A Quick Take On American Software

American Software (NASDAQ:AMSWA) reported its FQ1 2024 financial results on August 24, 2023, missing revenue but beating consensus earnings estimates.

The firm sells supply chain software and related consulting services to businesses globally.

I previously wrote about American Software with a Hold outlook on expectations for no revenue growth for the current year.

AMSWA continues to face challenging business conditions and uncertainties about strategic capital allocation options the Board is apparently considering.

I remain Neutral [Hold] on the stock for the near term.

American Software Overview And Market

Atlanta, Georgia-based American Software provides supply chain management software and also provides consulting services to clients globally.

The firm is headed by President and CEO H. Allan Dow, who joined subsidiary Logility in 2000 and was appointed as president in 2015.

The company’s primary offerings include the following:

-

Supply chain management

-

Enterprise resource planning

-

IT consulting

American Software acquires customers through its direct sales and marketing teams and through referrals from partners.

The firm has over 900 customers in 80 countries among industrial, enterprise and SMB customer types.

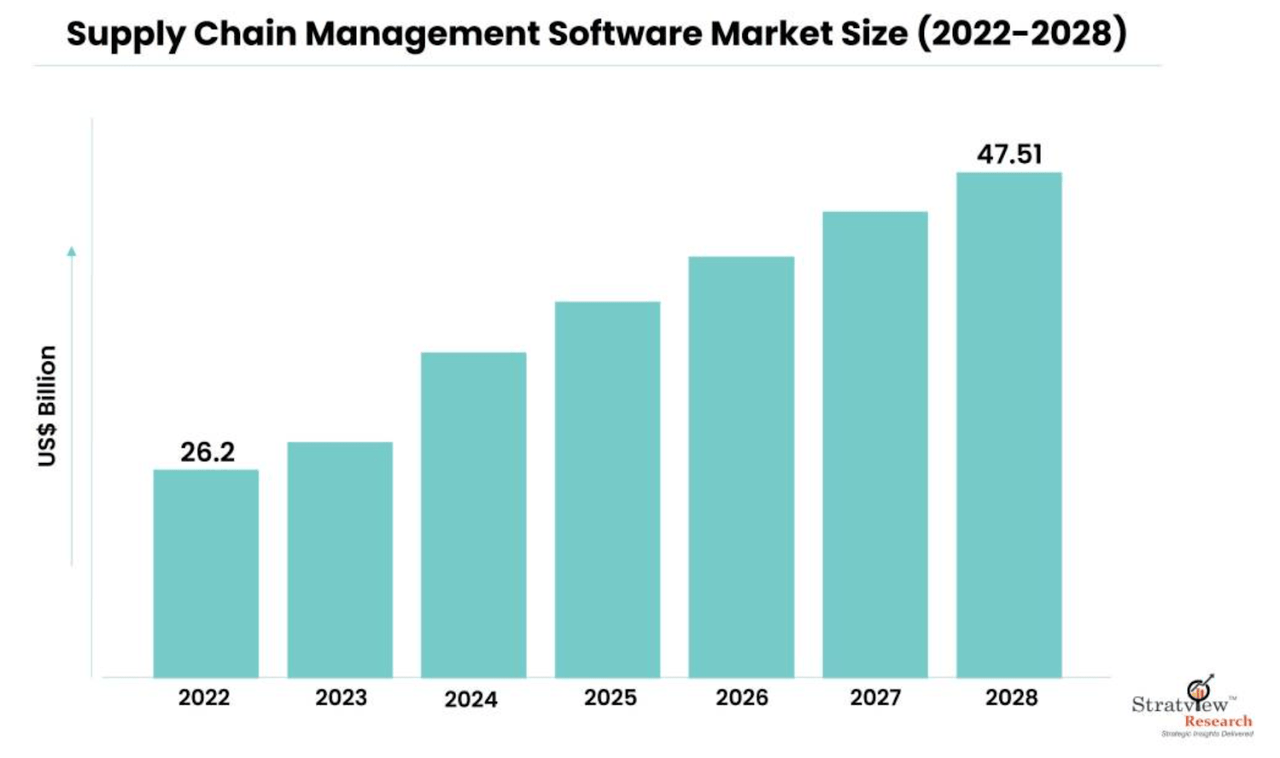

According to a 2023 market research report by Stratview Research, the market for supply chain management software and services was an estimated $26.2 billion in 2022 and is forecast to reach $47.5 billion by 2028.

