Goldman Sachs BDC (NYSE:GSBD) continues to make an extremely compelling value proposition for passive income investors when taking into account the BDC’s defensive portfolio positioning, high dividend coverage ratio, and solid credit/portfolio performance.

Though the BDC’s portfolio growth has slowed in light of softer demand for new loan origination in a high-interest environment, I think that Goldman Sachs BDC’s net investment income is more than sufficient to ensure that the company’s dividend will be paid at the present $0.45 per share rate moving forward.

Rating History

My article in May, Goldman Sachs BDC: This 13.8% BDC Yield Is Not As Risky As It Looks, concluded with a buy rating, as did my article from March, Goldman Sachs BDC: 11% Yield, Interest Rate Upside, Small Premium To NAV.

GSBD’s stock price fell drastically in March due to the meltdown of Silicon Valley Bank (unfortunate timing: the stock price has declined 10% since), a factor that has been unrelated to Goldman Sachs BDC’s portfolio performance. The justification for the buy ratings was the BDC’s helpful floating-rate exposure in a rising-rate environment as well as a more attractive valuation in May.

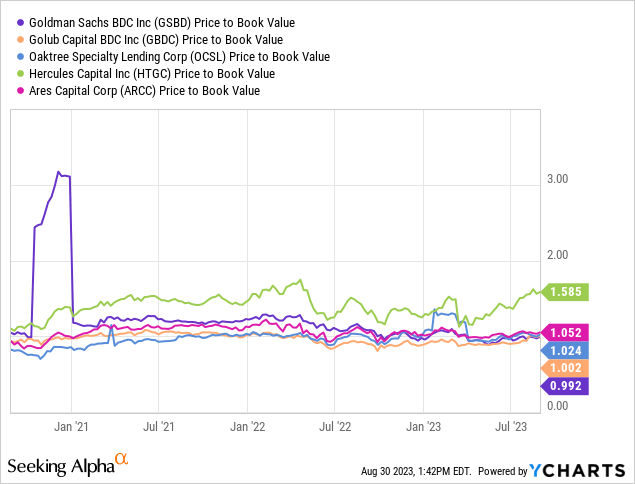

Since Goldman Sachs BDC’s dividend coverage improved considerably QoQ in the second quarter, the stock remains cheap (1% discount to net asset value), market fears related to the bank sector have subsided, and Goldman Sachs BDC has dividend upside. In my view, I now raise my classification to Strong Buy.

GSBD is now my third-largest BDC portfolio holding.

Goldman Sachs BDC’s Investment Portfolio Is Growing More Slowly, But Still Growing

Goldman Sachs BDC is a higher-quality BDC, in my view, because it has a substantial first-lien focus and very solid dividend coverage. First-lien debt has the first claim on collateral posted by a borrower and is, therefore, a lower-risk investment compared to second-lien debt.

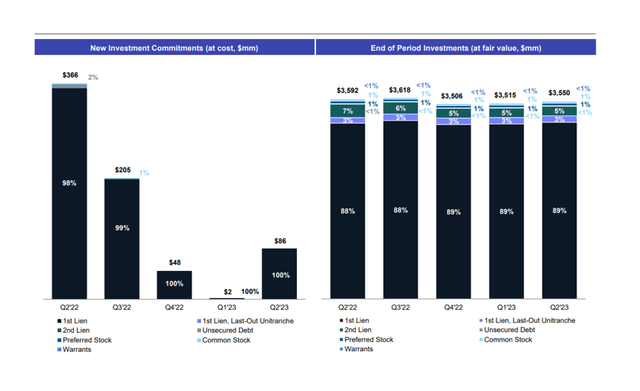

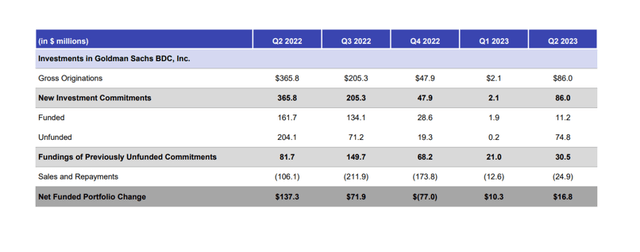

At the end of the second quarter, the BDC had 92% of its portfolio invested in first-lien debt whereas only 7% was allocated to other investments, predominantly second liens (5%). As has often been the case in the past, Goldman Sachs BDC’s new investment commitments were exclusively made in the first liens in the second quarter. A full 100% of loans are floating rate.

