Introduction

BlackRock’s Larry Fink began his 2023 Chairman’s Letter to Shareholders with a bit of childhood nostalgia, demonstrating how inextricable Spotify (NYSE:SPOT) has become from its users’ lives:

As a kid growing up in California, I used to go to the local record shop, buy a piece of vinyl and listen to the album on my record player. I still listen to records, though less often than when I was young. Today, streaming allows me to listen with ease to the whole album of an artist, or just that artist’s greatest hits, or a playlist of my own compilations, or those of other listeners. We have so much choice at our fingertips.

Spotify is a first-mover and category creator, with roughly a third of the music streaming platform market. Spotify is music streaming. Although Spotify’s service is borderline ubiquitous, serious value has yet to trickle down to shareholders; put differently, Spotify the stock has not performed as well as Spotify the product (users have increased by 2.85x since the IPO, and the fully diluted equity value remains the nearly same at $27 billion compared to $25 billion at IPO). A share price that has underwhelmed relative to operating metrics is no fault of Spotify’s management team, which I view as one of big tech’s most thoughtful and long-term oriented. Pre-2023, Spotify invested heavily to create a leading, differentiated product in a growing market. Daniel Ek and team have built a compelling global platform, attracted ~500 million users, and proven they can retain and monetize them, all without incurring material indebtedness.

As interest rates rise from multidecade lows, the growth-at-all-costs mentality emblematic of the post-2008 era is coming to an end. For the first time in modern financial memory, the cost of money matters for technology companies. Luckily for Spotify, the market’s renewed expectations coincide with its transition from a young growth company to a mature growth company. Spotify, as a mature growth company, will continue to add users due to its extant flywheel, invest less relative to revenues, and leverage its dominant position to increase average revenue per user. As investments made in the past begin to generate substantial free cash flows, the mature growth stage often proves to be a golden period for equity holders. Per the calculations detailed herein, I estimate that last year marked a turning point for free cash flows, which could increase from -€638 million in FY22 to over €3 billion by FY27.

This article is intended as follow-up to my piece written last year, as the market is ultimately compelling management to increase its free cash flows, a difficult, albeit reachable task. The company appears to be seriously addressing the challenge per its public pronouncements, organizational changes and 1Q23 results.

Deconstructing 2022 and Early 2023

FY22 was a year of heavy investment for Spotify, marked by increased research and development spend along with four strategic acquisitions totaling €293 million in cash. Podsights and Chartable were acquired in 1Q22 to provide analytics tools that optimize podcast monetization. In 2Q22, Findaway and Sonantic were both acquired for €117 million and €93 million respectively. Findaway will augment Spotify’s audiobook content library and Sonantic is an AI-generated voice platform, commonly known for producing Val Kilmer’s voice in the Top Gun reboot. To better illustrate the potential AI-generated voice poses, I will provide a link to the popular song written and performed by Kid Cudi, “Day ‘n’ Nite”, but voiced by an AI Kanye West. Imagine Freddie Mercury performing Billie Jean, or any of the other infinite possibilities. The technology’s implications and potential applications are boundless, and Spotify is in a favorable position to benefit from the forthcoming explosion in creativity due to its homegrown innovations and past acquisitions.

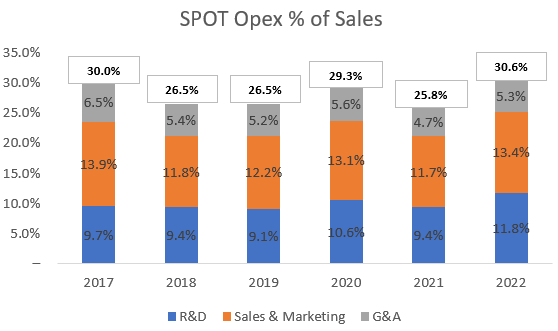

Innovation has a price, and Spotify’s recent operating expenses undoubtedly surprised to the upside. In FY22, Opex as a percentage of revenues reached 30.6%, the highest level in the company’s recorded history. Research and development expenses of €1.4 billion (11.8% of revenues) also reached record highs. R&D dollars expensed today will certainly drive customer growth and retention for years to come, and should rather be capitalized over future periods.

Company Filings

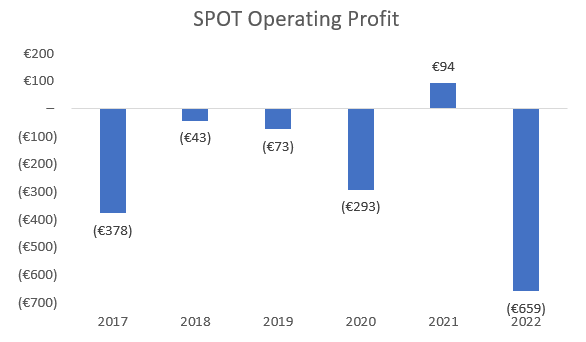

Predictably, Spotify’s increased expenditure resulted in correspondingly low operating profits.

