In my previous 10x Genomics (NASDAQ:TXG) article, I discussed that TXG had been on my radar to be added to the Compounding Healthcare “Bio Boom” speculative portfolio due to the company’s products, services, and research and development capabilities. I concluded the article with a game plan centered on technical analysis and specific conditions. Well, those conditions never came to fruition, so I am still sitting on the sideline waiting for an opportunity to finally establish a position in TXG. 10x’s Q2 earnings revealed impressive growth, which has only strengthened my bullish conviction on TXG, while also providing me with some information to reformulate my entry parameters.

First, I will provide an overview of 10x Genomics and its Q2 performance. Then, I will lay out my updated bull thesis. Subsequently, I will highlight some key potential downsides that investors should consider when managing their TXG positions. Finally, I will outline my updated strategy for initiating a position in TXG.

Background on 10x Genomics

10x Genomics is a leading life sciences technology company specializing in cutting-edge tools and products with a global customer base. Their approach involves continuous research and development efforts to deliver top-notch products. Furthermore, the company has expanded its scope through a series of strategic acquisitions.

10x Genomics offers a range of products and services, including consumables for their chromium instruments and associated software. These offerings provide recurring revenue and attractive margins. The company’s flagship platform is the Chromium Single-Cell Platform, known for its exceptional performance and versatility. They also have the Visium Spatial Platform for spatial analysis, as well as the Xenium In Situ Analysis Platform, which is highly sensitive and adjustable. Additionally, the company provides various software applications, which include cloud analysis and the Loupe Browser.

These instruments enable single-cell analysis, a valuable method for understanding cellular processes and complexity at a granular level. Single-cell analysis has applications in personalized medicine, disease research, and drug discovery, enabling researchers to develop tailored therapies and assess drug efficacy.

Q2 Performance

In Q2 2023, 10x Genomics achieved impressive results, with revenue growing by 28% year-over-year to reach $147M. This growth was driven by the company’s performance in both single-cell and spatial biology portfolios, with strong execution in the Americas and EMEA regions. However, it’s important to note that there were continued challenges in the Chinese market.

Despite the stellar revenue growth, there was a notable shift in gross margin, which settled at 68% for the quarter. This is a significant drop from the 76% logged in Q2 of 2022. The company attributed this decrease in gross margin to alterations in product mix, largely impacted by the launch of new products. Clearly, a big drop in margins is concerning, however, this shift is primarily is result of the company’s innovation efforts to meet evolving market demands.

The company’s Q2 OpEx came in at $163M, which is a 9% increase from the $150M in Q2 of 2022. Consequently, 10x recorded an operating loss of $63.4M, marginally higher than the $63.1M reported in Q2 of last year.

It’s worth pointing out that this operating loss includes $45.7M in stock-based compensation. This is a notable increase from the $36.3 million reported in Q2 of last year. Thankfully, despite the increase in OpEx, the company’s Q2 net loss was $62.4M, down from $64.5M in Q2 of last year. So it looks like 10x is taking strides towards attaining a more sustainable financial condition.

In terms of cash, 10x revealed a robust $391.4M in cash and cash equivalents, along with marketable securities. So, it looks as if 10x has a healthy financial cushion that can be used for growth, strategic investments, or to fund the company until they break even.

Overall, 10x’s Q2 earnings report presents a story of growth and adaptability. While some metrics like gross margin and OpEx have experienced transferals, the company remains prepared to capitalize on market opportunities. With a strong cash position, 10x is in an advantageous position to track strategic initiatives and withstand potential industry headwinds. However, investors should monitor 10x’s financial performance to see how the company’s margins fluctuate and their cash reserves are being consumed in this dynamic market.

Q2 Highlights

Beyond the company’s financials, they had some noteworthy achievements in Q2, including outstanding momentum behind the Xenium platform. 10x scaled up their Xenium shipments, but the demand was able to exceed their supply. Xenium is gaining recognition as the principal platform for In Situ analysis and is complemented by the continued demand for the Visium suite of spatial discovery tools. The success of Xenium highlights 10x’s ability to innovate and match the needs of researchers in search of first-rate spatial biology solutions.

