ NTM P/E of 30.29x and Alphabet (GOOG) at 5.10x/ 22.09x, respectively, we are not so certain if it is a wise comparison.

This is attributed to OPRA’s much smaller market cap of $1.32B and shares outstanding of 91.32M at the time of writing, compared to MSFT’s $2.44T / 7.46B and GOOG’s $1.72T / 12.76B, respectively.

Combined with limited browser and advertising offerings, we believe that it may be more prudent to view the stock through the current more conservative valuations.

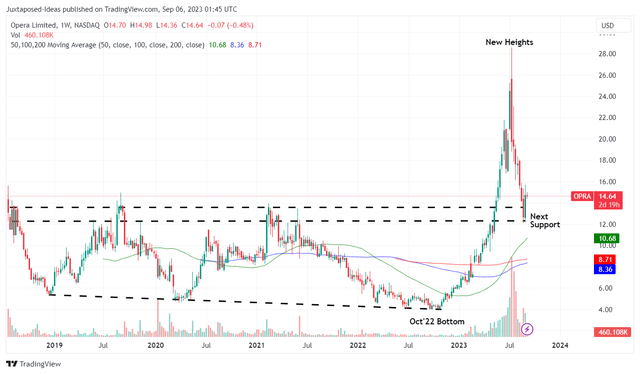

OPRA 5Y Stock Price

Trading View

While OPRA appears to be well-supported at the $13s, it has also lost -47.3% of its value since the recent shelf offering. Despite the exemplary FQ2’23 double beats, the stock continues to languish at these levels as well.

Therefore, while we may rate the OPRA stock as a Buy, the rating comes with a particular caveat.

Interested investors with may want to wait for a further retracement to $13 for an improved upside potential to our long-term price target of $18.13, based on the consensus FY2025 adj EPS estimates of $1.01 and NTM P/E valuation of 17.96x.

Even so, their portfolios must be sized appropriately, due to the massive volatility that we have witnessed since the October 2022 bottom.

Read the full article here