Gary Friedman: A Controversial Figure

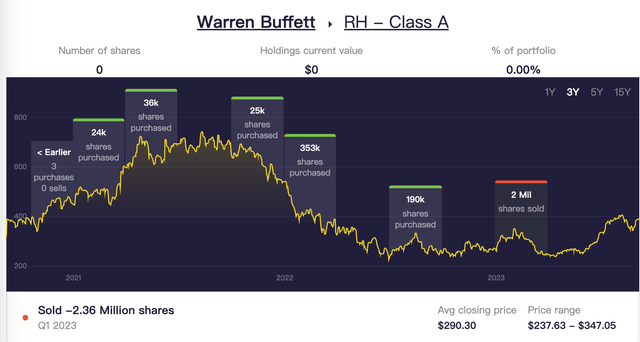

We have followed RH (NYSE:RH) for several years now. For those interested in RH, it is important to follow Gary Friedman, the company’s CEO and Chairman. Friedman is a controversial figure. He had a strong resume, having previously served brands like Williams-Sonoma (WSM) and Pottery Barn, before joining RH. His bold and aggressive style saved RH from the brink of breakdown in 2016. Friedman is a strong believer in branding, as evidenced by his dedication to building RH into one of the world’s premier furniture brands. His ambition to make RH a great brand on the level of Apple or LVMH has been stated repeatedly in shareholder letters over the years. He also liked to tout having Warren Buffett as a shareholder, though Buffett is no longer invested in RH after COVID.

Stockcircle

RH’s Evolution

Whether you like his personality or not, Friedman’s transparency in disclosing his views and interests seems highly aligned with shareholders in our opinion. We have followed him since 2016 when he bought a large stake in RH during a challenging period when the company faced competition from e-commerce players like Wayfair and omni-channel retailers like West Elm. RH was barely profitable at the time, but Friedman firmly believed brick-and-mortar was the future of furniture. Here is the quote:

We believe, “There are those with taste and no scale, and those with scale and no taste,” and the idea of scaling taste is large and far-reaching.

As a result, he started building RH’s signature large-format stores combined with dining spaces.

RH

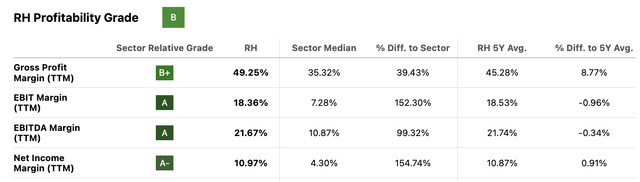

We tended to agree at the time, and his strategy seems to have worked, with RH growing from a 5% operating margin in 2016 to 20% in 2022.

RH has also proven resilient during COVID-19, when the US economy was nearly shut down. While the furniture industry benefited somewhat from work-from-home trends, RH’s lack of online presence and distribution initially worried investors. Surprisingly, the company maintained 7.6% revenue growth and 28% operating income growth in 2020 through catalog sales and designer visits. It also maintained industry-leading margins. This demonstrated the power of its business model.

Seeking Alpha

Gary’s Early Warning

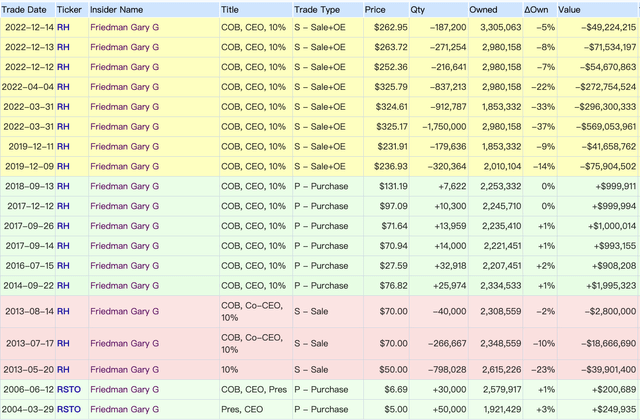

Gary also signaled early that RH would be impacted when the Ukraine war started in March 2022, as he saw consumer demand slowing. Though RH’s financials still looked resilient, Gary disclosed he was selling shares and advised investors not to buy if the CEO was selling. We view his insider trading history provides a useful indicator for RH investors in buying and selling.

