Back in mid-July, I placed a “Hold” rating on Block (NYSE:SQ), saying that while it’s been posting solid growth and its valuation has become more attractive, there were still a lot of questions about competition, the macro environment, and its Cash App business metrics. Since then, the stock has fallen about -17%. Let’s catch up on the name.

Company Profile

As a refresher, SQ is best known for its Square ecosystem, which was initially designed to permit sellers to accept credit and debit card payments right from their phones or tablets. Since then, the company has developed over 30 software and hardware products to help sellers, including vertical specific products and solutions for the restaurant and retail industries.

The company’s Cash App ecosystem, meanwhile, is a mobile payment service that allows users to send, receive, and store money. The app is commonly used as a free peer-to-peer payment network, but has expanded into debit cards, instant rewards, saving, lending, tax preparation, stockbrokerage account, and crypto services.

Q2 Results

SQ management has stated that it wants the company to get to a Rule of 40 on an adjusted operating income basis. As a reminder, the Rule of 40 is a measure that if you added a company’s revenue growth rate (or gross profit growth for SQ) with its profit margin, or other metric such as EBITDA margins or adjusted operating margins, it should exceed 40%. It is a way to measure if a company is growing efficiently and not just growing for growth’s sake.

Let’s see how the company progressed on this goal.

Company Presentation

For Q2, SQ saw its revenue climb 26% to $5.53 billion. Transaction revenue rose 11% to $1.64 billion, while subscription revenue climbed 33% to $1.46 billion. Bitcoin revenue jumped 34% to $2.39 billion, although it has very low gross margins of about 2%. Hardware revenue, which has negative gross margins, fell -7% to $44.9 million.

Gross payment volume (GPV) rose 12% to $59.0 billion, which was below the $59.7 billion analysts were expecting. Its transaction gross profit was $687 million, up 15%. As a percentage of GPV, it was 1.16%, up 2 basis points year over year. Subscription gross profit was $1.18 billion, a 34% year over year increase.

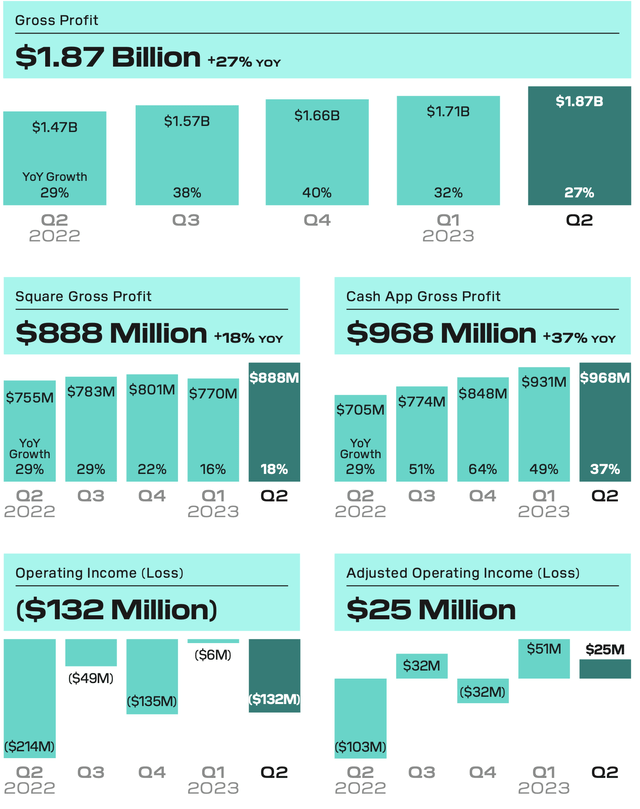

Overall gross profit rose 27% to $1.87 billion. Overall adjusted operating profit was $25 million. With de minimus adjusted operating profit, SQ fell well short of its Rule of 40 goal based on adjusted operating profit.

Adjusted EBITDA rose 105% to $384 million. However, stock-based compensation was $319.3 million. Using adjusted EBITDA ex-SBC Rule of 40, SQ would still fall short by about 1,000 basis of its goal.

Adjusted EPS came it 39 cents, more than doubling. That came in 2 cents ahead of the consensus.

Square segment revenue rose 12% to $1.93 billion. Square gross profit climbed 18% to $888 million. Square U.S. GPV grew 10%, and international GPV jumped 26%, or 32% in constant currencies. The company saw strong growth in its vertical specific solutions, such as Square for Restaurants and Square for Retail, with gross profit up 3%.

