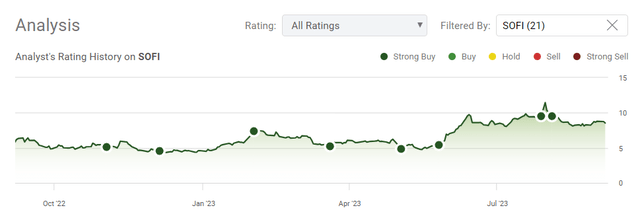

Since March, SoFi Technologies (NASDAQ:SOFI) top brass have increased their speaking engagements at industry conferences. This is important because it puts SOFI front and center next to industry heavyweights, increases awareness, and provides additional insights into SOFI’s operations outside of the earnings reports and conference calls. Anthony Noto (SOFI CEO) has participated in Bank of America’s 2023 Electronic Payments Symposium Conference, Piper Sandler Global Exchange & FinTech Brokers Conference, JP Morgan Technology, Media and Communications Conference, and the Goldman Sachs Communacopia + Technology Conference. Chris Lapointe (SOFI CFO) has also presented at the KBW Fintech Payments Conference, and the Morgan Stanley US Financials, Payments and CRE Conference. SOFI delivered a triple beat in Q2 as their adjusted net revenue and adjusted EBITDA came in above their Q2 high-end guidance, and they increased their initial 2023 fiscal year guidance for the 2nd time. No matter what SOFI does, there is still a significant amount of bearish sentiment as an analyst downgraded shares of SOFI after Q2 earnings, and the current short interest is sitting at 11.93% as of August 15th. Anthony Noto’s recent fireside chat at the Goldman Sachs (GS) conference on September 6th provided critical operational information, and I am just as bullish as I have ever been on SOFI the company, and shares of its stock.

Seeking Alpha

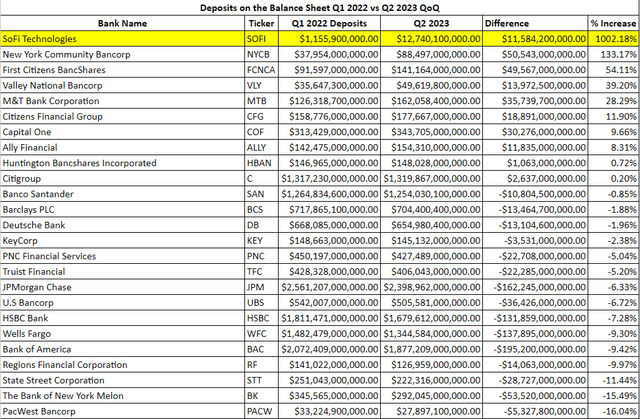

SOFI Bank continues to gain traction, and many deposits are coming from the 5 large money centers

I track the deposit inflows and outflows on 25 different banks, which include everything from the large money centers and regionals to digital FinTechs. I have shown the inflows and outflows from Q1 2022 through Q2 2023 in the table below because SOFI received its national banking charter in the middle of Q1 2022. Since the close of Q1 2022, 15 of the 25 banks have seen between -$3.53 and -$195.1 billion leave their institutions, while the remaining 10 banks I follow saw between $1.06 and $50.54 billion in deposit inflows. Since Q1 2022, SOFI has gained the 8th largest amount of deposits ($11.58 billion) and, on a percentage basis, has seen the largest amount of inflows at 1,002.18%.

Steven Fiorillo, Seeking Alpha

Mr. Noto provided everyone who listened to the conference or read the transcript with some critical information regarding banking. In the SoFi Money aspect, 50% of their funded accounts come from direct deposits, and these customers have an average balance of over $20,000. The 50% number is exciting because that means there is an overwhelmingly strong chance that the SoFi Money checking account is their primary bank account, which bills are being paid out of. This allows SOFI to benefit from gathering an immense amount of payment data across its members and model for how much its members are spending each month and what types of loans or credit cards are being paid. This information can be structured to place specific products in front of members that can help improve their financial profile rather than sending out mass physical and digital mailers and seeing what sticks. Having the knowledge that a member is paying 2 credit cards per se puts SOFI in a position to offer that member a personal loan to pay off higher-interest debt at a lower rate, earn trust, and subconsciously place SOFI higher on the internal list as an outlet for future financial needs.

We’re in the last month of Q3, and Mr. Noto indicated that he is confident that SOFI is on track to continue adding at least $2 billion in new deposits quarterly. Since the close of Q1 2022, Bank of America (BAC), JPMorgan Chase (JPM), and Wells Fargo (WFC) have seen the largest outflows on a dollar basis. I had suspected that SOFI’s member and deposit growth came from a combination of customers switching their primary financial institutions and more first-time customers wanting a cloud-first bank with a higher interest rate than a traditional bank as the need for physical locations continues to decline. At the Goldman Sachs conference, Mr. Noto specifically stated that SOFI sees where the ACH is coming from and that SOFI is taking share of the top-5 banks in the United States.

