This is an interesting and timely value play with a likely near-term catalyst. An activist is highly likely to win the ongoing proxy battle and subsequently launch an operational turnaround and a strategic review. Given the company’s cheap valuation as well as the activist’s targets/initiatives, there might be a significant upside here if things pan out as expected.

Pitney Bowes (NYSE:PBI) is a $0.5bn market cap ($1.1bn EV) company operating in three segments, including Global Ecommerce (offers parcel delivery services), Presort Services (provides mail sortation services), and Sending Technology Solutions (sells postage meters and shipping labels). PBI has recently come under pressure from activist investor Hestia Capital which has accumulated a 9% stake. The activist has argued that PBI has massively underperformed under the leadership of the current CEO since 2012 due to the poorly managed and unprofitable Global Ecommerce business while failing to focus on the stable and highly cash-generative legacy Presort Services and SendTech segments. Hestia has argued that the company should pursue operational improvements and a sale of the Ecommerce business while pursuing a number of measures in the legacy Presort and SendTech segments, including implementing alternative pricing strategies, increasing investments (e.g. expanding the sales teams), and performing tuck-in acquisitions. Hestia intends to nominate five candidates to PBI’s nine-director board (including a new CEO) during the upcoming shareholder meeting. The meeting along with the equity holder vote is set for May 9.

The activist seems poised to successfully take over the board. Aside from management’s poor track record (discussed below), there are a couple of other arguments suggesting that Hestia Capital is likely to successfully institute its nominees to the company during the upcoming shareholder meeting:

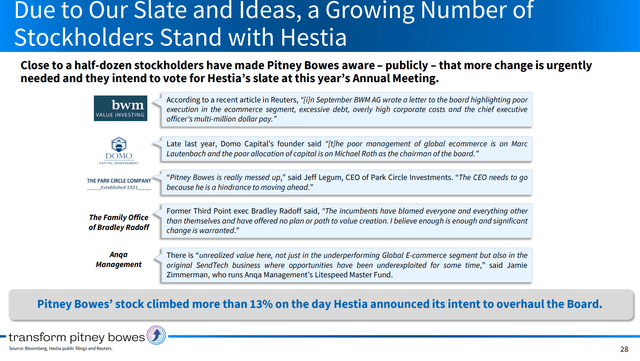

- During Hestia’s ongoing campaign, a number of PBI’s shareholders have come out publicly, stating that they will support the activist’s nominees. Opposing shareholder base includes a Swiss asset manager BWM AG (owns 1.5%) which in September ’22 wrote a letter to the company, criticizing the underperformance of the e-commerce segment, excessive debt, and high corporate overheads. Another equity holder, DOMO Capital (owns 1%), has also pushed for management changes. Other opposing shareholders include Park Circle Investors, Anqua Management, and the family office of activist investor Bradley Radoff.

- Proxy advisory firms ISS and Egan Jones have recently recommended PBI’s shareholders vote to elect either four or all five of Hestia’s nominees to the company’s board. PBI’s passive investor base includes Vanguard and BlackRock (own 10% each). A caveat here is that another proxy advisory firm Glass Lewis has supported Pitney Bowes’ slate of directors during the upcoming equity holder meeting.

- PBI’s management holds a rather insignificant 5% stake (CEO owns 3%).