This represents a forecast CAGR of 10.37% from 2023 to 2028.

The main drivers for this expected growth are continued demand for improved visibility into supply chains, which has become particularly important after the disruptions caused by the COVID-19 pandemic and the war in Ukraine.

Also, the chart below shows the expected growth for the supply chain management software market from 2022 to 2028:

Global Supply Chain Management Software Market (Stratview Research)

Major competitive or other industry participants include:

-

Epicor Software

-

HighJump

-

Info

-

IBM

-

JDA Software Group

-

Kinaxis

-

E2open

-

Oracle

-

SAP

-

Descartes Systems Group

-

Manhattan Associates

-

Others

American Software’s Recent Financial Trends

-

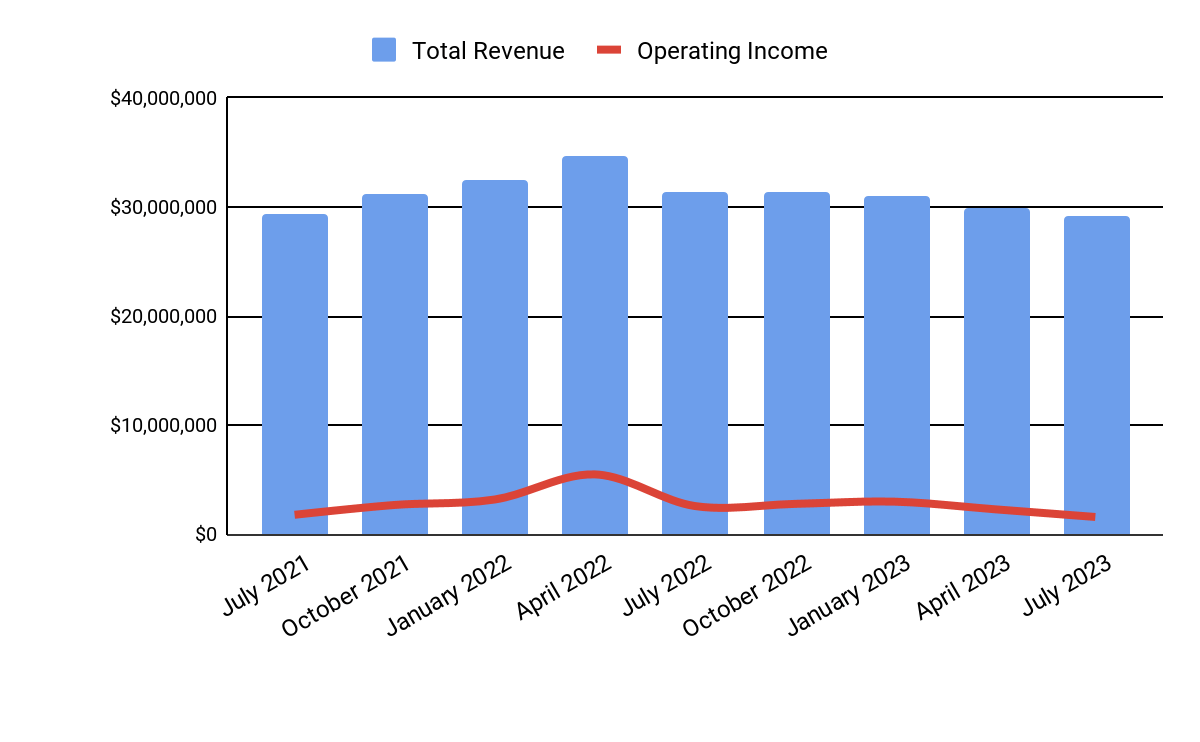

Total revenue by quarter has trended lower due to dropping IT staffing services revenue; operating income by quarter has also moved lower due to rising SG&A costs relative to lower revenue.

