Two major negative events hit the S&P 500 (SP500) this week: 1) crude oil spiked over the resistance as Brent Crude Oil crossed the $90/barrel mark, and 2) the Chinese government announced plans “to expand a ban on the use of iPhones to government-backed agencies and companies”.

Both of these events are related, as part of the unfolding trend of deglobalization.

Deglobalization

The unfolding trend of deglobalization will frame the financial markets over the foreseeable future – until something changes. Globalization resulted in a: 1) low and stable inflation, and 2) higher growth. Deglobalization will reverse these trends and produce: 1) higher and volatile inflation and 2) lower growth – or in other words a stagflationary environment with more frequent recessions.

Inflation

Specifically, with respect to inflation, deglobalization will produce higher and more volatile inflation based on supply-side variables.

- Geopolitics and Energy Inflation: Deglobalization includes the anti-NATO expansion sentiment, which is evident in the current real war in Ukraine. Russia is energy dependent and need to have higher oil price to wage a war. BRICS just expanded to include Saudi Arabia and Iran, and both need higher oil prices for domestic spending programs, and international agendas. Thus, the geopolitical situation is likely to produce a tight oil supply, and oil price spikes. Thus, energy, and in this sense food as well, inflation is likely to remain elevated and volatile.

- Labor shortage and service inflation: Deglobalization also includes the reshoring and onshoring of jobs from China. As a result, the demand for labor is likely to remain high in the US, which will increase the powers of unions and support higher wages in the US, which will contribute to higher service inflation in the US. The labor shortage will be magnified by demographics as baby boomers start the retirement wave.

- Protectionism and goods inflation: Deglobalization also includes the protectionist policies with import/export barriers which is likely to keep the cost of goods inflated. Note, reshoring/onshoring will also increase the cost of production and also contribute to the goods inflation.

Growth and earnings

The key benefit of globalization, other than outsourcing, has been the expanded global market for US companies, particularly to the rising middle class in the emerging markets, and specifically to the BRICS countries.

Deglobalization assumes the fragmentation in global trade, which is likely to gradually close the BRICS+ markets to US companies, due to specific bans and polices, or simply as the preferences change to domestically produced goods. As a result, US multinationals are likely to lose a significant percentage of revenues and earnings over time – currently S&P500 companies have about 50% of revenues from global operations.

Back to the current events

Over the longer term, deglobalization will result in higher inflation and lower earnings. However, in the near term, these “events” will start to materialize, which was evident this week.

Oil price

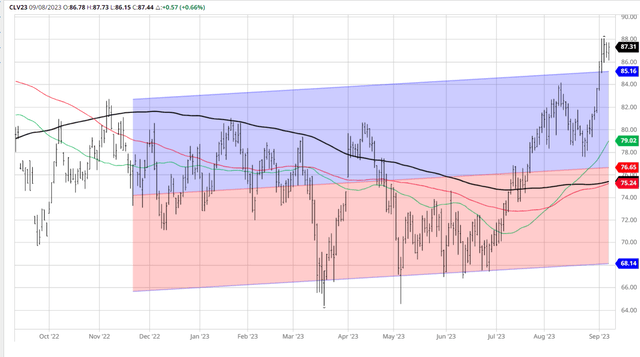

Saudi Arabia and Russia extend oil production cut through end of year. Despite still strong global energy demand, Saudi Arabia and Russia decided to extend the oil production cuts until the end of the year, while market expected the production cut to be extended to October. More importantly, this could signal a further extension in 2024. Obviously, Saudi Arabia and Russia are boosting the oil price, with WTI crude (CL) approaching $90/barrel.

Barchart

Rising oil prices clearly benefit Saudi Arabia and Russia. At the same time, higher oil prices are likely to boost the CPI inflation in the US, exactly at the time when the Fed is expected to pause the interest rate hiking cycle in September.

According to Nowcast, CPI is expected to increase 0.8% month-over-month in August, driven by higher energy prices. It will be difficult for the Fed to pause given the rising energy prices, which increases the risk of overtightening and a much deeper recession in 2024.

On the other hand, a premature Fed pause could cause a lower US dollar, which could further boost oil prices – and inflation. Either way, it’s a tough and delicate situation.

The China iPhone ban

Apple (AAPL) has 20% of sales coming from China, and now it seems like China is banning iPhone for government employees. However, this ban is a signal that China does not look favorably on the iPhone, and the general population could voluntarily ditch the iPhone.

This is especially important in the context of the surprise announcement that the Chinese chipmaker has been able to develop a powerful chip found in the new Huawei smartphone the Mate 60 Pro+, which now possibly rivals the iPhone. This increases the possibility that the Chinese consumer ditches the iPhone, which would be a major blow to Apple.

More importantly, the revelation of the new Chinese-made superchip is likely to escalate the US-China tech war, which will eventually touch all US tech companies.

SPY investment implications

The ETF that tracks S&P 500 (NYSEARCA:SPY) is the most popular investment with retail and institutional investors. SPY has $409 Billion in assets, making it the largest ETF by assets.

More importantly, the SPY is a value-weighted index which means that the largest stocks by market cap affect the index the most, and Apple the largest company by far in the index, accounting for more than 7% of the index. Thus, all investors in SPY are exposed to the Apple China ban.

Further, other tech companies are likely be affected by Chinese protectionist policies in the future as the tech war escalades also have a heavy weight in the SPY index: Microsoft (MSFT) 6% weight, Alphabet (GOOG) (GOOGL) 5% weight, Amazon (AMZN), Nvidia (NVDA) just above 3%, Tesla (TSLA) almost 2%. Altogether, these tech mega-caps account for almost 30% of the SPY index, and they are all exposed to the escalating US-China tech war.

Thus, my recommendation is to sell SPY.

Broader implications – The punches to continue

Aside from the heavy SPY exposure to the US-China trade war, the punches from the unfolding globalization are expected to continue over the near term, affecting all other SPY sectors.

- The UWA strike: The deadline for UWA labor negotiation contract is Wed 9/15. It does not look like the agreement is anywhere near. This will likely negatively affect the stock market, due to broader implications for inflation and wage growth. As previously mentioned, deglobalization is giving more power to the labor unions, and this is the trend which will continue.

- The Fed meeting on Sep 20th: the Fed wants to pause, and the market expects the Fed to pause, but deglobalization is throwing punches and the Fed will be forced to overtighten, which is likely to produce a deep recession. Alternatively, a premature pause will be punished by roaring oil prices, spiking long term yields (TLT), and falling USD (UUP).

Considering all of these variables, including the overvalued SPY price at PE ratio 20, the September/October period looks ripe for a major correction in SPY.

Read the full article here