I’m frequently asked to confirm that the thesis for a company remains intact. That’s understandable, given how volatile stock prices can be.

Sometimes, you’ll see a blue-chip go up or down 30% in a single day.

| Time Frame (Years) |

Total Returns Explained By Fundamentals/Valuations |

| 1 Day | 0.02% |

| 1 month | 0.33% |

| 3 month | 1.0% |

| 6 months | 2.0% |

| 1 | 5% |

| 2 | 10% |

| 3 | 15% |

| 4 | 28% |

| 5 | 36% |

| 6 | 47% |

| 7 | 58% |

| 8 | 68% |

| 9 | 79% |

| 10+ | 90% |

| 20+ | 91% |

| 30+ | 97% |

(Sources: DK S&P Valuation Tool, JPMorgan, Bank of America, Princeton, RIA)

Almost all of the time, the daily swings of the market are meaningless. It takes over six years just for fundamentals to drive the most returns.

But naturally, you don’t want to sit in Sears Kmart or GE for 7+ years waiting for confirmation that the wheels have fallen off the bus.

| Sector |

% Of Companies That Suffer Permanent 70+% Declines Since 1980 |

| Energy | 65% |

| Tech | 59% |

| Communications | 49% |

| Consumer Discretionary | 48% |

| Healthcare | 48% |

| All Sectors | 44% |

| Industrials | 39% |

| Materials | 38% |

| Financials | 29% |

| Utilities | 14% |

(Sources: DK S&P Valuation Tool, JPMorgan)

Not when up to 65% of an entire sector can poison your portfolio.

Energy investors can be a nervous bunch, and who can blame them?

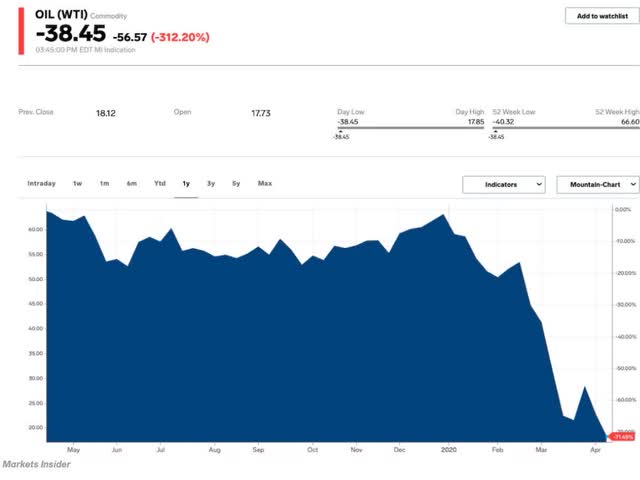

Business Insider

Since 2008, we’ve seen 3 of the largest oil crashes in human history, including one in which crude hit -$38.

Well, I just got a request for a confirmation check from several subscribers for one of our favorite midstream Ultra SWANs (sleep-well-at-night), Enbridge (NYSE:ENB).

So let’s look at how to check to see if the market’s beating on this 7.4% yielding dividend aristocrat is justified or if it’s the best time in three years to load up on the ultimate “buy and hold forever” energy utility.

What’s The Matter With Enbridge? Market Nervous About $14 Billion In Deals

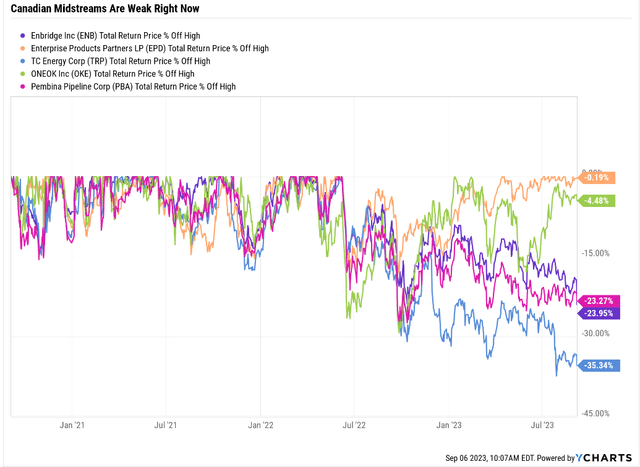

Ycharts

Canadian Midstreams, in general, are suffering while US midstreams are thriving.

