Founded in 2013, FIGS (NYSE:FIGS) transformed the once bland and unbranded scrub into a fashion item, reaching over $500 million revenue in 2022 along the way. After riding an initial wave of first-mover advantages and social media virality, the brand continued to soar in popularity throughout the pandemic.

But behind this meteoric rise, we believe FIGS might be hitting the formidable wall that halted many Direct-to-Consumer (DTC) upstarts. The signs are clear; FIGS is in the later innings of its growth curve.

To counter this, FIGS is now venturing into lifestyle categories and international markets. But the question remains: Have they earned their “right to win” in these markets? We doubt it. FIGS is a U.S. scrubs company without a physical retail presence. We believe FIGS will experience challenges expanding while facing margin decay doing so in the near term.

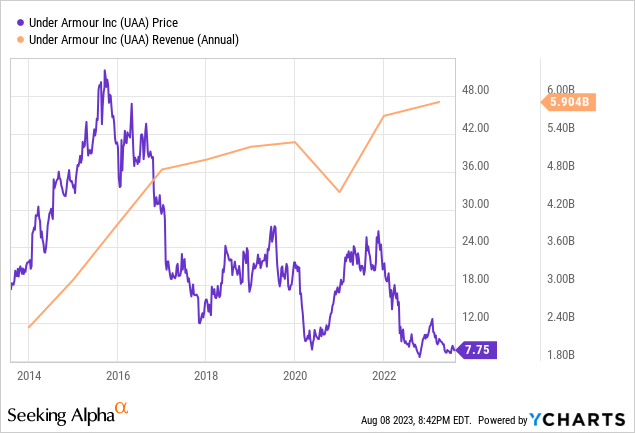

This story is not unprecedented. Just remember Under Armour (UAA), which hit its stock peak in September of 2015, only for the revenue to peak four years later.

For context, FIGS currently trades at a premium to all peers at 1.9x EV / Sales, 14.3x EV / EBITDA, and 77x P / E. On a revenue multiple basis, FIGS is more expensive than adidas (OTCQX:ADDYY) (OTCQX:ADDDF), Puma (OTCPK:PMMAF), Revolve (RVLV), and other comps.

Seeking Alpha

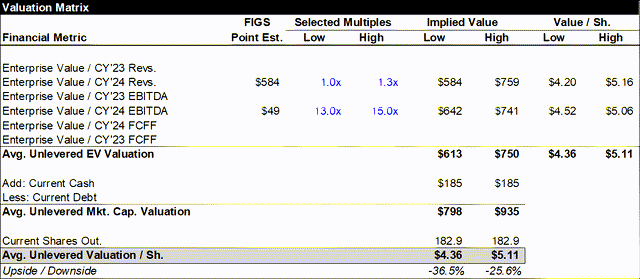

Using aggressive assumptions (1.0-1.3x sales), we believe FIGS is a fair price between ~$4.00 – $5.00 per share. If growth goes negative, FIGS can trade down to ~$3.00 per share.

Created by Author Using Public Filings and Analyst Estimates

Let us explain why.

TAM Overstated, Market Appears Saturated

Management for FIGS has identified the Total Addressable Market (TAM) in the United States to be $12 billion, based on a report commissioned by Frost & Sullivan in 2019. They emphasize that scrubs are non-discretionary, replenishment-driven, recession-resistant, and not susceptible to fashion or fad risk.

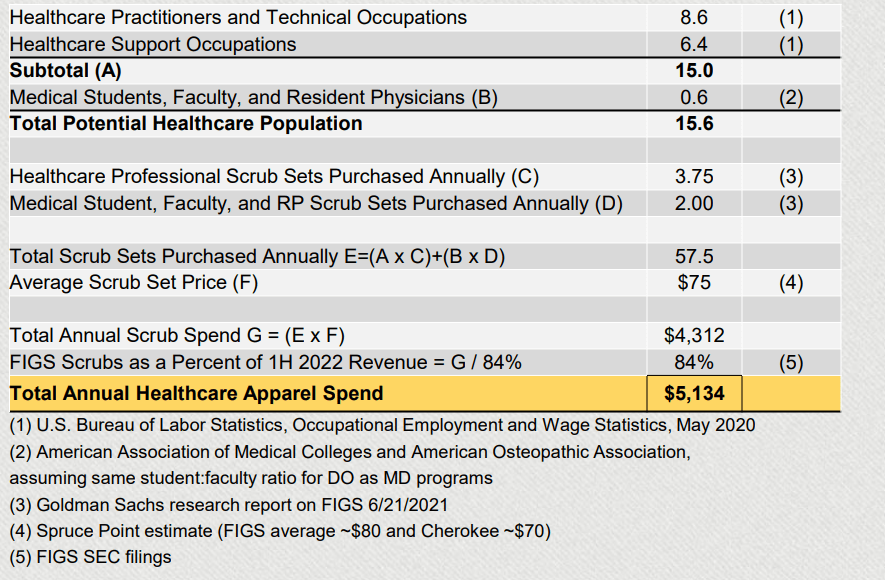

We, however, see this differently and align more with the view of Spruce Point. We believe FIGS’ TAM to be approximately $5 billion, rather than the stated $12 billion.

