Investment Thesis

Hyatt Hotels (NYSE:H) could see further upside from here on the basis of RevPAR growth for the Park Hyatt brand and the expansion of the Regency brand into China.

In a previous article back in February, I made the argument that Hyatt Hotels could see further growth ahead, on the basis of strong RevPAR growth and growing exposure to the Greater China market.

Since my last article, the stock is up by just over 3%:

Investing.com

The purpose of this article is to assess whether Hyatt Hotels could see further upside from here, taking recently released financial results into consideration.

Performance

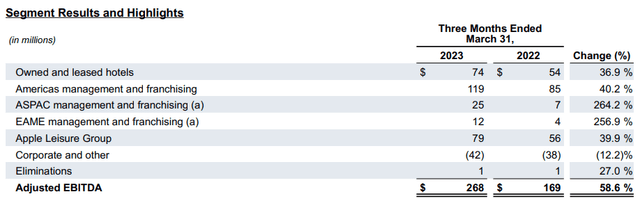

When looking at Q1 2023 results, we can see that Hyatt Hotels has seen strong growth in adjusted EBITDA of 58.6%.

Hyatt Hotels Q1 2023 Earnings Release

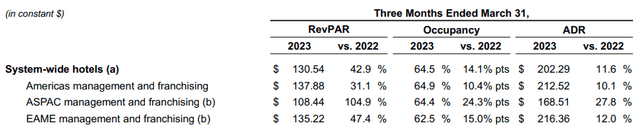

What is particularly notable is that when we look at RevPAR growth by region – ASPAC (Asia-Pacific) saw the largest RevPAR growth at 104.9% as compared to the same period last year.

Hyatt Hotels Q1 2023 Earnings Release

Additionally, the ASPAC region is the second-largest region for Hyatt by hotel rooms after the Americas (with 67,494 rooms across ASPAC and 168,913 across the Americas).

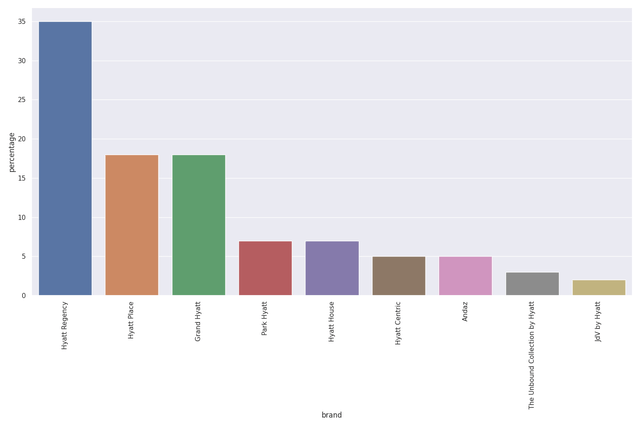

When looking at a breakdown of revenue by brand on a percentage basis, we can see that the Hyatt Regency accounted for 35% of total revenue for Q1 2023. The revenue for each brand was calculated as RevPAR * occupancy * number of rooms, with the percentage share of revenue for each brand displayed below:

Percentages calculated by author using SQL – using data sourced from Q1 2023 Hyatt Hotels Corporation Earnings Release. Bar chart generated by author using Python.

As we can see, the Hyatt Regency brand accounted for the highest portion of revenue across all brands at 35%.

The Hyatt Regency brand is concentrated primarily in the Americas, with a limited presence in EAME. The brand also has a presence in Bali, Indonesia, and Ahmedabad, India across the ASPAC region.

However, it is notable that China has become a major geographical target for the Hyatt Regency brand – with over half of future hotel additions reportedly set to appear in the region.

I take the view that this would allow the brand to further strengthen its presence in a region that has seen strong growth on a RevPAR basis – while also diversifying the brand geographically and guarding against a potential plateau in growth across the Americas going forward.

Additionally, the Park Hyatt (which is the hotel chain’s most expensive brand by ADR at $437.70 for Q1 2023) continued to see growth in RevPAR to $283.03 from that of $267.85 in Q4 2022.

In this regard, despite concerns that inflation may be hindering travel demand – RevPAR across more expensive brands still continues to see an increase.

Risks and Looking Forward

Going forward, Hyatt Hotels could have potential for further upside on the basis of expansion of the Hyatt Regency brand into the Chinese market, as well as continued RevPAR growth for the Park Hyatt in spite of inflationary pressures.

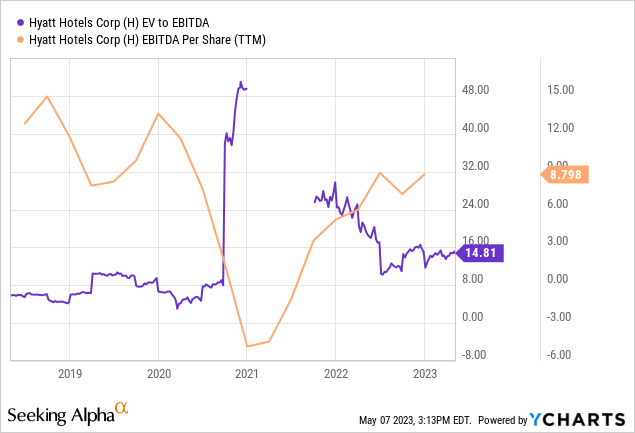

In addition, we can see that the stock’s EV to EBITDA ratio has fallen significantly from the highs seen at the beginning of 2021 – while EBITDA has seen a steady rise over the same period.

YCharts.com

This would suggest that valuations have approached a more realistic level following previous bullish sentiment on a post-COVID travel recovery. As such, I take the view that the stock could still have room to rise if we see earnings growth continue in spite of inflationary pressures. After seeing a prior high of $125 back in March – I take the view that the stock could exceed this level once again as the summer months approach.

In my view, the main risk for Hyatt Hotels at this point is adverse macroeconomic conditions dampening demand for hotel bookings during high season. Should bookings come in lower than expected for this time of year, then the stock could still see downward pressure. Additionally, with Hyatt expanding the Regency brand significantly throughout China, higher inflation could also place upward pressure on costs – which could end up impacting earnings growth in the short to medium term.

I take a bullish view overall, but the above risks could impact growth going forward.

Conclusion

To conclude, Hyatt Hotels has seen significant growth in RevPAR across its brands in spite of inflationary pressures, and the company’s expansion into the Chinese market provides long-term growth opportunities. Despite risks in the short to medium term, I take a long-term bullish view on Hyatt Hotels.

Read the full article here