Dear subscribers,

I’ve been adding more and more VICI Properties (NYSE:VICI) to my portfolio over the past few months. However, with the recent decline in the company’s share price when it very briefly touched below $30/share, the company is even more attractive than it has been before.

I believe it is time for an update on this company and to show you why I believe the company is set for double-digit earnings growth and potentially even multiple expansions towards something like 18-20x P/FFO.

Also, most importantly, given its current valuation, the company very much qualifies for my overall minimum upside of 15% annualized, on a conservative basis.

Let’s see what we have here, and why VICI is such a good choice.

Working With VICI and its upside

So, since VICI was publicly traded a few years back, the company quickly established trading at a decently attractive valuation range – around 12-15x P/FFO. Since that listing, the company has moved up from junk-rated to IG-rated, currently rated at BBB-, has a dividend of 5.14% at the current share price level, and has seen a high just above $35/share, and a 2-year low below $31/share.

However, the share price has been pretty mellow in terms of development. If you had invested in the company back in 2018, your current RoR would be around 11.8% – market-beating.

If you had applied valuation logic and bought the company when it was cheap, your RoR would be closer to 36% per year, or 184% since the COVID-19 decline. Of course, similar amounts of outperformance could be seen for many companies since that point in time.

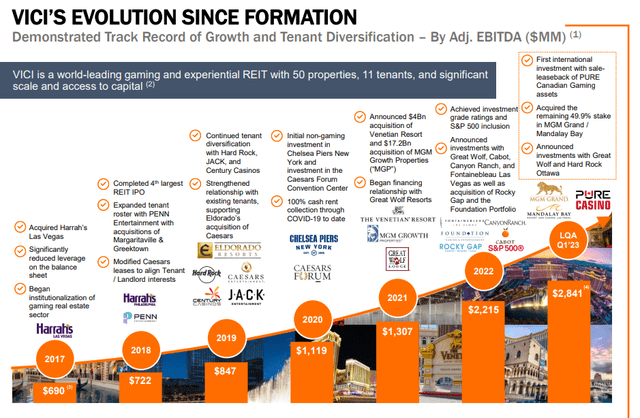

VICI Properties is a qualitative owner of mission-critical entertainment and experiential properties. As of the 2Q23 report, the company owns 50 properties and 4 golf courses, from 11 tenants with 80% from companies that are publicly traded. The company owns properties in both the US and in Canada.

Oh, another “small detail”.

The company has a 100% occupancy rate.

Another detail?

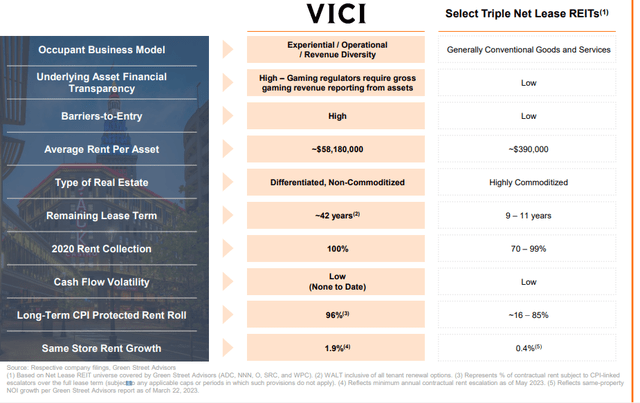

41.8 Years of the average weighted lease as of June 30th.

100% at almost 42 years, that’s what we’re looking at here – at investment grade credit with a 5%+ yield which is safe as a 75% FFO payout ratio.

What else?

Inflation-protected leases.

What does this mean?

It means that 96% of the company’s leases are linked to CPI-escalators over the long term.

The company is a capital allocator with demonstrated success. Since its inception, the company has invested in over $30B worth of assets, raising $21B of equity proceeds. The current company EV is over $50B.

VICI IR (VICI IR)

The company may lack the massive diversification that other REITs of this size present us with. Ceasars is 40% of the company’s ABR, and MGM is another 36%, meaning that 2 tenants have a concentration of over 75%. But the company is still in its formative years, and it’s preparing to invest in a whole other lot of experiential properties.