Spruce Report

This difference is significant. As a result, FIGS already commands ~10% market share in the healthcare apparel space. The company’s ambitious 2025 target revenue of $1 billion would suggest a 20% market share, a figure that is nearly unprecedented in the apparel category. To put this in perspective, even the world’s largest apparel companies, H&M and Zara, command a combined fashion apparel market share of less than 2.5%. The top 10 global apparel companies have a market share of less than 10%.

These comparisons lead to serious questions about FIGS’ market assumptions and growth prospects. The potential for saturation, coupled with the lofty market share targets, prompts us to view FIGS’ market positioning with caution.

A Closer Look at Decelerating Revenue Growth

FIGS is showing signs of losing momentum. The overall growth rate has been slowing down, with Year-Over-Year (YOY) revenue growth dropping from 21% in Q2 2022 to 13% in Q2 2023. This trend is visible across various segments of the company’s offerings:

Core Scrubwear Segment: Once the engine of growth, this area has also shown a decline, growing only 15% YOY in Q2 2022, and then slowing to 11% YOY in Q2 2023.

Lifestyle Segment: Even the Lifestyle category, which showed promise with 70% growth in Q2 2022, has cooled down considerably, registering only 25% growth in Q2 2023. This trend calls into question FIGS’ ability to establish itself in this new category.

These numbers are concerning in themselves, but they are part of a more complex problem. Acquiring new customers is becoming more expensive for FIGS. The company’s overall Customer Acquisition Cost (CAC) — essentially, the marketing spend required to gain each net new customer — has been on the rise every quarter.

The landscape is becoming more competitive, with new entrants like Jaanuu, Taara, Koi, and others, adding pressure and driving up marketing costs. Expanding into international markets is a challenge in itself, requiring significant investment in time and money. Like many other DTC companies, FIGS will continue to pay higher economic rent to META and GOOG.

On a macro level, following the Supreme Court’s rejection of Biden’s Student Loan Forgiveness plan, interest will start to accrue for borrowers on September 1, 2023, and repayments will begin in October. The effect on recent healthcare graduates could be significant, potentially decreasing their ability to purchase discretionary goods like FIGS products.

Unsustainable Competitive Moat

FIGS’ first mover advantage is not sustainable and the brand does not have clear defenses against the rapid rise of emerging competitors in the space.

Lack of Proprietary Technology: The core scrubwear styles are not based on any unique fabrication, technology, or style. 85% of FIGS’ production uses FIONx fabric “technology”, which consists of 72% polyester, 21% rayon, and 7% spandex. In recent years, many new entrants have joined the market with nearly identical products.

Undifferentiated Manufacturing: FIGS’ products are mostly manufactured in China and Vietnam, where market entry is relatively easy. This, too, opens the door for both small upstarts and large players to compete directly with FIGS.

Expansion into the Lifestyle Space: As FIGS seeks to grow in the lifestyle category, it faces a different set of challenges. The first-mover advantage that FIGS had in scrubwear is not available in the broader, and much more competitive, market for lifestyle wear. We believe FIGS will face diseconomies of scale as they enter into the Lifestyle Space.

FIGS dependence on non-proprietary technology and Asian manufacturing coupled with a lack of IP ownership poses significant risks to its core business. The company’s expansion plans further highlight these vulnerabilities.

FIGS is Over-Earning

In the world of apparel retail, there’s a well-recognized pattern known as the S-Curve. During the initial growth phase, vendors and retailers often enjoy strong profits, a phenomenon sometimes referred to as “over-earning.” Apparel vendors and retailers generally over-earn while they are accelerating up the S-Curve, not when they hit maturity.

Created by Author

Here’s why this happens:

Strong Unit Economics: Apparel has some of the highest profit margins among retail categories. It’s a product that people love to buy and share, making it lucrative for sellers.

The Sweet Spot of Growth: As a brand gains traction and popularity, it reaches an acceleration point on the S-Curve. The natural virality of consumer brands leads to lower CAC and reduced need for discounting and promotions. High margins and lean fixed costs combine to make this a particularly profitable phase.