Total Revenue and Operating Income (Seeking Alpha)

-

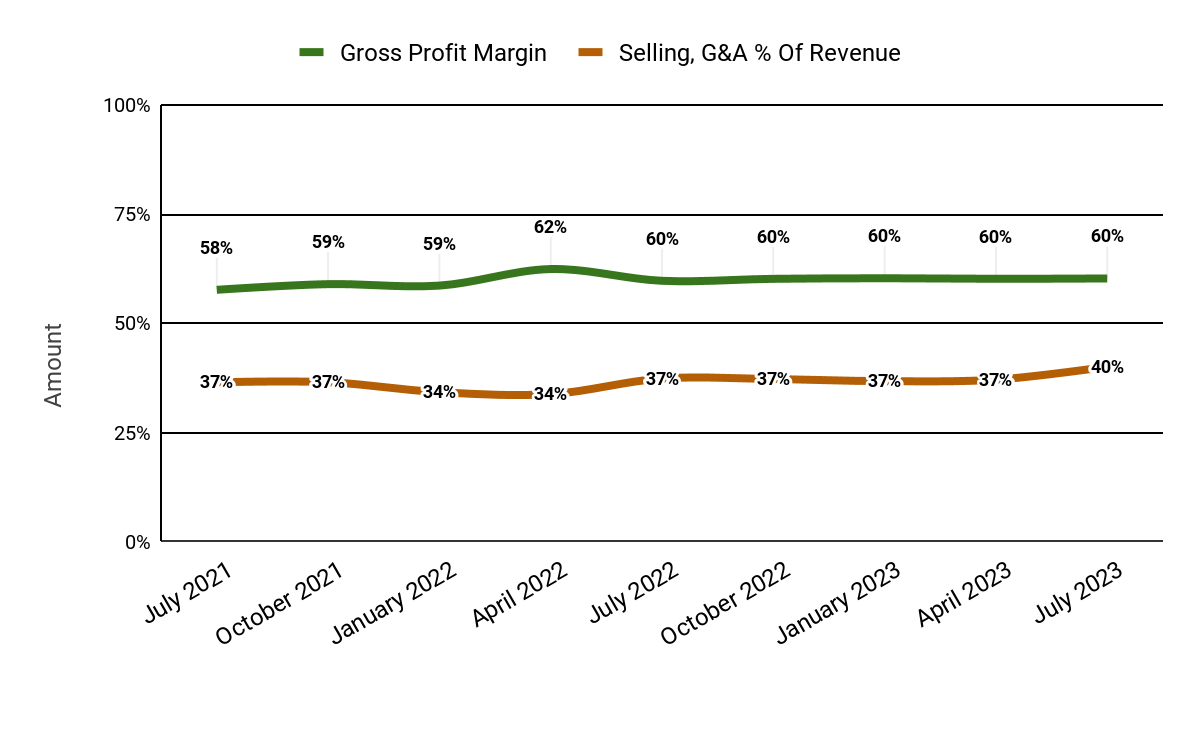

Gross profit margin by quarter has remained stable in recent quarters; selling and G&A expenses as a percentage of total revenue by quarter have risen, possibly due to greater outsourcing costs.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

