Thesis

The PGIM High Yield Bond Fund (NYSE:ISD) is a fixed income closed end fund. The vehicle focuses on U.S. high yield bonds, and seeks to provide a high level of current income with its 10% yield. The fund comes from a very reputable platform, namely PGIM Investments, which is part of Prudential.

Fixed income has been hit hard in the past two years by the rise in risk free rates. However, as rates start to peak and funding costs stabilize, it is worth looking at conservatively built CEFs which have provided very robust historic returns. ISD is one of them:

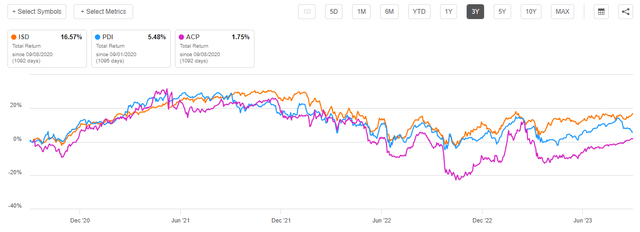

3-Year Total Return (Seeking Alpha)

In the past 3 years the fund has outperformed much better known names such as the PIMCO Dynamic Income Fund (PDI) and the abrdn Income Credit Strategies Fund (ACP). We can see ISD producing a total return in excess of 16% during that time-frame, while PDI and ACP show total returns sub 6%. That is almost a 3x difference.

In this article we are going to look at ISD’s composition, its structure in today’s funding environment and its forward in the context of fixed income CEFs.

Analytics

- AUM: $0.4 billion.

- Sharpe Ratio: 0.14 (3Y).

- Std. Deviation: 9.75 (3Y).

- Yield: 10%.

- Premium/Discount to NAV: -9.5%

- Z-Stat: 0.43.

- Leverage Ratio: 21%.

- Composition: Fixed Income – U.S. High Yield

- Duration: 4.7 years.

- Expense Ratio: 1.48%.

Leverage Composition

The one item that has held this CEF back this year, similarly to other leveraged vehicles, is its debt composition:

Leverage Profile (CefConnect)

The fund did not term fund any of its liabilities, thus doing its debt funding via Repo or TRS facilities. That translates into a floating cost of funds, which has reset higher with risk free rates.

The fund has fared better than others due to its conservative use of leverage, ratio which has hovered around 21%.

Holdings

The fund holds a classic portfolio of U.S. high yield debt:

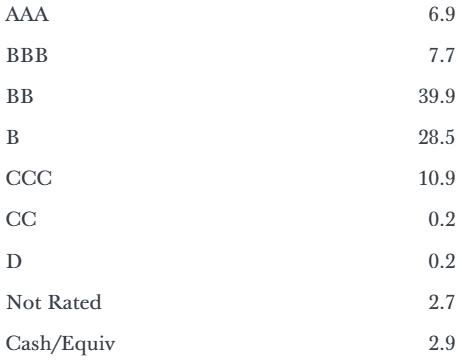

Ratings (Fund Website)

The vehicle is overweight better quality ‘BB’ names, which make up roughly 40% of the portfolio. The riskier ‘CCC’ bucket is capped at 10%, which adds to the lower beta build here versus its peers.

With a mild recession penciled in by some analysts for 2024, a retail investor needs to be mindful of actual bankruptcies, especially for the riskiest credits. CEFs with high leverage and high ‘B’ and ‘CCC’ buckets are the most susceptible of a significant turn in actual Chapter 11 filings.

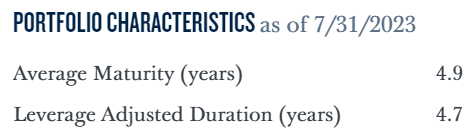

The fund is almost entirely composed of fixed rate corporate bonds, and has a rough duration of 4.7 years:

Duration (Fund Website)

Duration measures the sensitivity to changes in interest rates, and for this fund a 100 bps move down in the 5-year rate would translate into a 4.7% collateral gain from pure duration moves.