Why? The biggest difference between Canadian and US midstreams is regulatory. In recent months, investors have gotten nervous about pipeline giants being able to complete mega projects.

For example, the $23 billion TransMountain expansion project that Kinder Morgan managed to sell to the Canadian government is now delayed.

The pipeline requires a route change through British Columbia, but an indigenous group opposes it and is fighting the change in court.

TC Energy investors remember its $15 billion loss when Keystone XL was canceled when President Biden pulled the required permit.

What’s perhaps surprising to Canadian pipeline investors is the government’s apparent anti-pipeline stance after it paid $3.3 billion to buy the project from Kinder.

The Canadian government appears to be fighting itself on this one, and naturally, that is creating some fear about whether other megaprojects might face costly delays.

And then there’s the big M&A news that ENB just dropped.

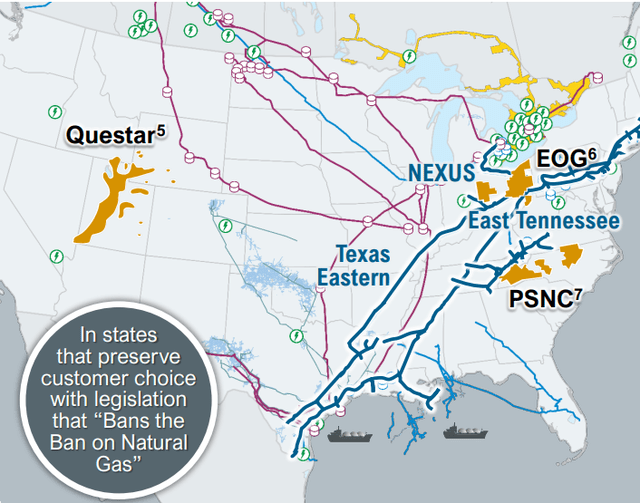

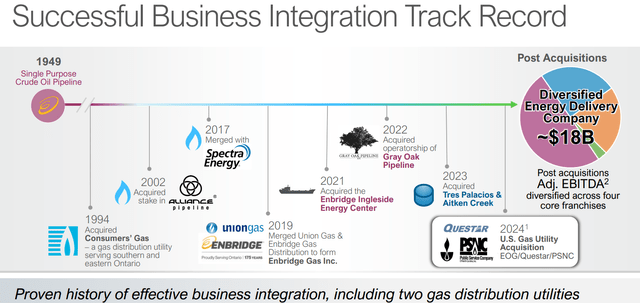

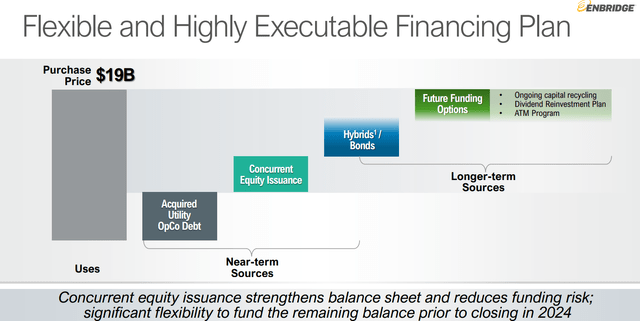

Enbridge is acquiring East Ohio Gas Company, Public Service Company of North Carolina, and Questar Gas natural gas distribution utilities for CAD 19 billion (USD 14 billion), including USD 4.6 billion in debt from Dominion Energy.” – Morningstar.

ENB is also issuing $3 billion in new shares in addition to funding the deal with $11 billion in debt, including the debt taken on from Dominion.

That’s 4.2% dilution to existing shareholders.

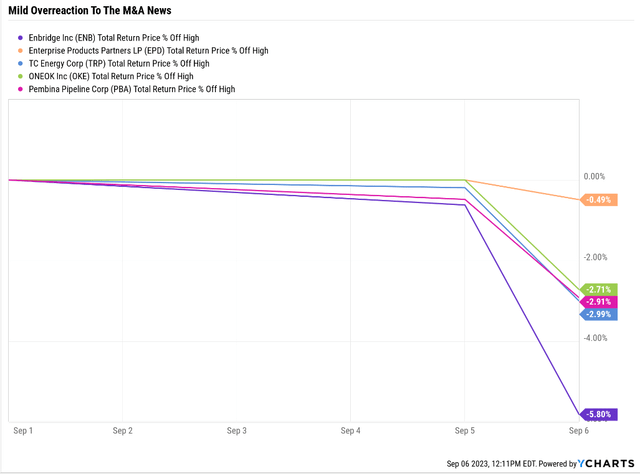

Ycharts

ENB dropped 6% on the news, a mild overreaction to share dilution.

