Investment Thesis

AutoZone (NYSE:AZO) is an easy to understand business that is in a completely anti-cyclical sector. In the last 5 years, AZO has beaten indices such as the S&P500 by a great difference, however, the news about the arrival of the electric vehicle have cast doubt on the future of the company and its ability to bring great returns to its shareholders due to the difference of EV with internal combustion vehicles, as we will discuss later.

It is undoubtedly an interesting question, which I will try to answer in this article through the data we have available and my opinion about it.

Price Return (Seeking Alpha)

Business Overview

AutoZone is the largest retailer of aftermarket automotive parts and accessories in the United States. The company was founded in 1979 and nowadays has almost 7000 stores in the United States, Mexico and Brazil.

This market typically exhibits anti-cyclical behavior. During times of recession or increased economic uncertainty, people tend to prioritize repairing their existing vehicles over purchasing new ones. However, even in periods of economic prosperity, the need for replacement parts remains constant, making this sector a reliable defensive one.

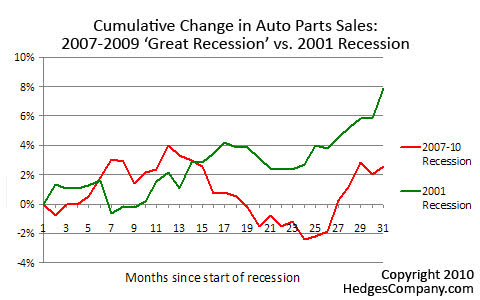

As demonstrated in the following image, auto parts sales were not significantly impacted during the 12 months following the last two severe recessions in the United States (in 2001 and 2008). In fact, they even experienced growth ranging from 2% to 4% during those periods.

Auto Parts during Recession (Hedges Company)

Age of Vehicles

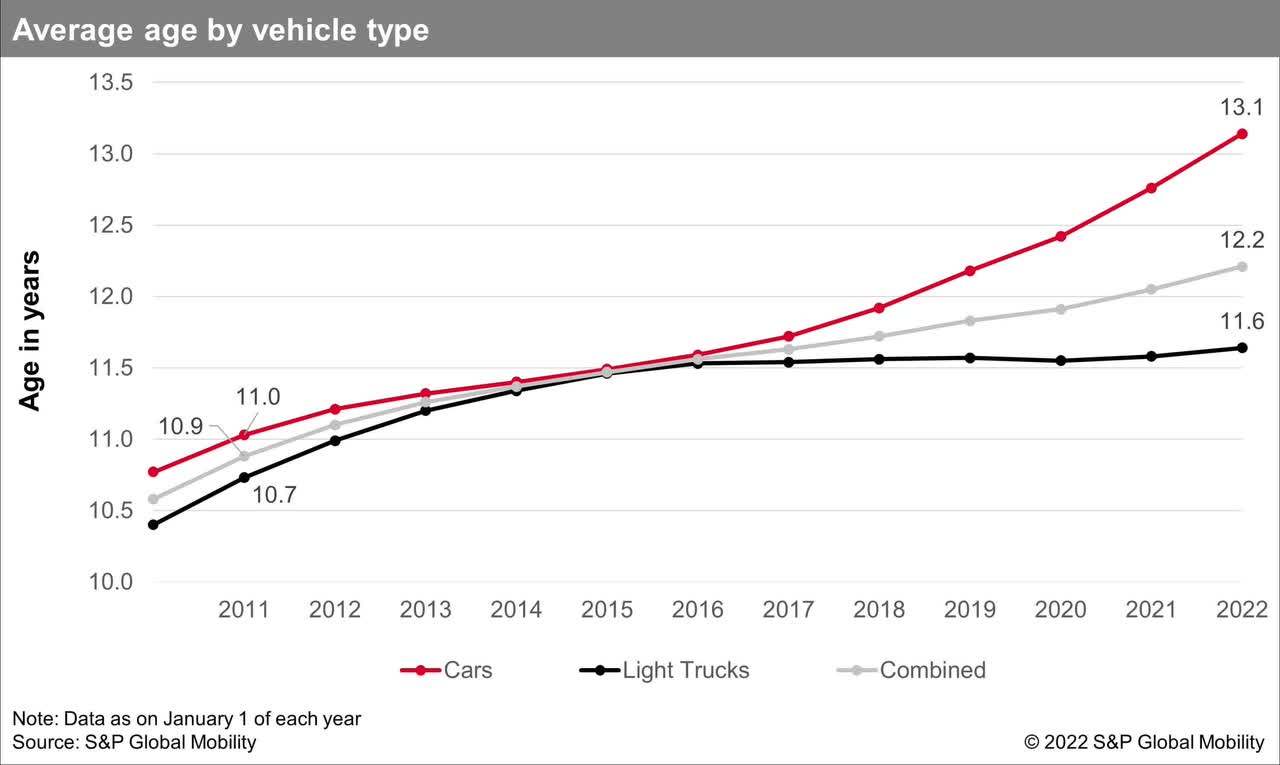

One of the main growth factors in the auto parts market is the average age of the vehicles, since the increase in this variable also increases the need for regular vehicle maintenance and the replacement of various automotive parts, such as tires, lubricating oil and other automotive components.