High Margins Before Scale: Even before a brand reaches large-scale success, these favorable conditions allow for better profit margins before maturity

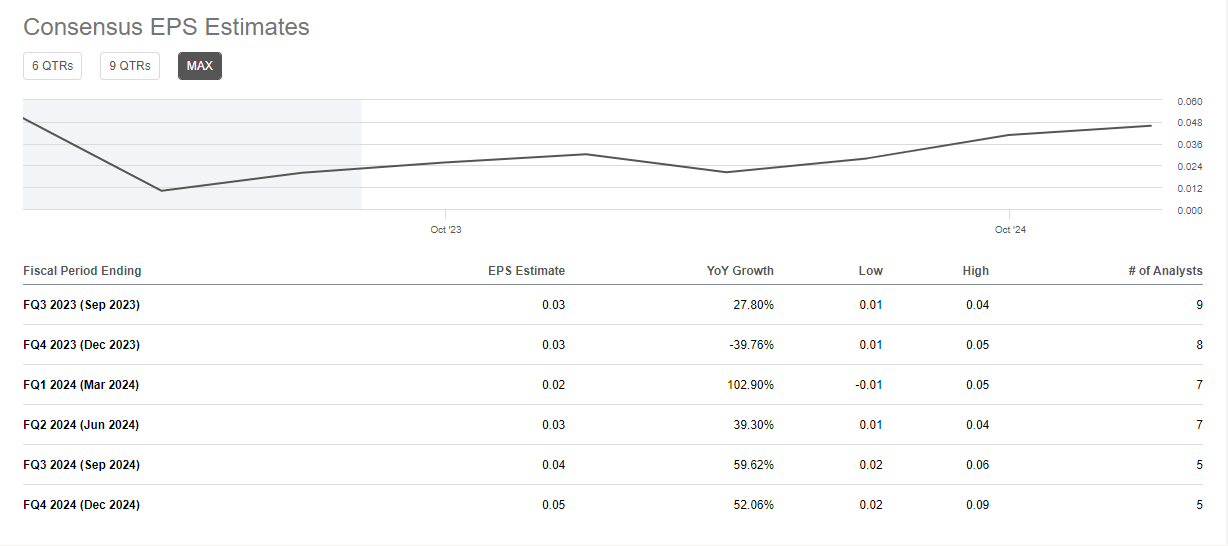

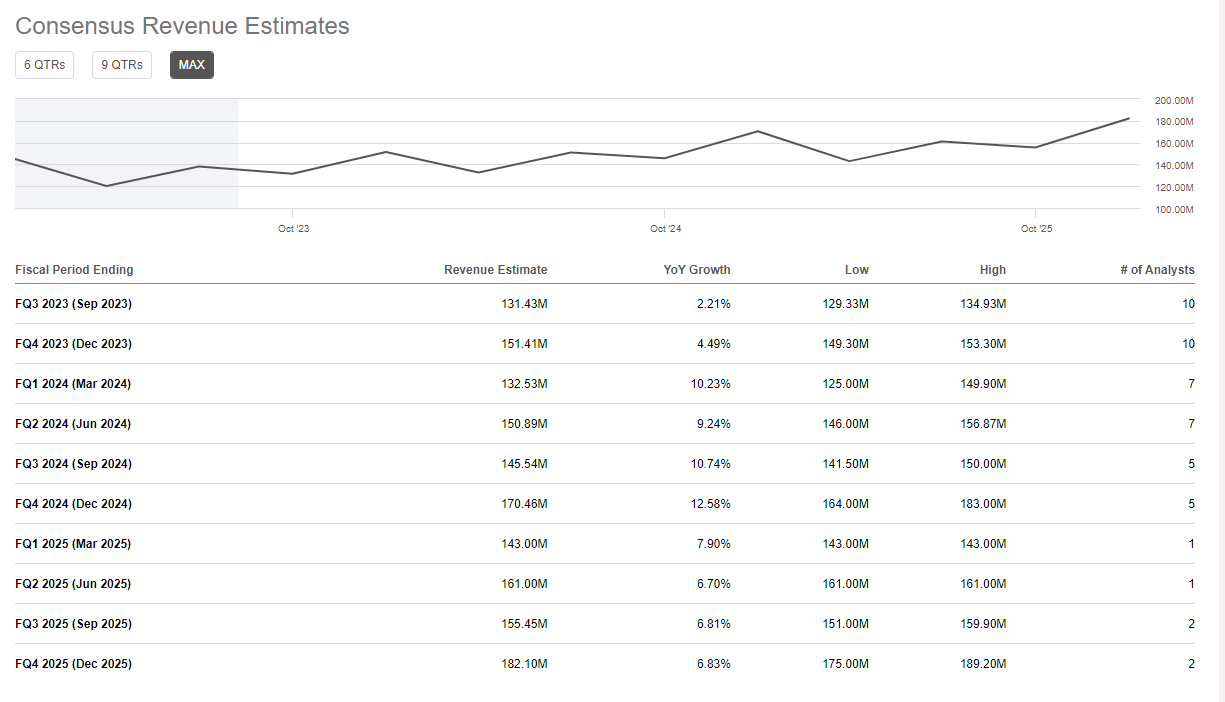

Despite this, Analysts are estimating a V-shaped recovery for FIGS. This is predicated on a reacceleration of growth which we cannot give the company credit for.