Spotify Annual Operating Profit (Company Filings)

When analyzing Spotify in early 2022, I mistook the meager FY21 full year positive operating profit as the beginning of a trend. I was wrong. I wasn’t fully apprised as to what management intended to build and the associated costs. Management is already lowering costs, as sales and marketing as a percentage of sales fell to 11.4% in 1Q23 compared to 14.3% in 4Q22, but the process will not follow a linear path.

2023 Pivot

Following Meta Platforms (META) and Alphabet (GOOGL), on January 23rd, Daniel Ek announced an organizational restructuring to focus on improved efficiency and cost controls given the macroeconomic climate. The easiest way to rationalize costs in the short term is via headcount reductions. Accordingly, Spotify has fired or plans to fire 6% of its staff (~600 employees). The company clearly over-hired during the pandemic boom and requires a painful adjustment as growth returns to trend. From FY2020 to FY2022, headcount grew by ~53% while revenues only increased by 48%, demonstrating a clear lack of discipline. It is within the realm of possibility that additional headcount reductions are scheduled for the rest of FY23.

Additional, sweeping changes were announced to the company’s organizational chart. In an attempt to quicken decision making, the firm will be more centralized at the top with a co-president structure; Gustav Söderström will serve as Chief Product Officer and Alex Norström as Chief Business Officer, with Ek acting as the veto in the event of disagreement.

The Söderström / Norström era’s first substantial deliverable was the recently launched home page redesign. A Tik-Tok inspired feed that effectively replaces the homepage on the mobile app, displaying album cover art and playing song excerpts to facilitate discovery. Discovery is the lifeblood of the Spotify experience, which is why the app consistently receives exceptionally high ratings for user satisfaction. On the old homepage, the algorithm was unaware if a user scrolled past a song due to disinterest, didn’t see it, or paused to evaluate it. The new redesign provides much more detailed information to Spotify’s recommendation engine and likely represents another step forward in new music personalization. It is uncertain whether the redesign will have the desired effect, as the need to mimic Tik-Tok doesn’t seem imperative. Tik-Tok should be viewed as less of a competitive threat to Spotify’s market share and more of a complement. Discovery can occur on Tik-Tok, and deeper, more involved listening will shift towards Spotify.

If the home page redesign is not warmly received by users, I don’t doubt management’s ability to quickly course correct. The Spotify team is not shy to experiment, and if those experiments fail to bear fruit, they are equally unshy to cut their losses. Spotify’s knack to quickly pivot (Car Thing and foray into live audio) is one of the secrets to its continued innovation and underpins my view that the company will be able to continue to add users and increase monetization over the next five years.

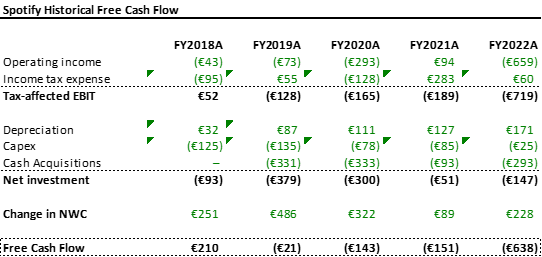

Historical Cash Flow

There are countless methodologies for calculating free cash flow with varying levels of generosity. I calculate free cash flow to the firm using the classically taught formula, but adjust for the cash consideration of Spotify’s prior acquisitions. Interestingly, I have not seen any other analysts on this platform adjust for cash acquisitions, which portrays a very different story than the one proffered by the company.

Spotify Free Cash Flow to the Firm (Company Filings)

Spotify has been running a perennial free cash flow deficit since debuting on the public markets in April 2018. The cumulative free cash flow deficit between FY2019 – FY2022 was €950 million, roughly equal to its cash acquisition spend of €1 billion. Cash acquisition spend was ~5% of revenues, in FY2019 and 4% in FY2020, which are both quite high. My calculation of free cash flow varies significantly compared to the calculation provided by the company. The company claims that its free cash flows for FY22 were positive, which only demonstrates the creativity of certain calculations. Wall street is becoming less receptive towards long lists of add backs and Spotify is generally not viewed as a cash flow positive company by institutional investors.

