The dramatic increase in interest rates experienced over the last two years has created a massive upheaval in the world of commercial real estate. Higher financing costs and higher cap rates are two very real headwinds that impact companies differently, depending on their financial and asset profiles. The current turmoil has created an opportunity to buy attractive real estate at large discounts to intrinsic value for the long-term investor. Such an opportunity exists in the common stock of W. P. Carey (NYSE:WPC). WPC is a REIT that focuses on investing in single-tenant net lease commercial real estate in the United States, as well as Northern and Western Europe. At current prices, WPC offers a 6.55% dividend yield, and should appreciate meaningfully over the next 3-5 years due to internal growth, and potentially a return to a higher valuation, especially if rates do head downwards once again.

WPC Q2 Investor Presentation

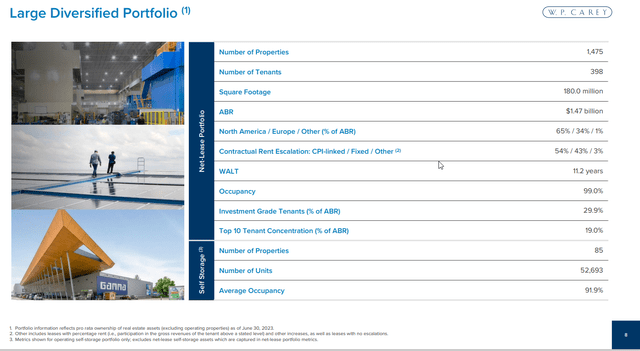

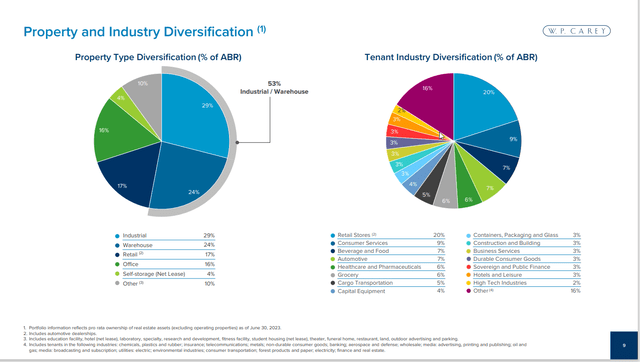

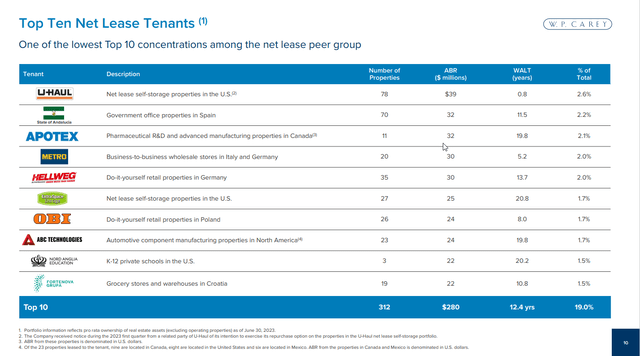

WPC is a very diversified REIT with Industrial and Warehouses, being its two largest areas of concentration, followed by Retail and Office. 65% of the 1,475 properties are in North America, with 34% in Europe, and just 1% outside of that. 54% of its leases are CPI-linked, which has provided a nice tailwind to revenues during this period of high inflation. One of the concerns the market has regarding WPC is that if inflation has peaked, same-store leasing growth will slow, but I believe those concerns are relatively short-sighted. The weighted average lease term is 11.2 years. The Top 10 tenants comprise 19% of ABR, which speaks well to the diversification of the asset base.

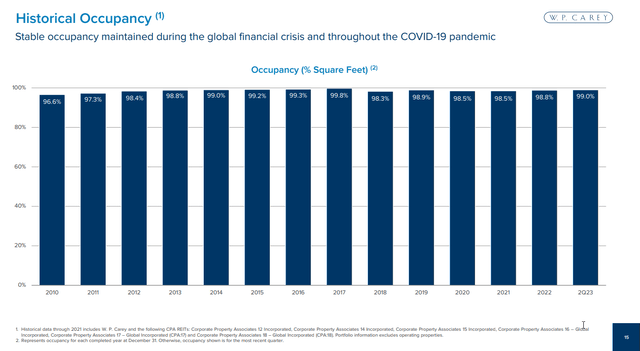

Office Exposure is only 16% and of course not all offices are created equal, as the European office market is far healthier than in the U.S., and medical offices for example, have much better occupancy than say technology companies. One of WPC’s largest Office tenants is the State of Andalucia, which has roughly 70 properties in Spain. One can get a grasp of the quality and importance of WPC’s assets, in its stellar occupancy ratios that have been consistently around 97-99% over the past decade. WPC prefers single-tenant occupancy, with assets that are critical to the tenant’s business. The purchase price is usually between $5-$500MM, with lease terms of ten years or more. Most of the company’s leases are triple net leases, where the tenant promises to pay all the expenses of the property, including real estate taxes, building insurance, and maintenance. This reduces CAPEX requirements for the company and frees up cash to buy additional properties, pay dividends, or reduce debt.

