Introduction

I have written about several hospitality REITs in previous months, most recently on RLJ Lodging Trust (RLJ). Similarly, the focus of this article, Xenia Hotels & Resorts (NYSE:XHR) is a hospitality REIT as well. It is a stock that hasn’t received much coverage on the Seeking Alpha website – just 5 articles over the past 5 years – hence I figured I would take a look at the company and give my two cents worth on it.

The Portfolio

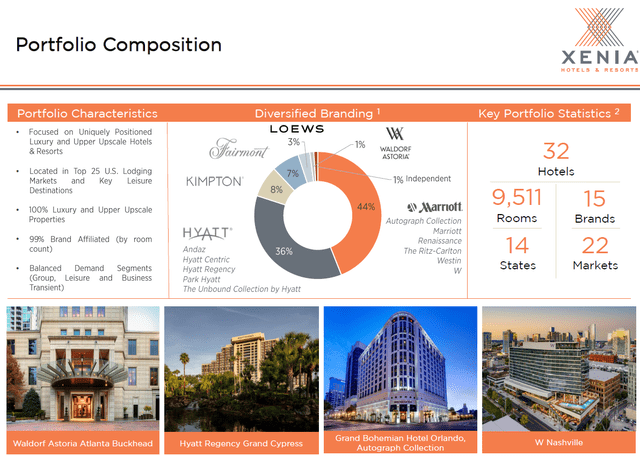

Xenia Hotels & Resorts is a hospitality REIT focused on luxury and upper upscale hotels and resorts. As of Q2 2023, the company’s portfolio encompasses 32 hotels comprising a total of 9,511 rooms with 30% of these rooms dedicated to luxury properties and the remaining 70% to upper upscale establishments. Virtually all of the company’s properties are brand affiliated, with the Marriott and Hyatt brands making up the bulk of the properties at 80%.

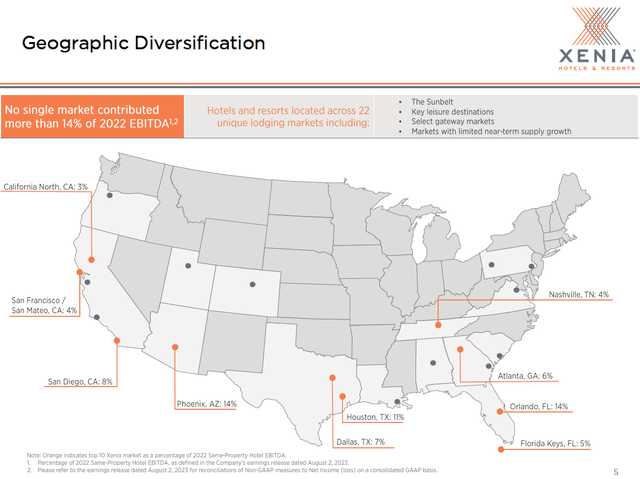

The company’s hotels are spread across 22 markets in 14 states, with a focus on the Sunbelt states. The company is not overly reliant on a particular area, with no single market accounting for more than 14% of the company’s EBITDA. Additionally, the company derives its revenue from 3 demand segments – group, business, and leisure transient – with a fairly even split among each segment, reaffirming its diversification.

