The banking industry may be resilient, but it is showing signs of stress, according to a report from the Federal Deposit Insurance Corp. on Thursday.

Second-quarter earnings at U.S. banks amounted to $70.8 billion, the FDIC said. The tally marks an 11.3% drop from the prior quarter but that decrease stemmed from the failure of Silicon Valley Bank and two other institutions this spring. Absent those bank failures, profits would have been steady quarter-over-quarter and 5.7% higher than the year-ago period.

There are signs that profitability could be waning. Initially, the Federal Reserve’s push to raise interest rates over the last year and a half was a boon for banks, as it allowed them to earn more on interest-earning assets. But eventually, higher rates mean that banks feel pressure to pay their depositors, and they see other funding costs creep up as well. Accordingly, net interest margin at banks fell three basis points to 3.28% in the June quarter from the first three months of the year. This follows a decline of seven basis points in the first quarter. Still, net interest margin is nearly 0.5 percentage points higher than a year ago, and a few ticks above the prepandemic average of 3.25%.

Higher interest rates have hit banks in other ways, too. Unrealized losses on securities are up 8.3% from the prior quarter to $558.4 billion, the FDIC said. During the pandemic, when loan demand was low and banks were sitting on excess deposits, they put capital into fixed income, mostly bonds backed by the U.S. government. But with rates rising rapidly, the value of those bonds plunged.

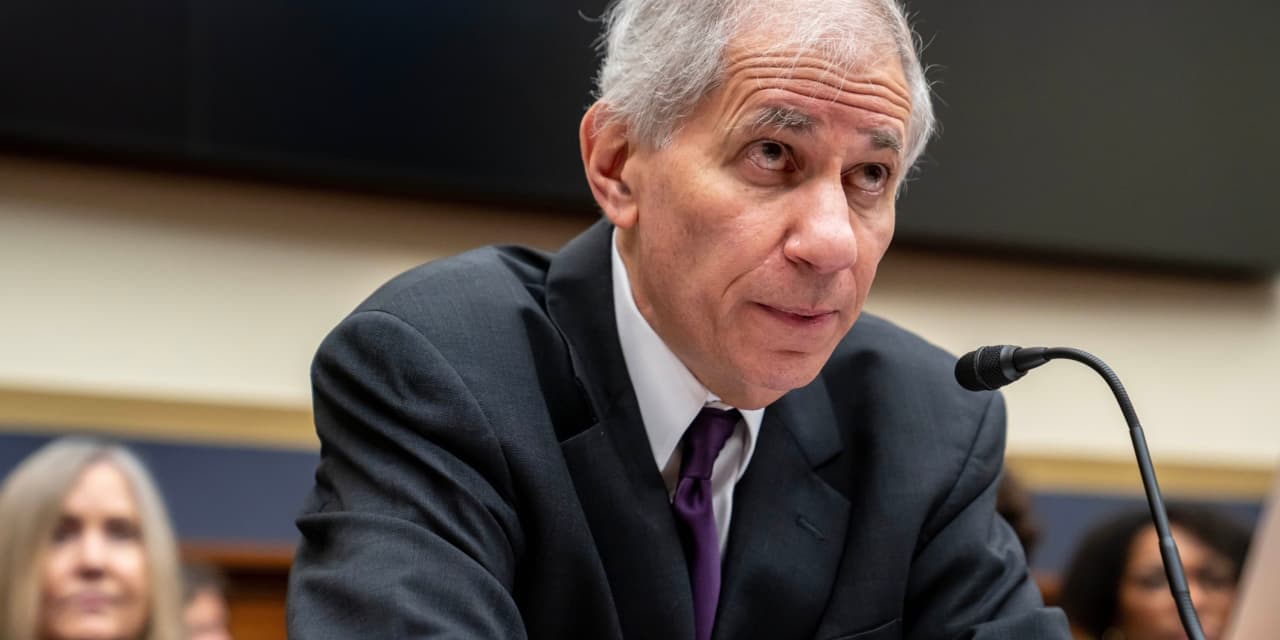

This caused problems within the sector this spring when depositors, in search of higher yields, yanked money from some banks, forcing them to crystallize those losses. While deposit outflows continued for the fifth straight quarter, the pace “moderated substantially” from the first three months of the year, FDIC Chairman Martin Gruenberg said Thursday.

Still, Gruenberg cautioned that banks still face “significant challenges” due to inflation, higher interest rates, and geopolitical uncertainty. Several banks have seen their credit downgraded by ratings firms over the past month because of these concerns.

“These risks, combined with concerns about commercial real estate fundamentals, especially in office markets, as well as pressure on funding levels and net interest margins, will be matters of continued supervisory attention by the FDIC,” Gruenberg added.

Bank stocks ticked lower Thursday with the

SPDR S&P Bank ETF

(KBE) down by 1% while the

S&P 500

fell 0.4%.

Write to Carleton English at [email protected]

Read the full article here