Thesis

I am currently in the process of researching low volatility couples for use in a high-yield portfolio. I am planning on designing something I would feel comfortable using with reasonable amounts of margin.

The JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ) has been on my list of research targets for a while now. It has a reputation for producing a high yield while still maintaining rough parody on a total return basis with its underlying. Very few high yield ETFs manage to achieve this, I currently rate JEPQ as a Buy.

Fund Background

JEPQ seeks to generate income through a strategy revolving around selling options on U.S. large cap growth stocks. It attempts to deliver returns comparable with the Nasdaq 100 Index, but with less volatility. They employ a proprietary data driven strategy designed to maximize risk-adjusted expected returns. The fund has been trading since May 2022, and currently charges an expense ratio of 0.35%.

Holdings

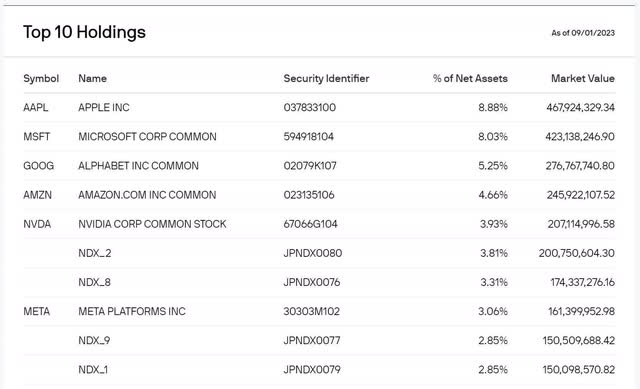

Currently, JEPQ’s largest holdings are Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG), Amazon (AMZN), and NVIDIA (NVDA). The fund also gains exposure to the Nasdaq 100 through equity-linked notes.

JEPQ Top Ten Holdings (JPMorgan.com)

Performance

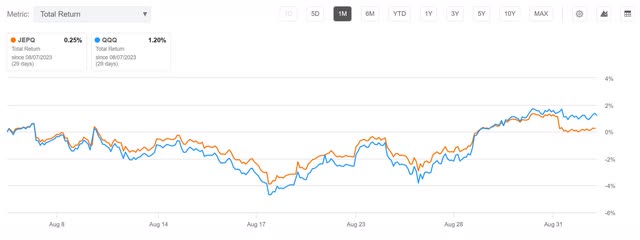

When looking at JEPQ on multiple timeframes, it maintains a relatively high degree of correlation with the Nasdaq 100. I should note that all of these are looking at performance on a total returns basis. Also, to represent the Nasdaq 100, we will be using the Invesco QQQ ETF (QQQ). Over the last month, JEPQ is down by 0.25% and lagging QQQ’s 1.29% by 1.04%.

JEPQ 1-Month Performance (Seeking Alpha)

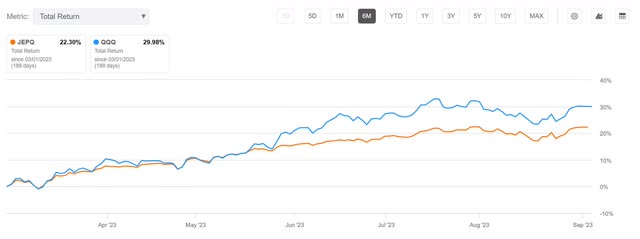

Over the last 6 months, JEPQ is up by 22.22% and lagging QQQ’s 30.03% by 7.81%.

JEPQ 6-Month Performance (Seeking Alpha)

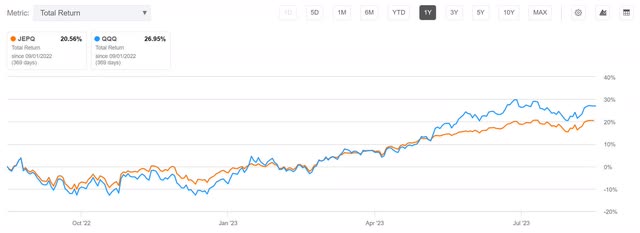

Over the last year, JEPQ is up by 20.48% and lagging QQQ’s 27.02% by 6.54%.

JEPQ 1-Year Performance (Seeking Alpha)

The Volatility Hedge

By pairing JEPQ with another asset which is also highly correlated to the QQQ, we can form a low volatility couple. I have two obvious choices available to me for this: ProShares UltraPro QQQ ETF (TQQQ) and their UltraPro Short QQQ ETF (SQQQ). Both are triple leveraged ETFs which come with their own performance and risk profile.

I recently wrote an article describing how gains can be extracted by shorting both assets to form a low volatility couple. Both of these leveraged assets experience a long-term decay of their Net Asset Value because they are designed to correlate to the daily performance of their underlying. This leaves them unable to maintain correlation over longer periods.

With any asset, when it goes down by 20% on a given day, it would need to gain 25% the next day to return to its previous value. The magnitude of this problem is amplified during more violent moves. A 33% drop would need a 50% rise to reach its previous value, while a 50% drop would then need a 100% rise.

To show an example of this value erosion: If the QQQ goes down by 10% one day, and then up by 11.1111% the next, it will effectively return to its original value.

100 x (0.90) x (1.111111) = ~100.00

However, the triple leveraged ETF designed to correlate with it, would land at a much different point:

100 x (0.7) x (1.333333) = 93.33331

So to recap: after the move has finished taking place, the underlying ETF would not have experienced a significant change, yet the leveraged ETF would have lost ~6.66%.

