Overview

My recommendation for Frontier Communications (NASDAQ:FYBR) is a hold rating, as the upside is not lucrative enough at this share price. That said, I do recognize that there is a potential upside catalyst over the next few quarters if management comes out saying that their investment phase is going to end earlier. If not, I think the better time to invest is when the fiber rollout plan is nearing its end (sometime in FY25 or FY26), as that is when I expect the market to start appreciating the FYBR FCF profile.

Business

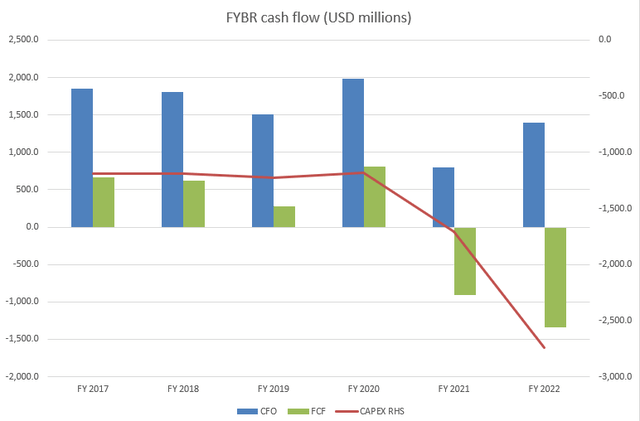

FYBR operates as a telecommunications company. The Company offers a variety of communications solutions services through its fiber-optic and copper networks, including video, high-speed internet, advanced voice, and frontier secure digital protection. FYBR revenue is broken down into two streams: the consumer side and the business and wholesale side, where the consumer side contributes slightly more than the business and wholesale segment. EBITDA and FCF are key metrics for this company as it is CAPEX intensive during its investment years and cashflow generative once the CAPEX (fiber layout) is done. I have shown FYBR historical FCF, CFO, and CAPEX for reference.

FYBR

Recent results & updates

Better revenue and EBITDA were reported by FYBR in 2Q23. Their reported revenue of $1.449 billion was slightly higher than the consensus estimate of $1.444 billion. The company’s EBITDA for 2Q23 was $533 million, whereas consensus had expected $530 million. In 2Q23, FYBR expanded their fiber network to an estimated 316k homes and saw a net additions growth of 66k. FYBR reported $63.12 in ARPU for Fiber consumer broadband and $51.90 for copper consumer broadband for broadband services to end users.

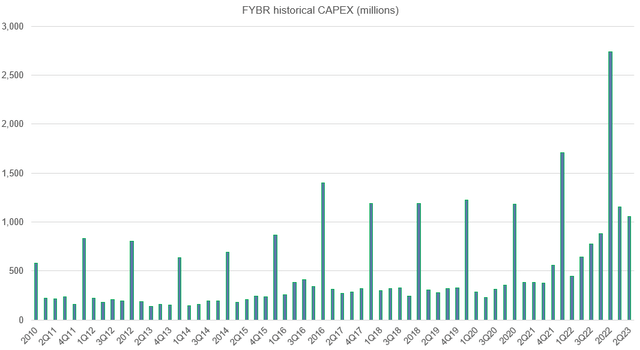

The positive side of things is that FYBR reported 316k new fiber passes in 2Q23 and still anticipates building 1.3 million homes in 2023, 100k more than in FY22. More importantly, management anticipates a drastic step-down in CAPEX in 2H23 as the current inventory buffer is depleted following an initial build period. This signals a key message to the market that the FYBR FCF generative machine is back online. If we look back at FYBR’s historical CAPEX, it has historically required around $1 to $1.5 billion of CAPEX, but has lately spiked up to >$2.5 billion, which has significantly reduced its FCF profile. And as of lately, CAPEX has been way up since 1Q22. 2Q23 finally showed that the CAPEX trend has reversed and is going to continue going down from here as the company approaches the completion of Phase 2 with 10 million fiber homes in the FY26 time frame. I expect CAPEX to gradually decline here, back to the historical range.

Author’s valuation model

In terms of fiber net adds, I acknowledge that it is a little slower than I had wanted it to be. Management disclosed weaker-than-expected penetration gains for the 2Q21 and 2Q22 cohorts, but I am confident that FYBR will continue to see growth in net adds as FYBR continues to convert copper uses and ride on the long-term secular tailwind of growing data consumption.