-

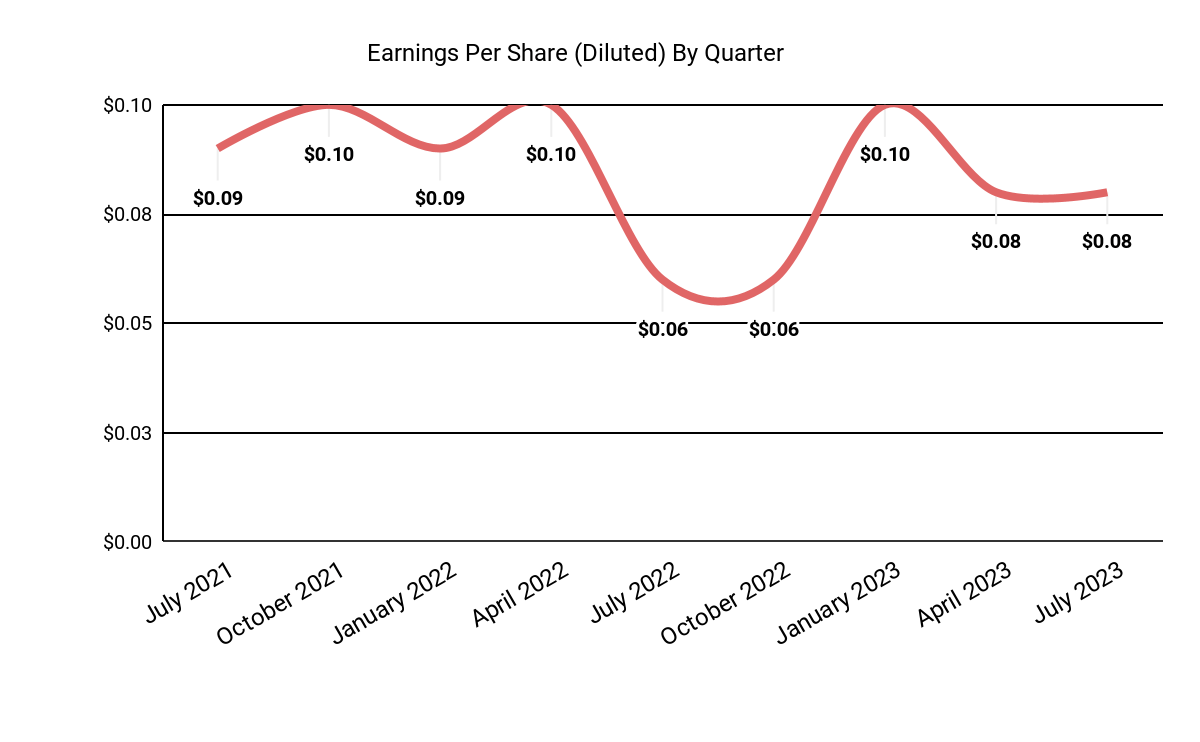

Earnings per share (Diluted) have remained positive but have been trending lower in recent quarters as the firm’s cost structure has weighed on its net results:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

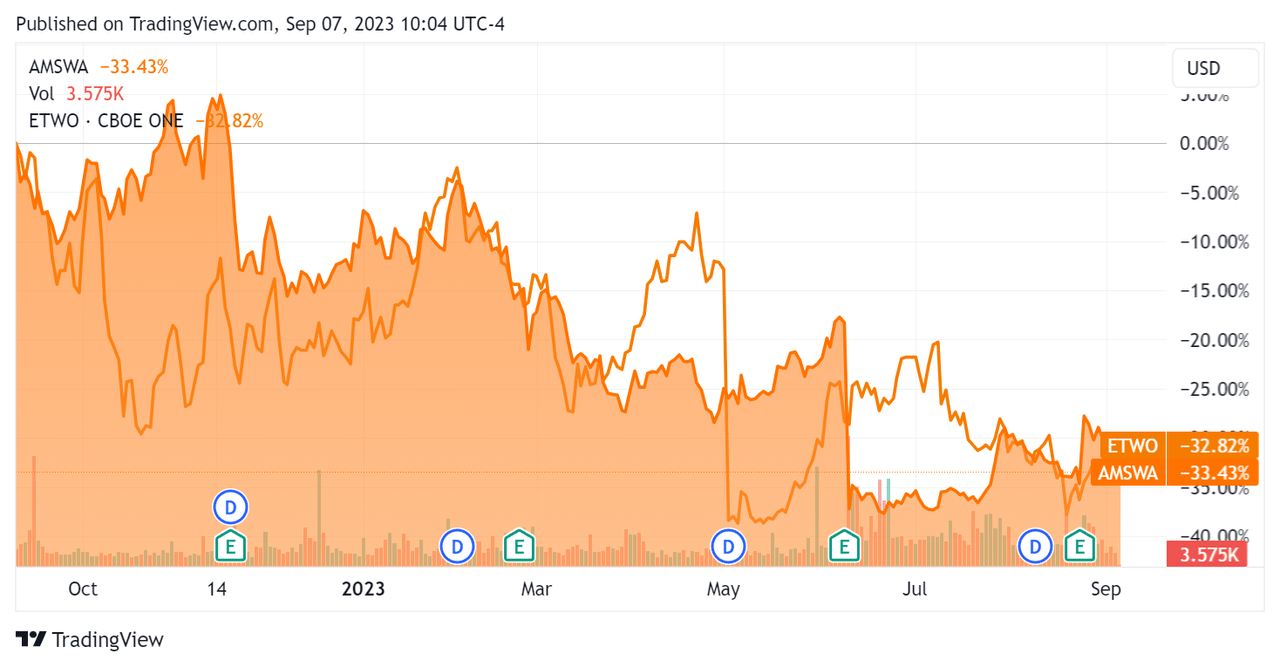

In the past 12 months, AMSWA’s stock price has dropped 33.43% vs. that of E2open’s (ETWO) fall of 32.82%:

52-Week Stock Price Comparison (Seeking Alpha)

For balance sheet results, the firm ended the quarter with $114.8 million in cash, equivalents and short-term investments and no debt.