That variable has risen considerably in the United States and the median age now stands at 13 years, slightly above the global median of 12.5 years. This is because rising prices from inflation and recessionary fears are making consumers more cautious when it comes to a purchase as big as a new car, preferring to keep their own rather than buying one.

Average Age of Vehicles (S&P Global Mobility)

ICE vs EV

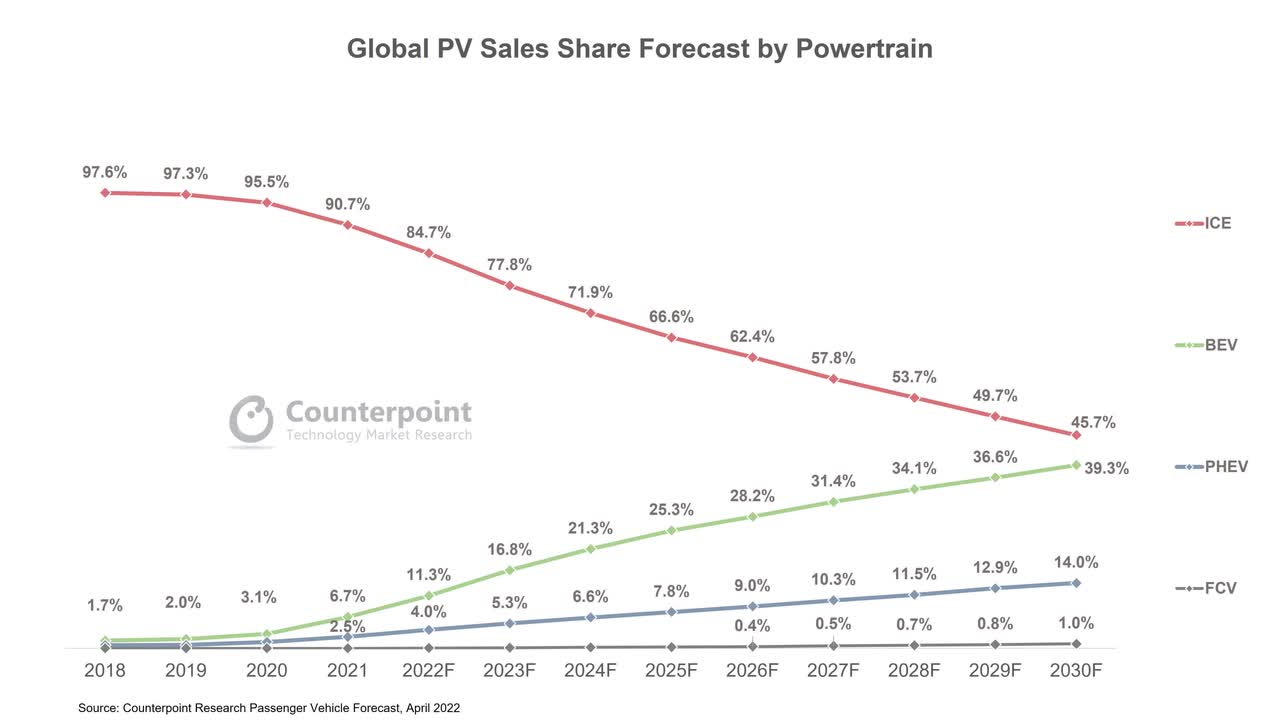

One of the biggest concerns for auto parts sellers is the advent of electric vehicles (EV), since these have far fewer moving parts than internal-combustion engine vehicles (ICEV). In fact, it is estimated that there are about 20 moving parts in EVs compared to about 2,000 in an ICEV. This brings less need for parts maintenance and therefore directly affects the vendors of these.

However, electric vehicle sales are not expected to surpass those of internal combustion vehicles in market share in the next decade. And even if they did, this would not imply the automatic disappearance of ICEV maintenance, added to the fact that less developed countries could take even longer to transition to electric vehicles.