Hestia Capital Management Investor Presentation, April 2023

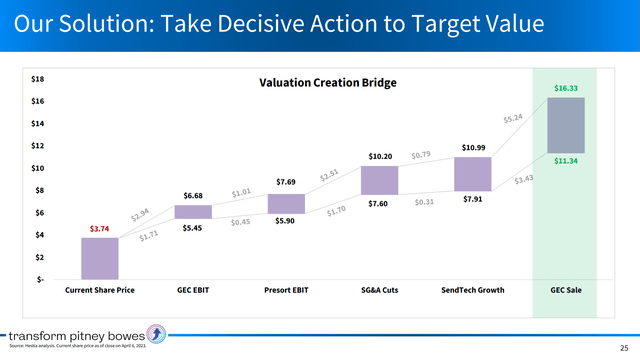

I think there might be a substantial upside here even when ascribing no value to the Global Ecommerce business. At current share price levels, PBI’s two legacy segments are trading at 4x EV/TTM EBIT (after deducting total company-level corporate overheads). This seems to be a too-conservative multiple for stable and cash-generative businesses even after taking into account the secular headwinds the segments have been facing. My conservative SOTP valuation, valuing SendTech and Presort in line with a close peer, suggests that PBI might be worth $9/share. Having said that, PBI’s Global Ecommerce segment is unlikely to have zero value to potential acquirers or as a remaining segment of PBI. Hestia has claimed that after operational improvements the Global Ecommerce business might be worth $1.4bn-$2.0bn or $8-$11/share. The activist has set a share price target for PBI at $11-$16 per share, implying a multi-bagger upside from current levels.

Hestia Capital Management Investor Presentation, April 2023

The opportunity seems to exist due to several reasons:

- PBI is a small-cap stock that screens as a highly leveraged entity. However, the majority of the company’s net debt is attributable to the SendTech business banking segment.

- Another reason for the current mispricing might be the fact that SendTech and Presort both operate in industries facing a secular decline in mail volumes, however, the decline is expected to be moderate and steady while the company has already begun expansion into higher-growth markets, such as shipping labels.

- Finally, PBI has an entrenched management team with a poor track record of shareholder value creation, however, I expect Hestia to win the proxy battle and subsequently launch a strategic turnaround.

Pitney Bowes

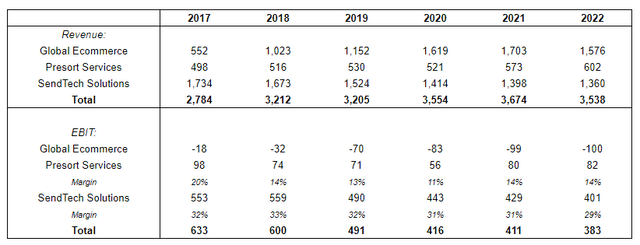

Below is a description of PBI’s business segments and their recent operational performance.

Company Filings

Sending Technology Solutions- This segment primarily comprises PBI’s postage meter business. The company sells/leases postage meter devices, such as SendPro, that weigh and process mail for PBI’s customers. The SendTech segment also includes banking services, i.e. Pitney Bowes Bank which offers a revolving credit to customers for purchases/leases for devices as well as deposits for postage. SendTech’s revenues come from equipment sales/leasing as well as related business/support/financing services. The segment is the dominant player in the postage meter market in the US, with a 70% market share. The industry is heavily regulated, suggesting there are high barriers to entry.

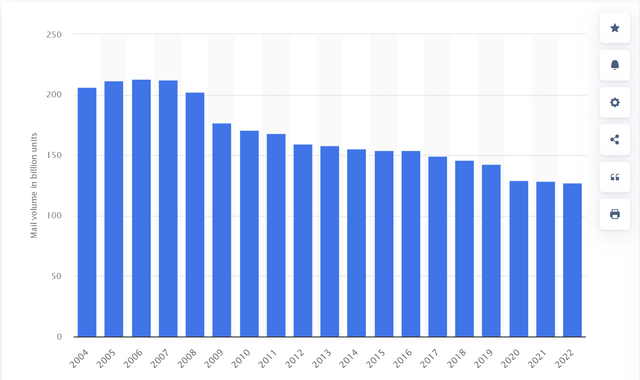

SendTech has been in a secular decline over the last decades due to decreasing mail volumes (see chart below), with revenues declining at an average 5% clip during 2017-2022. Given the secular headwinds in the mail segment, the company has recently been increasingly focused on the growing shipping label segment which includes equipment for shipping labels and related offerings, including software. In 2022, SendTech’s shipping-related revenues were up 22%, driven by the launch of the new offerings, including PitneyShip Pro software and PitneyShip Cube device. However, the shipping subsegment still remains tiny vs legacy mailing operations, with only c. 10% of revenues coming from the subsegment.