Over the trailing twelve months, free cash flow was $5.5 million, during which capital expenditures were $2.8 million. The company paid $5.4 million in stock-based compensation in the last four quarters, the highest trailing twelve-month figure in the past eleven quarters.

Valuation And Other Metrics For American Software

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.3 |

|

Enterprise Value / EBITDA |

23.2 |

|

Price / Sales |

3.2 |

|

Revenue Growth Rate |

-6.2% |

|

Net Income Margin |

9.1% |

|

EBITDA % |

9.7% |

|

Market Capitalization |

$389,160,000 |

|

Enterprise Value |

$274,310,000 |

|

Operating Cash Flow |

$7,200,000 |

|

Earnings Per Share (Fully Diluted) |

$0.32 |

(Source – Seeking Alpha)

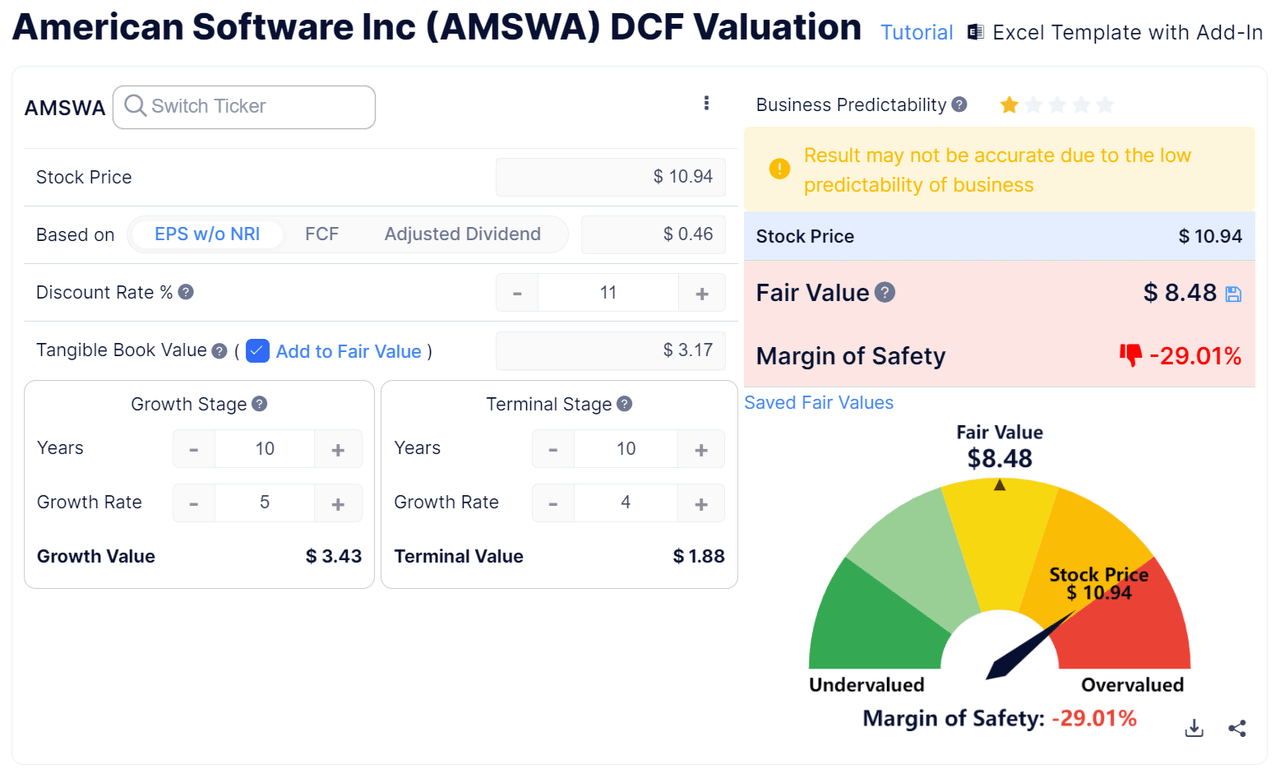

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Discounted Cash Flow – American Software (GuruFocus)

Based on the DCF, the firm’s shares should be valued at approximately $8.48 versus the current price of $10.94, indicating they are potentially currently overvalued.