Free Cash Flow Levers and Key Assumptions

Spotify has never raised prices on its United States individual premium plan since launching the service in 2011. The change in the US price level since 2011 is 34%, yet Americans can still access over 70 million songs, podcasts and audiobooks for $9.99 per month. If Spotify’s subscription fee was indexed to inflation, today it would be $13.38 per month. Additionally, most of Spotify’s competitors have already raised prices. For instance, Apple Music subscription fees increased to $10.99 in October 2022 and Amazon followed suit earlier this year. I estimate that increasing the US premium subscription to $10.99 would add an incremental 10 cents to Spotify’s average revenue per user, bringing the figure back to 2019 levels (€4.65) and boost annual revenues by €300 million – €400 million. My base case assumption is that Spotify will be able to increase its ARPU by 5% per year over the next five years from €4.55 to close to €5.50. I expect the company to generate increased revenue per user due to its ability to cross sell merchandise, enter the ticket market for live events and continued price hikes.

A material portion of price increases will have to be shared with labels, but gross margins still have considerable upside in the coming years. Gross margins have been stuck around 25% since 2018, when Spotify last negotiated multiyear agreements with the major labels. These agreements typically last four to five years and management is intensely private about the underlying negotiations. Over the last five years, Spotify has maintained its market share and only increased in importance to the major labels (Sony, UMG and Merlin). Oddly, Universal Music Group’s (OTCPK:UMGNF) one third market share in the label streaming market is effectively the same as Spotify’s platform streaming share, yet commands an equity valuation of over $40 billion, 1.5x Spotify. I expect this valuation gap to diminish over the long term as Spotify better monetizes its user base. In this war of attrition, Spotify has diversified away from the major labels with podcasting and audio books faster than the labels have attempted to diversify away from Spotify. My base case assumption is that by FY27, gross margins will be comfortably in the low thirty percent range following more favorable licensing terms compared to the 25.0% margins of the last few years.

My final assumption is a relative decrease in operating expenses as a percentage of revenues from 30.6% in FY22. The company has done the grueling work of entering almost all global markets and expanding its service footprint to 184 countries. In FY22, the company spent roughly €1.6 billion (13.4% of revenues) on sales and marketing, a figure which I project to steadily decrease to 8% of revenues by FY27, but still increasing in magnitude to €2 billion. I forecast a similar decline in R&D and G&A costs to bring FY27 opex to only 20% of revenues.

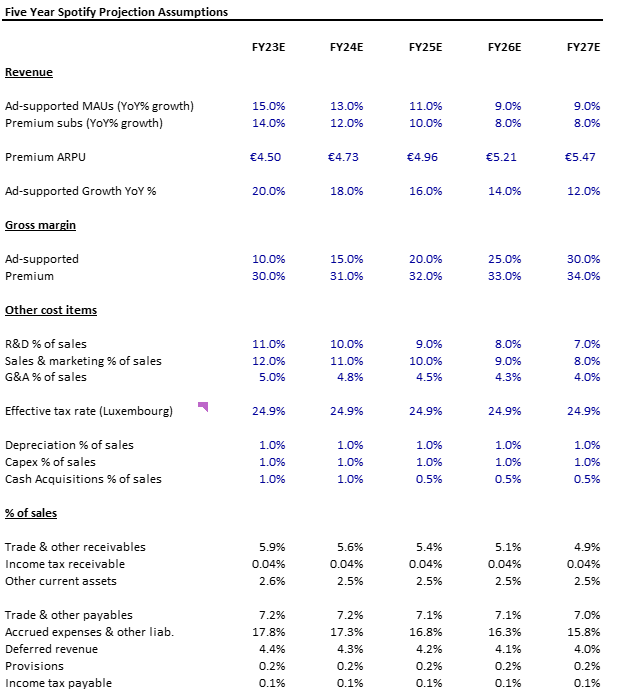

Since Spotify is both a more mature firm and spending relatively less on sales and marketing I forecast a sharp reduction in premium subscriber growth. The five year trailing CAGR for premium subscribers was 23.6% and I forecast the next five years (FY23-FY27) to be 10.4%, with 336 million premium subs by FY27. Accordingly, I forecast a deceleration in ad-supported revenue from a trailing five year CAGR of 28.8% to 16% for the projected period of FY23-FY27. These assumptions of lower growth embed a certain amount of market share loss, something I don’t find particularly troubling for the business. A detailed overview of the assumptions employed is included below:

FY23 – FY27 Assumptions (Author)