Going forward, mail volumes are likely to continue to decline – USPS previously estimated that mail volumes will decline by 18% from 2020 through 2024. During the Q1’23 earnings call, PBI’s management noted that the mailing volumes are likely to see a mid-single-digit decline in the foreseeable future. The secular headwinds are likely to be partially offset by PBI’s increasing revenues from shipping labels. The company’s management has estimated the subsegment’s TAM at $3.7bn (i.e. much larger than the postage meter market) with 5% annual growth. Given these dynamics, PBI’s topline is likely to see a flat growth/low-single-digit decline in the upcoming years. From a profitability perspective, it is important to note that shipping labels have lower margins than postage meters (not specified), suggesting SendTech’s margins might decline as the share of shipping label revenues increases. This implies that SendTech’s EBIT is likely to continue on its c. 5% decline trajectory.

United States Postal Service’s total mail volume from 2004 to 2022 (Statista)

Presort Services- This segment includes PBI’s mail sortation services where the company aggregates and distributes mail across transportation networks. The business offers an end-to-end solution from mail pick-up to delivery into the postal system network. Mail sortation allows PBI’s commercial clients to qualify for USPS workshare discounts for a number of mail classes. PBI is the leading player in the US mail sortation market, with a c. 25% market share compared to 2% for the next-largest competitor.

The segment has been impacted by the same secular headwinds as the SendTech segment, with the number of mailing volumes in a steady decline over the past few decades. However, despite these headwinds, the segment has benefited from increased outsourcing of pre-sort services, displaying a moderate 4% growth from 2017 through 2022. PBI’s management has noted that Presort Services still has significant headroom to grow its market share (as opposed to SendTech) partially due to the fact that declining mailing volumes might push other sortation competitors out of business due to a lack of economies of scale. Given these points, I think it is fair to assume that the segment’s topline growth will be flat or mildly positive going forward.

Global Ecommerce- Since the acquisitions of Borderfree (2015, $395m) and Newgistics (2017, $475m), PBI has been running a parcel delivery service both in the US and internationally. The segment operates parcel sortation centers and a transportation network. PBI further divides the Global Ecommerce business into domestic parcel (75% of revenues), cross-border logistics (15-20%), and digital (5-10%) segments. Global Ecommerce primarily competes with much larger industry players, such as UPS and FDX, and holds a tiny market share of less than 1%. However, unlike the larger parcel delivery service providers, PBI does not handle the final delivery mile and instead partners with the US Postal Service.

The segment has been loss-making since the acquisitions of Borderfree and Newgistics despite the scaling of the distribution network and a boost from COVID in 2020-2021. The negative performance in recent years was influenced by cost pressures (elevated labor and transportation costs) as well as still suboptimal distribution network size as Global Ecommerce was unable to achieve the economies of scale possessed by peers such as UPS and FDX. Global Ecommerce’s gross margins stood at 2% in 2022 vs 25% for FDX and UPS. More recently, management has singled out the cross-border subsegment as driving the revenue decline in 2022 (7%) due to foreign exchange headwinds (i.e. strong dollar) and the partial insourcing of services initiated by two large customers. PBI has hinted that while the cross-border continues to face the above-mentioned headwinds, the performance of the largest domestic parcel subsegment has already started to pick up, with a 10% growth in 2022 and expanded unit margins. PBI’s management expects the domestic parcel subsegment to expand at a 10-15% clip going forward. PBI’s leadership expects this to lead to Global Ecommerce’s positive EBITDA in 2023 (compared to -$22m in 2022).

