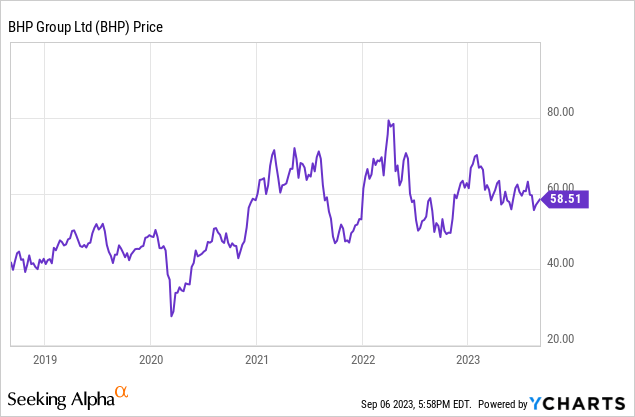

With a slowing global economy, and growth forecasts for resource-hungry China being lowered in particular, the valuations of cyclical companies are starting to feel the pressure. One such company is global diversified mining giant BHP Group (NYSE:BHP) who has already seen their share price fall around 18% from 52-week highs due to commodity prices decreasing. This leaves the company trading at 22.9x TTM P/E with a dividend yield around 5.8%.

BHP is a highly profitable and diversified miner as this article will discuss and should be able to survive and thrive through the next recession. They have highly efficient operations and are the lowest cost producer of iron ore globally which helps them earn profits at lower points on the demand curve. With a FCF yield around 8.3% and trading near fair value, BHP is a company I will be holding onto and looking to add to on any economic weakness.

Introduction To The Company

With a market cap around $148 billion, BHP is a global powerhouse. The company segments itself into Iron Ore, Nickel, Copper, Metallurgical and Energy Coal, as well as the upcoming Potash operations through Jansen. BHP is diversified across a large range of commodities critical to the global economy with railway, port, and processing facilities.

The company now boasts the largest copper resources in the world through Escondida in Chile which is the world’s largest copper mine, in addition to their Australian copper assets which will see the recently acquired OZ Minerals integrated into the Olympic and Oak Dam deposits to create Copper South Australia. Western Australia Iron Ore is the operating name for BHP’s four processing and five mining hubs across 1,000 kilometers of rail infrastructure and port facilities in the Pilbara region of northern Western Australia.

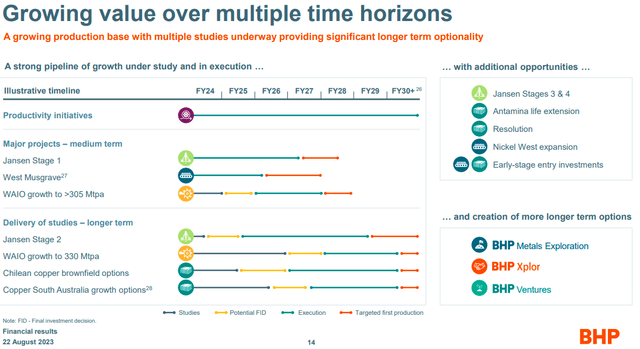

Through these operations, BHP is the lowest cost major iron ore producer globally, as mentioned in the quarterly results. To achieve this feat, the company invests will drive further gains in volumes and efficiencies. Below is a snapshot from the FY 2023 materials. The company lays out its production initiatives nicely for investors with further drives growth into copper and potash segments.

BHP Project Pipeline (from BHP FY 2023 Presentation)

In my general economic education, precious metals increase in real value because of their scarcity but common minerals decrease in real value compared to inflation as society gains economics efficiencies in their extraction. BHP is at the front of these economic efficiencies with their autonomous trains and dump trunks. Also of note for investors with environmental, social, and governance (ESG) concerns, BHP completed their divestment of BHP Petroleum in 2022 providing investors with a more pure-play mineral focused company.

The company also pays its fair share of taxes for the resources it extracts throughout its global operations. In the Queensland operations, when combined with income taxes, it equates to an adjusted effective tax rate including royalties of 55%. In total, once BHP’s $3.8 billion of revenue and production based royalties are included, the company’s effective tax rate was 41.3% for the latest year.

A Profitable And Growing Business

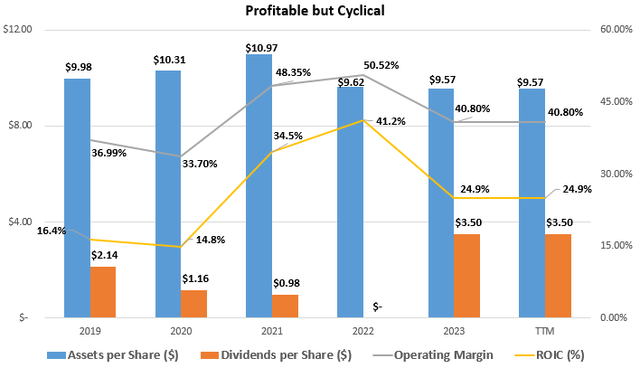

BHP’s global and diversified portfolio have allowed the company to achieve an average return on equity and return on invested capital of 28.0% and 26.1%, respectively, over the past five years. This average level of profitability is well around my rule of thumb seeking 15% ROE and 9% ROIC, allowing me to be confident that, in my opinion, the company is able to maintain and continue to increase its intrinsic value over a business cycle.