However, we have not seen Gary purchase any shares yet since his last sale in 2022, though RH has started buying back shares, another meaningful indicator to watch.

Openinsider

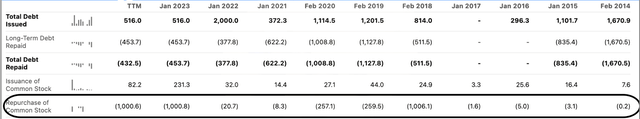

RH’s Share Buyback History

RH’s share buyback policy is very aggressive. In 2017, to demonstrate management’s confidence in RH’s future, the company spent $1 billion in cash to buy back shares, retiring almost 50% of shares outstanding and leaving just $18 million in cash at fiscal year-end. The stock rose from as low as $26 to $160 per share in one year. This reflects Gary’s style over RH’s history over the past decade. So it’s an encouraging sign that RH started buying back shares again in 2022, spending $1 billion to retire 17% of shares outstanding.

Seeking Alpha Seeking Alpha

Overall, RH is a shareholder-friendly company, though Gary’s aggressive approach carries risks.

Recent Earnings and Market Challenges

RH reported Q2 earnings today and its stock was down 7% after hours. RH’s Q2 2023 results showed a 20% revenue decrease, similar to Q1, with full-year guidance implying a 15% decline suggesting further improvement in 2H 2023. However, operating income dropped 36% with significant deleverage. The buybacks helped only modestly, as diluted EPS still fell 26%.

Gary expects the luxury housing market and the broader economy to remain challenging through fiscal 2023 amid high mortgage rates. This aligns with trends in luxury consumer spending per recent results from LVMH, Kering, and West Elm. RH also admitted its strategy of maintaining high prices failed, and it increased promotions after Q1. RH’s 8% inventory decline in Q2 was slower than the revenue drop, signaling inventory liquidation pressures ahead. However, RH remains resilient, maintaining an 18% operating margin despite promotion and traffic challenges.

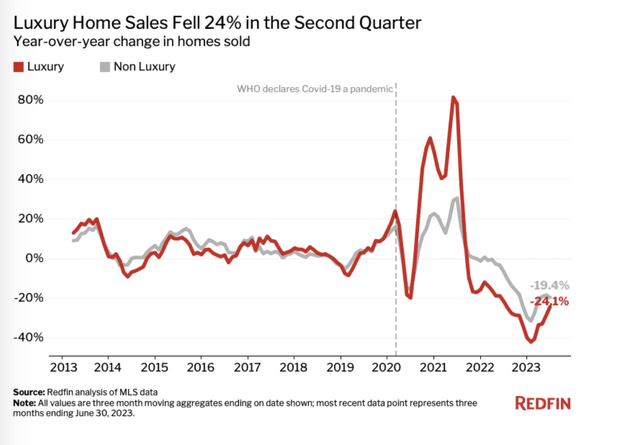

Market Conditions for Luxury Homes

Per Redfin, luxury home sales fell 24% in Q2, the smallest drop in a year, as high rates bring some buyers back.

Redfin

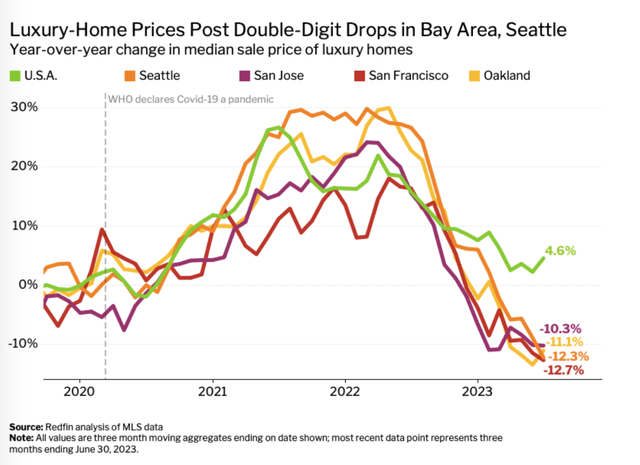

We believe the luxury segment has seen a slight easing in sales declines because luxury home prices have already fallen substantially from last year’s peaks. Prices dropped far more in formerly hot markets like San Francisco and Austin. This significant correction in prices has made high-end properties more affordable.