The company’s Chromium platform, a leader in single-cell analysis, was able to produce double-digit year-over-year growth. Notably, Chromium Flex has grown momentum since its launch a year ago and is expected to be a game-changer for the Chromium franchise. Moreover, the impending Feature Barcode application for Flex will expand its applications, making it even more alluring to researchers. It looks as if 10x Genomics is focused on expanding Chromium’s capabilities, offering researchers the ability to profile gene expression and cell surface proteins concurrently across multiplexed samples and millions of cells.

The Visium platform, known for its robust spatial biology capabilities, saw strong demand for the CytAssist instrument, which has simplified workflows and driven increased usage of the Visium platform. With the launch of the Visium CytAssist Gene and Protein Expression Assay, researchers now have the ability to analyze multiple analytes on the same tissue section, enhancing the platform’s versatility. Additionally, the company is making progress on Visium HD, an impressive project expected to offer unmatched spatial discovery at single-cell-scale resolution.

Despite challenges in the APAC region, primarily attributed to the Chinese market, 10x Genomics was encouraged enough by the strong Xenium momentum to raise their full-year revenue guidance to a range of $600M to $620M.

Amplifying The Bull Thesis

In my previous 10x Genomics article, I laid out my bull thesis, which was centered on the company’s growth trajectory, strategic focus on innovation, and product development. These features were driving 10x’s success in the ever-evolving landscape of biotech and life sciences. Well, the company amplified that standpoint with its remarkable Q2 performance, showcasing a growth trajectory that is both remarkable and promising. With a year-over-year revenue increase of 28%, reaching $147M, 10x’s strategic focus is driving its success.

10x’s growth is coming from both single-cell and spatial biology platforms. These platforms have made significant advances. Notably, the Xenium platform has gained rapid adoption, underscoring their ability to develop elite cutting-edge tech for what researchers require. Moreover, the Chromium single-cell analysis products are in demand, highlighting 10x’s importance in the world of life science research.

The company’s relentless efforts to innovate are evident in their capacity to expand their product portfolio. The introduction of the Chromium Flex platform and plans to launch the Feature Barcode application are indicative of the company’s determination to stay at the forefront of the industry. These strategic moves are not only expanding their market reach but will be recognized as being part of critical research in a variety of diseases, including cancer research.

In spatial biology, the company’s Visium and Xenium platforms are shaping the future of spatial biology research. The company reported that demand for the CytAssist instrument is strong, and the upcoming launch of Visium HD holds significant promise. Xenium, in particular, is harvesting admiration for its outstanding performance, sensitivity, throughput, and versatility in a variety of tissues and sample types.

Fortunately, the company’s IP portfolio appears to be strong enough to help protect their products and position. With over 2K patents issued or pending, 10x appears to have safeguarded its technological advancements and preserved a competitive advantage in their contentious market full of IP legal battles.

In terms of financials and commercial performance, the company’s Q2 results were strong with an improvement in total revenue that helped encourage the company to raise their full-year guidance to the range of $600M to $620M, signaling a strong internal belief that they will have sustained growth in the second half of the year.

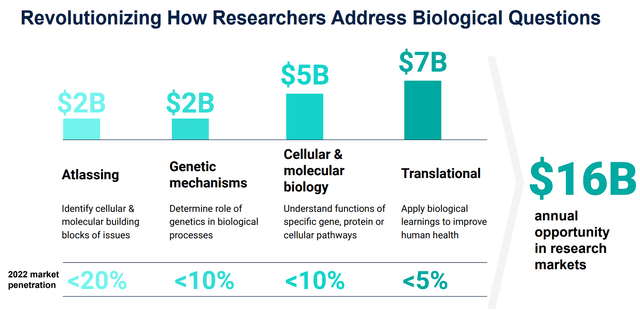

Although there will be some hurdles and headwinds, the company’s long-term growth prospects are exceptional. 10x Genomics aspires to establish itself as a significant contender in a $16B market, covering areas such as atlas creation, genetic mechanisms, cell bio, molecular bio, as well as translational biology. Industry experts predict robust double-digit expansion in the forthcoming years, potentially leading to a revenue surpassing the $1B mark.