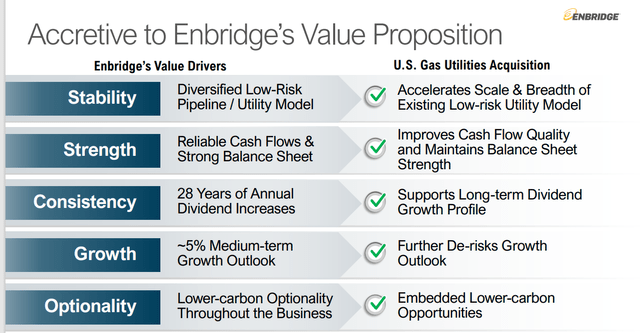

Why is Enbridge buying these three utilities?

investor presentation

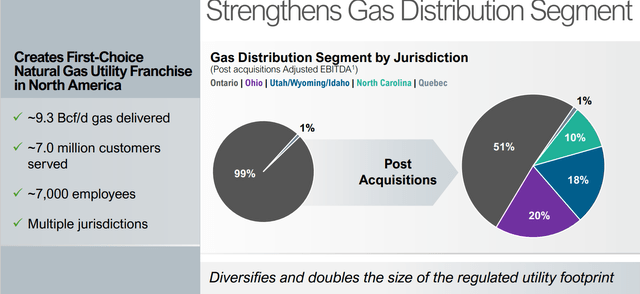

The deals will mean ENB is about 25% utilities and has 7 million customers, the largest single utility in North America.

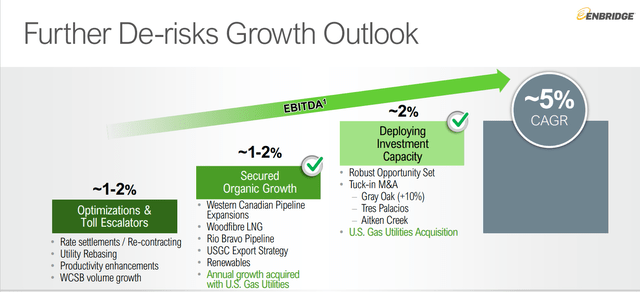

Management believes these new utilities can help it achieve its goal of 4% to 6% growth, including through green energy investment opportunities.

For example, the Public Service Company of North Carolina is working to complete hydrogen blending facilities ENB thinks can be ready next year.

These three utilities also include $1.3 billion in new growth projects which are lower risk than the traditional midstream project. Most utility growth projects are approved ahead of time and even if the costs prove higher than expected, utilities can usually pass on costs, not the case with pipelines.

investor presentation

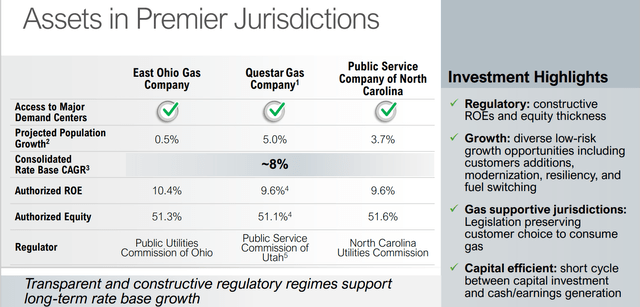

ENB is paying 16.5X earnings for these utilities which about average for natural gas utilities right now.

So ENB isn’t getting a bargain but is buying at a fair price.

In terms of distributable cash flow per share, ENB thinks it will be accretive in the first full year of ownership.

investor presentation

ENB is getting some good utilities here with around 10% returns on equity, slightly above the national average. But the approved growth projects represent 8% growth in the rate base, and thus revenue from the utility assets its buying.