However, the core investment thesis is the mission-critical nature of its assets. I argue that not even Realty Income (O) or Agree (ADC) have the same sort of mission-critical infrastructure that this company presents us with, for its sector.

VICI IR (VICI IR)

These assets have made possible some of the best CPI protection in the entire REIT industry.

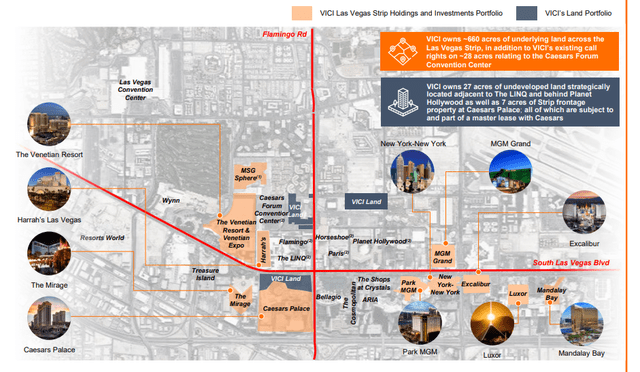

The company’s assets are some of the best out there, and contain some of the most famous casinos in the world. While the company is only in NA due to some of the nature of the industry in Europe and Asia (watch our CEO interviews on iREIT on Alpha, it really goes into detail about these things!), these are certainly good enough to interest me – and should be good enough to interest you as well. With regard to Las Vegas, the company owns some of the best assets in the world.

VICI IR (VICI IR)

The company intends to continue its impressive growth trajectory through a mix of qualities and strategies, including expansion to other suitable experiential sectors (the company has in fact already begun to do this). In a very short timeframe, VICI has managed to climb to one of the top REITs in the entire nation and got added to the S&P500 less than 6 years after its public listing.

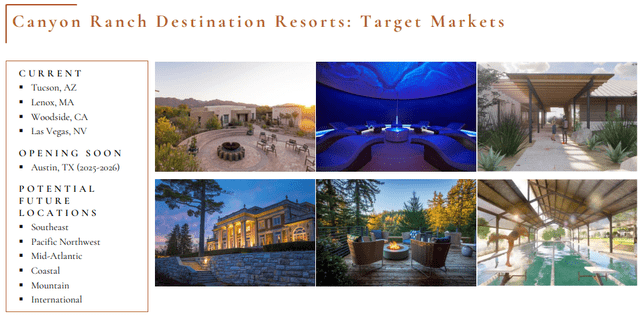

As I said, future growth is likely to come from a mix of experiential sub-segments. The latest that the company is moving into is the wellness sector, with its M&A of Canyon Ranch, one of the oldest players in the sectors and providers of integrative wellness experiences – or as I prefer calling them “Health and wellness Ranch”.

This is an interesting sector for a number of reasons, many of which people with the financial means and exposure to the sector have discovered.

VICI IR (VICI IR)

To be completely honest with you, dear readers, I was surprised at the sheer size of the sector – but when you think about it, it does make sense – and given the company’s ability and expertise so far to work the experiential and entertainment sector, I do not doubt these numbers or these projections. This model has a massive advantage over your standard hotels, with an absolutely smashing Rev/room – for 2022, it was $1,720.

The company/partnership is already a market leader in the sector.

VICI IR (VICI IR)

The transaction for VICI will come in the form of a preferred equity investment, valued at $150M with a 10-year term with optional redemption at any time. This also gives VICI the option to call the real estate assets of the company – at least some of them, subject to some conditions. Overall, it’s a very interesting transaction and the company’s first move into the sector. The fact that Canyon Ranch is both finishing new locations (2 in 2023/2024) and looking at several locations for new places is a testament to the working nature of this business model.

The company also recently entered Canada, with a sales leaseback of four Casinos.