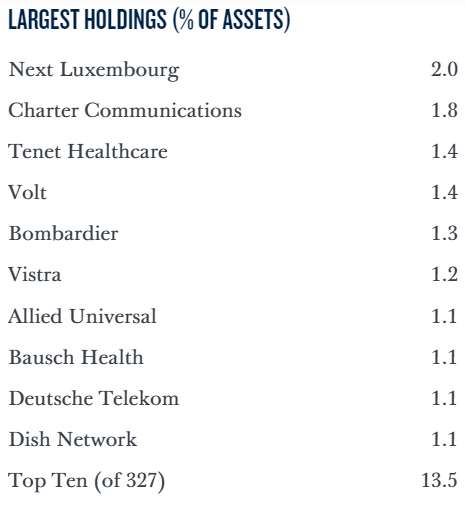

The portfolio is very granular here, with most names below 1.5% of the collateral pool:

Holdings (Fund Website)

An investor needs to be very mindful of granularity in today’s environment, given the bankruptcy risk mentioned above. Granular funds will be able to weather today’s environment much better due to their lack of single issuer concentration.

Premium/Discount to NAV

The fund usually trades at a discount to net asset value:

Discount to NAV (YCharts)

What we like about this name is the low beta for the discount to NAV. The range is fairly tight here and the volatility is fairly low. That is a good characteristic to have for a more conservative name. In the past year and a half we can see the CEF having moved in a tight -12% to -8% range. That is very narrow for a fixed income CEF.

Big opportunities do indeed arise when there is a sudden dislocation and the discount to NAV moves to very egregious levels, but a regular buy-and-hold investor should desire a low beta ‘discount to NAV’. Why? Because it allows for predictability of returns. Your holding in the name will be driven by fundamental factors rather than the market perception of the CEF.

Distribution Coverage

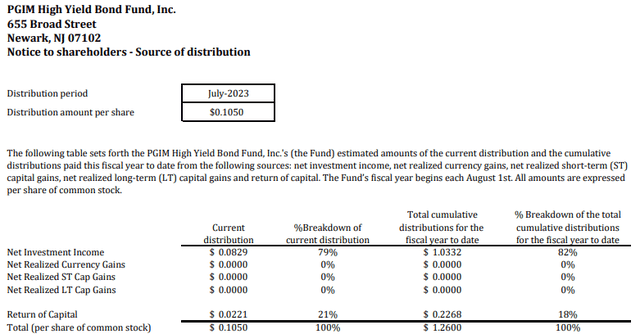

The fund pays dividends monthly, and currently covers its distribution to the tune of 82%:

Distribution Coverage (Section 19a)

All else equal, as time passes and rates peak, the fund will see an increase in the distribution coverage. The reason behind this is the gradual maturity of its bond portfolio. As bonds mature or are early terminated, the fund will have ‘dry powder’ to invest in new names at the current prevailing yields, yields which are much higher than in the past.

Outlook for the CEF

The fund hits the right notes when it comes to collateral composition. Its holdings are granular and overweight ‘BB’ names, with no sectoral concentrations. The fund runs a run of the mill duration profile that should bring it benefits once rates start moving lower.

However, ISD shines when it comes to leverage. In today’s environment, as a retail investor, you want a conservative fund. ISD delivers via a low 21% leverage ratio and a low beta of its discount to NAV. Absent a significant market risk-off event, you want a fund that is going to be a steady accretive instrument with a buffered downside.

We believe the 5-year point in the yield curve is in the process of plateauing, while the back end will move a bit higher due to the ‘higher for longer’ rates environment. With a short to intermediate duration, ISD’s returns going forward should be entirely driven by credit spreads.

ISD has proven itself to be wisely managed in the past 3 years, and we expect a similar story going forward when it comes to choosing good credits that will outperform. With a low leverage ratio and a low discount beta, this fixed income CEF should be a steady accretive instrument.

Conclusion

ISD is a fixed income CEF from Prudential. The fund focuses on U.S high yield in the form of corporate bonds. This CEF has outperformed much better known names in the space such as PDI and ACP on a 3-year lookback, and comes from a very reputable platform in Prudential.

We like this fund for its conservative portfolio build, low leverage ratio of 21%, and low beta of its discount to NAV. In today’s environment where short rates are stabilizing, ISD is a good conservative choice to be had in the U.S. high yield CEF space. The fund pays a monthly 10% dividend yield which is mostly supported by its interest income. We are a Buy for this name here.

Read the full article here