Goldman Sachs (NYSE:GS) has missed its earnings estimates putting downward pressure on its stock. While it doesn’t happen often, in the past two years the company has missed 3 times and beat by 5 times.

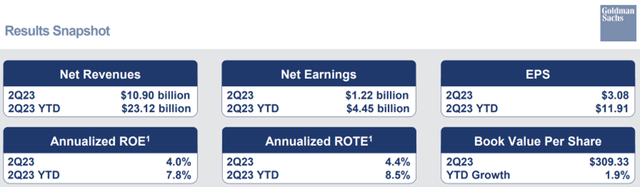

The company had EPS of $3.08 in Q2 2023 much less than the consensus estimate of $4.04 and a far cry from $7.73 a year prior.

This could present a chance to accumulate shares in the bank though as within the investment banking community Goldman Sachs remains unrivaled.

Q2 Results Disappoint

The company’s Net Revenue fell from $11.8 billion in Q2 2022 to $10.9 billion in Q2 2023. For simplicity in presentation, I actually prefer to use the data from Goldman’s 10-Q to present its revenue changes. Having it all clumped within Goldman’s internal departments makes it seem more confusing to me. This way we can see where exactly the missed results are coming from.

- Investment banking revenues were $1.4 billion in Q2 2023 compared to $1.7 billion at the same time last year

- Investment Management was largely flat. Revenues in Q2 2023 was $2.36 billion compared to $2.39 billion the year prior

- Commissions and Fees fell sharply from $1.07 billion in Q2 2022 to $893 million this year

- Market Making had a decline of 11% from $4.91 billion in Q2 2022 to $4.35 billion in Q2 2023

- Net Interest Revenues fell from $1.73 billion in Q2 2022 to $1.68 billion in Q2 2023

As you can see the decrease in revenues is felt across the board and in most of Goldman’s business lines. The macroeconomic environment has been tough for the investment banking business. There had been a significant decline in M&A transactions industry-wide leading to the 20% YoY decline in Goldman’s Investment banking fees.

According to data from Dealogic, there were 18,311 global announced deals valued at $1.36 trillion. This was a drastic decline from the 23,247 mergers worth $2.24 trillion the year prior. This slowdown in deal volumes and value is the worst since the start of the COVID-19 pandemic in 2020.

However, despite this decline, Goldman still held on to the top spot in the industry. According to Dealogic, Goldman had 145 deals so far in 2023 with a value of $321.3 billion. This is a healthy lead over second place JPMorgan (JPM) with $309.9 billion in transactions.

To me all of this means quite simply that the “Vampire Squid” has not lost its mojo. It may have been distracted quite a bit, but Goldman is still one of the (if not the) top investment banks in the world. Investment banking and Global markets are inherently volatile businesses. With the recent macroeconomic uncertainty, it’s not too surprising to see the company have an earnings miss.

The Streamlining Continues

Speaking of volatile revenue and earnings, Goldman has started to divest itself away from its ill-advised foray into mass consumer banking. I believe this attempt at business diversification was a mistake as it strayed too far away from the company’s core competence. I understand the appeal of having a consumer business as it means a steadier stream of earnings. However, this is all ultimately a distraction from the company’s core competence of investment banking.

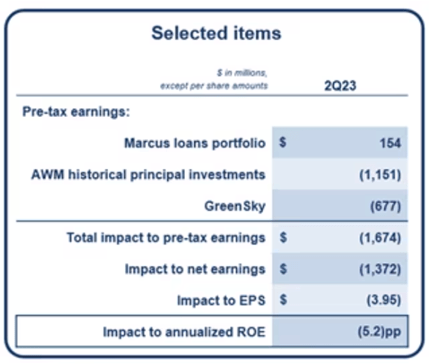

In conjunction with the company’s plan of streamlining its business, Goldman has realized losses of $1.15 billion from legacy investments in its Asset Management business and a $504 million impairment of goodwill related to Greensky. In total these items affected EPS by $3.95 and annualized ROE by 5.2% which means that the company’s actual results are not as bad as it seems taking into account these items. Reversing these charges would raise EPS to $7.03 which is only slightly lower than the $7.73 the same time last year.