Management’s Track Record

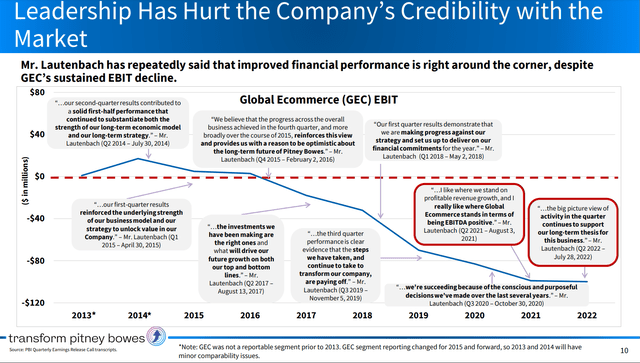

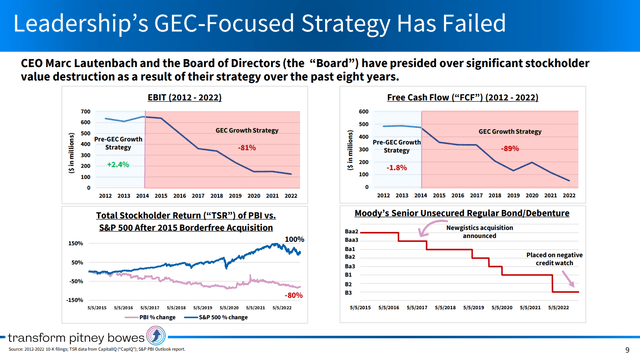

I believe management changes are highly likely to be supported by PBI’s equity holders given the incumbent management’s poor track record so far. The company’s transition to the parcel delivery segment has so far been wildly unsuccessful as the segment failed to reach profitability despite continuing investments (see below). PBI’s management previously guided for 8-12% segment EBIT margins in 2022. The Global Ecommerce business has burned $300m in FCF since 2015, with a total acquisition cost of $870m. Worth noting that last year PBI sold the Borderfree business for $100m – a substantial discount to the $395m acquisition cost. Meanwhile, the profitability of the legacy cash-generating SendTech and Presort businesses continued to decline due to decreasing investments and a limited number of tuck-in acquisitions. EBIT margins of the Presort Services segment fell from 25% to 14% under the leadership of the current CEO. As a result of these factors, PBI’s stock price has declined by c. 80% over the last decade while the FCF dropped by 90%. In the meantime, the company’s executives continued to be paid generously, with the CEO pocketing $66m in 2022.

Hestia Capital Management Investor Presentation, April 2023

Hestia Capital Management Investor Presentation, April 2023

The Activist’s Plan

Hestia has led its campaign at PBI since November ’22. The activist has proposed a number of operational improvement measures, including:

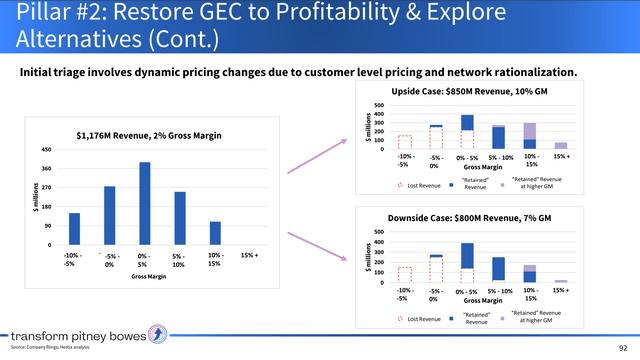

- Subscaling the loss-making Global Ecommerce segment and subsequently launching a strategic review for the business, including a potential sale. Hestia has stated it would pivot the segment to a niche strategy that would help avoid competition with parcel delivery giants FDX and UPS. The activist intends to rationalize Global Ecommerce’s network and implement a dynamic pricing strategy to reduce the revenues generating negative margins. Gross margins are expected to reach 6-9% after the segment’s turnaround.

Hestia Capital Management Investor Presentation, April 2023

- Improving the profitability of the Presort Services business, coming primarily from alternative pricing strategies, increased investments, and tuck-in acquisitions. Hestia expects the measures to increase Presort’s EBIT by $12m-$24m vs $82m printed in 2022.

