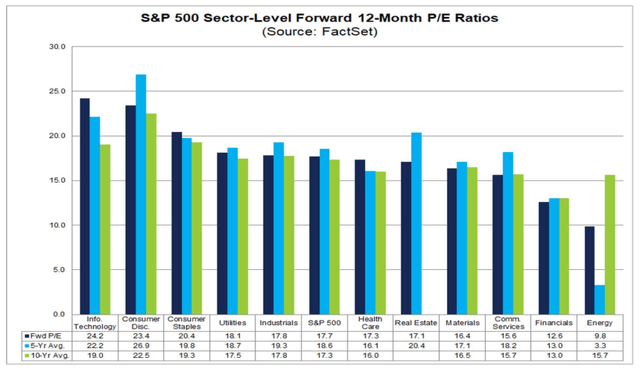

The Consumer Discretionary sector remains one of the priciest parts of the S&P 500. The growth-heavy niche sports a forward P/E of 23.4, above the SPX’s 17.7 ratio, according to FactSet. Caesars Entertainment (NASDAQ:CZR) reported Q1 results last week, and shares traded lower. I reiterate my hold rating.

Discretionary Stocks Trade At A Valuation Premium

FactSet

According to Bank of America Global Research, CZR is a US gaming operator formed after the combination of ERI and CZR in July 2020. The company has a significant footprint in Regional Gaming and Las Vegas. The company owns, leases, or manages domestic properties in 16 states with slot machines, video lottery terminals and e-tables, and hotel rooms, as well as table games, including poker.

The Nevada-based $9.6 billion market cap Hotels, Restaurants & Leisure industry company within the Consumer Discretionary sector has negative trailing 12-month GAAP earnings and does not pay a dividend, according to The Wall Street Journal.

On May 2, CZR reported an EPS miss while it beat on the top line. Net sales rose 22% year-over-year, but per-share GAAP profits were driven lower by bad weather during the quarter. Las Vegas sales and earnings were robust with higher sequential margins, while its Regionals segment was just ‘ok’ as weather disruptions dinged profitability. Finally, Online was a bright spot, and new initiatives in this space offer an upside to earnings in the quarters ahead.

Sift through the report, and you will see that EBITDAR was $958 million, which was a good number. Las Vegas operations were indeed stout, which was somewhat assumed given the results from MGM. The firm issued a 2025 goal to produce $5 in EBITDA and more than $12 or more in free cash flow per share.

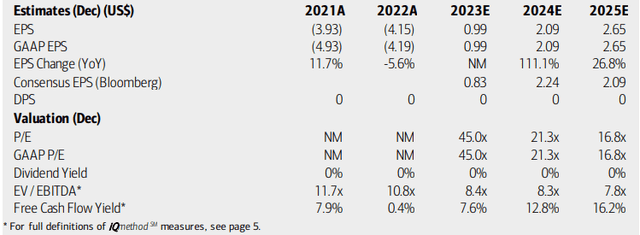

On valuation, analysts at BofA see earnings turning positive this year after back-to-back annual per-share losses. By 2025, earnings are seen as stabilizing in the low to mid-$2s. The Bloomberg consensus forecast is not as optimistic as BofA’s outlook, however. No dividends are expected to be paid on the stock, though CZR has growing free cash flow. While the company trades at a high current-year P/E, if we take normalized EPS from out-year estimates, then shares are not as pricey.

If we assume a sector-average low 20s P/E multiple on ‘24 profits, then the share price should be in the low to mid $40s, so the stock is not a value here, but not overly expensive either. I reiterate my hold rating on valuation. Still, CZR’s EV/EBITDA ratio is below that of the market and its free cash flow yield is expected to turn quite attractive over the coming quarters, so it is a mixed valuation picture. If the management team can hit its $12+ FCF/share goal for ’25, then shares have significant upside potential – and that’s seen in Seeking Alpha’s A+ growth quant rating.

Caesars: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

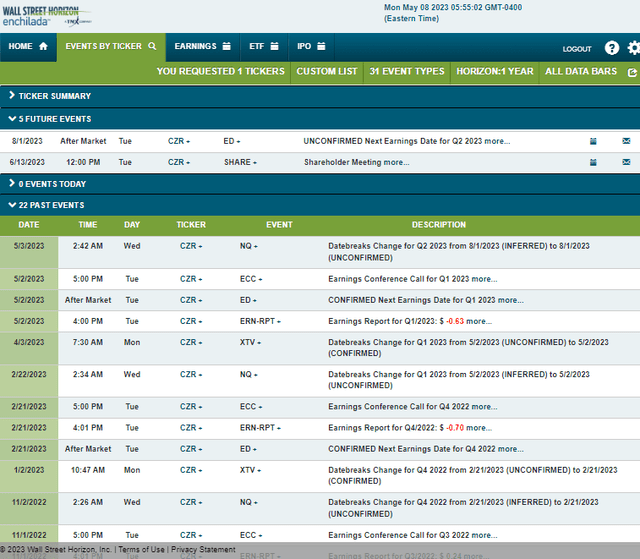

Looking ahead, corporate event data provided by Wall Street Horizon show the Caesars’ annual shareholder meeting on Tuesday, June 13 before its Q2 2023 unconfirmed earnings date of Tuesday, August 1.

Corporate Event Risk Calendar

Wall Street Horizon

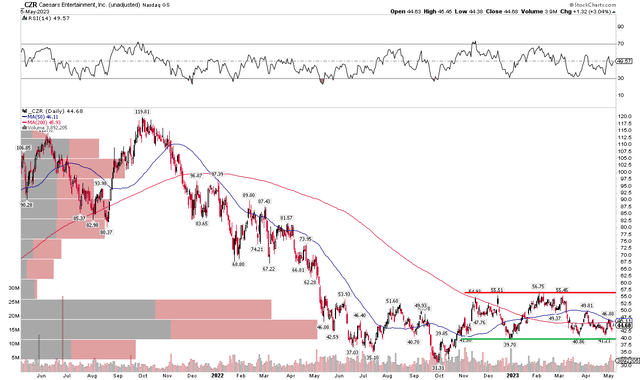

The Technical Take

Back in January, I noted resistance in the mid-$50s after the stock had broken a downtrend resistance line off the late 2021 peak near $120. Shares continue to trade sideways, but a new range has developed that investors should mind. I see support in the $39 to $41 range, while $54 to $57 has been met with selling pressure in recent months. Further indicative of trendless price action is a flat 200-day moving average and a 50-day moving average that is near the current stock price.

CZR has underperformed both the broad market and its sector over several timeframes, so relative strength is also not something the bulls can point to. With heavy volume by price in the current range, a breakout into the upper $50s or a bearish breakdown under $39 is all the more important.

CZR: Trendless Price Action Persists

Stockcharts.com

The Bottom Line

I reiterate my hold rating, but I am turning more optimistic on the valuation given the impressive growth target set by Caesars’ management team. Still, price action is not indicative of a bullish trend ensuing any time soon.

Read the full article here