Sales by Powertrain (Counterpoint)

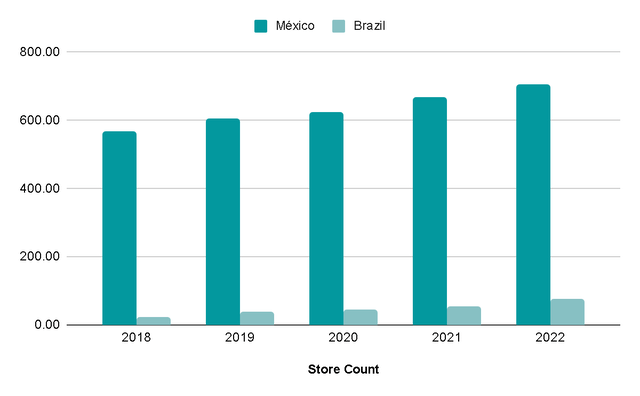

And it is here where it is worth mentioning the presence that AutoZone has in emerging countries such as Mexico and Brazil, since countries like Mexico currently have EV purchase volumes of less than 1%, quite far from the almost 6% of the United States. This presence in emerging markets could increase AutoZone’s terminal growth, which added to the above, could facilitate another decade of sustainable growth.

Store Count (Author’s Representation)

Key Ratios

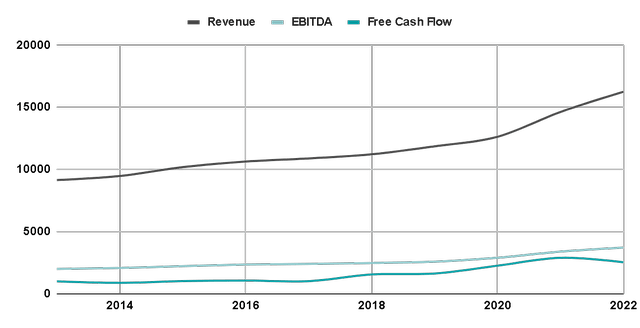

The company’s sales have grown at a stable 6% per year since 2013, although if we look at it in terms of sales per share that growth skyrockets to almost 18% because AutoZone buys back a lot of shares every year and in the last 5 years has bought back almost 7% annually.

Likewise, EBITDA has grown 7% annually and Net Income has grown 11% annually (but 25% in per share terms). This will be relevant to take into account in the assessment.

Revenue and Profitability (Author’s Representation)

The Net Debt/EBITDA ratio is usually around 2x, although since 2020 this ratio has decreased at levels close to 1.5x thanks to the fact that the cost of debt became cheaper and EBITDA margins were maintained even during the worst of the COVID-19 crisis.

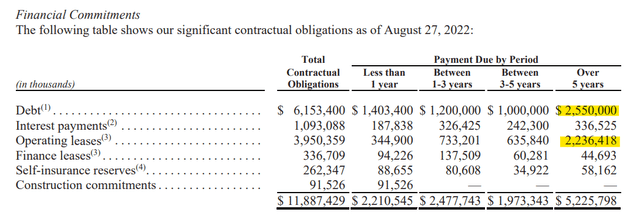

As of August 2022, the company had nearly $12 billion in liabilities, primarily consisting of $6.1 billion in debt and nearly $4 billion in leases. Approximately 40% of the debt, amounting to $4.8 billion, has payment dates extending beyond 5 years. This nearly $5 billion in long-term debt represents 1.5 times this year’s EBITDA, indicating that debt is not currently a concern.

Liabilities Structure (AutoZone)

Here, I’m providing an image that breaks down the debt, highlighting that the largest obligations are due in the years 2030 and 2032.

Debt Structure (AutoZone)

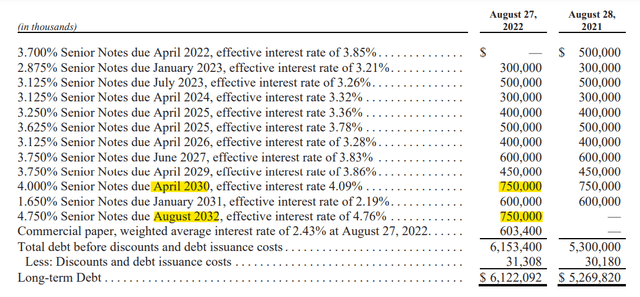

The cash conversion cycle (CCC) is a metric that expresses the days that it takes for AutoZone to convert its investments in inventory into cash flows from sales.

This metric seems relevant to me because businesses like AZO require a lot of stored inventory to always have the solution that the client requires in the shortest possible time. Currently, it takes AutoZone 25 days to pay for its investments after collecting the cash, in other words, the metric is -25 days (for reference, ORLY has -30 days CCC).

