Block Inc. Is Trading At A Discount And Holds Strong Long-Term Upside Potential

Block, Inc. (NYSE:SQ), formerly known as Square, Inc., the prominent fintech company that now owns Cash App and has revolutionized the payments and financial services industry has had a slow year. Despite growing revenue over 25% and beating on earnings in both of their 2023 conference calls, the stock has struggled. With its ever increasing diverse range of products, including payment processing, Cash App, and Bitcoin services, investing in Block’s stock can be an appealing prospect for investors seeking exposure to the fintech sector offering both value and growth (Figure 1). In this article, we will explore various aspects of why you should consider investing in Block, Inc and how the stock could see as much as 175% upside in the next 3-4 years representing a CAGR of over 28%.

Block Investor Page

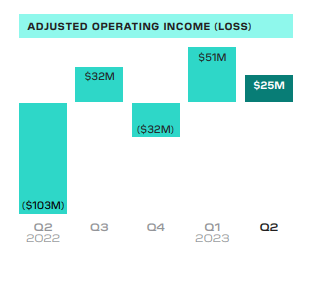

Figure 1. Block’s profitability has been trending upward in recent quarters

Block has been making headlines recently with its significant moves in the cryptocurrency space. The company made a substantial investment in Bitcoin, which has gained in value over time, contributing to its impressive financial performance and proves this can be a profitable venture (Figure 2). Furthermore, Block has been actively expanding its services and features within its Venmo (PYPL) rival Cash App, attracting more users and generating higher transaction volumes. These developments have propelled the company’s stock price only to pull back in recent weeks due to macroeconomic headwinds. We believe this pullback is unwarranted and opens up value with a high upside thanks to strong growth for patient investors.

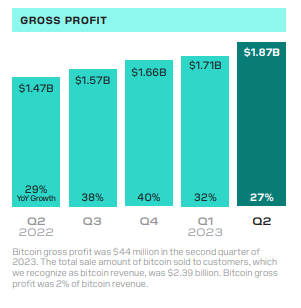

Block Investor Page

Figure 2. Block has proven Bitcoin can be a profitable venture for big businesses in recent quarters

Current Valuation

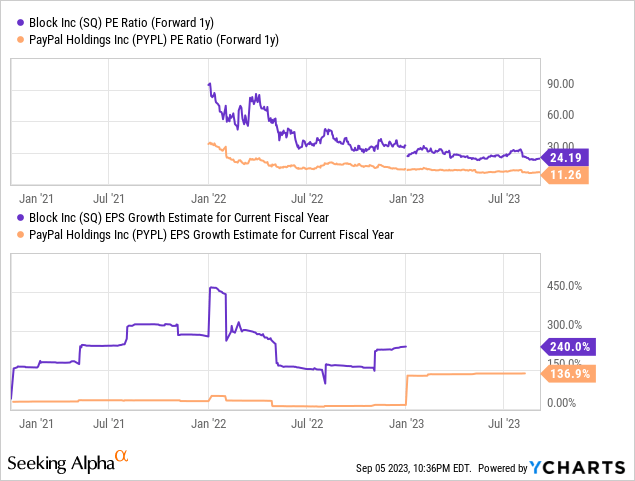

When it comes to Block’s valuation, the stock has seen remarkable growth, but it may still hold potential for investors. Its price-to-earnings (P/E) ratio is relatively higher than industry averages at 33.8x forward earnings, indicating that investors have placed a premium on the company’s growth potential. This premium has been well warranted as the stock is a leader in growth and has found numerous ways to continue to fuel growth. Furthermore, Block’s diversification with a broad portfolio of services and the continued growth of Cash App suggest that the valuation is well justified. Additionally, its involvement in the cryptocurrency market adds a unique dimension to its valuation, making it an interesting choice for investors who want exposure to the digital asset space.

The reason we believe Block has more long-term upside potential than competitor PayPal is we believe a shift from investor’s chasing value over to growth stocks is eminent. The Federal Reserve appears to have a good handle on inflation and with this we see tech growth stocks once again taking favor. With this Block will be a strong target for both individual and institutional investors as the stock is a less mature stronger growth alternative to PayPal. Both stocks have strong upside potential in our opinion, but Block has the potential to maintain growth at a higher rate than competitors which will be a key indicator going forward.

YCharts

Figure 3. Block trades at a premium to its closest competitor but for good reason as they have historically and anticipate to be a dramatically higher grower than PayPal

We believe if all goes well Block could easily return to a $160+ stock price before the end of 2027. With an average estimated EPS growth of 37.5% & average estimated revenue growth of 16.3%, average overall growth (EPS growth % + Rev. Growth % / 2) is projected to be over 27% over the next 4 years. This adds up to a roughly $160 price target if the stock can maintain its current price ratios which we believe is very possible in more favorable trading environments.

Risks

Investing in Block, Inc. is not without risks. The fintech industry in general is highly competitive and subject to regulatory scrutiny, which could impact the company’s operations and profitability. The cryptocurrency market is also known for its volatility, and Block’s exposure to Bitcoin carries inherent risks. Moreover, changes in consumer behavior and preferences could affect the adoption of payment and financial services offered by the company. Investors should carefully assess these risks before considering an investment in Block’s stock. Quarter to quarter investors must monitor Block’s growth. The Aforementioned $160 price target is dependent on the company averaging hitting or beating their estimates over the next 3-4 year time period. If the company misses repeatedly or macroeconomic headwinds such as high inflationary periods persist longer than expected, the stock will likely not hit this “best case” scenario.

Indubitable Information

“In God we trust. All others must bring data” – Robert Hayden

Something new we are have begun to try to incorporate into our stock coverage is to bring forth one simple statistic from each business we delve into that sets the company apart from the competition and screams buy or sell. For Block there are plenty of growth stats that drive investors to buy, but one in particular stands out from the rest.

Cash App has grown both users and revenue by more than 1000% over the last 5 years. That is a 200% increase on average over 5 years.

In Summary

In conclusion, Block, Inc. presents an appealing investment opportunity for those interested in the fintech sector and the evolving landscape of digital payments and cryptocurrencies. Recent news indicates the company’s growth and diversification in its services, which could lead to continued stock price appreciation in improving macroeconomic environments. However, investors should be mindful of the associated risks, including regulatory challenges, estimate misses, and market volatility. With its unique position holding both value and growth opportunities in the fintech and cryptocurrency space, Block, Inc. is a stock worth considering for those looking to invest in innovative financial technology companies, and if all goes well should beat the DOW and NASDAQ considerably over the next 3-5 year timeline which is why we give the stock an outperform rating and a $160 2027 price target.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here