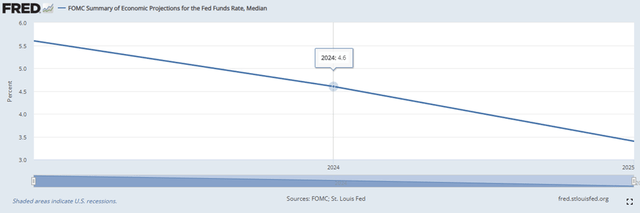

The next question that is probably on some investors’ minds is will SOFI be as attractive to potential customers as a banking option in a declining rate environment as the Fed gets closer to pivoting. We’re heading into an upcoming CPI report on September 13th, then the Fed interest rate decision and economic projections on September 20th. The Fed had previously paused and stated that they would remain data-dependent regarding future rate hikes. Trading Economics has forecasted that CPI will come in at 3.4%, so we will see what occurs. The bigger story for me is that Core CPI continued downward from 4.8% in June to 4.7% in July. Trading Economics had forecasted for 5% in June and 4.8% in July and is forecasting for 4.5% in August. The St. Louis Fed still has its forward Fed Funds rate declining to 4.6% in 2024 and 3.4% in 2025. Regardless of whether we get another rate increase at the September or November meeting, all signs are pointing toward the Fed easing and cutting rates on the horizon.

St. Louis Fed

Being able to offer one of the largest yields on cash was a tremendous asset as individuals realized that traditional banks would never reward them with a competitive rate for utilizing their deposits to fund loans. We could see a declining rate environment be more attractive for SOFI since SOFI has both sides of the business intertwined from deposits to originations, they’re in a position where they have options in a declining rate environment. SOFI charges an APY that allows them to fund loans at a 200-basis point margin. When rate cuts start to occur SOFI can reduce their APY and still be a leader in interest on cash and increase their margin by 50% to 300 basis points or they could leave their APY where it is for a period of time and gain further market share as they would have the ability to do so. Mr. Noto sees a scenario where when rates decline, either SOFI’s market share or spread between interest paid and interest generated on loans increases, allowing them to acquire customers at an attractive long-term value and a 12-month payback cycle.

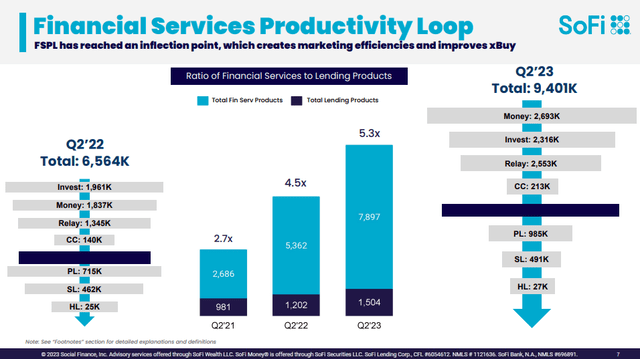

The aspect that people should remember is that SOFI is a young company, and its national banking charter is less than 2 years old. SOFI is building a sticky ecosystem that is validated from the metrics of its financial services productivity loop. SOFI’s flywheel incorporates different products that focus on specific use cases that work better together. SoFi Money and Relay are at the top of the funnel and act as a bridge into investments, loans, and credit cards. The amount of existing members who utilize invest has increased from 45% to 65%, and between 25-30% of SOFI’s loans come from existing members. A very bullish thesis regarding its ecosystem is created if you take these metrics and extrapolate them out across a larger member base. SOFI is still in its infancy, but looking at this company 5-10 years down the road, SOFI has the ability to take market share from its competitors, cross-sell its products to an increasing member base, and become one of the largest financial institutions in the United States.

