On 24 August, Ulta Beauty (NASDAQ:ULTA) released results for the quarter and half year ending 29 July 2023. Solid numbers and a good outlook were ignored by the market, and I think the current drop in share price to the low $400’s brings it back into buy territory for those that like a good long term growth story in general and especially for those that prefer to buy growth at a reasonable price (GARP)

Let’s dig into the numbers

Net Sales for the 13 weeks ended July 2023 were up 10% vs the same quarter last year. These figures were helped along by higher comparable sales, new store openings and growth in other revenue. Volumes or Tickets slipped 1% but transaction values held up well. I’d point out here that consumers are still buying but buying a little less as higher prices eat into spending power.

This resulted into an increase in gross profits of 7.1% to $993.6m. Gross profit margins were softer at 39.3% (vs 40.4%) however as lower merchandise margins, shrink and higher supply chain costs overcame better growth in other revenue and better leverage of store fixed costs.

Being net cash positive added $4.4m to the bottom line as higher interest rates boosted that line item. Overall diluted earnings per share (DEPS) rose 5.6% to $6.02.

Looking at the Half Year….

If we zoom out for the first six months of the financial year, we see that net sales were up 11.2% to $5.2bn with comparable sales up 8.7%.

Gross profits rose 9.6% to $2bn and gross profit margins settled at 39.7% (vs 40.3%). Once again lower merchandise margins, shrink and higher supply chain costs held back gains in other revenue and leverage of store fixed costs.

Overall, almost $12m in interest was earned and net income rose to $647m vs $627m on the prior year. Diluted EPS was 7.5% higher at $12.90.

The standout categories for growth were prestige and mass skincare, Salon Services and Fragrance & bath which all grew by double digits. Haircare and Make-up grew by Mid and low single digits respectively.

The loyalty program also grew members by 9% to 41.7m active members and spend per member increased too driven by greater shopper frequency. The partnership with Target has now been rolled out to 421 locations vs 359 in the prior quarter and new store openings are still expected to reach 25-30 this year and 70 next year.

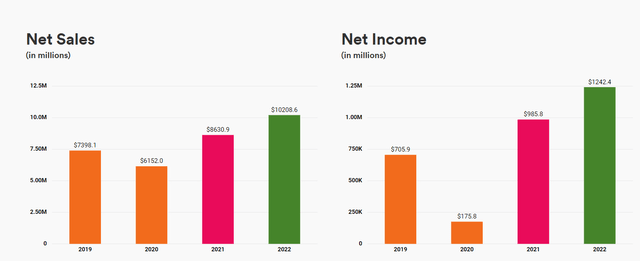

Net Sales and Net Income progression (Company Website)

Strong Balance sheet important considering the current macro

With interest rates having risen as much as they have, a debt free balance sheet (B/S) is certainly the place to be right now and with $388.6m in cash on the books ULTA fits the bill quite nicely. Higher sales demand, new stores on the roster, product cost increases and new brand launches resulted in a boost in inventory to over $1.82bn (this is about $150m up on the last year figure) and the cash conversion cycle (CCC) was 71.8 days as a result. Slightly higher than last year’s figure too (68.6 days) but I’d argue that more store openings and subsequent stock requirements are the reason there, with volumes up over 10% for the first half of the FY its clearly not a marked slowdown in sales. Overall trends in this metric seem steady.

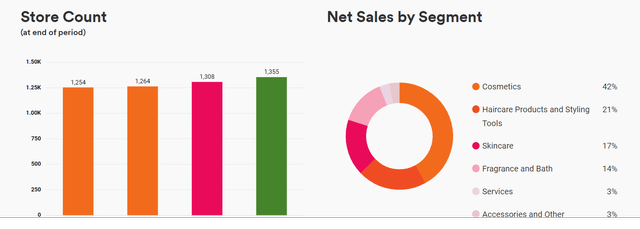

Store Count and Sales split (Company Website)

Cash utilization

The company is a solid cash generator and is able to use that cash for multiple resources. We’ve seen the boost to inventory as mentioned above which has sucked up about $150m in cash. Selling and general & administrative expenses (SG&A) was $1.2bn. This totalled 23.5% of sales and was spent on strategic investments, marketing, and staff payroll & benefits. On top of this $559m was spent on share buybacks where 1.1m shares were repurchased. Sifting through the results it seems as if they have in fact purchased 1 134 737 shares for a total cost of $561.3m as per the two separate quarterly releases here and here. In hindsight and in the short term it doesn’t seem to be the best use of shareholder capital considering the current spot price of $ 416.00 (the company has guided to $900m in share buybacks this year, hopefully they’re using current weakness to dollar cost average!). These purchases look like this below against and average closing price from 1 Jan 2023 to 29 July 2023 as per Yahoo! Finance.