- Increasing growth of SendTech through investments in external sales and increasing focus on shipping labels as opposed to secular headwinds-facing postage meters. The activist expects to free up $200m in restricted cash currently held up at the PBI Bank.

- Cutting excessive corporate overheads (cuts of $50m-$70m). The activist has stated that even with $70m in overhead cost cuts, the company’s unallocated corporate-level expenses would remain above other holding companies.

- Repurchasing $250m in PBI’s debt during 2024-2026 which is projected to reduce the debt ratio from 3.8x currently to <2.5x.

Hestia Capital expects its plan to achieve full run-rate within 12 months.

Valuation

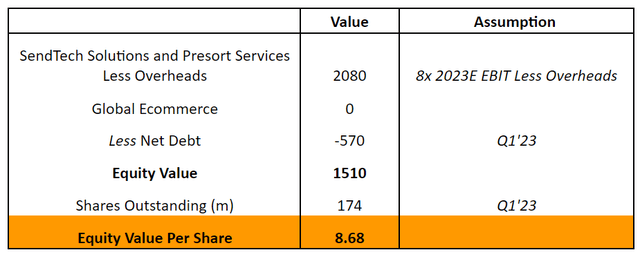

Below is my attempt to estimate PBI’s value on a 2023E SOTP framework. My valuation suggests PBI might be worth $8.68/share on fairly conservative assumptions that are detailed below.

Author’s Calculations

SendTech Solutions and Presort Services- The two segments produced $279m in 2022 EBIT (less corporate overheads). Combining the flat revenue/EBIT growth of the Presort Services and the projected mid-single digit EBIT decline of the SendTech segment, I think the two segments can reasonably generate c. $260m in 2023E EBIT. Note that this does not include the potential impact of any operational improvements and/or corporate overhead reductions proposed by the activist.

The closest comparable Paris-listed Quadient is currently trading at 8x EV/2023E EBIT. The competitor is a €0.6bn market cap company primarily providing postage meters and related mailing-related services (70% of revenues). Quadient holds a 20% market share in the US mail processing market (behind Pitney Bowes). The peer’s revenues have been declining at 1-10% per annum clip since 2017 with growth displayed only in 2019 and 2022. Quadient’s EBIT margins stood at 14% in 2022 vs 13% for PBI’s SendTech and Presort segments (after deducting corporate overheads). Given these points, I think it is fair to value the two segments at an 8x 2023E EBIT multiple.

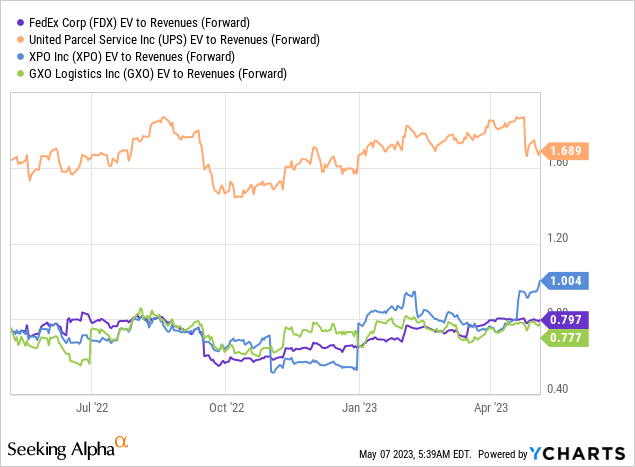

Global Ecommerce- Given Global Ecommerce’s continuing cash burn, I ascribe zero value to this segment in the SOTP valuation. Having said that, the business might have some value in a potential sale, even if at a substantial discount to the Newgistics acquisition cost. Larger, profitable, and much higher gross margin peers FDX, UPS, XPO, and GXO currently trade at 0.6x-1.6x EV/forward revenue multiples. Comparison to these logistics industry players is admittedly difficult, however, even at a substantial discount to Global Ecommerce might alone be valued close to PBI’s current market cap.