These utilities have good relationships with regulators allowing them to rapidly recoup construction costs through higher rates.

investor presentation

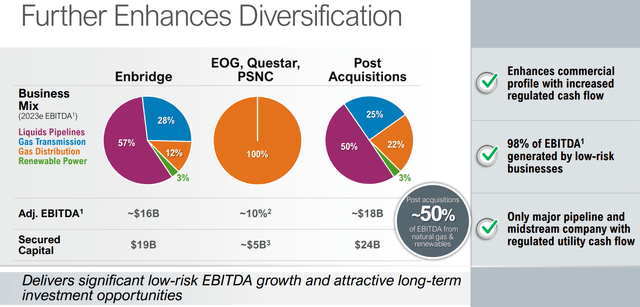

After this deal closes ENB estimates its growth backlog will be $18 billion and it will get almost half of cash flow from utilities and renewables.

That’s a pretty smart move since natural gas demand is expected to keep rising through at least 2050 while oil demand is expected to peak in 2030 before gradually declining.

This utility buy seems a natural fit for ENB as it works to make itself even more utility like.

investor presentation

ENB will now have utility businesses in five states or provinces, including rapidly growing markets such as North Carolina.

investor presentation

ENB has been consolidating natural gas utilities for decades. This is actually the 11th gas utility that ENB has bought since 1994. That means, on average, ENB buys a gas utility every three years.

ENB estimates that it will be able to recoup the $3.7 billion in growth spending on those utility projects within 3 years.

investor presentation

ENB has a goal to grow at 5%, a steady utility like rate. The liquid business, consisting of oil pipelines, is a slow growth industry. Utilities are a relatively faster growth market because utilities have to invest in the green energy transition.

- the more utilities invest in new capacity the faster they are allowed to pass on costs to consumers

TC Energy is spinning off its liquids business to focus on natural gas and renewables. ENB isn’t going that far, yet, but is definitely focused on the growthiest and safest part of its markets.

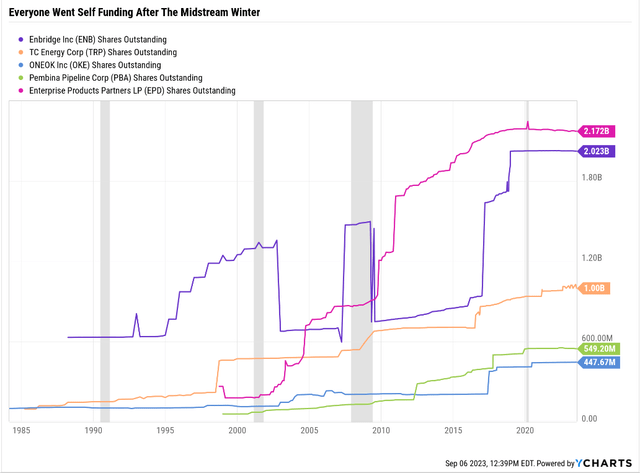

And Here’s Why Wall Street Is A Bit Upset

investor presentation

ENB is going to be issuing shares to fund part of this deal and it says it is open to issuing more shares in the future to buy more utilities (or possibly even other midstreams).

This harkens back to the bad old days when midstream ran hot payout ratios of nearly 100% and funded growth with cheap debt and overvalued stock.

Remember when oil was $100 between 2010 and 2014? Remember when Kinder Morgan was paying out 93% DCF and promising 10% annual dividend growth…right until it slashed its dividend 75%?

Remember the midstream winter? Years of bear market and payout cuts, sometimes more than one from the same midstream?

Ycharts

REITs, utilities, yieldCos, and from time to time, midstream, all issue shares to fund growth.

Midstream has mostly gone fully self-funding in recent years, funding growth with safe amounts of debt and retained cash flow.

Now ENB is going back to the old ways, selling new shares if it has to. That’s a riskier strategy than a pure free cash flow self-funding model like what EPD has.

BUT that doesn’t necessarily mean it’s a bad one.

While we think Enbridge (ENB) paid a reasonable price and see the long-term merits of the deal (cash flow diversification, enhanced stability of cash flows), high leverage and a funding gap could act as overhangs.” – Seeking Alpha

ENB is adding $13 billion in debt to its balance and gaining about $850 million in EBITDA. That means leverage will rise a bit, as Wells Fargo notes in its recent downgrade.