This is achieved because most customers pay instantly because we as retail consumers do not have the possibility of negotiating a greater number of days to pay, it would be illogical. However, AutoZone is so large and handles such significant volume that your suppliers would rather give you more days to pay than lose you as a customer.

And although it seems something very simple to achieve, if we see the Advance Auto Parts (AAP) CCC we realize that it is not. Despite being the third with the largest market share in the USA (behind AZO and ORLY), its CCC is 80 days. This gives us an idea of the scale and reputation required to have such a metric.

Cash Conversion Cycle (Author’s Representation)

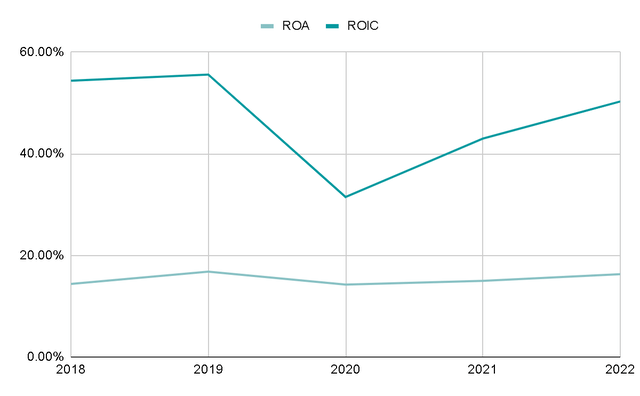

In my opinion, this good management of working capital and inventory has brought a great ROIC to the company, since managing inventory well can reduce carrying costs and improve the turnover rate of inventory, contributing to a high ROIC.

As you can see, except for 2020, the ROIC has remained at levels above 40%. This suggests that the company is effectively generating value from its invested capital, which is mostly used to grow organically through building new stores in the United States and especially in Mexico and Brazil, where they still do not have as much presence but are already making their way.

ROA and ROIC (Author’s Representation)

Valuation

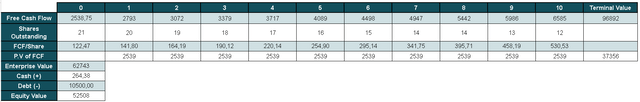

For the valuation I will do a Reverse DCF, so that we can know what growth is implicit in the current valuation based on the data we already know.

These are the variables that I will take into account (as FY2022):

- FY2022 Free Cash Flow: $2.54 billion.

- Shares Outstanding: 20.74 million.

- Cash: $264 million.

- Debt: $10.5 billion (taking into account the leases).

Now, the assumptions that I will make are the following:

- Expected Return: 10% CAGR because AZO is a stable business and would be a good support in crises.

- Terminal Growth Rate: 3% CAGR from year 10.

- Share Reduction: 5% CAGR, a rate somewhat lower than what it has been doing in the past.

Implicit Growth Rate (Author’s Representation)

With the provided data, Free Cash Flow would need to grow by approximately 16% annually over the next decade to justify a 10% return from the current prices. However, I find this scenario unlikely, and my estimate leans more towards the company achieving a 10-12% annual growth in its FCF per share, factoring in 5% buybacks.

Given these assumptions, the current price might yield a return of approximately 8%. This is relatively low, even for a stable company, as it offers little margin of safety.

Reverse DCF (Author’s Representation)

Risks

Competition: The auto parts retail industry is highly competitive, with numerous players ranging from national chains and regional stores to online retailers. Price competition can erode profit margins, necessitating investments in marketing and customer service for differentiation. While AutoZone enjoys a strong reputation and scale, there’s always the possibility of margin pressure due to price wars, particularly with competitors like ORLY.

Electric Vehicles: I’ve already mentioned why I believe this won’t be a significant risk in the next decade. However, it’s important to acknowledge it. Electric cars require minimal mechanical maintenance, which could lead to a substantial drop in AutoZone’s sales volume as electric vehicles become more prevalent on the streets.

Final Thoughts

While the emergence of electric vehicles (EVs) is a potential risk, it appears to be a long-term concern that shouldn’t significantly impact AutoZone for several years, or even decades.

This, coupled with AutoZone’s strong market position and expansion into emerging markets, provides insights into how the company might navigate this challenge and extend its longevity. Additionally, the company maintains a solid financial position with minimal debt and strong cash flow generation.

However, considering the current valuation, the expected returns do not appear particularly attractive to me. Therefore, I would prefer to wait for more favorable prices, especially given that the company still has a substantial growth path ahead.

Read the full article here