AMSWA’s most recent unadjusted Rule of 40 calculation was only 3.5% as of FQ1 2024’s results, so the firm’s performance has deteriorated sequentially and is in need of substantial improvement, per the table below:

|

Rule of 40 Performance (Unadjusted) |

FQ4 2023 |

FQ1 2024 |

|

Revenue Growth % |

-3.1% |

-6.2% |

|

EBITDA % |

8.6% |

9.7% |

|

Total |

5.5% |

3.5% |

(Source – Seeking Alpha)

Sentiment Analysis

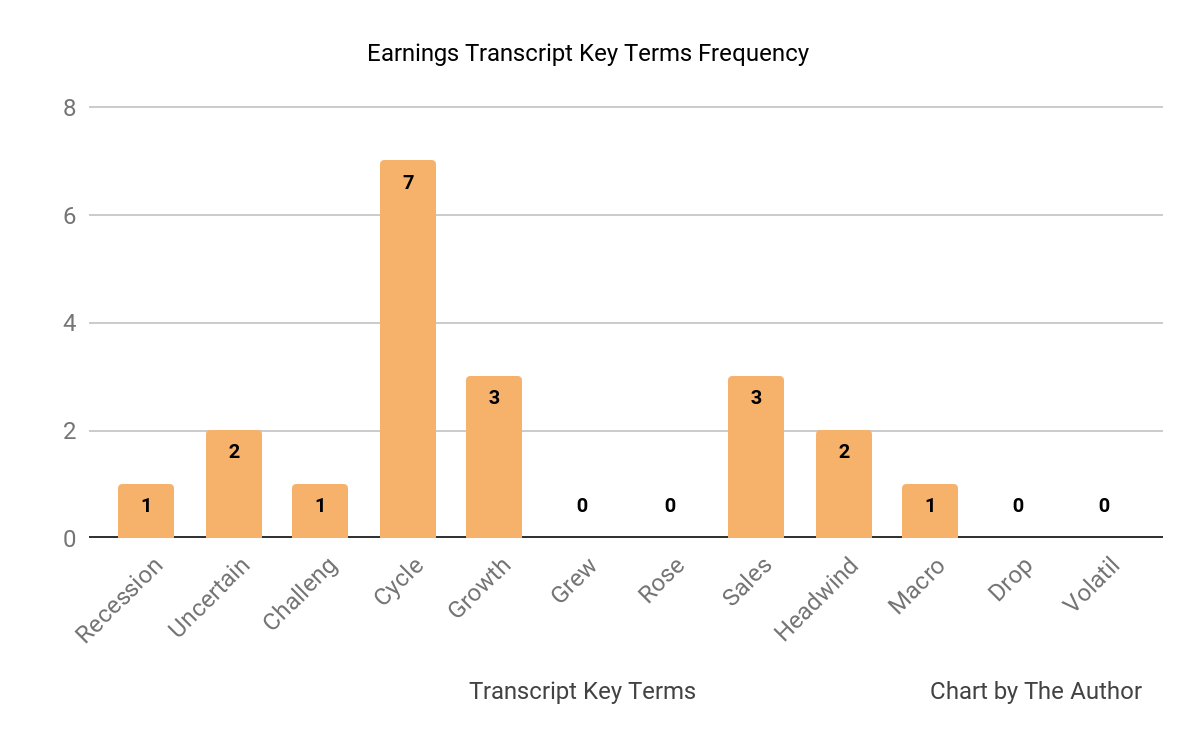

I prepared an analysis of keyword frequency of management’s current earnings conference call:

Earnings Transcript Key Terms Frequency (Seeking Alpha)

The chart above shows significant negative discussion about the firm’s business conditions, with numerous mentions of ‘Recession, Uncertain, Challenging, Headwind and Macro’ keywords.