XHR Aug 2023 Investor Presentation

Balance Sheet

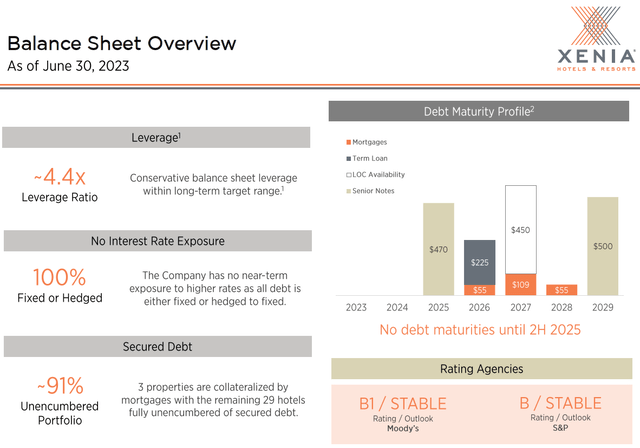

Examining the company’s balance sheet provides a reassuring view of the company’s finances. As of Q2 2023, the company boasts a substantial liquidity of $705 million, comprising $255 million in cash and cash equivalents, with the remaining $450 million coming from its revolving line of credit. In terms of its debt structure, the company has approximately $1.4 billion in total debt, with a weighted average interest rate of 5.47%. Crucially, the company took steps during the second quarter to ensure that all of its debt is effectively fixed. While 5.47% may appear to be a relatively high rate (the company paid over $20 million in interest expense during the second quarter alone), it is crucial to consider the broader economic context. With the high interest rates at present, and with interest rates expected to rise even further in the near future, having a fixed debt structure provides the company a significant advantage in terms of cash flow stability and predictability.

A look at the company’s debt maturity schedule shows a relatively clear runway, with no significant maturities due until almost 2 years later in the second half of 2025. This long runway, together with the company’s significant liquidity position, means the company is in a position of financial strength, with the flexibility to take advantage of any opportunities which may arise in the market.

XHR Aug 2023 Investor Presentation

Dividend

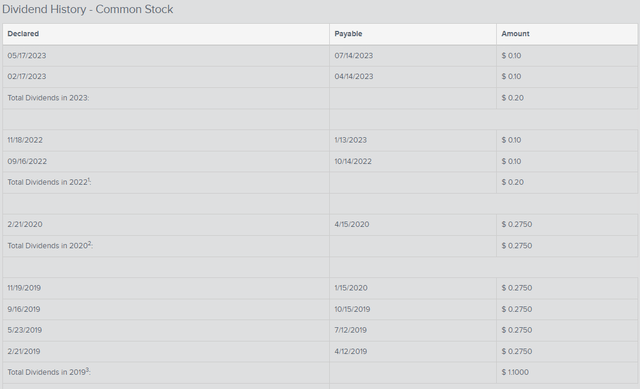

When it comes to REITs, dividends are probably the key metric investors look at, and Xenia Hotels & Resorts is no exception. Prior to 2020, the company was paying a quarterly dividend of $0.275/share, or $1.10/share annually. However, when the pandemic hit, the company took the decision to suspend its dividends after Q1 2020. This suspension lasted for over 2 years until Q3 2022, when the company finally resumed its dividend distributions. Nevertheless, the resumption came at a reduced rate of $0.10/share, less than half of the pre-pandemic level. The company has maintained this reduced dividend for 4 consecutive quarters, with the latest payout for Q2 2023.

Based on the current share price of $11.85 and an annualized dividend of $0.40/share, the company’s forward dividend yield stands at 3.38%. On its own, this figure doesn’t tell us much, hence it is crucial to assess the safety of these dividends. In this context, it should be noted that the company’s adjusted funds from operations (AFFO) for Q2 2023 came in at $0.47/share, and $0.87/share for the first half of 2023. This translates to a dividend payout ratio of just over 21% for Q2 2023 and approximately 23% for the first half of the year. Looking ahead, the company has projected an AFFO of between $1.42/share and $1.60/share for the FY 2023. Even at the low end of the projection, the company’s dividend payout ratio would be approximately 28%. This suggests that the company’s current dividend is secure, with ample room for potential increases in the future.

That being said, it should be noted that the current dividend yield of 3.38% is a modest one, especially when considering the prevailing inflation rate. It will be worth watching out for the company’s Q3 2023 dividends, which is expected to be announced in the coming weeks, to see if the company chooses to raise its dividends.

