Thesis

J.Jill, Inc. (NYSE:JILL) has recently showcased stellar second quarter results. However, beyond these impressive numbers, there are underlying trends, challenges, and strategies that define the current state and future prospects of the company. This analysis argues that while J.Jill’s initiatives like size inclusivity and technological improvements show promise, there are financial metrics and market challenges that warrant investor caution.

Exceeding Projections in Style

J.Jill is a women’s apparel brand, operating as an omnichannel retailer in the United States since 1959, boasting an expansive range – from casual and athletic wear to trendy footwear and accessories like scarves and jewelry.

The company’s second-quarter results unveiled a non-GAAP EPS of $1.10, outpacing expectations by a noteworthy $0.30. With a revenue generation of $155.7M, they surpassed market estimates by $3.3M.

During the conference call, management emphasized the historical significance of this season for J.Jill, both in terms of sales and EBITDA. Their insight appeared spot-on as summer essentials like dresses, tees, and linens flew off the shelves. The design strategy, evidently focusing on modern details and vibrant colors, seemed to strike a chord with the consumers.

Seeking Alpha

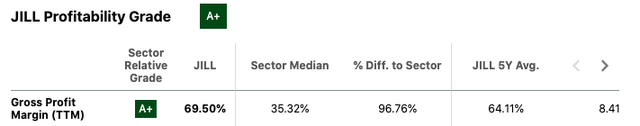

Delving deeper in terms of sector profitability, J. Jill’s gross profit margin stands at a commanding 69.50%. To put that in perspective, it’s an impressive 96.76% above the sector median and an uptick of 8.41% from the company’s own 5-year average.

Seeking Alpha

Yet, the metric that might grab the attention of investors was J. Jill’s EBIT margin, clocking in at 13.52%. That’s not only an 87.29% surge over the sector median but also a staggering 410.16% climb from their own half-decade benchmark.

Seeking Alpha

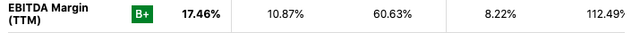

The EBITDA margin, though categorized as B+, underpins the brand’s strength, surpassing both its sectoral competitors and its own historical data. These figures underline the brand’s prowess not just in raking in revenue, but in the prudent management of its operating expenses.

Seeking Alpha

The company’s net income margin hovers at 4.94%, a figure that merely nudges past the sector median. This raises questions. Could this indicate potential hiccups in handling financing costs or unforeseen non-operational outlays?

Seeking Alpha

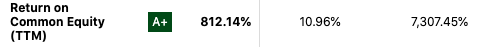

The Return on Common Equity showcases a staggering 812.14%, making it hard to draw parallels with the sector median.

Seeking Alpha

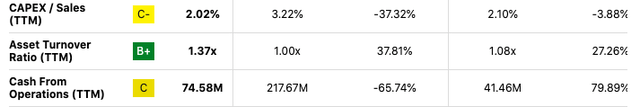

However, no financial landscape is devoid of pitfalls. The CAPEX to sales ratio and cash from operations don’t inspire the same confidence as some other metrics. A particular point of concern is the company’s cash from operations trailing considerably behind the sector median, hinting at potential liquidity challenges in the horizon.

Size Inclusivity: J.Jill’s Fresh Approach to Fitting In

According to management, at the outset of the season, there was an observable hesitancy in customer spending patterns. However, as the season progressed, it became evident that their summer offerings were resonating with the market. J.Jill was able to employ category-specific promotions. Notably, these didn’t just spur sales of the targeted items; there was a discernible spillover effect that benefited their broader product line.

July was particularly telling. The month witnessed J.Jill not just pushing, but successfully driving full-price sales. Concurrently, the brand saw an uptick in its customer base across all sales channels. The direct channel, in particular, registered a significant influx of new customers.

An initiative that appears to be working is J.Jill’s focus on size inclusivity. Analyzing the data, there seemed to be a correlation between this initiative and a surge in younger demographics gravitating towards both J.Jill and their sub-brand, Wearever.

To provide a broader context, historically, according to InStyle, the term “plus-size” described clothing made for sizes above 12. Curiously, many brands still cap their offerings at this size. However, a pitfall of this label was its inadvertent side-effect; it seemed to segregate buyers, creating an unintended chasm. It implied that those who fit into these sizes weren’t the norm but an “add-on.” When considered against data from the CDC, which posits that the average adult woman aged 20 and over corresponds to a size 18 to 20, the incongruity becomes evident. Moreover, the physical placement of these clothes in separate sections of stores compounded the issue.

This led to a shift in nomenclature and ethos. “Size-inclusive” has increasingly become the favored term to depict clothing lines that cater to a broader size spectrum. As for “plus-size,” it’s evolved too, becoming more of a badge of identity for those who opt to embrace it.

Fitting Into the Future

Stepping into a J.Jill store or browsing their online platform these days reveals a discernible strategic shift. By Q3’s conclusion, J.Jill will have a new point-of-sale (POS) system fully operational across its physical locations.

When I looked into findings by Coresight, it became clear that J.Jill isn’t alone in this transition: approximately 74% of retailers have initiated their journey towards omnichannel retailing. However, only 34% can claim to have a well-established strategy.

J.Jill isn’t stopping at the checkout counter. There’s an ongoing enhancement of their order management system. The raison d’être behind these tech-intensive efforts? A seamless customer journey coupled with a more efficient operational backbone. Innovations like a reimagined fit guide and the “Shop The Model” feature stand as testaments to J.Jill’s commitment to understanding and improving the online customer experience.