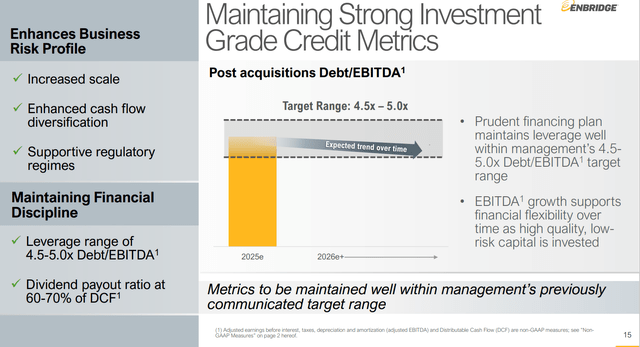

What does ENB’s leverage go from? From 4.6 to 5.4X debt/EBITDA.

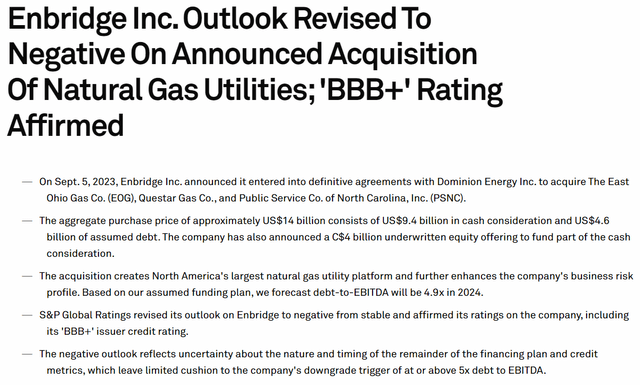

Rating agencies want to see 5X or less leverage in this industry. So it’s not surprising that S&P has downgraded its outlook to negative, implying a 33% chance of a cut to BBB in the next two years.

S&P

S&P estimates that next year’s new growth projects coming online will bring leverage down to 4.9X, but if there is any unexpected disruption in cash flow, that ratio could cross 5X.

There is approximately US$6.5 billion to be funded before close in 2024. The company has indicated it will rely on a number of avenues to fund the remainder of the purchase price including noncore asset sales, hybrid capital, dividend reinvestment plan, at-the-market program, and debt. Although Enbridge has superior market access, given a significant portion of the cash consideration still requires funding, we believe that execution risk remains in the short-to-medium term.” – S&P

The market is perhaps a bit worried that ENB is taking on $11 billion in debt at a time of high interest rates.

ENB is moving back to a growth focus in an age when energy investors, traumatized by a lost decade, want dividends and buybacks and no talk of growth or ATM (sell shares into the market to fund growth) programs.

We could lower our rating on Enbridge if the company is unable to successfully raise additional funds through asset sales or other means such that adjusted debt to EBITDA is at or above 5x for a prolonged period.

We could revise the outlook to stable if the company is able to raise a substantial portion of the remainder of the capital to fund the acquisition and reduce debt to EBITDA closer to 4.75x during the next 12-18 months.” – S&P

Management says its 4.5X to 5X leverage target remains in effect. S&P doesn’t necessarily not believe them, just thinks there is some risk given that Canada’s government has been stricter on the regulatory front in recent months.

- significant cost overruns at TRP have rating agencies worried that ENB’s leverage ratio might go higher than planned

investor presentation

ENB remains committed to a strong balance sheet and a 65% payout ratio.

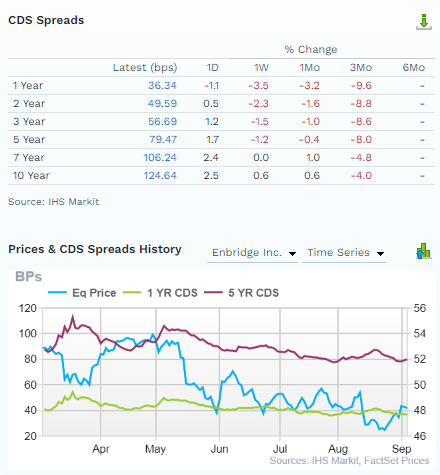

FactSet Research Terminal

The bond market believes ENB with the 1 day default risk rising by just 2.5% to 1.25% or so for the next decade.

- implied 3.75% 30-year default risk = BBB+ rating

Bond investors are not worried about ENB’s big new load of debt.

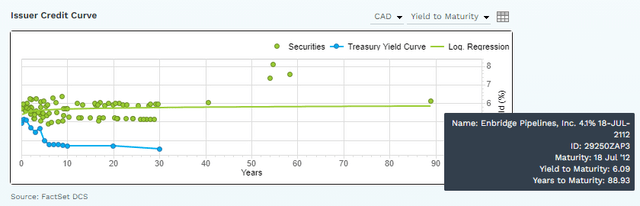

FactSet Research Terminal

When the US treasury tries to sell a 40 year bond, the bond market laughs.

