Introduction

Zymeworks (NASDAQ:ZYME) is a biotech firm dedicated to crafting novel, multifunctional biotherapeutics, especially for challenging cancers and diseases. Their primary product, zanidatamab, is a bispecific antibody targeting HER2. Collaborations exist with BeiGene (BGNE) and Jazz Pharmaceuticals (JAZZ) for zanidatamab’s development and marketing in varied regions. Their research demonstrates zanidatamab’s potential against HER2-expressing cancers. Zymeworks is also progressing with zanidatamab zovodotin, another HER2-targeted therapy. Additionally, they are advancing several preclinical projects, notably ZW191, ZW171, and ZW220.

The following article discusses Zymeworks’ biotech advances, their financial health, collaborations, and potential investment value in the biotech sector.

Q2 Earnings Report

Looking at Zymeworks’ most recent earnings report, revenue for the first half of 2023 surged to $42.6M, primarily from a $40.9M deal with Jazz. Research and development expenses dropped 28% ($33.2M) due to lower manufacturing and development costs, partially offset by rising preclinical expenses. General and administrative costs rose 41% ($11.3M), largely because of higher stock-based compensation and professional services expenses. Net loss reduced by 45% to $75.5M, mainly from the Jazz collaboration and higher interest income. Zymeworks has $431.4M cash on hand, expecting to last till at least 2026. They anticipate a 2023 net operating cash burn between $110M-$130M.

Cash Runway & Liquidity

Turning to Zymeworks’ balance sheet, as of June 30, 2023, the combined value of ‘cash and cash equivalents’, ‘short-term investments’, and ‘long-term investments’ stands at $432.3M ($142.1M + $197.9M + $92.2M). The “Net cash used in operating activities” for the first six months of 2023 is $89.6M, translating to a monthly cash burn of approximately $14.9M. Based on the total assets derived, the estimated cash runway is around 29 months ($432.3M divided by $14.9M). However, it’s important to note that these values and estimates are grounded on past data and may not necessarily project future performance.

Regarding the company’s liquidity status, it currently holds significant cash reserves and investments. There’s no explicit mention of debt, suggesting a debt-free position. Given its substantial liquidity and no evident debt burden, Zymeworks seems well-positioned to secure additional financing, if needed. These observations and/or estimates are my own and might vary from other analyses.

Valuation, Growth, & Momentum

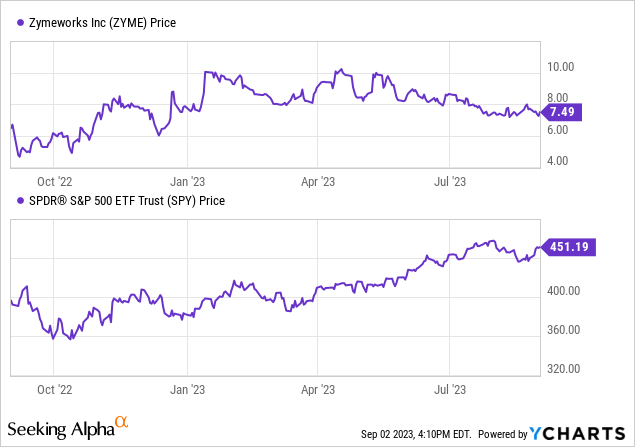

According to Seeking Alpha data, Zymeworks showcases a compelling capital structure with an insignificant amount of “debt” relative to its market capitalization and substantial cash reserves, leading to an enterprise value of $195.20M. Its valuation grade of A+ is impressive, with Price-to-Earnings (GAAP) at 2.69 and a low EV/EBITDA of 1.01, indicating potential undervaluation. The company’s growth is evident, with a Year-over-Year revenue increase of 1,315.75% and a three-year Compound Annual Growth Rate at 145.21%. Although ZYME’s stock has seen recent declines over shorter time frames, it has appreciated 15.77% YoY.

Zanidatamab: Biliary Cancer’s New Jazzed-Up Nemesis

Zanidatamab, a HER2-targeted bispecific antibody, showed promising results in the HERIZON-BTC-01 study for treating HER2-positive biliary tract cancer [BTC] in patients who had previously undergone gemcitabine-based therapy. The trial reported a 41.3% objective response rate, indicating notable efficacy. Furthermore, zanidatamab has a commendable safety profile, with the most severe side effects impacting fewer than 5% of participants for any specific ailment, and no treatment-related deaths were reported. The potential of this drug is underscored by the significant prevalence of HER2 mutations in biliary tract cancers and its substantial response rate. Moreover, the onset of its therapeutic effect appears rapid, with a median time to first response of only 1.8 months.

