Thesis

Although Endava plc’s (NYSE:DAVA) growth may face challenges in the coming quarters due to ongoing macroeconomic pressures, I have confidence in the company’s ability to achieve organic growth of over 20% in the long term, due to its strong focus on digital engineering and transformation services that positions it well to continue on its growth trajectory in the long term. Furthermore, DAVA’s extensive expertise in rapidly expanding sectors like payments, TMT (Technology, Media, and Telecommunications), retail, CPG (Consumer Packaged Goods), and private equity makes it a top choice as a pure-play investment in the digital transformation services market. The market is expected to continue its robust growth as global corporations increasingly prioritize investments in cutting-edge technologies and platforms. Despite the near-term macro challenges, I maintain a positive outlook on DAVA’s shares. This optimism is driven by the enduring trends propelling the adoption of digital transformation initiatives among Global 2000 companies. Considering that the stock is trading at a modest P/E multiple compared to peers in the sector, I view the risk-reward ratio as favorable and assign a buy rating to the stock.

Focus On Digital Transformation & Strong Client Relationships To Drive Growth

Endava aims for a yearly organic revenue growth of at least 20%, a target I find achievable due to the company’s emphasis on digital transformation projects and its limited exposure to traditional “legacy” IT services. These legacy services are under pressure as clients seek to optimize technology spending and modernize their IT systems. The demand for digital transformation services remains robust, with IDC forecasting investments in this area to reach $3.4 trillion by 2026, growing at a five-year compound annual growth rate (CAGR) of 16.3%. In my view, Endava’s commitment to being a specialized digital services provider positions it well to achieve industry-leading growth in the coming years.

Outside of the favorable mix of digital versus legacy revenue compared to many of the company’s peers, I consider the company’s client exposure to also be beneficial for sustaining robust long-term growth. In addition, Endava’s vertical mix is favorable for strong growth. Roughly half of Endava’s revenue comes from financial services clients, but the mix is tilted heavily towards payments, asset management, and insurance, segment. Outside of financial services, the company has a rapidly growing presence in TMT. Financial services and TMT are two early adopters of digital engineering and transformation services, putting Endava in a favorable position to capitalize on robust spending trends as clients are looking to modernize their IT systems and operations to enhance efficiencies in their front and back-office, expand growth opportunities, and improve the customer experience.

Growth to Rebound Post FY24

The demand environment has softened industry-wide over the past few months primarily due to ongoing macro pressures. The recent instability in the US regional banking sector has also contributed to reduced demand, particularly in the banking and financial services sector, which makes up more than half of DAVA’s revenue. Presently, DAVA is experiencing the most pressure from its private-equity backed clients. In response to the slower growth environment, the management has taken measures to control hiring and implement cost-saving transformation programs, which I consider to be a sensible approach. Given the current soft demand trends, I expect limited pricing flexibility and a moderation in wage inflation, resulting in a mostly neutral impact on profitability. I believe that the current decline in demand is temporary and anticipate a rebound as the overall economic situation improves and uncertainties in these sectors subside. Additionally, I foresee increased demand in the long term as clients turn to generative AI to enhance efficiency and maintain competitiveness.

Valuation

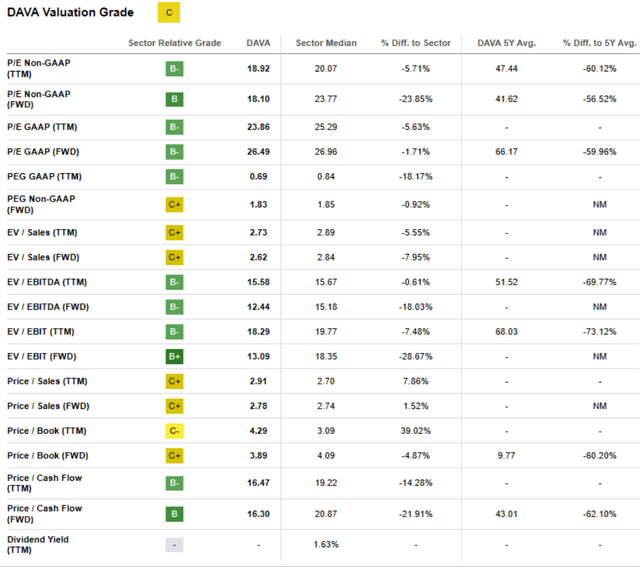

DAVA currently trades at a forward P/E multiple of 26.5x, a modest discount to peers, which I believe reflects a favorable entry point for investors. Longer term, I believe the shares warrant a premium valuation relative to the group given DAVA’s favorable competitive positioning as a leading provider of high-end digital transformation services and the company’s strong track record of delivering best-inbreed 20%+ organic growth long-term while also improving PBT margins steadily. I remain confident in management’s ability to navigate the near-term challenges and return to “trend” growth by FY24 and beyond while also managing costs to help protect profitability. Despite the near-term headwinds, I hold a bullish outlook on the stock due to the significant and enduring trends pushing companies in the Global 2000 to embrace digital transformation initiatives. These firms are making long-term investments to stay competitive. Considering that the stock is currently trading at a relatively modest price-to-earnings P/E multiple of around 26.5x, I view the risk reward as favorable and assign a buy rating to the stock.

Seeking Alpha

Investment Risks

Endava has substantial delivery centers located in important digital engineering hubs, notably in Eastern Europe and Latin America. However, an intensifying competition for skilled professionals in these regions could hinder Endava’s ability to recruit and retain the additional workforce required for its growth. Moreover, a substantial portion of Endava’s revenue comes from clients in the financial services sector, particularly within payments and insurance. If there is a decrease in technology spending within these key sectors, it could negatively impact Endava’s growth prospects.

Conclusion

Endava’s strong focus on digital transformation projects and limited exposure to legacy IT services positions it to continue on its growth trajectory and achieve its targeted annual organic revenue growth of 20%. The global demand for digital transformation services is robust, with IDC forecasts indicating investments worth $3.4 trillion by 2026. This commitment to specialized digital services places Endava for industry-leading growth. Its client mix, particularly in financial services (especially payments, asset management, and insurance) and TMT, further supports long-term growth, capitalizing on digital adoption trends. I view the risk-reward as favorable, with the stock currently trading at a relatively modest price-to-earnings P/E multiple of around 26.5x, and assign a buy rating to the stock.

Read the full article here