I expect the unit economics of each net addition to improve as well. Total blended broadband ARPU may be down 1% year over year, but I believe the recent 2% sequential increase will continue through the rest of the year. This growth is due to the fact that FYBR has cut back on the use of gift cards, adapted its prices to the market, and separated its value-added services. That’s why I think churn went up this quarter, but it shouldn’t be too much of a problem because those who left were probably not FYBR’s typical customers to begin with (the kind who shop around for the best price). The organic growth driver is robust, complementing the short-term levers that drive ARPU growth. In 2Q23, more than half of all new customers opted for the more expensive Gig+ speeds, which resulted in a higher average revenue per user. Since the company has reached a point where it can reduce previous promotions, management is optimistic about the future of ARPU growth. I share the same perspective as the management in this regard because I believe that FYBR has established itself as a well-known brand with a significant presence. This achievement comes after substantial investments were made to ensure that its fiber-based services are accessible to over 50% of the intended 10 million customer locations in the coming years. The fact that management has observed ARPU in the $70 range among new fiber customers is the best indicator that ARPU can rise further. For these reasons, I anticipate that consumer fiber broadband ARPU will return to positive annual growth.

Valuation and risk

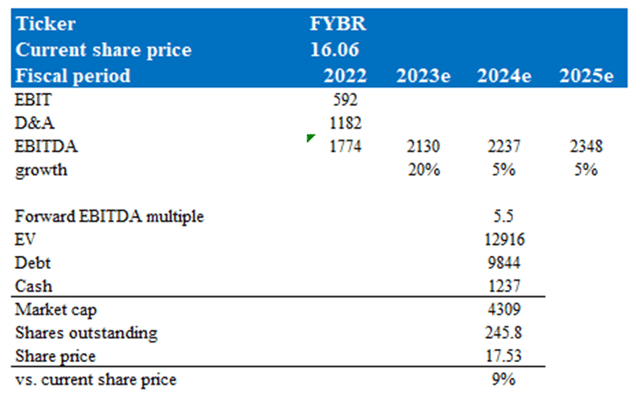

Author’s valuation model

According to my model, FYBR is valued at $17.53 in FY24, representing a 9% increase. This target price is based on my EBITDA growth forecast of 5% (in FY24 and FY25), more than half of the 20% growth that management guided for FY23, as I remain conservative on the pace of net additions given that performance has been lower than expected so far. However, the weakness is that net additions will be supplemented by the growth in ARPU.

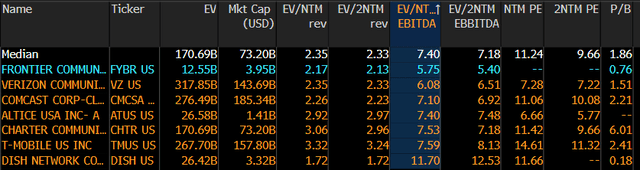

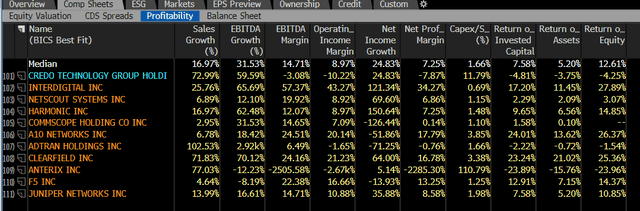

FYBR is now trading at 5.7x forward EBITDA, which I believe should stay at the current level as it deserves to continue trading at a discount to peers. There are a couple of reasons for this discount. Firstly, FYBR is still in the investment phase, which means CAPEX is still going to stay high (albeit decreasing over time). This also means that FCF will be low (consensus forecasts negative FCF for the next 3 years). Secondly, FYBR is a much smaller player in the industry compared to its larger peers, whose revenue is multiple times larger. Scale matters in this industry, as the more subscribers one has, the better the unit economics, as fiber capex and ongoing opex can be split across a larger base.

That said, a positive catalyst that might drive valuation higher is FYBR ending its investment phase earlier than expected, delivering a positive FCF. This would certainly cause valuations to go up, driving further upside than the 9% I am conservatively modeling today.

Bloomberg

Bloomberg

Downside risks include increased competition from larger players that have sufficient balance sheet capacity to go after FYBR markets if they deem the ROI attractive. Counter-intuitively, the faster FYBR grows and recognizes the market as attractive, the more threat it faces as competition is always on the lookout to grow.

Summary

My recommendation for FYBR is a hold rating, primarily due to the current share price not offering a highly lucrative upside. However, there is potential for a catalyst in the near future if management indicates an earlier end to the investment phase. Alternatively, a more favorable time to invest may be when FYBR’s fiber rollout plan approaches completion around FY25 or FY26, at which point the market is likely to better appreciate FYBR’s FCF profile.

Read the full article here