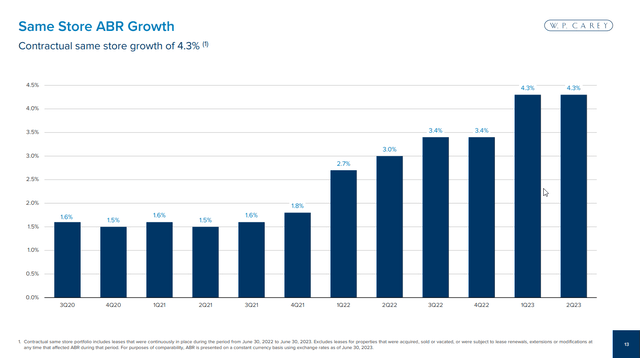

Often WPC will work with existing tenants or private equity firms with whom it already has relationships, where it can execute sale-leaseback transactions. This is a great way for both the tenant and the REIT to grow together and can potentially lead to dozens of transactions with the same tenant. WPC also executes capital investments to expand or renovate developments, leading to better utilization and higher rents. Organic growth occurs via the CPI-linked escalators, or fixed contractual rent increases. The CPI-linked contracts have led to peer leading same-store rent growth, and while that may slow down a bit, it should still grow at a decent clip. If the cost of debt expenses rises more rapidly than the lease revenue, FFO can be pressured in the near-term, which is a risk for the sector and WPC.

WPC Q2 Investor Presentation

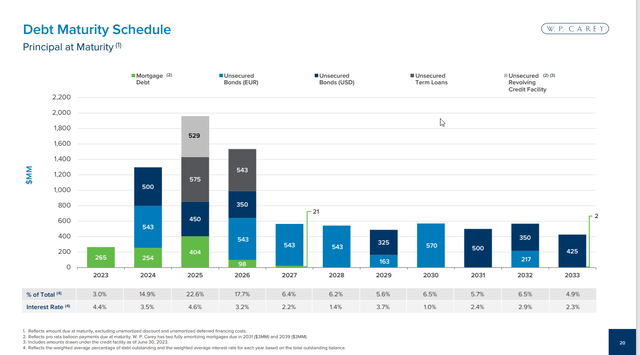

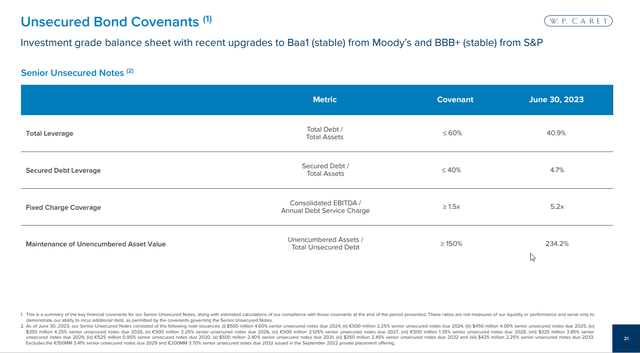

WPC ended Q2 with total pro rata net debt of $8.559B, which is around 5.7x adjusted EBITDA. The total consolidated debt/gross assets ended at 41.3%. The debt has a weighted average interest rate of 3.3%, which is fantastic, but on the negative side, the weighted average debt maturity (pro rata) is 3.9 years, which is a bit on the short side. The company ended the quarter with $1.9B of liquidity, including $384MM of forward equity. WPC’s credit rating was upgraded to Baa1 (stable) by Moody’s and BBB+ (stable) by S&P in September 2022, and January 2023, respectively. The company’s goal is to maintain conservative leverage targets in the (mid-to-high 5s Net Debt to EBITDA).

The company still has approximately $385MM of unsettled forward equity, raised at an average price of over $83 per share. Combined with planned asset sales, which include around $465MM from the proceeds of the U-Haul portfolio, the company should be able to fund the remaining investment volume included in its guidance, while maintaining a strong and conservative balance sheet. Management is evaluating additional sales in self-storage where there is better liquidity than other sectors. The internal valuation of that portfolio is around $1.5B. WPC also holds a large investment in Lineage Logistics, which is on the balance sheet at a fair value of around $400MM and is not currently paying a dividend. The company expects Lineage to go public at some point, providing a good opportunity to monetize it. WPC maintains a $1.8B revolving credit facility provides ample liquidity and along with two term loans, accounts for about 1/3rd of the debt maturing over the next 2.5 years. On the revolver, the higher interest rates are already flowing through given their floating nature, so the eventual refinancing shouldn’t be too shocking.

