Intro

We wrote about Banco BBVA Argentina S.A. (NYSE:BBAR) in November of last year (stock was trading at $3.18 per share) when we stated that higher prices were in store for the Argentinian bank. The bank’s strong return on equity profile as well as its cheap but growing book value were key reasons why we liked the stock at the time. Since shares however had not yet undergone a technical breakout by November of last year, we published a ‘Hold’ rating on the stock. However, it didn’t take long for BBAR to register that upside breakout (December 2022) with shares then going from strength to strength in the aftermath. In fact, when we include the dividend proceeds from BBAR since the breakout, shares have returned a very impressive 88% to currently trade at $5.72 per share.

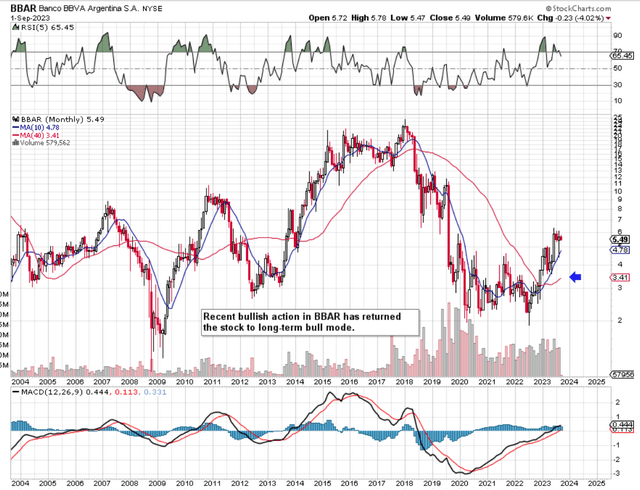

Now, given the excellent returns BBAR has achieved over the past 12 to 18 months or so, one may be led into believing that the opportunity has passed in the Argentinian bank. However, when we look at the bank’s long-term chart, it is evident that BBAR still has significant upside potential for the following reasons. Firstly, shares have traded over $25 per share in the past (2017 highs) and recent share-price action has resulted in a bullish crossover of the stock’s long-term moving averages (the 10-month moving average has now moved above the bank’s 40-month comparable). This essentially means that BBAR has returned to a long-term bull market and although it is impossible to know the scale of the pending up-move in BBAR, investors are beginning to like BBAR’s forward-looking fundamentals.

BBAR Long-Term Technicals (StockCharts.com)

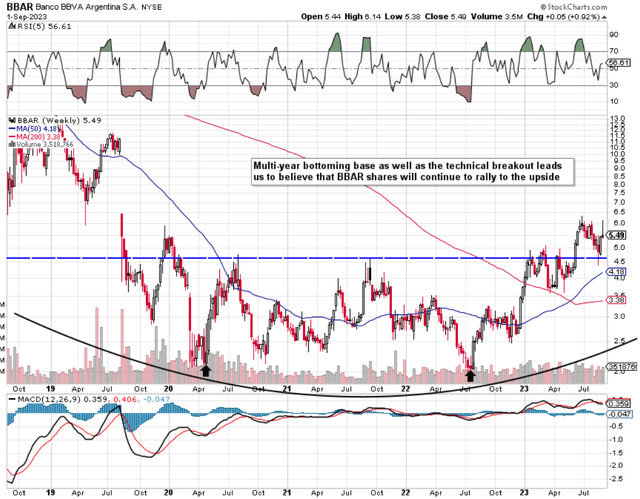

In fact, if we go to the intermediate 5-year chart, we see that the bank’s 3-year bottoming formation should now mean that what once overhead resistance should now become solid underside support. Support was actually tested successfully a few weeks back when shares of BBAR dropped below $5 a share before buyers came in aggressively to buy into the downswing. Furthermore, if indeed a long-term double-bottom reversal pattern is in play in BBAR, shares should have plenty of room to move to the upside before the reversal pattern plays itself out in full.

BBAR Intermediate 5-Year Chart (StockCharts.com)

Remember, the technical charts have already priced in the ramifications of Argentina’s upcoming elections, the country’s falling GDP as well as the soaring rate of inflation we presently see in the country. Furthermore, from a growth standpoint, BBAR continues to post impressive customer growth numbers, with digital and mobile client growth up by 10% and 14% in the bank’s most recent second quarter.

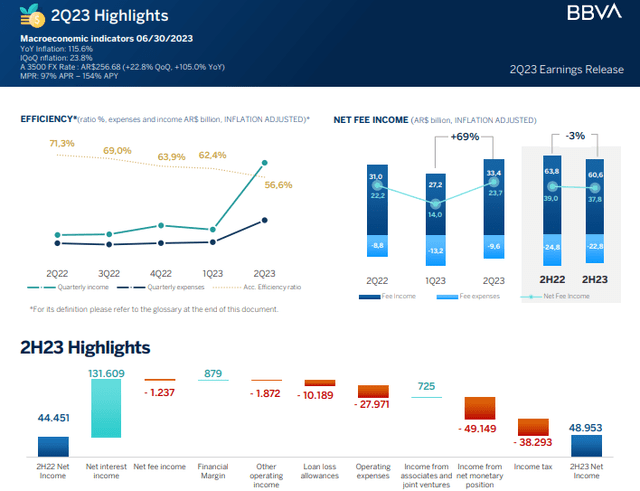

This resulted in the company’s Q2 adjusted net income of $30.4 billion, resulting in a return on equity of over 21% for the quarter (well above the trailing 12-month ROE number of just under 16%). Moreover, the bank’s strong operating profit results stemmed from elevated interest and fee income and efficiency ratios continue to improve, as we see below.

BBAR 2Q-23 Highlights (Company Website)

Management on the recent Q2 earnings call pointed to caution over the near term (with respect to the uncertainty of the macro environment, inflation, upcoming elections, etc.) but we reiterate the point that BBAR can face these uncertain times with a lot of positivity. Technicals aside, for example, the bank’s market share continues to grow and liquidity and solvency ratios remain sound where management should be able to remain ahead of the curve with respect to protecting the balance sheet from inflation.

Suffice it to say, BBAR’s forward price-to-book ratio of 0.6, its trailing 12-month return on equity of almost 16% and really encouraging revision trends (where the fiscal 2023 EPS estimate of $1.84 has increased by 27%+ alone over the past three months) point to internal fundamental strength irrespective of external trading conditions. All we can do as investors is to invest in what is in front of us. BBAR’s growth story remains on track. Yes, volatility will most likely increase over the upcoming weeks, but we still maintain downside risk remains limited in this play.

Conclusion

Q2 numbers and associated trends point to further gains in Banco BBVA Argentina S.A. over the long haul. In fact, when one looks at the bank’s long-term charts (technicals), the very attractive book multiple (value), and growing ROE (profitability), investors looking for capital gain appreciation as well as income should do very well here going forward. We look forward to continued coverage.

Read the full article here