SoFi Technologies

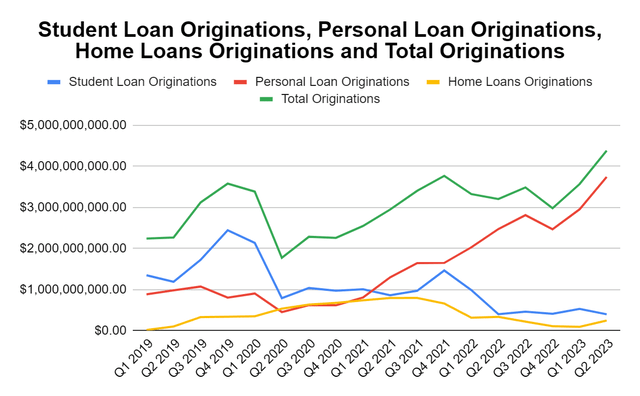

These comments from Mr. Noto should be looked at as bullish. In a rising rate environment where mortgage originations were stagnant due to homeowners being handcuffed to low single-digit mortgages and federal student loans were still frozen, SOFI was able to achieve record organizations that exceeded $4 billion in Q2. If SOFI can capitalize on one of its critical success factors of offering more enticing products at a better value than the competition during an environment where rates are declining, then we could certainly see its market share expansion in member growth trickle down to investment and loan products. When I put this together and use the numbers that Mr. Noto provided, if 25-30% of members take out loans with SOFI, then every 1,000,000 members added could account for an additional 250,000-300,000 new originations, and that doesn’t include the people who take loans that aren’t members. I am expecting SOFI to see a significant increase over the next 6-9 months in student loan originations, and when the Fed brings rates back down to the 4% level, I think home loan originations will heat up.

Steven Fiorillo, SoFi Technologies

The technology side and possibly getting a hybrid or tech valuation

SOFI isn’t just a finance company, it’s also a technology company, regardless of whether people want to admit it or not. The technology side is just as exciting as the finance side, because the possibilities are immense. For those that are under the impression that there is nothing special about SOFI’s platform or its underlying technology, I would suggest conducting a fair amount of due diligence. SOFI owns the entire backend, and it’s now backed by a national banking charter. Galileo was acquired so SOFI could replicate the end-to-end integration they created in lending with their checking and savings business. The Cyberbank platform from Technisys is cloud-native and supports the integration of third-party technologies via the Technisys marketplace. SOFI is positioned to deploy a robust product stack utilizing every component of SOFI’s arsenal as a service platform that can be white-labeled and custom-branded. If large financial institutions such as JPM had the underlying tech, they wouldn’t be enlisting Thought Machine to deploy their cloud-based systems for their retail banking.

2023 marks the 1st year in a 3 year cycle where SOFI will recognize annual synergies between $75-$85 million in cumulative cost savings by transitioning SOFI’s checking, savings, and credit card to the Technisys technology stack. From 2026 onward, SOFI is projected to generate $60-$70 million in annual cost savings. The dilution that shareholders endured from the Technisys acquisition will actually pay for itself from just the cost savings in addition to providing an additional critical success factor, allowing SOFI to innovate and deploy products on their timetables. From a revenue-generating aspect, SOFI is putting itself in a position to power the financial services of its competitors and generate ongoing recurring revenue. This is where the technology aspect gets exciting as SOFI will be able to innovate and reduce its costs internally and monetize the same platform it built for itself externally. When you think about SaaS companies and the valuations that have been placed on them due to their tech, it’s not crazy to think SOFI will be valued as a hybrid company between a financial institution and a technology company when they start onboarding customers and generate significant amounts of revenue from their technology stack.

Steven Fiorillo, SoFi Technologies

On the Q2 conference call, Mr. Noto disclosed that Galileo signed five new clients, and Technisys brought four clients live. He also announced that SOFI was selected to compete in a number of requests for proposals (RFPs) from large institutions. In the recent fireside chat, Mr. Noto elaborated on this theme and discussed how big banks have started to do more RFPs for more modern technology and that SOFI has been invited to participate due to the core technology in Technisys. An interesting aspect is that, in some cases, when SOFI has explained its product mix and tech offerings, some of the big banks conducting the RFPs became interested in Galileo’s processing capabilities or APIs. If SOFI hadn’t been in the interview process because of Technisys, these banks would have never known about the capabilities of implementing services from Galileo.