5 Year Projections

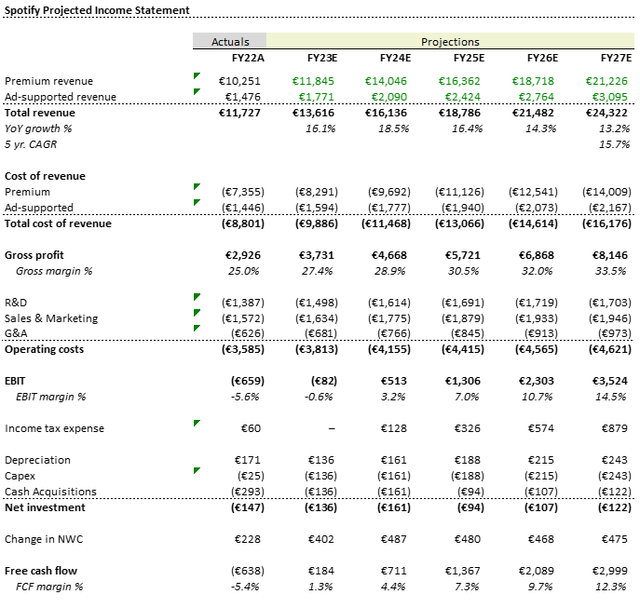

When incorporating the previously outlined assumptions into a set of five year projections, the following cash flow output is produced:

Spotify 5 Year Financial Projections (Author)

Notably, Spotify has run an increasingly negative working capital balance through its operating history, and its cash flow has been aided by favorable working capital changes, an aspect of the business I expect to continue as the company further exerts itself within its niche.

Valuation

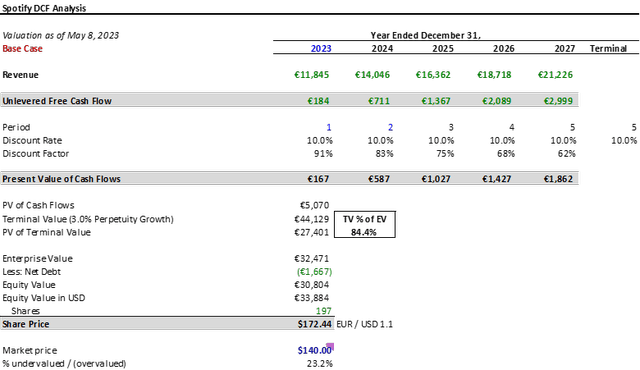

If Spotify is able to achieve future operating results reasonably consistent with the projections previously delineated, then what is the business worth? What would the market be willing to pay for close to 850 million pairs of captive ears generating €3 billion in free cash flow by FY27? My DCF below assumes a 10% WACC and a 3% perpetuity growth rate, two reasonable assumptions given the current interest rate environment. Spotify’s product is probably less discretionary than most market participants believe and the business is effectively unlevered. The beta used for calculating Spotify’s WACC should therefore likely be less than the 2-year weekly regression beta vs. the S&P500 that I’ve estimated to be 1.68. Using the 3.6% 30 year US treasury rate, a beta of 1.3 and a 5% equity risk premium, the 10% WACC seems reasonable. The €32.5 billion enterprise value generated by my DCF model implies a share price (assuming no additional dilution) of $172 per share, or 23% upside from today’s price. €32.5 billion enterprise value implies roughly 1.5x FY27 revenue (the median historical multiple since Spotify’s IPO is 4.4x EV/LTM Revenue) and $39 per MAU (median historical value of $111 EV/MAU).

Spotify Discounted Cash Flow Analysis (Author)

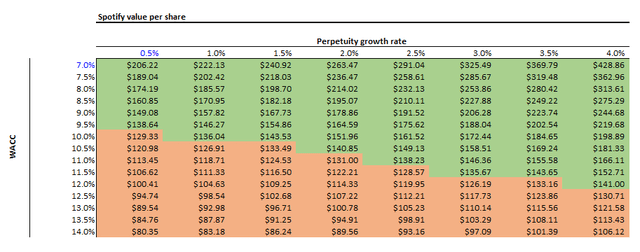

It is critical to realize how sensitive the share price produced by the DCF is to Spotify’s WACC. The below table shows the DCF implied share price under a range of perpetuity growth rates and WACCs:

DCF Sensitivity – WACC vs. Perpetuity Growth % (Author)

If rates drop in the near term as many are forecasting, Spotify’s share price could increase significantly, and if they do not, the company is still moderately undervalued.

Conclusion

Most conservative investors are unwilling to touch Spotify, as the company was never profitable on a GAAP basis and has burned considerable cash since becoming public. As the business enters the next stage of its life cycle, it will begin to monetize the significant investments previously made and be far more disciplined on costs. The balance of power will continue to shift away from music labels towards Spotify, and free cash flows should drastically increase. Institutional investors will begin to feel more comfortable with the business model and be more likely to allocate capital to the company’s equity.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here