YCharts

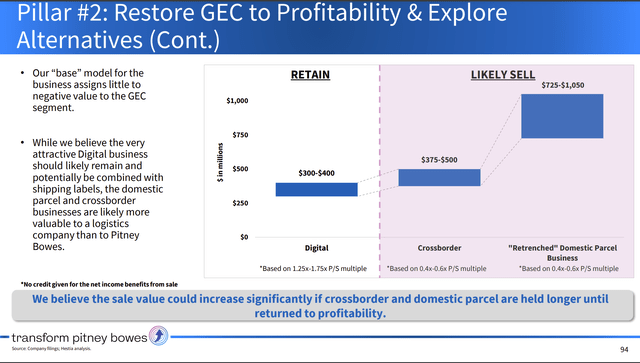

Hestia has estimated that after operational improvements the segment might be worth $1.4bn-$2.0bn (see below). The activist has noted that PBI should retain the Digital subsegment while selling cross-border and domestic parcel businesses to larger logistics companies.

Hestia Capital Management Investor Presentation, April 2023

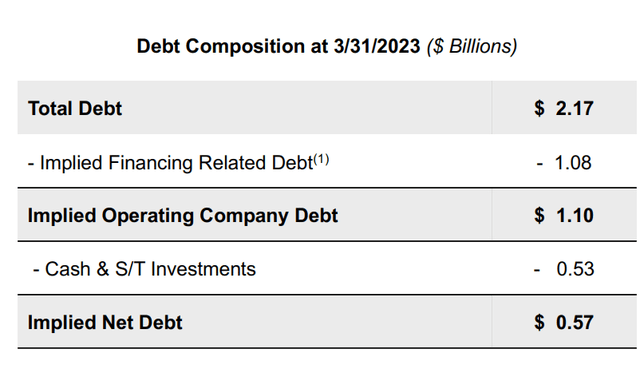

Net Debt- Given that a portion of PBI’s debt is attributable to SendTech’s financing subsegment, the operating business’ debt burden differs from the reported figure. Management has estimated the operating company’s net debt at $0.57bn as of Q1’23.

Pitney Bowes Q1’23 Investor Presentation

Hestia Capital

Hestia Capital is a small value-oriented investment firm led by its founder Kurt Wolf. The firm has displayed solid investment results so far, with 31% annualized net returns since its inception in 2009. Hestia is generally a passive investor and Pitney Bowes is its second activist campaign. The activist previously launched a campaign at GameStop before the stock’s subsequent popularity and meteoric rise. Back in 2019, Hestia started pushing for management changes and capital returns at the company. Hestia’s founder Wolf was eventually appointed to GME’s board in 2020. GME subsequently raised capital to eliminate its debt and avert potential bankruptcy. Hestia reportedly recorded a 3500% gain on its position in GME upon exit in 2021. The activist’s other previous investments include Best Buy and Packaging Corporation of America.

Risks

- One of the main uncertainties here is the company’s ability to successfully sell the Global Ecommerce segment given its unprofitability as well as a rough wider financing environment. However, a positive here is that PBI has already disposed of a part of the Global Ecommerce business (i.e. Borderfree subsegment), albeit at a significant discount to its acquisition cost – $100m vs $395m. It is worth noting that PBI’s management has remained open to the divestiture of Global Ecommerce’s worst-performing cross-border subsegment, noting that its separation from the domestic parcel subsegment might not be complicated given the low overlap with the domestic parcel subsegment in terms of facilities and logistics.

- Another key risk is secularly declining SendTech and Presort businesses. However, given the relatively contained mailing volume decline rate, PBI’s expansion into the shipping label segment as well as increasing mail sortation outsourcing by customers, I believe the segments have a sufficiently long cash generation runway ahead of them.

Conclusion

PBI currently presents an interesting investment opportunity with a near-term event-driven angle. The activist Hestia will likely succeed in its efforts to take over the company and will subsequently launch operational improvements as well as a strategic review for the Global Ecommerce business. I expect these moves to be significant catalysts driving a short-to-medium-term share price re-rate.

Read the full article here