When ENB tries to sell a 100 year bond, maturing in 2112 at 4.1% interest rates, investors back up the truck.

Today ENB’s 100 year bonds yield 6.1%, lower than many 40 year corporate bonds from investment grade rated companies.

Why You Can Trust Management Knows What It’s Doing

Management says this is a good deal, a sound part of a master long-term plan to get ENB through the energy transition.

It’s a plan the bond market loves enough to buy 100 year ENB bonds, something no other energy company can claim.

Wall Street is initially skeptical, having been traumatized by years of shareholder dilution and high debt funded deals back when oil was $100.

S&P believes management but is watching closely.

Bond investors believe ENB.

So far Wall Street is skeptical.

Who should we believe? I’m siding with management and here’s why.

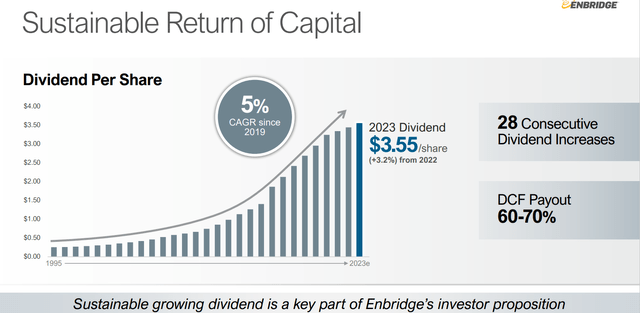

investor presentation

ENB boasts the longest dividend growth streak in the industry, at 28 years.

Management has been working on the green energy transition for nearly a quarter century. That’s why S&P considers it the 2nd best energy transition plan in the industry (behind WMB’s).

- ENB’s long-term risk management (including energy transition plan) is ranked 96th percentile by S&P

- top 320 companies on earth

What about the future dividend? It is expected to grow slightly slower than cash flow allowing ENB some financial flexibility.

Do you know who has the best judgement about ENB’s management and corporate culture? The stock market.

As Ben Graham said, over the long-term the market is a weighing mechanism correctly “weighing the substance of a company”.

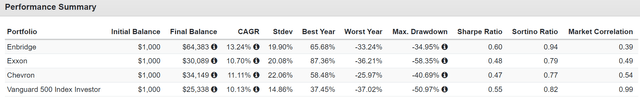

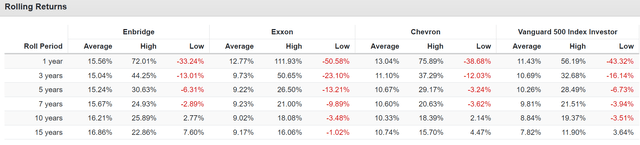

Total Returns Since 1990 (33 Years = 97% Returns From Fundamentals)

Portfolio Visualizer Premium

The stock market has determined with 97% statistical confidence that ENB is a world-beater midstream, running circles around its peers, and even the only other aristocrats in the sector.

Portfolio Visualizer Premium

ENB has been delivering dependable dividend growth and market-beating and peer crushing returns for almost a third of a century.

This 3 utility deal is part of a 100 year plan to continue that dividend growth streak into the 22nd century.

Why Enbridge Is A Very Strong Buy

| Metric | Historical Fair Value Multiples (9-Years) | 2022 | 2023 | 2024 | 2025 |

12-Month Forward Fair Value |

| 5-Year Average Yield (Pure Industry Bear Market) | 6.51% | $39.48 | $39.94 | $39.94 | $43.01 | |

| 13-Year Median Yield | 4.48% | $57.37 | $58.04 | $58.04 | $62.50 | |

| Operating Cash Flow | 9.64 | $37.21 | $43.57 | $43.57 | $48.68 | |

| Average | $43.08 | $46.00 | $46.00 | $50.17 | $46.00 | |

| Current Price | $33.28 | |||||

|

Discount To Fair Value |

22.75% | 27.65% | 27.65% | 33.67% | 27.65% | |

|

Upside To Fair Value (Including Dividends) |

29.45% | 38.22% | 38.22% | 50.76% | 46.03% | |

| 2023 OCF | 2024 OCF | 2023 Weighted OCF | 2024 Weighted OCF | 12-Month Forward OCF | 12-Month Average Fair Value Forward P/OCF |