10x Genomics Estimated Market Opportunity (10x Genomics)

To me, 10x Genomics is becoming an essential player in the life sciences industry, with its technology poised to play a critical role in future medical advancements. This presents a substantial market opportunity in both the short and long term. Additionally, the company maintains favorable margins and a strong financial position. In my opinion, TXG’s bull thesis is stronger than ever and is worthy of a spot in the Compounding Healthcare Bio Boom Portfolio.

Key Risks

Speculative healthcare stocks carry a considerable amount of risk, and TXG is no exception. The company is still reporting losses, and profitability is unclear. So, almost every little concern is magnified until the company is able to address it. For example, 10x acknowledged challenges in the Chinese market, with soft demand and inventory dynamics affecting their Q2 performance in that country. Make note, that they anticipate continued headwinds in China for the next couple of quarters. Another issue to keep an eye on is the short-term impact of Xenium’s adoption on gross margins and cash flow. Yes, both of these concerns should not harm the company’s long-term growth and prospects as a market leader, but they can be a source of apprehension amongst investors.

A different element to consider is that 10x is in a very competitive industry, with established players and emerging innovators that could pose a challenge both commercially and in terms of IP.

Another concern is that TXG’s stock price has exhibited considerable volatility, which is common for tickers of companies in genomics, healthcare tech, and life sciences tools. Therefore, investors in TXG should remain attentive and have a defined strategy for managing this volatility.

Considering these risks, I am giving TXG a conviction level of 2 out of 5.

Still Looking For An Entry Point

I have to admit, I was ready to pull the trigger on TXG several times over the past few months, but it still remains on my watchlist due to some concerns raised during subsequent technical analysis.

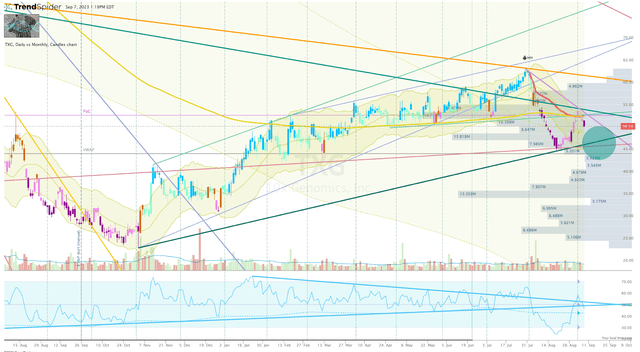

The share price was able to break the wedge sequences that we saw over the first half of 2023, but it got rejected after running into another downtrend ray formed from the April 2022 high.

TXG Daily Chart (Trendspider)

Subsequently, the share price fell into a step sell-off but bounced off the previous uptrend, but was rejected by the anchored VWAP spawned from the August-high. Moreover, the Go-No-Go indicator is bearish at the moment. Therefore, we really don’t have a solid setup to work with at the moment.

I’ll be monitoring the share price as it approaches the uptrend ray from the lows (green dot). If it successfully rebounds off the uptrend ray and surpasses the downtrend ray from the recent high, I’ll consider initiating a modest position in TXG. However, should the share price dip below the uptrend ray before breaking the downtrend, I’ll be inclined to establish a position on a high conviction setup around the $35 support level.

After securing a position, my strategy involves gradually increasing my holdings in TXG over the next few years. TXG will be a key component of my Bio Boom portfolio, with the aim of transforming the position into a “House Money” status through a series of trades. This approach will help mitigate risk and pave the way for long-term holding potential in my “Bioreactor” growth portfolio.

Read the full article here