Introduction

First Trust Cloud Computing ETF (NASDAQ:SKYY) is an exchange-traded fund that provides investors with exposure to companies involved in the cloud computing industry. The expense ratio of the fund is reported as 0.60%, with total assets under management of $2.87 billion as of September 1, 2023. Net fund flows have been negative by about -$943 million over the past year, although SKYY itself has performed strongly more recently in terms of price.

My last coverage on SKYY was published in May 2023, in which piece I expressed my view that the fund was too volatile to justify owning. I did not think it was overvalued, but simply too variable. Further, my IRR projection was just over 8% per annum, which appeared to me to be unattractive, all considered and in light of the fund’s characteristic volatility. Since then, SKYY has risen 25.77%, while the S&P 500 U.S. equity index has risen 9.11%. Therefore, while you could argue I was “wrong”, it is worth recalibrating my thoughts and trying to understand whether my view would be different today. The implication based only on the above information is that SKYY is more likely to overvalued today, considering the run up.

New Opinion

In this article, I will outline my view that SKYY remains overvalued in relation to earnings growth expectations and considering its higher-than-average volatility. Volatility has picked up considerably just recently, only to the upside, which I believe is a better signal of short-term irrational demand and optimism, rather than a sustainable and pivotal shift in the underlying trajectory of the companies that SKYY is exposed to in aggregate.

Fund Benchmark and Portfolio

SKYY’s benchmark is the ISE CTA Cloud Computing Index, which is designed to track the performance of predominantly U.S.-listed companies that operate or are involved in the cloud computing industry. There are only 64 constituents in the index, and correspondingly SKYY has 64 holdings. The minimum market cap is $500 million per holding, and there are some other basic requirements to filter out illiquid stocks, etc.

Each security selected for SKYY is classified under IaaS, PaaS, SaaS: these stand for Infrastructure-as-a-Service, Platform-as-a-Service, and Software-as-a-Service, respectively. Therefore, companies may be chosen if they operate Infrastructure (servers, storage, networks), Platforms (virtualization software, middleware, operating systems), or Software (over the Internet). Naturally, many companies will operate across more than one category. Additional weight is applied to IaaS, followed by PaaS, and then finally SaaS. Therefore, SKYY actually has more of a “hardware” and “back-end” bias, rather than investing predominantly in software as one might assume.

Individual weights are capped at 4.5%, with a minimum of 0.25%, which is a prudent way of managing costs and keeping the fund concentrated enough, which helps if one sees potential alpha in the sector. Accordingly, no more than 80 securities in total is one limitation. The portfolio is rebalanced quarterly.

The largest holding is Pure Storage, Inc. (PSTG), a California-based all-flash data storage hardware and software product maker. The company had $2.75 billion in revenue in its FY 2023, with net income of $73.1 million. PSTG represented 4.61% of the portfolio as of September 1, 2023, hence it will be rebalanced upon the next rebalancing due to out-performance. However, given low concentration in any given holding, the fund is unlikely to endure material rebalancing portfolio-wide.

Other top holdings include Arista Networks, Inc. (ANET), a California-based company that designs and sells multilayer network switches to deliver software-defined networking for large datacenters, cloud computing operations, high-performance computing, and high-frequency trading environments. The company generated $4.38 billion in revenue in its FY 2022, with net income of $1.35 billion. ANET represented 4.10% of the portfolio.

Other names more widely known include IBM (IBM) at 3.98%, Amazon.com, Inc. (AMZN) at 3.96%, Oracle Corporation (ORCL) at 3.95%, Alphabet Inc. (GOOGL) at 3.82%, and Microsoft Corporation (MSFT) at 3.46%. You can find a full list here, however note that I have missed out many others between these companies at the top, which are engaged in less consumer-oriented aspects of the cloud computing industry.

Base Projection and Valuation

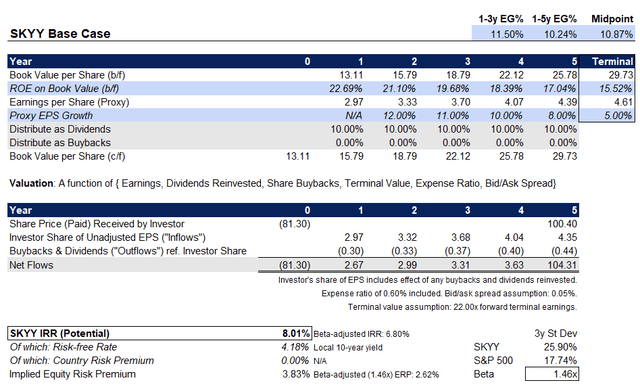

Benchmark index data is limited, however I can refer to Morningstar data for analyst estimates. This reveals an estimate of three- to five-year earnings growth of 11.17% on average, with a forward price/earnings ratio of 27.33x (vs. 24.90x in my May article) and a price/book ratio of 6.20x (compared to 3.79x previously) with an implied forward return on equity of 22.69% (as compared to 15.22% before). These changes are going to be due to changing estimates from the same data provider, combined with a portfolio rebalancing. The portfolio is now on average a higher-ROE generator, but it is also as a result pricier.

I think it makes sense to assume a slightly lower-than-consensus earnings growth projection to be more conservative than not. I also think that, as before, it is wise to assume a maturing, lower price/earnings ratio by our terminal year five. I will assume 22x to keep it constant with my prior assumptions. This assumes a mature earnings growth rate of zero in real terms over the long run, plus a circa 4.50% equity risk premium. This is most likely too conservative, but on the balance of risks, it is a good starting point.

Based on these inputs, my IRR projection is similar as before, at 8.01% per annum. For simplicity, considering the portfolio’s overwhelmingly U.S. portfolio and U.S. listing, I have used the U.S. risk-free rate (10-year yield) of 4.18% to find an implied equity risk premium of 3.83%, which is within the bounds of fairness.

Author’s Calculations

However, as noted in the bottom-right part of the chart above, the fund is quite volatile, with a three-year beta of 1.46x. Therefore, on a volatility-adjusted basis, the ERP is closer to a much lower 2.6%. This suggests over-valuation, since an ERP should really be in the region of 3.2-5.5% for mature markets. Granted, SKYY has a portfolio with above-average earnings growth potential. Nevertheless, one should always build in some maturity assumptions, and it is unlikely that the fund will maintain a super-high price/earnings ratio on average forever, with above-average earnings growth rates forever (excluding the effects of rebalancing).

The aim is to build a model that values SKYY on what it owns at present, as that is indeed what you are buying. To me, SKYY currently still appears overvalued, and so the recent rise of 26% over the S&P 500’s 9% since my last piece, which is a scale of 2.89x, suggests short-term demand has outstripped rationality. I believe there are better sources of value in the market, and that one should not buy higher-priced ETFs only based on business quality but also valuation. I would be unsurprised to see SKYY under-perform the broader market in the near term, but as always it will be worth revisiting again soon.

Risks to Thesis

As before, I could certainly be wrong insofar as SKYY could continue to rise and out-perform. However, after already recently out-performing considerably, the risks should be lower, and the valuation already seems tight. I cannot control the market, but based on the available information today, I think it would be unwise to allocate a large percentage of one’s portfolio to SKYY if one is participating in active management. Longer-term shareholders will probably still do well, considering the importance of the cloud computing industry, however short-term performance should be constrained by the current price.

Read the full article here