|

Q1 |

Q2 |

H1 |

|

|

Spend |

285,800,000.00 |

275,500,000.00 |

561,300,000.00 |

|

Shares |

541,108.00 |

593,629.00 |

1,134,737.00 |

|

Ave |

528.18 |

464.09 |

494.65 |

|

Average closing price for the period |

497.02 |

||

Some supported Brands (Company Website)

Valuation and outlook

I think that the current fall in the share price is on the back of concerns around a slowdown in sales growth and a pinch in margins for the next quarter. Last year on the back of robust demand the company was able to raise prices quite meaningfully which resulted in a 3-5% boost to performance. This helped the business through a rough patch on the cost side in its last FY as inflationary headwinds bit, but clearly the odds of that happening again this year are unlikely. So, the normalization is not just about sales growth or volumes but also about pricing growth, all of which are moving back to trend. For the next quarter this is going to be felt as like for like pricing growth and price increases are lapped which means that operating margins are likely to come under pressure for Q3.

The company is ploughing ahead with investment in the business with spend rising on initiatives like ship from store and technology upgrades. Staff costs also remain elevated as will store expenses and added to this are still high supply chain costs, promotional activity and shrink.

This was reflected in the outlook where the net effect is that Operating margins are probably going to fall into the mid 13% range for Q3 as these costs rise, and then bounce back again in Q4 as cost pressures subside. So, watch for that ‘13%’ print which may disappoint the market. For the full year though, this seems to wash through the system as can be seen by the company’s guide for FY23 which is as follows:

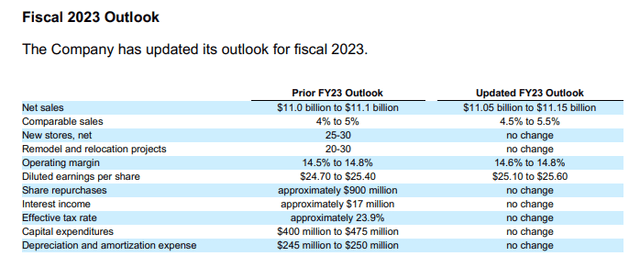

Company Guidance (H1 results statement)

They’ve firmed up to DEPS range to $25.10-$25.60 (mid $25.35) and tightened the operating margin range to 14.6%-14.8%. So, despite the company guiding to a weaker operating margin in Q3 they haven’t cut the FY outlook at all. In fact, they’ve tightened the range a bit. This makes me think they might be erring on the side of caution with their messaging at present.

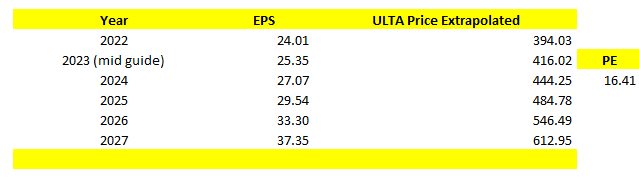

On This basis the Forward PE moving into the end of FY 23 would sit at 16.41x. Checking the Seeking Alpha earnings estimates page for ULTA shows us that the market out there is looking for the following up to 2027.

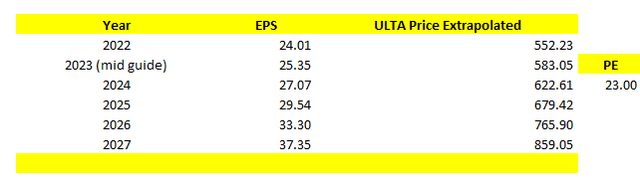

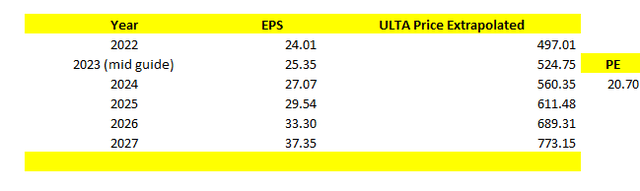

Share price at current valuation (Analyst)

By implication, from here at the current PE valuation ULTA could be worth just on $613.00 by the end of its 2027 earnings release which from today would imply about 14.3% per annum in total returns. (3.3 years). This is quite intriguing considering that the long-term average return of the S&P500 is 8.5%.

