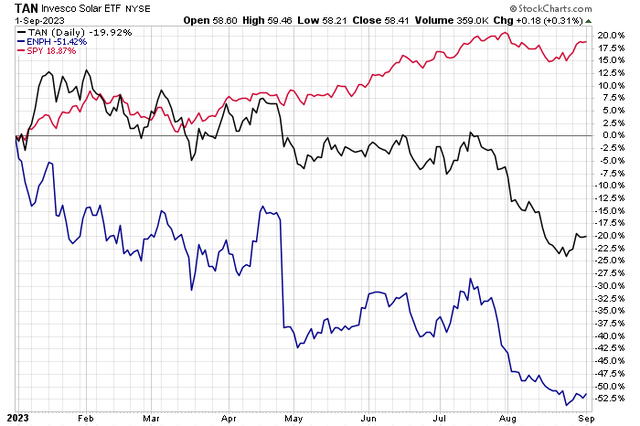

It has been a dreadful 2023 for solar-related and clean energy stocks. The Invesco Solar ETF (TAN) is down 20% total return on the year while the S&P 500 is up by almost that same amount. One of the fund’s largest weights, Enphase Energy (NASDAQ:ENPH) has been cut in half. But is there value in the name now? Perhaps, but this stock is a key example of how paying attention to momentum and price action is vital to risk management.

I reiterate my buy rating on the company and highlight a particular price zone that both the bulls and bears must monitor.

Solar Stocks Sink in 2023, Enphase A Major Loser Thus Far

Stockcharts.com

According to Bank of America Global Research, ENPH sells micro-inverters, energy storage, and software solutions catered to residential (rooftop) solar applications. The company offers a semiconductor-based microinverter, which converts energy at the individual solar module level and combines with its proprietary networking and software technologies to provide energy monitoring and control services.

The California-based $17.5 billion market cap Semiconductor Materials & Equipment industry company within the Information Technology sector trades at a high 32.4 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend. Ahead of earnings at the end of next month, implied volatility is high at 42% while short interest is also elevated at 7.7% as of September 1, 2023, according to Seeking Alpha.

Back in July, Enphase delivered a mixed earnings report, but it was really its poor sales guidance that cast major shade on shares. Q2 revenue verified at $711 million, short of its guidance midpoint of $725 million while EPS came in at $1.47 on an operating basis, topping the consensus estimate of $1.27. The company also revealed strong free cash flow of $225.2 million and a total cash and securities balance of $1.8 billion. Enphase Energy’s board approved a new $1 billion share repurchase program, valid until July 26, 2026, which I find encouraging.

Still, the firm appears to be coming to grips with lower expected US microconverter shipments, now seen as falling 25% YoY by Q4 2023, down from –18% from previous expectations.

The reset may lead to reduced revenue for several quarters to come. 3Q revenue is projected to be between $550-$600 million as a result of the microconverter situation. The firm also faces potential headwinds from US sell-through demand and international and storage expansion that make the road ahead a bit more challenging, particularly in the EU market.

Good news came last month when the company announced that it had expanded the deployment of its IQ8 microinverters in South Carolina. They recently started shipping microinverters from their new US production facility in Columbia, South Carolina, increasing their global capacity

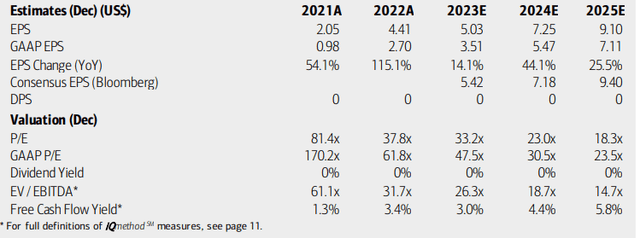

On valuation, analysts at BofA see earnings rising at a mid-double-digit pace this year before per-share profits jump in the out year. In 2025, operating EPS may top $9, though the very latest consensus estimate is $8.64, down from earlier this summer. Despite positive free cash flow, Enphase is not expected to pay a dividend over the coming quarters. While its EV/EBITDA ratio is working lower, it remains significantly above the average of the S&P 500.

Enphase: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

If we assume normalized forward 12-month non-GAAP EPS of $5.90 and apply a 30 P/E, then shares should trade near $177. I downshifted the earnings multiple from my previous outlook given the less sanguine earnings outlooks by Wall Street, but I still see the stock as undervalued. Moreover, given the anticipated ~25% EPS growth over the coming two years, the PEG ratio is about 1, which is attractive versus history.