Current Forward P/OCF |

| $4.52 | $4.52 | $1.39 | $3.13 | $4.52 | 10.2 | 7.4 |

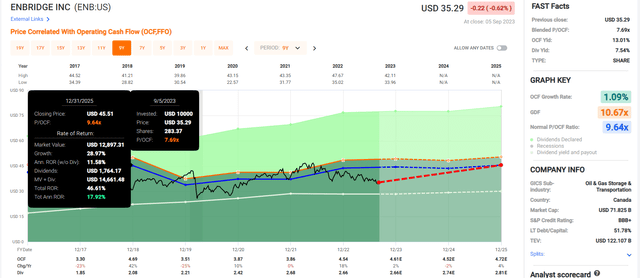

ENB is historically worth 10X cash flow and trades at an Anti-bubble 7.4 today.

- 11.3 EV/EBITDA = private equity valuation

You’re getting the same level of value as private equity funds like Brookfield and Blackstone are getting.

| Rating | Margin Of Safety For Very Low-Risk 13/13 Ultra SWAN Quality Dividend Aristocrat | 2023 Fair Value Price | 2024 Fair Value Price | 12-Month Forward Fair Value |

| Potentially Reasonable Buy | 0% | $46.00 | $46.00 | $46.00 |

| Potentially Good Buy | 5% | $43.70 | $43.70 | $43.70 |

| Potentially Strong Buy | 15% | $39.10 | $39.10 | $39.10 |

| Potentially Very Strong Buy | 25% | $32.78 | $34.50 | $34.50 |

| Potentially Ultra-Value Buy | 35% | $29.90 | $29.90 | $29.90 |

| Currently | $33.11 | 28.02% | 28.02% | 28.02% |

| Upside To Fair Value (Including Dividends) | 46.78% | 46.78% | 46.78% |

ENB has about 50% upside potential in the next year to return to historical fair value.

Enbridge 2025 Consensus Total Return Potential

FAST Graphs, FactSet

Enbridge 2029 Consensus Total Return Potential

FAST Graphs, FactSet

Enbridge 2033 Consensus Total Return Potential

- 7.4% yield

- growth: 2.7% to 5% (management guidance 5%)

- 10-year valuation boost: 3.3% CAGR

- 10-year consensus total return potential: 13.4% to 15.7% CAGR = 252% to 330% vs 130% S&P

How’s that for a rich retirement dream machine?

What About The Risks? Here’s Why Enbridge Isn’t Right For Everyone

- ENB is a Canadian company

- 15% dividend tax withholding ON TAXABLE ACCOUNTS

- NONE on tax-free IRA, 401K, Roth IRA, etc.

- tax-credit available for taxable accounts

- requires some paperwork unless you own very few international stocks

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

Risk Profile Summary

Enbridge’s biggest challenges are primarily regulatory, legal, and other stakeholder risks related to identifying and executing on projects within its growth portfolio. Challenges over Line 3, 5, and its small stake in the Dakota Access Pipeline offer clear examples of the potentially higher costs and lost earnings involved.

Material ESG exposures create additional risk for midstream investors. In this industry, the most significant exposures are greenhouse gas emissions (from upstream extraction, midstream operations, and downstream consumption), and other emissions, effluents, pipeline spills, and opposition and protests. In addition to the reputational threat, these issues could force climate-conscious consumers away from fossil fuels in greater numbers, resulting in long-term demand erosion. Climate concerns could also trigger regulatory interventions, such as production limits, removal of existing infrastructure, and perhaps even direct taxes on carbon emissions, which already exists in Canada. Notably, Enbridge recently entered a $1 billion sustainability-linked credit facility and $1 billion bond, which links its ESG performance to borrowing costs.” – Morningstar

ENB’s Risk Profile Includes

- Economic cyclicality risk: modest cash flow variability in recessions (up to 19% but larger in oil crashes)

- M&A execution risk: from future industry consolidation

- regulatory risk: specifically for new project approvals (Keystone XL is a good example of what can go wrong)

- failure of the green energy transition plan

- talent retention risk in the tightest job market in 54 years

- Cyber-security risk: hackers and ransomware (Colonial pipeline hack is an example of what can happen)

- currency risk, including the dividend

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

DK uses S&P Global’s global long-term risk-management ratings for our risk rating.

