Thesis

In the last 60 days, the refining segment has seen strong gains. So much so, that analyst groups such as Bank of America have downgraded the entire group based mainly on valuation and risk of peaking margins. This begs the question if this group is still investible at their current prices.

The viewpoints expressed at Bank of America make sense on the surface. After a nice run and the continuance of historically high crack spreads, the group could take a beating if margins regress to historical levels. However, all refiners are not created equal. In fact, when looking at the three biggest refiners in the US (Marathon, Valero, and Phillips 66), you will find three different business structures.

In this article, I will discuss two refiners, Phillips 66 (NYSE:PSX) and Valero (NYSE:VLO). Only one of these companies has the staying power to warrant your investment dollars, and the other is at high risk of falling into the thesis feared by BoA.

The Refiner’s Edge

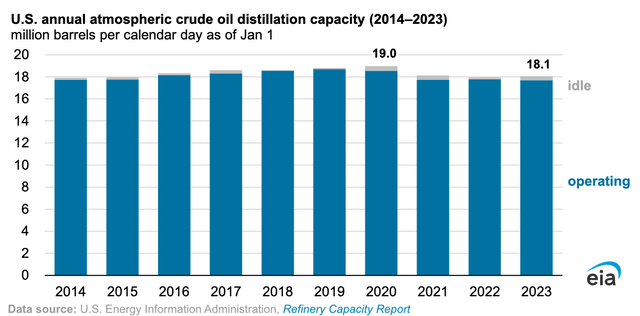

As a whole, the refinery industry has gotten smaller since the pandemic. Total refinery capacity has actually shrunk to 2014 levels as a result of under investment in the industry and closures. We are now entering the hangover period from the pandemic. The pandemic’s sudden shock to the industry has resulted in refiners closing up shop, and those who stayed in business put off large maintenance projects to stay afloat. This has shifted the supply and demand balance resulting in higher rates for refiners. These new rates have allowed refiners to post outstanding numbers over the last 12-18 months.

EIA

Since greenfield refineries aren’t exactly appealing in the public eye, and electric vehicles are becoming more ingrained in the transportation industry, the industry has shifted its investment focus. The big players are now focusing growth initiatives on renewable diesel for both its environmental and economic benefits.

To that end, several companies aim to start up renewable diesel projects to capture the high margins that are offered by renewable credits (more on that later) for producing renewable diesel. Below are some of the notable renewable diesel projects in the works.

- Valero recently started DGD 3 at Port Arthur in early the fourth quarter of 2022. This unit has the capacity of 30,000 BPD.

- PSX plans to complete Rodeo Renewed in early 2024. This project has a capacity of 50,000 BPD.

- PBF recently completed start up activities at its St. Bernards facility. This new facility has a 21,000 BPD capacity.

- Marathon is in the startup phase of the Martinez Renewable Fuels facility. At full capacity, this facility can produce over 47,000 BPD. Completion is expected by the end of 2023.

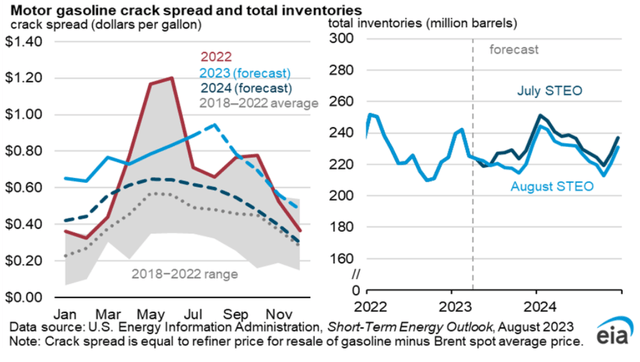

As with most things, the market takes some time to respond to these incremental changes. Currently, the EIA projects the 3-2-1 crack spread to remain elevated for 2023 before settling back to a slightly elevated level by 2024.

Does all of this point toward the demise (or at least regression) of the refinery sector? Let’s dive in to VLO and PSX to find out.

EIA

Valero Energy

VLO is a moderately sized company with a market cap of $46 billion, just a bit smaller than PSX ($50 billion). VLO is also a highly visible brand with its logo on top of over 7,000 gas stations nationally. VLO also has 15 refineries and a renewable fuels segment. The renewable fuels group consists of two renewable diesel facilities and 12 ethanol plants.