So, VICI is an above-quality player in a very attractive sector, that’s also subject to a fair amount of recession-resilience, as odd as this may sound for a Casino asset REIT. However, look at the data and you’ll see that downturns in this sector, even during recessions, are either smaller than you might expect, or not even present.

This enables investment at a very attractive upside, provided the company continues to grow (which I obviously believe).

How good?

Vici’s 15%+ annualized upside at this price.

As you know, I don’t invest in anything that doesn’t give me that market-beating upside, and 15%+ is usually around double what the market gives on average, over time – so I consider it a good target to shoot for.

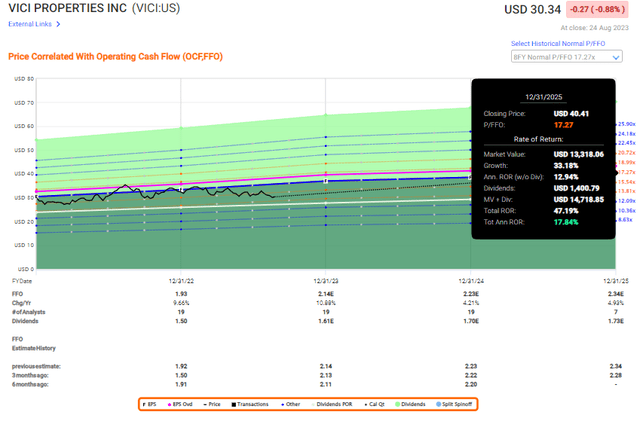

VICI’s way of offering this upside comes in the form of a reversal to a 15-18x P/FFO, with 18x /FFO implying above 18% annualized, and 17.2x at around 17.8% annualized. That’s inclusive of dividends, but that dividend is going to continue to grow, as I see it.

VICI Upside (F.A.S.T. Graphs)

The company doesn’t have the upside of some of the other companies I recently presented. However, this is the reason I argue that you should have some diversification in your portfolio – you shouldn’t just buy one attractive company, but a basket of them to get yourself a bit of diversification and risk spreading. VICI may underperform. Any company may underperform.

But over time?

I believe this company is going to significantly outperform. The company is headed by one of the better management teams in this part of the REIT space, spearheaded by Ed Pitoniak, with decades of experience in the industry.

But in terms of valuation, even if you were to expect underperformance from the company here to the tune of 12-13x P/FFO, that would still entitle you to over 6-8% annualized RoR, if these current forecasts hold. That’s still not negative, or even close to it – and that is assuming underperformance.

This is the sort of case I am looking for. So I “love” that the market is undervaluing and punishing VICI properties because it enables me to do the equivalent of bargain hunting.

S&P Global has high hopes for the business – equivalent to my own long-term targets for the company. Despite its relatively new nature, 20 analysts follow the business at this time.

Out of those, 19 are at “BUY” or an equivalent positive rating, with an average price target of $37.84.

That’s a current upside of 23.5%, with a low price target of $32/share, meaning that at current levels, not a single analyst believes the company is even close to overvalued.

I would agree with this sentiment – and others here on iREIT on Alpha would as well.

VICI might not be as large or as old as Realty Income. That does not mean it’s not a good REIT or even a REIT with a similar sort of safety.

I recently increased my allocation to the company by 30%. This was a large buy for me. I’m expecting to add more here if I see more weaknesses, or even if the company doesn’t move back up. I’m targeting a 2-3% long-term allocation to this REIT.

Here is my current thesis for VICI.

Thesis

-

VICI Properties is what I view as the sector leader in experiential triple-net lease REITs. It has a solid set of fundamentals, superb management, a great yield, and a decent upside even considering the recent upward trajectory of its valuation.

-

Taking all of these things into consideration, only a downturn in fundamentals or a significant movement towards overvaluation would cause me to become negative on this REIT.

-

That’s not where we are today. I give VICI properties a conservative PT of no less than $38/share, based on a 2025E 16-17x P/FFO, and an upside in the double digits.

-

I’m at a “BUY” here, and am adding shares of VICI.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This company fulfills every single one of my investment criteria barring cheapness – I’m at a “BUY”.

Read the full article here