Profitability & Growth Highlights (compiled by author from company financials)

Latest Annual Results

For the fiscal year ended June 30, 3023, BHP’s revenue decreased by US$11.3 billion primarily as a result of significantly lower prices across iron ore, metallurgical coal, and copper. Underlying EBITDA was $28.0 billion (down 31%) from FY 2022 EBITDA of $40.6 billion and underlying attributable profit reduced by 37% to $13.4 billion. “Underlying” comes from management and adjusts FY 2022 for discontinued BHP Petroleum operations of $10.7 billion separated and merged with Woodside Petroleum (WDS). The introduction of the new royalty regime resulted in an additional $0.7 billion in royalties paid to the Queensland Government by BHP in relation to FY 2023.

The decrease in financial results was driven by revenue declines from high iron ore prices in previous years. This indicates current prices are already starting to reflect the weakness in the economy, in my opinion. While BHP has tried to mitigate the effects of the current inflationary environment, unit cost were still were around 9% higher across major assets, according to the latest management presentation. Even given the latest economic headwinds, Western Australia Iron Ore (WAIO) extended its lead as the lowest cost major iron ore producer globally according.

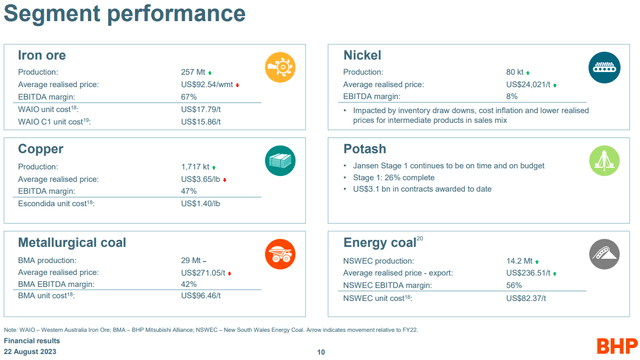

Despite the decrease in prices, volumes were strong with production records at WAIO, Olympic Dam and Spence. Full year production guidance was also achieved for copper, iron ore, metallurgical coal, energy coal and nickel. Below are the segment performance highlights from the latest management presentation showing these strong production figures.

Segment Performance (from BHP FY 2023 Presentation)

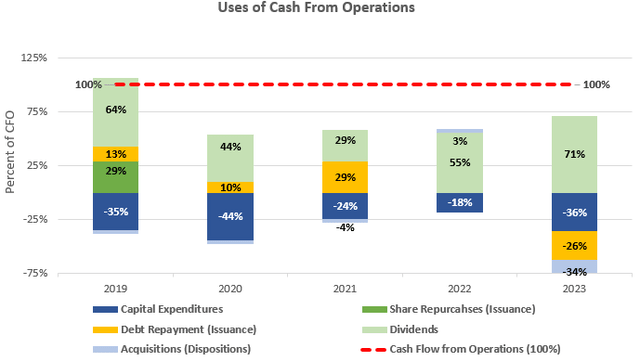

Returning Cash To Shareholders

BHP does a great job of returning cash to shareholders both in the form of dividends, share repurchases, and spin-offs. With capital expenditures and acquisitions taking up on average 32% and 13% of cash flow from operations over the past decade, this leaves approximately 55% to be returned to investors in the form of dividends and share repurchases. With average cash flow from operations of $22.3 billion over the past three years, this 55% would imply free cash flow to shareholders of $12.3 billion for around an 8.27% free cash flow yield at the current $148.8 billion market capitalization.

An intrinsic value calculation of BHP yields a fair value of $56.30 which is only around 4% higher than the $58.50 share price when this article was written. This valuation uses the average free cash flows over the past five years adjusted for inflation discounted at my usual 9% required rate of return less 3% growth (net 6% discount rate). This 3% growth rate is generally as aggressive as I get in my valuation models and is reserved for highly profitable and well-moated companies, such as BHP, which I expect to grow alongside global growth.

Cash Flow Analysis of BHP (compiled by author from company financials)

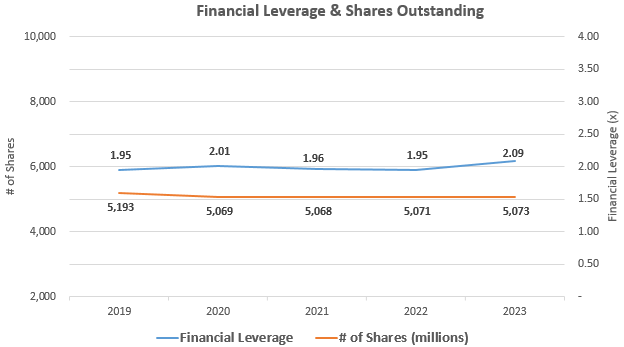

Financial Leverage Looks Conservative

BHP’s financial leverage has stayed fairly conservative for the five years as can be seen in the graph below. Currently, financial leverage sits at a conservative 2.1x today and the company’s interest coverage ratio is a healthy 10.2x in the trailing twelve-month period. The company and cash flows are cyclical so in 2021 ($27.2 billion) and 2022 ($32.2 billion) cash flows were almost 50% higher than today ($18.7 billion) making the interest coverage ratio then a high +29x.

The other side of this is that I am comfortable with this ratio dipping into the negatives for a year or two if the economy and commodity markets take a turn. These healthy leverage ratios give me comfort that this company will be able to drive through the next downturn in commodity prices.

Financial Leverage and Shares Outstanding at BHP (compiled by author from company financials)

Takeaway

BHP is a nicely profitable diversified company able to achieve an average ROE and ROIC of 14.9% and 11.2%, respectively, over the past decade. While the company might be in a cyclical business, it has world-class resources that allow it to be the lost cost producer in their WAIO business, able to be profitable in market scenarios where other competitors are not. The company’s low financial leverage gives me confidence that the company will be able to survive through the next recession when it comes along. I will be looking to add to my position on any significant pullbacks and collect the current 5.8% dividend though the economic cycles.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here