Company divestitures (Goldman Press Release)

I fully expect divestitures and write-downs to continue to plague Goldman’s earnings results for months to come. Recently the company has announced that it is selling its “mass-affluent” investment-advisory it acquired in 2019. This is part of the company’s new more asset-light approach for its wealth business. In other words, Goldman has a renewed focus on the ultra-wealthy over the only wealthy. The company is also actively seeking to get rid of its “Apple Card” business it won in 2019.

Valuation

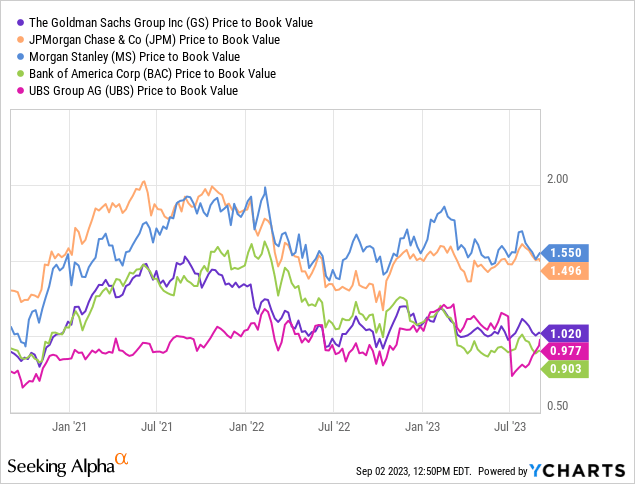

In terms of valuation, Goldman Sachs is trading at a discount relative to its peers. At its current price, the company is trading at 1.02x Price to Book value. This is a lot cheaper than the 1.5x Price to Book of JPMorgan and Morgan Stanley (MS). Given Goldman Sachs’ prestige and reputation, I believe that GS stock should be trading closer to its peers, around 1.3x to 1.5x.

The bank also has a decent Return on Equity despite its more recent setbacks. The company has an annualized ROE of 7.8%. This allows the company to continue to fund its dividend growth and buybacks. Thus enhancing shareholder returns.

Results Snapshot Q2 2023 (Investor Presentation)

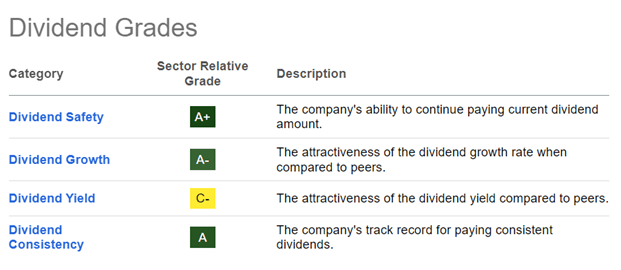

The company recently increased its dividend by 10% to $2.75 per share for Q3 2023. This implies a forward dividend yield of 3.35%. Goldman scores top ranks in Seeking Alpha’s Quant rankings for Dividend Safety, Dividend Growth, and Dividend Consistency. Goldman also has Standardized CET1 capital ratio of 14.9% further highlighting the strength of the bank’s balance sheet and safety of its dividend. This makes this yield very attractive for me.

Quant Dividend Rating (Seeking Alpha)

Using a Discount Rate of 8% and a conservative dividend growth rate of 5%, I have arrived at a target share price of $366. Using a conservative Price to Book value of 1.25x, I can value GS stock at $387 per share. Therefore, I am using the range of $366 to $387 per share as a conservative valuation for GS stock.

The company’s board also authorized a massive $30 billion share buyback program. As of Q2 2023, the company bought back $3.3 billion worth of shares. This means the company still has plenty of firepower to support its stock price should it decline further from here. There can also be further upside from my price targets assuming the company is successful in its streamlining efforts.

Read the full article here