Investment Portfolio (Goldman Sachs BDC)

Like most BDCs, Goldman Sachs BDC has seen a consistent decline in new investment commitments (loan originations) in the first six months of 2022 which resulted from the increase in borrowing costs in a rising-rate environment.

Nonetheless, Goldman Sachs BDC did originate $86 million worth of new first liens in the second quarter. In total, GSBD originated $88.2 million in loans in the first half of 2022 compared to $497.5 million in the year-ago period. This means that the BDC’s originations have been reduced by a whopping 82%. A reversal of the central bank’s interest rate policy may lead to a resurgence of Goldman Sachs BDC’s net investment income in 2024, however.

Originations (Goldman Sachs BDC)

Portfolio Quality Remained Solid In 2Q-23

Goldman Sachs BDC had to place two more loans on non-accrual in the second quarter which brought the total number of under-performing loans to ten. The non-accrual ratio rose from 0.6% in 1Q-23 to 0.8% in 2Q-23 of the investment portfolio, based on fair value, so overall portfolio quality remained solid. I consider a non-accrual ratio above 1.5% as concerning and I start to worry only if the non-accrual ratio exceeds 2.0% (though this depends on the particular case).

One BDC that I recently aggressively doubled down on is TriplePoint Venture Growth BDC Corp. (TPVG) which, despite an increase in bad loans well above the 2% non-accrual threshold mentioned here, offers passive income investors very competitive dividend coverage metrics.

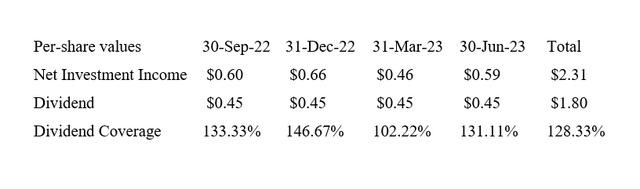

Dividend Coverage Improved QoQ

Goldman Sachs BDC earned $0.59 per share in net investment income in the second quarter which translates into a dividend payout ratio of 131%. In the last twelve months, Goldman Sachs BDC produced a dividend coverage ratio of 128%, so I think the dividend not only has a high degree of safety but actually has room to grow.

Dividend (Author Created Table Using BDC Information)

Fair Value Likely Substantially Higher

Goldman Sachs BDC is trading at 0.99x net asset value and the BDC reported a 1% increase in its net asset value in 2Q-23. Taking into account that GSBD’s dividend coverage improved QoQ, that it has room for dividend growth and that it saw only slightly deteriorating credit quality in the second quarter, I stand by my prior assertion that the BDC could trade at a 20% premium to net asset value.

Why I Might Be Wrong About Goldman Sachs BDC?

Goldman Sachs BDC has decent portfolio quality and dividend coverage which is sufficient to lead me to the conclusion that the dividend is reasonably safe.

With that being said, potential issues with credit quality can creep up in an environment of weakening asset quality (a recession) and Goldman Sachs BDC faces net investment income headwinds in case the central bank reverses its interest rate cycle in 2024.

Goldman Sachs BDC is aggressively positioned to take advantage of rising interest rates (100% of investments are floating-rate) and compressing net investment income could affect the BDC’s dividend coverage moving forward.

My Conclusion

Goldman Sachs BDC is a well-managed BDC that has a surprisingly well-covered 13% dividend yield. The payout has consistently been covered by net investment income without exception in the last 12 months.

What stands out with Goldman Sachs BDC is not only the decent dividend coverage ratio but also the fact that the BDC has a very high allocation of investment funds to first liens, which provides a certain degree of portfolio protection in a softening economy.

As long as credit quality remains below 1.5%, I feel confident in recommending Goldman Sachs BDC for passive income investors.

Besides TPVG, GSBD is now one of my largest BDC holdings in my portfolio.

Read the full article here