During Q2, WPC completed $761MM of investments, which brought first half volume to $939MM, at a weighted average cap rate of 7.3%, 120 basis points above the average for the investments to be completed over the same period last year. Most of these were sale-leaseback transactions, as companies seek to find more affordable funding alternatives to traditional loans. Management is targeting cash cap rates in the 7s, which translates to unlevered IRRs in the 8s and 9s with rent growth on long-term leases. For example, fixed-rate rent hiked completed in the first half of 2023 had rent increases averaging just under 3%, compared to historical averages around 2%. The investments completed over the first half of the year have a weighted average lease term of 22 years.

WPC Q2 Investor Presentation

WPC Q2 Investor Presentation

WPC Q2 Investor Presentation

In Q2, WPC generated AFFO of $1.36 per diluted share, up 3.8% sequentially, reflecting the positive impact of recent investments and rent growth, partially offset by higher interest expense. Same store rent growth remained at a peak level of 4.3% YoY, 130 basis points higher than it was a year ago. The uncapped CPI rent escalations were up 7.5% in Q2, reflecting the lagged impact of CPI on rents, which is embedded in the growth. Fixed rent increases also will trend upwards, helping to sustain same store rent growth even as inflation declines. The company expects internal growth to continue to be strong with 2nd half growth of 4%, and to average around 3% in 2024 based on current inflation forecasts. Comprehensive same store rent growth in Q2 was 3.9% YoY, including the benefit of certain rent recoveries. The company expects same store rent growth to average about 100 basis points below contractual same store. WPC captured close to 100% of prior rents through re-leasing activity for the quarter, or about 1.5% of ABR, with an average extended lease term of six years.

WPC Q2 Investor Presentation

WPC Q2 Investor Presentation

WPC Q2 Investor Presentation

WPC only had $5.5MM of disposals in Q2 and $48MM of decided disposals in the first half of the year. For the full year, WPC expects total dispositions of between $300-$400MM including the sale of nine of the 12 Marriott operating hotels the company owns, which represents about 2/3rd of the annualized NOI generated by the hotel portfolio. Interest expense totaled $75.5MM in Q2, with the increase driven by the funding of investment activity and of course the impact of higher rates. The 3.3% weighted average interest rate was up from 2.6% a year ago. G&A expense totaled $25MM in Q2, down $2MM from Q1, due to the timing of certain payroll-related items. For the full year, the company expects G&A to be between $97-$100MM. Tax expense on an AFFO basis totaled $12.8MM in Q2, including $3.3MM of incremental expense related to a tax audit in Europe. The company expects the quarterly run rate to be closer to $11MM. Management narrowed full-year AFFO guidance by $.04 to between $5.32 and $5.38 per share, which implies around 3% YoY growth. Investments are expected to total between $1.75B and $2.25B.

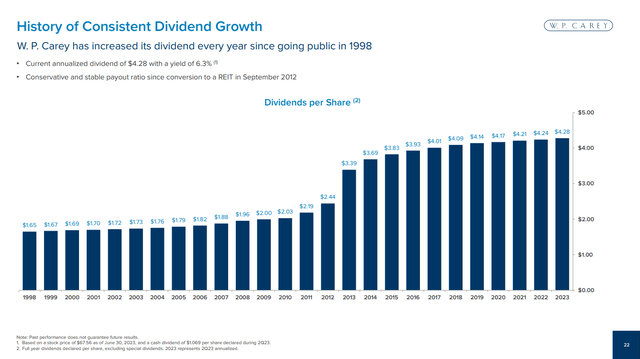

At a recent price of $65.30, WPC trades well below its 52-week high of $87.30, and the dividend yield is an extremely healthy 6.55%. WPC is a dividend aristocrat having increased its dividend every year since going public in 1998. The stock trades at about 12.2x 2023 expected AFFO, which is a materially lower multiple than historical averages. WPC is a high-quality REIT with attractive reinvestment opportunities. The company has the financial wherewithal to be able to invest at the more attractive cap rates that are available, without having to sacrifice its conservative financial posture. I believe long-term investors can continue to count on the hefty yield and between 25-40% appreciation in the stock price over the next 2-3 years. I’d expect WPC to hold up well even in a recessionary environment, with the benefit of lower rates that would likely come with that. Clearly, higher rates are a headwind, but it is times of turmoil that present the best opportunity to buy attractive real estate, which derives its cash flow over many decades.

Read the full article here