Although this example would represent an unusually large two-day dip and then recovery, smaller moves occur regularly and compound over time. This is why it is not advisable to be long a leveraged ETF over extended timeframes. Enough people have misunderstood their behavior that the SEC and FINRA have both issued warnings.

Which To Choose?

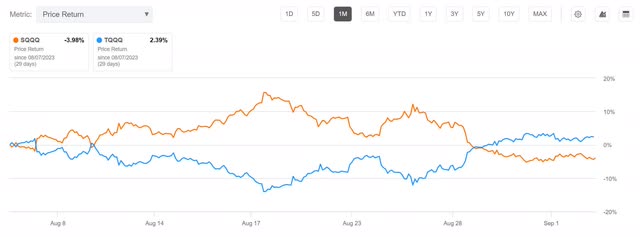

To achieve a low volatility couple, we have the choice of either going long SQQQ or shorting TQQQ. Both funds carry a gross expense ratio of 0.98% and are inversely correlated to the same underlying. This is why they mirror each other’s performance.

TQQQ vs. SQQQ 1-Month (Seeking Alpha)

TQQQ vs. SQQQ 1-Year (Seeking Alpha)

It is important to note that over longer timeframes the losses in SQQQ approach 100%. However, over those same periods TQQQ has the potential to go up by significantly more than 100%.

TQQQ vs. SQQQ 10-Year (Seeking Alpha)

The performance of both positions must be considered when deciding which one to choose. By going long in SQQQ, one is exposed to its long-term NAV decay. By shorting TQQQ, one is exposed to its cost to borrow fees. Because of their long-term behavior, neither hedge is expected to perform well over longer timeframes.

Neither choice appears to be significantly more appealing than the other. I am choosing to be long SQQQ because I would rather have stable management fees than worry about spikes in cost to borrow fees. Also, its long-term behavior of approaching zero is more appealing than shorting TQQQ, whose long-term behavior has the potential to gain more than 100%.

The Couple

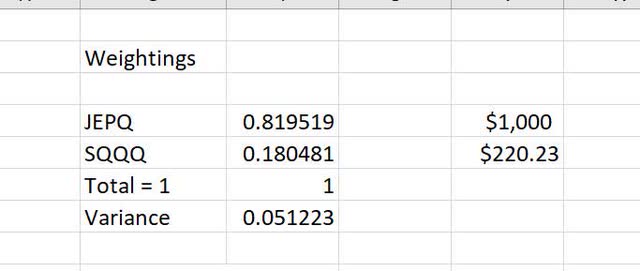

My minimum variance calculator shows that I can achieve a variance of 0.0512 by buying $220.23 of SQQQ for every $1000 one is long JEPQ.

JEPQ vs. SQQQ Minimum Variance Weighting (By Author)

If you scroll up to the TQQQ vs. SQQQ one year chart, it becomes clear that either a short position in TQQQ or a long position in SQQQ would be down by roughly 63% over the last year. With decay this significant, the size of the hedge would have to be considerably smaller than JEPQ to consider it viable. With the lowest variance occurring with JEPQ weighted at 81.95% and SQQQ weighted at 18.05%, this hedge loses value quickly enough that I believe it is better to own JEPQ without it.

Risks

JEPQ’s performance is linked to the performance of the Nasdaq 100. It should underperform anytime its underlying is also underperforming. The fund is also actively managed, intentionally weighting some assets higher than the index. This weighting increases the threat of larger declines during periods where the more heavily weighted assets underperform.

Anytime one chooses to form a low volatility couple with a highly correlated asset, there is always the risk that the two assets fall out of sync with each other. It is also possible the minimum variance calculation is incorrect. Also, depending on which assets you chose and how their underlying mechanics function, they are likely to have different long-term behavior and so require frequent rebalancing.

With the yield curve inverted for months now and the Fed still fighting against inflation, we may face a significant recession as the job market loosens.

Catalysts

The same catalysts that affect the Nasdaq 100 also affect JEPQ. The Fed is currently holding rates at an elevated state in an effort to fight inflation. If inflation cools off and the soft landing materializes, markets may treat the lowering of rates as a bullish signal and begin a major rally. However, the Fed also has a history of lowering rates as a reaction to something breaking. So depending on the context of why rates are being lowered, this may be bullish, or it may be bearish.

Conclusions

JEPQ appears to be an attractive source of yield. With a ttm of 11.4%, it is not as high as some of the other sources I have been looking at. However, JEPQ does not appear to be plagued by the same long-term NAV erosion that most covered call ETFs suffer from.

The fact that I was not able to find an attractive pair to form a low volatility couple will not exclude it from my margin portfolio. However, it does mean I will have to use it at a lower weighting. I was originally thinking I could find 10 attractive couples and weight each of them at 10% of the portfolio. With each couple already designed to be at a minimum variance, combining 10 low variance couples together forms a portfolio with extremely low volatility.

However, when I researched Simplify Volatility Premium ETF (SVOL), I found it attractive yet was unable to find an attractive pairing to form a low-volatility couple. JEPQ is in the same situation. I would like to include it, but without a volatility hedge. At this point, I am probably another two or three months away from running low on high-quality targets to research and do not know how many more of these I will come across. But I will consider including SVOL, JEPQ, and any others like these, except at a lower overall weighting.

Read the full article here