- S&P has spent over 20 years perfecting their risk model

- which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

- 50% of metrics are industry-specific

- This risk rating has been included in every credit rating for decades

The DK risk rating is based on the global percentile of a company’s risk management compared to 8,000 S&P-rated companies covering 90% of the world’s market cap.

ENB scores 96th Percentile On Global Long-Term Risk Management

S&P’s risk management scores factor in things like:

- supply chain management

- crisis management

- cyber-security

- privacy protection

- efficiency

- R&D efficiency

- innovation management

- labor relations

- talent retention

- worker training/skills improvement

- occupational health & safety

- customer relationship management

- business ethics

- climate strategy adaptation

- sustainable agricultural practices

- corporate governance

- brand management

- interest rate risk management

ENB’s Long-Term Risk Management Is The 33rd Best In The Master List 93rd Percentile In The Master List)

| Classification | S&P LT Risk-Management Global Percentile |

Risk-Management Interpretation |

Risk-Management Rating |

| BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

| Enbridge | 96 |

Exceptional |

Very Low Risk |

| Strong ESG Stocks | 86 |

Very Good |

Very Low Risk |

| Foreign Dividend Stocks | 77 |

Good, Bordering On Very Good |

Low Risk |

| Ultra SWANs | 74 | Good | Low Risk |

| Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

| Low Volatility Stocks | 65 | Above-Average | Low Risk |

| Master List average | 61 | Above-Average | Low Risk |

| Dividend Kings | 60 | Above-Average | Low Risk |

| Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

| Dividend Champions | 55 | Average | Medium Risk |

| Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal)

ENB’s risk-management consensus is in the top 7% of the world’s best blue chips and is similar to:

- Ecolab (ECL): Super SWAN aristocrat

- UnitedHealth Group (UNH): Ultra SWAN

- Microsoft (MSFT): Ultra SWAN

- Canadian National Railway (CNI): Ultra SWAN aristocrat

- Lockheed Martin (LMT): Ultra SWAN

The bottom line is that all companies have risks, and ENB is exceptional, at managing theirs, according to S&P.

How We Monitor ENB’s Risk Profile

- 18 analysts

- four credit rating agencies

- 22 experts who collectively know this business better than anyone other than management

- and the bond market for real-time fundamental risk assessment

When the facts change, I change my mind. What do you do, sir?” – John Maynard Keynes

There are no sacred cows. Wherever the fundamentals lead, we always follow. That’s the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: Enbridge Isn’t Broken, It’s Just A Very Strong Buy

Enbridge is making a bold move that the market doesn’t like. But it’s ultimately a smart move designed to get ENB, the most utility like midstream, and make it even more utility like.

Investor presentation

99% of ENB’s cash flow is now going to be under long-term take-or-pay contract or regulated.

The most utility like midstream will become even more of a utility.

In fact, 47% of cash flow will now be utilities or renewables.

ENB started out as a pipeline company that invested in renewables and utilities.

It is now on track to become a utility that owns a lot of pipelines by the end of this decade.

Before global demand for oil peaks, ENB will be getting the majority of cash flow from low-risk regulated utility sources.

And the same management team and corporate culture that brought you a 28-year dividend growth streak, with a plan to get to a 50 year streak in 2045 (3 years ahead of EPD), is saying that this will help ENB grow at 5% long-term.

- 7.5% yield + 5% growth = 12% to 13% long-term returns

- + nice value boost of 3.3% per year over 10 years from the 28% discount

Do I like this deal? Yes. It’s right up ENB’s ally.

The market doesn’t for understandable reasons.

The midstream winter was traumatic but ultimately if you like ENB you trust management.

With the bond market offering its full support to this deal, and S&P reaffirming the BBB+ rating (with an outlook downgrade) I am willing to say I too sign off and support this utility M&A deal from Enbridge.

Is it risky? A bit, but ENB has handled bigger deals than this in the past, in tougher industry conditions (Spectra in 2018).

Is this a screaming bargain? Like what OKE got with MMP? Nope, ENB is paying market prices for these gas utilities.

But is buying “wonderful companies at fair prices” a good long-term strategy? Yes, and that’s what ENB appears to be doing here.

Read the full article here