Redfin

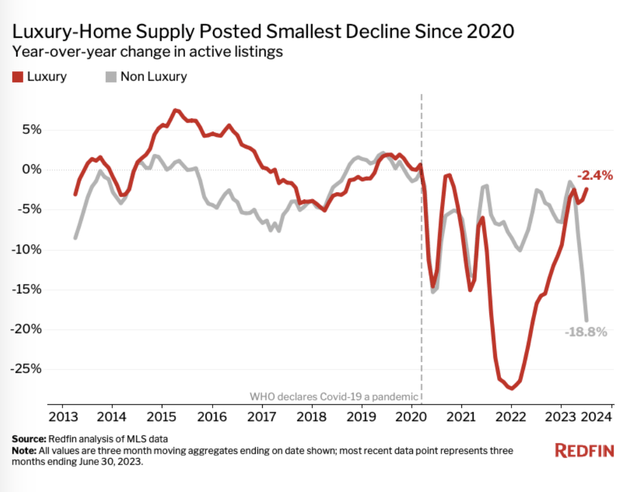

However, while the supply of luxury homes appears to be stabilizing, luxury home prices likely face further downward pressure compared to non-luxury housing. Demand for expensive properties remains weak, with mortgage rates high and an uncertain economic outlook. Though early signs point to the market bottoming out, full recovery will be gradual, especially at the top end. Luxury homebuilders and retailers like RH still face headwinds until sales volumes and prices stabilize.

Redfin

Valuation

RH has succeeded in boosting operating margins substantially over the past decade, driven by its effective brand-building and flagship retail experiences. Despite these strengths, RH’s overall revenue growth has been modest at best. Over the past 10 years, revenues have increased at a compound annual rate of just 10%, even with the introduction of a membership model and impressive earnings growth.

This has left RH more of a value play than a growth stock in our view. New store openings provide some incremental growth, but that strategy has limits.

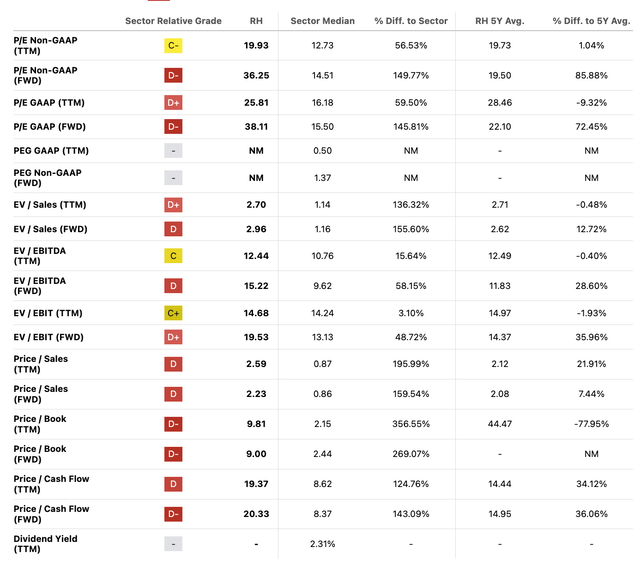

Hence, RH does not appear cheap based on historical P/E or P/S ratios. The stock’s pullback after the recent earnings report seems understandable when factoring in the company’s growth challenges and the management’s muted market outlook. Conditions in the luxury housing market also remain unfavorable for the next few quarters at least. Hence, we do not see the current price level attractive.

Seeking Alpha

Conclusion

RH CEO and Chairman Gary Friedman’s aggressive leadership style may not appeal to all investors, much like Elon Musk’s polarizing persona. However, we regard Friedman’s shareholder policies as transparent and investor-friendly. Monitoring his personal stock trading provides useful signals on RH for investors. The company has solid underlying fundamentals as a premier luxury furniture brand. Given these strengths, RH remains a stock worth monitoring or holding long-term in our view. That said, with the luxury housing market facing ongoing pressures and RH still working through excess inventory, the company is not out of the woods yet. With valuation not attractive for a value play currently, patience seems prudent until macro conditions improve and inventory normalizes. We suggest waiting for now.

Read the full article here