Management echoed a belief that these modifications might address J.Jill’s historical challenge of elevated return rates. Projecting ahead, the expanded touchpoints, both in-store and online, are likely to give a shot in the arm to J.Jill’s customer acquisition metrics.

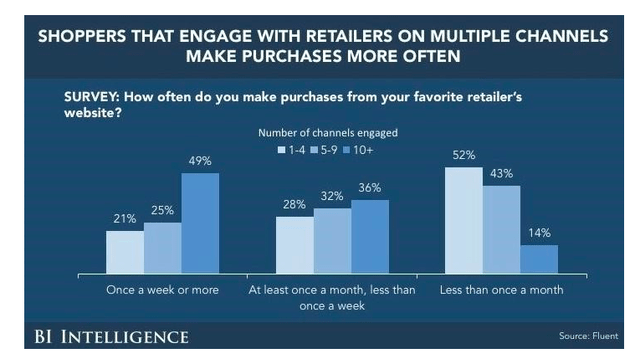

BI Intelligence

A final observation to underscore here: those who engage with J.Jill across multiple channels tend to have wallets that are three times as generous as their single-channel counterparts.

Valuation

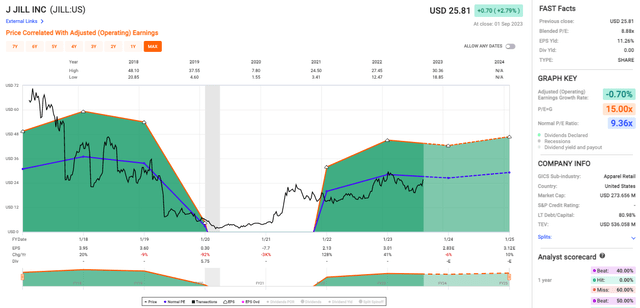

JILL’s blended P/E ratio is 8.88x (see chart below), and generally speaking, a P/E ratio that low can signify that the market views the stock as undervalued, or perhaps it suggests skepticism about the company’s future earning potential. For context, the normal P/E ratio for J. Jill seems to float around 9.36x, so it’s not like we’re in bargain-basement territory, but it’s still under the average for the retail sector.

FAST Graphs

This relatively low P/E ratio raises a flag when you look at the EPS Yield of 11.26%. That’s a high earnings yield by most standards, which should, in theory, make this an attractive investment. It essentially suggests that if the company were to distribute all its earnings, an investor could expect a double-digit percentage return. The disconnect between a high EPS yield and a relatively low P/E ratio could mean that the market is pricing in some risk factors that aren’t immediately apparent in these basic metrics.

Also, the Adjusted Operating Earnings Growth Rate is at a negative 0.7%. A contracting earnings growth rate isn’t exactly what you want to see if you’re betting on a turnaround or sustained long-term growth.

Risks & Headwinds

Sales dropped to $156 million, marking a 2.9% dip as compared to the same season last year. The charts particularly show in-store sales, an essential barometer for the health of the company, slipping by approximately 1% from Q2 of 2022. While not exactly alarming, there was also a downturn in direct sales – a cornerstone of the company’s revenue – which faced a 5% setback year-over-year.

The sales data suggests a clear inclination of consumers towards full-priced items. However, the broader financial tapestry reveals the effect of this preference was cushioned by the lower quantity of transactions. A possible explanation? The limited availability of discounted items during the season. Digital sales, while presenting their own set of challenges primarily in the form of returns, showed a silver lining with rates slightly stabilizing, albeit the change being marginal.

Crunching the numbers, the company’s gross profit stood at $111 million, dwindling by $1.1 million from the corresponding quarter of 2022. When diving into the adjusted EBITDA, this season witnessed a further decline: the metric reads $34.5 million, a soft slide from last year’s $35.6 million.

Executive Vice President, Chief Financial Officer and Chief Operating Officer Mark Webb underscored a downturn of 1.3% in the company’s identical sales for Q2. Contextualizing this, the preceding year witnessed an uptick of 0.8%. There’s a silver lining, though. Certain positive sales trends manifested during the season. Yet, they were essentially neutralized by the curtailed number of discounted items that made it to the checkout counters.

Reflecting on JILL’s inventory challenges which reared their head in the closing stages of 2021, the narrative seems to be inching towards the better. This year marked more consistent shipments. But, peeling back the layers reveals inventories at the culmination of Q2 to be approximately 16% leaner than what they were a year ago. Much of this discrepancy is attributable to the disturbances from yesteryear.

Lastly, looking into the future, caution seems to be the company’s watchword for the ensuing quarters. The projections for the third quarter are somber, predicting sales to lag behind Q3 of 2022, and adjusted EBITDA projections oscillate between a modest $23 million to $25 million.

Rating: HOLD

J.Jill has demonstrated strong financial performance metrics, such as their EBIT margin and Return on Common Equity, and has embraced promising initiatives like size inclusivity and technological enhancements for an improved customer experience. However, liquidity concerns, a below-average cash from operations, a slight dip in sales from the previous year, and cautious projections for upcoming quarters temper my enthusiasm. And while the valuation suggests a potential undervaluation, the negative earnings growth rate and concerns around inventory and discounts raise questions about its near-future performance.

Read the full article here