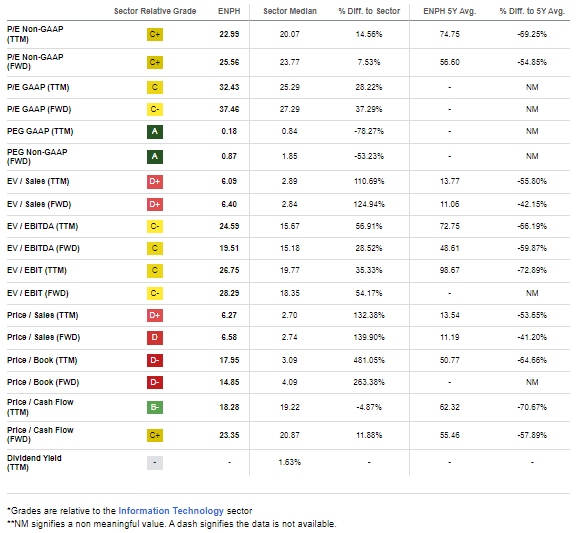

ENPH: Low PEG Ratio, But Concerning Growth Rate of Change

Seeking Alpha

Compared to its peers, Enphase’s current valuation is not all that bad as many names in the industry trade with rich multiples even after some tumultuous times in 2023. ENPH also sports a growth rating that is higher than average, but its weak share price momentum continues to be a near-term headwind, something I was particularly concerned about earlier this year. As referenced, EPS revisions are extremely poor with Enphase, so negative earnings headline risk is something to consider.

Competitor Analysis

Seeking Alpha

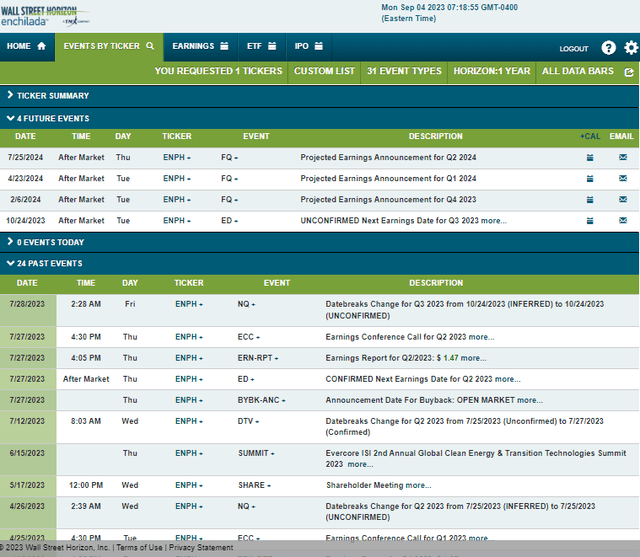

Looking ahead, corporate event data from Wall Street Horizon show an unconfirmed Q3 2023 earnings date of Tuesday, October 24 AMC. No other volatility catalysts are expected on the calendar.

Corporate Event Risk Calendar

Wall Street Horizon

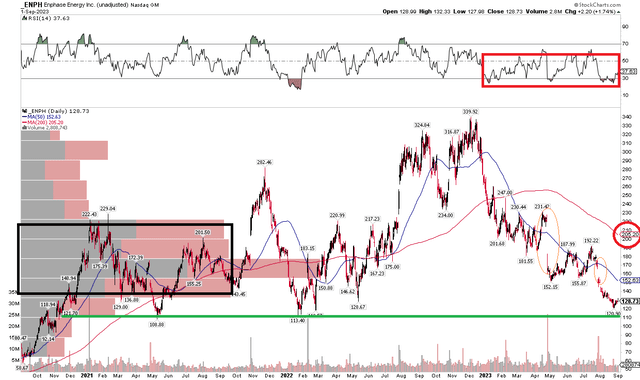

The Technical Take

While I continue to see the stock as undervalued despite the negative earnings revision situation, the chart remains dominated by the bears. Notice in the graph below that shares are finally approaching a long-term support area that I pointed out back in Q2 in the $108 to $120 zone. This range is key for the bulls to defend, and it creates an intriguing risk/reward play from the long side. Long with a stop under $100 looks reasonable to me.

Prudence is warranted, however, since the long-term 200-day moving average remains negatively sloped – signaling that the bears indeed have their grips on the stock. What’s more, the RSI momentum indicator at the top of the chart is stuck in the bearish 20 to 60 range – I would like to see that breakout above 60 to help support the case for a bullish price action reversal. With a pair of taps (one near $165, the other around $220) and high volume by price throughout the $140 to $220 zone, the bulls will have their work cut out for them to sustain rallies. While gaps sometimes get filled, they are also a natural point of profit-taking by near-term traders.

Overall, long here with a stop under $100 looks good, but taking some off the table near $160 is prudent.

ENPH: Shares Plunge To Key Support, Two Upside Gaps In Play

Stockcharts.com

The Bottom Line

I reiterate my buy rating on Enphase. The valuation still looks good, and the technical picture offers a better opportunity from the long side compared to my initial coverage of the stock in June.

Read the full article here