XHR Investor Relations

Valuation

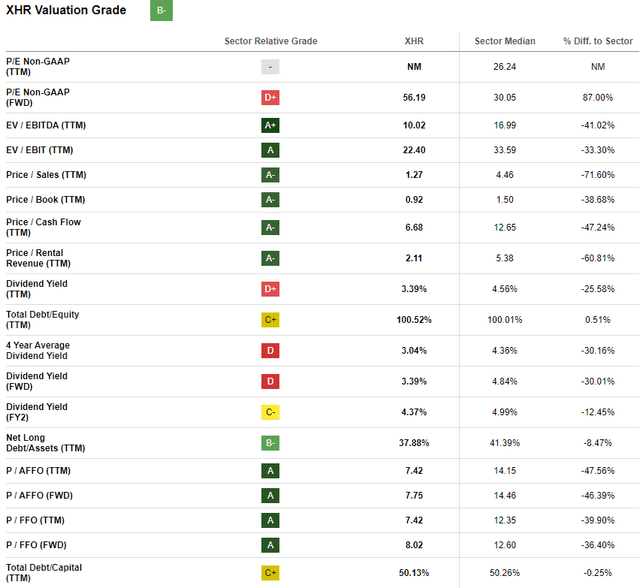

A look at the Seeking Alpha quant system shows that the company receives a “B-” rating in terms of its valuation. While the rating may not be ideal, it is essential to look at the individual metrics contributing to this rating. One of the key factors dragging down the rating is the company’s dividend yield, which has received a “D” rating due to its lower dividend payments compared to its peers. This aspect has been discussed in the previous section, hence I shall not delve into it further.

A look at the company’s price-to-book ratio (P/B ratio) and forward price-to-AFFO (forward P/AFFO ratio) indicates that the company’s shares are currently trading at a substantial discount to its industry peers. This suggests that the market may not be fully reflecting the company’s underlying value. The management appears to share this belief as well, as evidenced by its continued share repurchases. In Q1 2023, the company repurchased nearly 3% of its outstanding shares at an average price of about $13.50/share. This repurchase continued in Q2 2023, when the company bought back approximately $28 million worth of its shares, with a remaining $97 million available under its share repurchase program.

Hence, taking all these factors into account, it appears that the company’s shares are undervalued at the moment.

Seeking Alpha

Risks

There are, however, a couple of potential points for consideration before investing in the company.

First, the concentration of the company’s portfolio in several markets. While it is true that no single market takes up more than 14% of the company’s EBITDA, a closer look shows that the top 3 markets – Phoenix, Orlando, and Houston – collectively contribute close to 40% of the company’s EBITDA. This indicates a significant dependency on these areas, and any adverse economic or market-specific conditions in these regions could impact the company’s financial performance disproportionately. Moreover, the top five markets account for more than half (54%) of the company’s EBITDA, further showcasing the company’s reliance on just a few markets.

XHR Aug 2023 Investor Presentation

Next, the company’s dividend yield. As highlighted above, it is a relatively low yield, especially when the current macroeconomic environment is taken into account. While the company’s current dividend payout ratio is modest and does show the potential for further increases, it is essential to remember that there is no guarantee the company will do so. Moreover, the company has only recently restored its dividends, thus it may be a while before we see an increase in its dividends.

Finally, the performance of the company’s share price is another factor to be considered. The company is currently trading near its 52-week lows and is down over 40% from when it first went public in 2015. While this might suggest that the company’s shares are undervalued, it is also plausible that the market views the current price as a fair one and the shares will not increase in value.

Seeking Alpha

Conclusion

Xenia Hotels & Resorts is a company with a strong balance sheet. Based on the company’s current and projected performance, it is able to comfortably cover its dividends with room left over for potential increases. However, the company has only recently restored its dividends, thus talk of any increase in dividends might seem premature. Additionally, the company’s share price has consistently shown weakness, and there is no guarantee the company’s share prices will recover. In the current situation, I believe that the risk outweighs the potential reward and I rate the company a “Hold”, at least until the company announces its Q3 2023 dividend. If the company announces a hike in its dividend payout, I may reconsider my rating.

Read the full article here