Regarding its commercial prospects, in October 2022, Zymeworks partnered with Jazz, granting them the rights to develop and market zanidatamab globally, excluding territories covered under Zymeworks’ 2018 agreement with BeiGene. As of today, Zymeworks has received ~$375 million from this collaboration. Moreover, they can get reimbursement for all zanidatamab-related expenses based on the project’s plan and budget. They’re also in line to potentially receive up to $1.76 billion, including regulatory and commercial milestones. Upon regulatory approval of zanidatamab, Zymeworks will also receive royalties ranging from 10% to 20% on Jazz’s net sales, subject to specific conditions.

Zanidatamab’s New Groove Beyond BTC

Zymeworks recently emphasized a diverse R&D portfolio during their earnings call. While zanidatamab’s treatment potential for HER2-amplified BTC was spotlighted, the company revealed broader ambitions:

-

Advanced HER2-positive Breast Cancer: Phase 1b/2 study of zanidatamab combined with docetaxel is underway.

-

Collaborations: Partnerships with Jazz and BeiGene will lead to several presentations in 2023, including at the European Society of Medical Oncology in Madrid.

-

Future Royalties: Zymeworks expects significant financial gains from their agreements with Jazz and BeiGene as zanidatamab nears regulatory approval.

-

Zanidatamab’s Expanded Role: Beyond BTC and gastric applications, zanidatamab shows potential in treating other HER2 positive cancers, with ongoing trials and data expected in 2024.

-

Pipeline Development: Aiming to introduce five novel therapeutic candidates by 2027, Zymeworks anticipates IND filings for ZW171 and ZW191 in 2024. Additionally, they’re exploring the clinical potential of ZW220, targeting NaPi2b, with IND filing expected by 2025.

-

Strategic Partnerships: Zymeworks plans to co-develop drug candidates with potential partners, securing both funding and favorable financial terms.

My Analysis & Recommendation

Having thoroughly examined Zymeworks and its noteworthy contributions to the biotech industry, it’s evident that the company is on a trajectory laden with immense potential. Zymeworks is not just leaning on the promise of zanidatamab, as strong as that is, but is strategically diversifying its portfolio and securing partnerships that offer financial fortification. As a keen observer of the biotech sector, I must commend the company’s outlicensing of zanidatamab. The move has allowed Zymeworks to harness significant capital inflows, which looks set to continue, offering the financial breathing space required to push forward with their wholly-owned preclinical projects.

For investors, the salient point to observe in the coming weeks and months is how Zymeworks navigates the clinical trials of zanidatamab in new indications, the progress of its pipeline, and the tangible milestones arising from its collaborations. It’s worth keeping an eye on the announcements around the European Society of Medical Oncology presentations, as these could serve as catalysts for the stock. Furthermore, as Zymeworks looks forward to introducing new therapeutic candidates and potential IND filings, the company seems to be placing its chess pieces strategically for a robust future.

Even though Zymeworks was celebrated as a potential leading cancer innovator in 2020 with soaring share prices, it is crucial to evaluate its current position and future prospects. With an enterprise value under $200 million, the valuation seems incongruent with its rich pipeline, strong collaborations, and robust financial health. Given the comprehensive data at hand, the growth trajectories, and the tangible prospects on the horizon, I believe Zymeworks is positioned for a resurgence.

In light of the aforementioned insights, I recommend Zymeworks as a “Strong Buy” for risk-tolerant, biotechnology-focused investors. The rationale lies not just in its undervaluation but in its potential to become a formidable player in the biotech sector, driven by both its innovative products and strategic partnerships.

Risks to Thesis

When the facts change, I change my mind.

Potential risks that might contradict my final investment recommendation include:

-

Overemphasis on Positive Data: While Zymeworks’ data is impressive, I may have overly focused on the positive aspects, not giving equal weight to potential challenges or negative data.

-

Underestimation of Competition: The biotech sector is rapidly evolving, and competitors may introduce similar or superior therapies that challenge Zymeworks’ position.

-

Regulatory Hurdles: FDA and other regulatory approvals are unpredictable. A delay or denial can significantly impact the stock.

-

Biases and External Influences: My recommendation may have been influenced by prevailing market sentiment or biases towards innovative biotech firms.

-

Financials Overlook: I emphasized collaborations and revenue, but have not deeply evaluated the potential for hidden liabilities or contingent obligations.

-

Clinical Trials: There’s inherent risk in drug development; not all drugs that show promise in early trials succeed in later stages.

-

Management Decisions: Future decisions by the company’s management can impact its trajectory.

-

Reliance on Partnerships: Heavy reliance on Jazz and BeiGene could be risky if these collaborations face challenges.

Read the full article here