It’s quite tough to get a competitor list for Ulta Beauty. Walgreens (WBA), CVS (CVS), Kohl’s (KSS) and Macy’s (M) for example all have instore offerings which could be considered as competitors. Ulta has a partnership with Target (TGT), Sephora is owned by LVMH (OTCPK:LVMHF) and something like Sally Beauty (SBH) also has some similarities but there is no direct standalone competitor here. So, what’s a fair valuation?

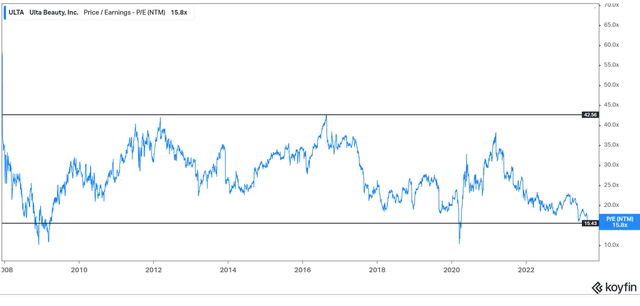

The average PE Ulta Beauty has traded at over the last five years is 23x earnings. The current PE of 16.41 implies a massive derating in the company’s valuation. Should ULTA find its way back to its 5yr average multiple over time, valuations would change significantly and so would the share price.

Share price at 5yr average valuation (Analyst)

Suddenly 14% annual returns shoot up to 35% on this basis. And we have on our hands not just a market beater but a considerable one at that.

The Consumer discretionary sector as measured by the XLY ETF trades on a FPE of 25x earnings. again, not entirely sure what the correct comparative is here but Home Depot (HD) trades at 22x, McDonald’s (MCD) at 24x, TJX at 25x…

From a DCF perspective we could punch in those analyst forecasts and get to a valuation of $507.25

DCF Value (Analyst)

And even if you went for a mid-range PE between it and its sector average, we’d get to 20.7x earnings which would extrapolate to the following:

Value at mid of sector and current PE (Analyst)

So, on a DCF and mid-range PE perspective we have a current average fair value of $516.00 which is a solid 24% higher than current prices.

Risks

High interest rates and sticky inflation aren’t considered a good environment for retailers and consumer discretionary companies on the whole and neither are recessions, the US is not in the all-clear when it comes to the latter. This could mean markets fall back at some point if one transpires.

Changes in consumer spending patterns need to be watched, inflation is hurting as few items are being purchased at present. Higher prices are helping offset this, but this isn’t a trend you’d want to see for a long time. Consumer health is important for a company like this.

Margin pressure has been guided for and a rebound next quarter (Q4) is important.

Investment in the business to grow revenues is good but increased promotional activity is not. When asked about this on the results call management alluded to the fact that they promote when appropriate. If the economy slows significantly that may very well increase.

Theft or ‘Shrink’ is becoming a major talking point in the retail sector. Although the ‘impact’ of shrink remained in line with Q1 numbers management did say that there is an increase in theft and organised retail crime in the US that needs to be addressed. Management have done their bit by adding locked fixtures in their stores (up to 50% of stores at present) and mostly in high ticket items like fragrances. The comments portend to the likelihood that theft is also increasing on lower priced items too.

Conclusion

Ulta Beauty is the largest beauty retailer in the USA with over 1300 stores on its books with a wide footprint that covers 50 states. They are in appealing locations that attract high traffic visitors and in power centres too which keeps them front of mind from a consumer perspective.

Alongside this they support both established and emerging beauty brands and aim to stay relevant via smart marketing using both traditional and non-traditional methods.

If a recession does rear its head, this sector of the market has always been traditionally defensive courtesy to what has commonly been referred to as the ‘lipstick effect’. Consumers tend to cut back on many discretionary items when times get tough, but makeup and beauty products remain a relatively affordable luxury that they choose to stick to which improves their sense of wellbeing and value. You might cut back on another pair of fancy shoes but are less likely to change your make up regime.

At its current PE we haven’t seen ULTA trade this cheaply since COVID 19 and before that the GFC. This company has clearly endured hard times before and I think the market is being overly punitive at the moment.

Ulta Beauty is a strong buy for investors with a long-term mindset.

Long term NTM PE for Ulta Beauty (Koyfin)

Read the full article here