Analysts questioned senior management about a range of topics, including sales cycles, a potential headquarters building sale and other strategic actions.

Management responded by saying that sales and approval cycles have stabilized compared to the previous quarter, but there are no signs of improvement yet. Leadership expects some sales cycle acceleration in the fall.

Furthermore, potential strategic actions like a sale of its headquarters which could free up cash for distributions, buyback or acquisitions, which are in the process of being reviewed by the Board.

Management also expected gross margins to improve in coming quarters due to continued cost reductions and increased professional services revenue.

Commentary On American Software

In its last earnings call (Source – Seeking Alpha), covering FQ1 2024’s results, leadership highlighted the firm’s revenue fluctuations due in part to seasonal factors.

However, professional services revenue did not meet expectations, while subscription revenue growth met expectations at a 14% growth rate YoY.

Recurring revenue now represents 75% of total revenue, and the company has been able to secure ‘inflationary increases on renewals.’

Management has sought to simplify its project implementation processes and has increased its outsourcing efforts, which will reduce its service revenue contribution to total revenue.

Leadership didn’t publish details on company or revenue retention rate metrics but did characterize its ‘retention rates as returning to more normalized levels.’

Total revenue for FQ1 2024 fell 6.7% year-over-year, and gross profit margin was flat.

Selling and G&A expenses as a percentage of revenue increased 2.7% year-over-year while operating income decreased 38.5%.

The company’s financial position is strong, with ample liquidity, no debt and small positive free cash flow generation.

AMSWA’s Rule of 40 performance has been low and declining.

Looking ahead, full fiscal year 2024 revenues are expected to decline 2.2% year-over-year.

If achieved, this would represent a drop in revenue decline rate versus fiscal 2023’s decline rate of 3.2% over fiscal 2022.

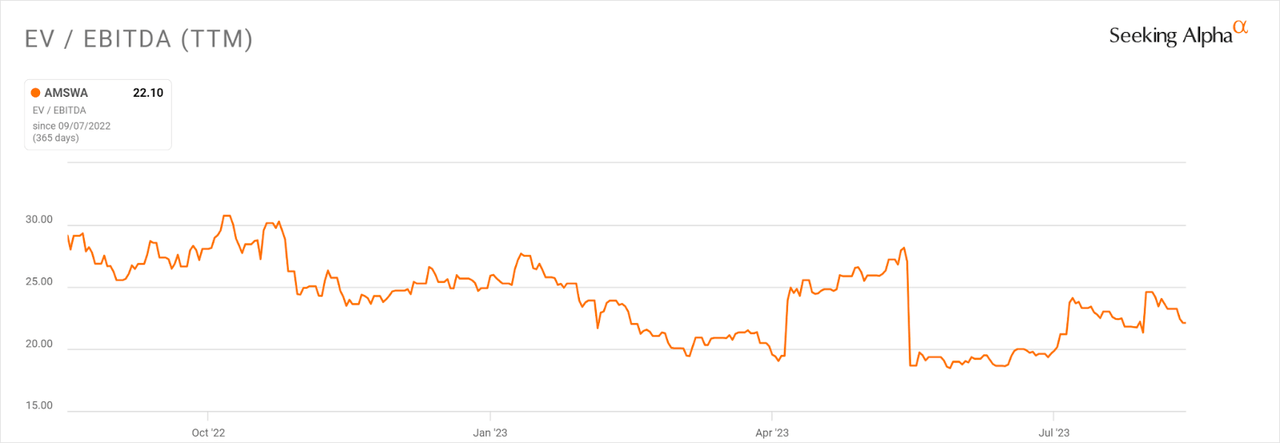

In the past twelve months, the firm’s EV/EBITDA valuation multiple has fallen by 24%, as the chart from Seeking Alpha shows below:

EV/EBITDA Multiple History (Seeking Alpha)

A potential upside catalyst to the stock could include sales cycle improvement in the back half of 2023, per management’s discussion.

Also, if the Board approves a buyback, announces the sale of the company headquarters or makes a notable acquisition announcement, then that could be a catalyst for the stock, at least in the short term.

However, given analyst concerns and challenges management is facing with business conditions, absent any of those potential announcements, the underlying fundamentals of the company are not strong enough to get too excited about.

I remain Neutral [Hold] on AMSWA for the near term.

Read the full article here