Summary

Ollie’s Bargain Outlet Holdings (NASDAQ:OLLI) is a retail company that operates stores selling name-brand items at low, closeout prices. Products offered by the company include goods such as food, cleaning supplies, books, office supplies, and more. Readers may find my previous coverage via this link. My previous rating was a hold given the near-term uncertainty in OLLI results due to the tough competition that it is going to face in 2Q24. Furthermore, my model suggested that OLLI was modestly overvalued at that share price. I am revising my rating from a hold to a buy rating as I expect near-term performance to be better than I previously expected given the strong performance demonstrated.

Financials / Valuation

As a result of a rise in comparable store sales of 7.9% and the contribution of new stores, OLLI’s net sales rose by 13.7%, to $514.5 million, surpassing consensus estimate of $499 million. Also as a result of improved supply chain costs and higher merchandise margins, gross margin increased 649bps to 38.2%. The main factors that drove the 13.6% increase in SG&A costs to $134.6 million were the addition of new stores and increases in incentive pay. Despite this, SG&A as a percentage of sales remained relatively stable year over year at 26.2%, with fixed cost leverage offsetting the impact of higher incentive compensation. EPS came in at $0.67, $0.06 higher than expected.

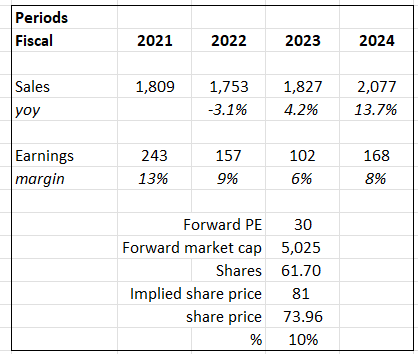

My mistake previously was to value OLLI on a long-term DCF basis without understanding that the market was focused on the near term. With my revised outlook (turning bullish based on OLLI 2Q24 results), I now have a price target of $74 with the expectation that OLLI will grow 13.7% in FY24 as per its net sales growth this quarter. My positive outlook is supported by my view that the trade down will continue to be a tailwind for the near term. With this momentum, I now see the possibility for valuation to re-rate back to 30x forward PE as sentiments improve along with earnings growth momentum. This could yield a 10% return over the next 6 months (note that the valuation is based on FY24 figures), which is quite attractive.

Based on author’s own math

Comments

The results were splendid, I believe, which is making me increasingly positive about the business’s near-term outlook. Recall that I was uncertain about the near-term outlook previously. Deeper analysis reveals that the rise in transactions was the primary contributor to OLLI’s 7.9% quarterly increase in comparable store sales. I interpret OLLI’s strong transaction-led comp growth as evidence that their appealing, value-priced product offering is resonating with customers in the present market. I was also heartened to see that the majority of product types chipped into the comp increase, with food and beverage, seasonal, and home goods showing especially robust sales. Big-ticket items like furniture and air conditioning were down, which was not unexpected given the lower willingness to spend on discretionary big items. I am also now becoming optimistic about the near-term outlook due to management’s comments about the ongoing trade-down in higher income cohorts and the fact that the fastest-growing segment of new customers is the one with annual household incomes of $100,000 to $150,000. Management at OLLI has noticed that these new, higher-income customers are signing up for Ollie’s Army, which indicates that the demand may be sticky but that it is too early to tell. Until the current macro situation is resolved, I believe this trade-down will continue to be a tailwind. My positive outlook is also in line with management’s outlook, where they raised their outlook for 3Q comparable sales to increase 2%–3% (a rather big increase from the flattish outlook previously).

I am also turning more optimistic due to management’s mention of a rise in promising closeout opportunities. I think OLLI is well-positioned to capitalize on these opportunities, both with its current suppliers and potential new ones, given its strong existing supplier relationships and willingness to engage in substantial closeout deals. Looking ahead, I expect these agreements to contribute to increased revenue growth, driven by the appeal of OLLI’s product range.

Risk & conclusion

The primary concern lies in the potential for demand to rebound at a slower pace than anticipated, or for a sustained decrease in demand as consumers cut back on non-essential spending. There may also be minimal or no advantage gained from the trade-down phenomenon (this is if the inflow from trade down from higher income consumers net off the outflow of consumers trading down from OLLI). Overall, OLLI has exceeded my earlier expectations, prompting a rating upgrade from hold to buy. The company’s impressive financial performance, driven by a substantial increase in comparable store sales and improved margins, supports this positive outlook. OLLI’s ability to resonate with customers seeking value-priced products and its promising transaction-led growth are particularly encouraging. Additionally, management’s outlook, including an optimistic stance on trade-down trends and closeout opportunities, further reinforces my confidence in OLLI’s near-term prospects. I believe the company is well-positioned to capitalize on these opportunities, leveraging its strong supplier relationships.

Read the full article here