Investment Thesis

Trex Company, Inc. (NYSE:TREX) has good revenue and margin growth prospects moving forward. The company should see revenue growth recovery in the back half of 2023 due to easing comparisons and channel inventory destocking ending. In addition, new product development across different price points, continued strength in the repair and remodeling market, and increased branding investments should also support revenue growth in the coming years. Further, I believe the long-term growth prospects for the company should benefit from the market conversion from wooden decking to wood alternatives. On the margin front, the company should benefit from cost-saving initiatives, raw material optimization, easing comparisons, and volume leverage.

However, these growth prospects already seem to be reflected in the company’s current valuation which is trading at a premium to its historical average and sector average. So, despite good growth prospects, I would like to wait on the sidelines for a better entry point and have a neutral rating on the stock.

Revenue Analysis and Outlook

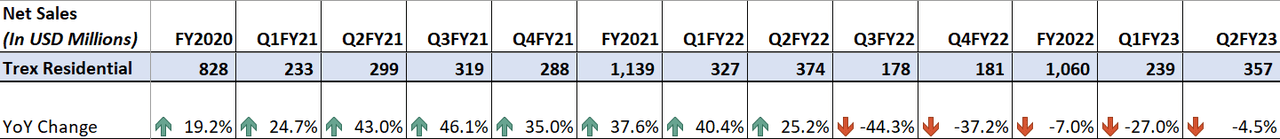

In the recent quarters, Trex sales has been significantly impacted by inventory destocking and tough comparison from channel inventory build in 1H22. While the sales was again down 4.5% Y/Y in the second quarter, the rate of decline moderated meaningfully from a ~27% Y/Y decline in Q1 FY23. In the second quarter of 2023, the company saw improving demand for its decking products driven by accretive innovations and increased brand investments as the company experienced a mid-single-digit growth in channel sell-through. However, sales declined due to tough comparisons from the previous year’s quarter as a result of the nonrecurrence of the channel inventory build that occurred during the first half of 2022 as well as some inventory destocking. This resulted in a 4.5% Y/Y decline in net sales to $357 million.

Trex’s Historical Revenue (Company Data, GS Analytics Research)

Looking forward, TREX’s growth should benefit from easing comparisons in the back half of this year. Compared to 40.4% Y/Y growth in Q1 22 and 25.2% Y/Y growth in Q2 22, the company’s sales declined 44.3% Y/Y in Q3 22 and 37.2% Y/Y declined in Q4 22. So, Trex should see meaningful growth in Q3 2023 based on easing comps alone.

Further, after almost four quarters of inventory destocking which started in Q3 2022, the channel inventory is lean enough and I am not expecting destocking-related headwinds in the coming quarters. So, that should also help. The company is also executing well and continues to invest in branding and new product development. Last quarter, the company introduced the Trex Select T-Rail system, an entry-level product to compete against vinyl systems. This product complements the company’s decking portfolio and its entry-level price point should address the needs of price-sensitive consumers who are looking for affordable options. The company’s continuous product development to address the needs of consumers across the price point coupled with its strong channel partnerships should continue to drive its growth looking forward.

The company has a secular market share gain opportunity as customers move away from wooden decks (currently accounting for approximately three-fourths of the market) to alternative and more durable Trex decking. Further, the underlying repair and remodel industry fundamentals also remain strong with high home equity levels after the appreciation in home price post-pandemic. The high average age ( ~40 years) of the current U.S. housing inventory should also trigger a need for remodeling, helping the company’s sales. Overall, I am optimistic about the company’s revenue growth prospects.

Margin Outlook and Analysis

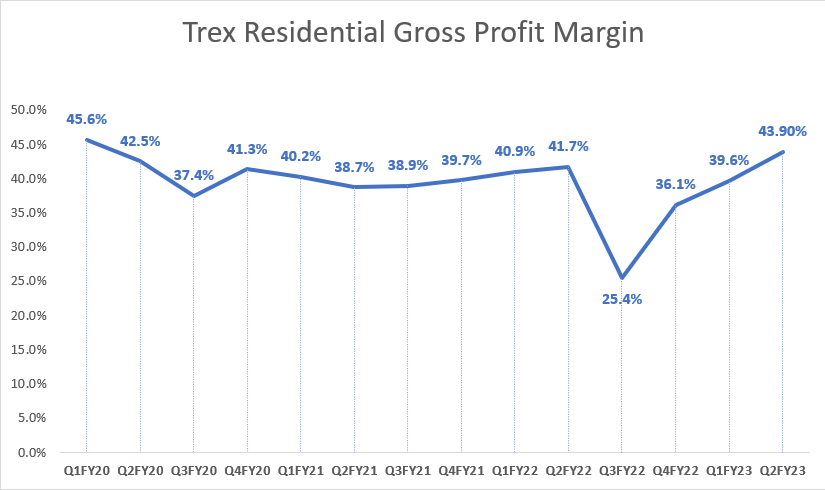

In the second quarter of 2023, the company’s margins continued to face headwinds from volume deleverage. However, the company was able to recover and expand margins with the help of cost-cutting and productivity initiatives taken over the last few quarters. This resulted in a 220 bps YoY increase in gross profit margin to 43.9%.

TREX’s Historical Residential Gross Margin (Company Data, GS Analytics)

Looking forward, the company’s margin should see significant Y/Y improvement in the near term given the easy comparisons as well as the recent cost reduction initiatives and volume leverage. During the pandemic, when demand was very high and the company’s production facilities were running at full capacity, the company didn’t have much time or resources to work on efficiency improvement initiatives. This changed during the last four quarters as reduced production levels and downtime helped the company implement a series of cost reduction and continuous improvement projects related to production optimization, line upgrades, energy efficiency, and raw material processing improvements. In the coming quarters, as production volumes ramp up the optimized cost structure, the company margins should see a good improvement.

Valuation and Conclusion

While I am optimistic about the company’s growth and margin improvement, one thing that bothers me about the stock is its valuation. The stock is trading at 41.1x FY23 consensus EPS estimates. This is a meaningful premium versus the sector average of 18.10x.

While the stock has always enjoyed a premium valuation given its good growth prospects, and over the last 5 years it has traded at historical forward P/E of 38.45x, I believe these valuations leave a little margin of safety. Also, while the company enjoys leading market share and good profitability, I believe other players might be attracted to this market and should ramp up their investments given the extremely strong 40% plus gross margins in this business. So, there is some long-term risk as well. I believe the company’s growth prospects are already getting priced at current levels and would prefer to wait on the sidelines for a better entry point.

Read the full article here