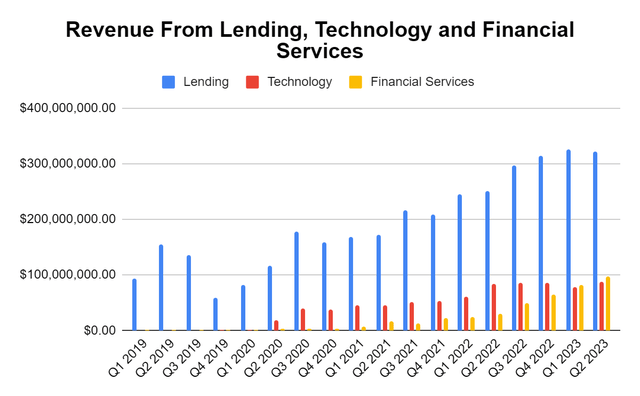

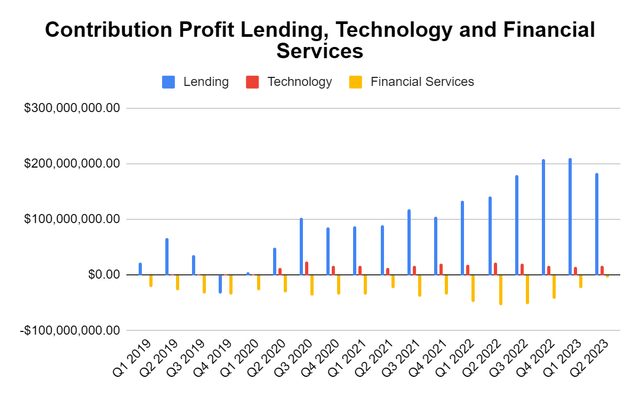

Potential customers can recognize a significant number of synergies between Galileo and Technisys in addition to cross-selling products. When you add the bank charter and SOFI’s products, they can white-label a fully customized solution for financial institutions as well as non-financial institutions that want to offer financial products to their customers. For some companies, it will make sense just to outsource the engineering to SOFI rather than dealing with the internal resources needed to create and maintain the product suite in addition to staying compliant with external regulations. The technology side has generated $335.94 million in revenue and $68.43 million in contribution profit in the trailing twelve months (TTM). Looking out several years, or just over 6 years to 2030, how should SOFI be valued if it becomes one of the biggest providers of cloud banking solutions and is generating over $1 billion annually of revenue from its technology segment? SOFI’s technology segment is operating at a 20.37% contribution profit margin, so if the tech segment keeps its current margins, then every $1 billion of revenue would produce roughly $200 million in contribution profit annually. I don’t think the bears understand the technology aspect, and how critical it can be for SOFI’s future valuation.

Steven Fiorillo, SoFi Technologies

Where I see SOFI headed and what I want to see going forward

I’m excited about the Football season because of SoFi Stadium. A Thursday, Sunday, or Monday night football game will generate roughly 20 million unique views, which is 5 million more than the unique views SOFI generated from its previous sponsorships. By shifting their spending to the naming rights for SoFi Stadium, SOFI will generate roughly 80 million unique views from having 4 games at these timeslots in addition to the audience hearing the name SoFi Stadium 15 times during the broadcast. SoFi Stadium has also been selected for The Olympics opening ceremony, The World Cup, and 6 shows of Taylor Swift. I think the brand recognition from SoFi Stadium, their increased advertising, and referrals from current members will significantly expand their member base in Q3 and Q4.

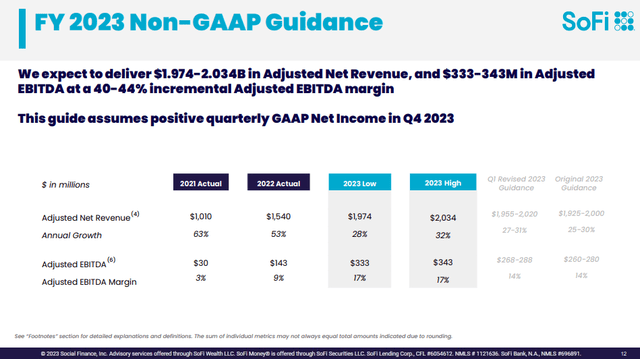

For those that follow SOFI, they became synonymous with beating expectations and raising guidance throughout 2022, without guidance on student loans. In 2023, it’s more of the same, and SOFI is projecting to be profitable by Q4, which means that when Q4 results are released, we will see GAAP profitability. I think SOFI will provide a triple beat in Q3 and raise guidance again. I think SOFI will finish 2023, generating $2.08 billion in revenue and generated at least $375 million of Adjusted EBITDA. I am in SOFI for the long haul, and when student loans are back in full effect, it’s going to be interesting to see what the impact on the top and bottom lines will be. The critical milestones for me are $10 billion in Adjusted Net Revenue, $2 billion in Adjusted EBITDA, and 10 million members, and I think these can all be by 2030, some sooner than others.

I would love for SOFI to have an investor day sooner rather than later and elaborate on their roadmap for future services. For SOFI to become a top-10 financial institution, it will need to broaden its offerings and continue to take the fight to the competition. By the end of 2025, I want to see SOFI build out a business banking segment to take deposits, run payroll, issue corporate credit cards, issue corporate purchase cards, and provide business loans. The infrastructure is already there on the banking side, and I can’t see a scenario where this isn’t on the whiteboard. SOFI needs to service both personal and business banking needs to deliver on their goals.

SoFi Technologies

Conclusion

I think investor sentiment and the narrative regarding SOFI are getting stronger. The proof is in the numbers, and SOFI is growing its member base, its top and bottom line numbers, and seeing its margins increase. I think all eyes will be on the ramp-up for student loans and their fiscal year 2024 guidance. I am not concerned about the fluctuations in SOFI’s share price or that the earnings bump was sold off. This is a long-term investment for me, and I plan on being in this for at least 5-10 years as I feel SOFI has the potential to generate some of the largest percentage base returns from anything I am invested in going forward. I am looking forward to the Q3 earnings release, and I still believe shares can reach $15 by the end of the year.

Read the full article here