The company said Square growth upmarket was solid, with gross profit from mid-market sellers up 20%.

Cash App revenue jumped 36% to $3.56 billion. Its gross profit, meanwhile, climbed 3% to $968 million. Excluding bitcoin, Cash App revenue rose 39% to $1.16 billion.

Cash App GPV was $4.86 billion, up 15% year over year. Transaction revenue rose 15% to $134 million, helped by increased transactions. Subscription revenue roared 43% to $1.03 billion, driven by transaction fees from the Cash App card and Instant Deposit, as well as interest earned on customers’ funds.

Cash App saw inflows of $62 billion, up 25%.

Overall, SQ delivered a mixed quarter. Profitability was solid versus expectations, as the company makes progress towards setting itself up to get to Rule of 40 growth. However, growth is slowing, as seen by Square GPV year-over-year growth of just 12%, down from 17% growth in Q1, and Cash App inflows rising just $1 billion, or under 2%, sequentially, after growing by $7 billion, or 13%, quarter over quarter in Q1.

Outlook

Looking ahead, SQ raised its full-year outlook. It now expects to generate $1.5 billion in adjusted EBITDA, up from prior guidance of $1.36 billion. Analysts were expecting adjusted EBITDA of $1.38 billion at the time.

Adjusted operating income, meanwhile, is now projected to be $25 million for the full year. That’s up from prior expectations of a loss of -$115 million.

The company also noted that it expected SBC to rise by $25 million from Q2 levels in Q3.

Moving forward, the company is foregoing some operations to focus on more profitable growth. On its Q2 call, CEO Jack Dorsey said:

“For sales and marketing, we have focused on efficiency to drive acquisition while decreasing spend. We’ve pulled back on brand spend and more experimental channels across our ecosystems in favor of channels with more proven returns. This past quarter, we also decided to wind down operations in certain markets, including Cash App’s Verse brand in the EU and our buy-now-pay-later platform, Clearpay, in Spain, France and Italy. These required significant investment and the markets have not seen the growth and profitability we had expected over the past several years. We see an opportunity to shift these resources towards strategic areas that have a higher potential return on investment. As we continue to drive towards our goal, we may identify other areas where we aren’t seeing the expected and necessary returns. We also continue to improve our cost structure for each of the ecosystems by identifying opportunities to expand our structural margins. These include the investments we make in technologies like automation and machine learning to manage risk and finding ways to optimize our partnerships. As a result of our investment discipline, we are increasing our profitability expectations for this year.”

Overall, I like SQ’s focus on more profitable growth, so pulling back on products and solutions that were not resonating with customers instead of continuing to pour money into them makes sense. While this could hurt GPV growth, I think profitable growth is more important at this point in its maturity. However, its high SBC remains an issue, and it expected to rise another $25 million in Q3 doesn’t show that the company is looking to address this issue, even though it says it is an area it is focused on.

Valuation

I think the best way to value SQ is using an EV/gross profit metric. The company has gross margins of about 34.2% last year, and it is similar the first 6 months of this year. Using a 34% gross margin, based on the revenue consensus of $21.4 billion, it would generate about $7.28 billion of gross profit. Based off of 2024 revenue forecasts of $24.29 billion, its 2024 gross profit would be $8.26 billion.

On that basis, the company trades at about a 4.8x multiple of 2023 estimates and 4.2x 2024 estimates. That’s a huge discount to where the stock traded pre-pandemic.

From an EBITDA perspective, the company is projected to post EBITDA of $1.53 billion in 2023 and $1.94 billion in 2024. That puts it at about a 22.8x multiple for 2023 and 18 for 2024. However, stock comp will likely wipe out most of those profits.

Conclusion

While there are some signs of slower GPV growth, I like SQ’s focus on more profitable growth as it tries to move towards adjusted operating income Rule of 40 metrics. Adjusted operating income does include SBC expenses, so it is not trying to shuffle these costs out with this goal.

I think with the stock down and profitability forecasts and estimates up since I last looked at the stock, now is the time to upgrade the stock to “Buy.” The stock certainly carries risks and its SBC issues still need to be addressed, but I do like the direction the company is headed. I’ll put a $80 price target on the stock, which is an under 6x EV/gross profit valuation of the stock.

Read the full article here