Seeking Alpha

We believe FIGS will see margin compression over time, not expansion, especially as revenue growth slows.

Seeking Alpha

Upside Risks

Several macroeconomic factors could challenge our perspective. Here’s a breakdown:

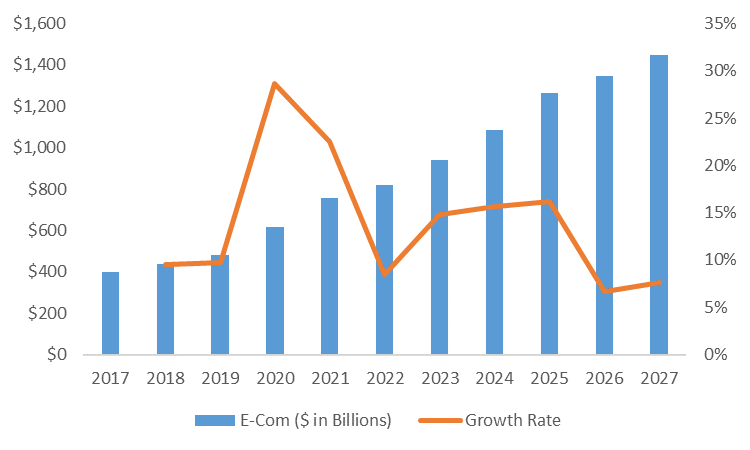

E-Commerce Growth: After a slowdown in 2022, there’s been a broad reacceleration in e-commerce growth. This trend could favor FIGS, especially if it continues, so it’s a factor we’ll keep a close eye on.

Created by Author using Statista

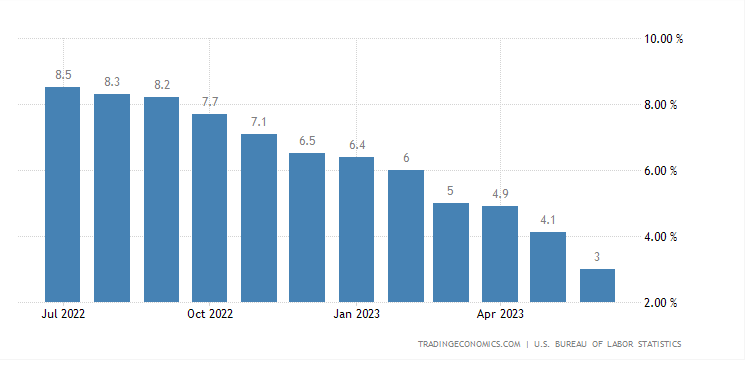

Subsiding Inflation Pressures: Inflation has now fallen consistently over the last 12 months due to interest rate hikes and can contribute to reduced recession worries that may help the consumer wallet

TradingEconomics.com

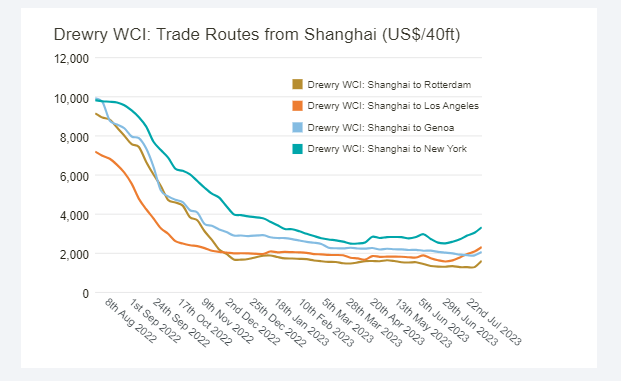

Freight Rates Dropping: Since COVID, freight rates have dropped from their peaks and are settling over the last 6 months. Lower freight rates are a leading indicator of reduced COGS to improve consumer company margin profiles.

Drewry

Conclusion

Overall, we are currently bearish on FIGS because we do not believe in the growth trajectory path to $1 billion and the V-shaped recovery modeled by the street. FIGS has not demonstrated a right-to-win in the lifestyle category market and is facing increasing competition from upstarts and legacy brands alike. Growth is slowing in the business yet current valuation is still at a healthy premium to comparables.

We believe FIGS is a $4.00-$5.00 business representing a 30-40% downside from current valuations.

Read the full article here