When I look at Valero’s investor presentations, I see a lot of discussion points regarding their renewable diesel technology, the Green Diamond Diesel brand, and ethanol production. These could easily be dismissed as admirable endeavors with minimal (possibly negative) economic value. As with any renewable initiative in an investing format, the measuring stick will always be how much ‘green’ it can generate and how do these assets stack up against traditional refineries.

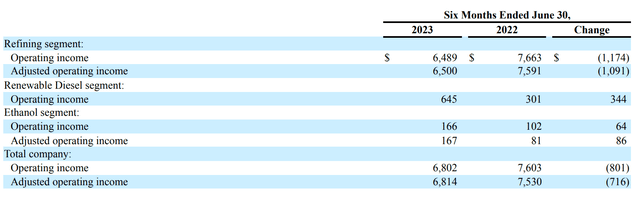

Below you will find Valero’s Q2 10-K report. You can see that after impressive growth from 2022’s numbers, the renewable diesel and ethanol groups accounts for 12% of the companies operating income, up from approximately 5% in 2022. While not an overwhelming number, it is certainly a contributing factor to the company’s bottom line.

VLO 10-K

In my opinion, the VLO investor presentations do a poor job representing the renewable fuels’ potential. To get our facts straight, I like to put my engineer hat on and let the numbers speak for themselves. The table below displays overall profitability for each segment based on Q2 results.

| Refining | Renewable Diesel | Ethanol | |

| Operating Income | $2,432m | $440m | $127m |

| Production Volume (gallons) | 11,348m | 400.4m | 404.4m |

| Profit/Gallon | $0.214/gallon | $1.10/gallon | $0.314/gallon |

Based on the above data, is it very evident that the renewable fuels fetch a considerable premium compared to conventional refining, although at much smaller volumes. Before we jump on the renewable bandwagon, we need to understand how renewables are incentivized and what risks are involved.

Diamond Green Diesel

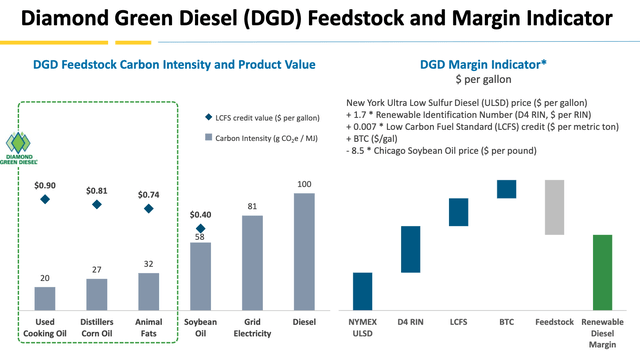

Diamond Green Diesel is VLO’s brand for renewable diesel. In the 4th quarter of 2022, VLO completed its third DGD unit at Port Arthur. The premium generated by this product results from the multiple credit sources the government has established to spur its production. As shown below the price of RINs, LCFS credits, and BTC credits all play into the margin generated by DGD.

It is important to note that currently LCFS credits are only offered in the states of California, Oregon, and Washington and thus the addressable market is relatively small. The pricing mechanism for these credits is affected by the number of ‘credits’ produced by low carbon sources and the number of credits ‘consumed’ (i.e. penalized) by high carbon sources. Therefore, this pricing mechanism could deteriorate as more renewable projects come online and replace high carbon fuel sources.

More detail can be found at the California Air Resource Board.

The remaining price mechanisms for renewable diesel are the RIN credits and the Biodiesel Tax Credits (BTC). Both of these programs are administered at the federal government level. Similar to LCFS credits, RIN credits fluctuate based on supply and demand that is created by government established criteria.

From the graph below (right side) you can see that the entire monetary value of renewable diesel is based purely on government subsidies with the feedstock costs significantly exceeding the selling price of the basic diesel commodity (Ultra Low Sulfur Diesel or ULSD). Ultimately, dollars are dollars so I choose not to judge the source. It is important however, to understand the origination of profit.

VLO Investor Deck

Ethanol

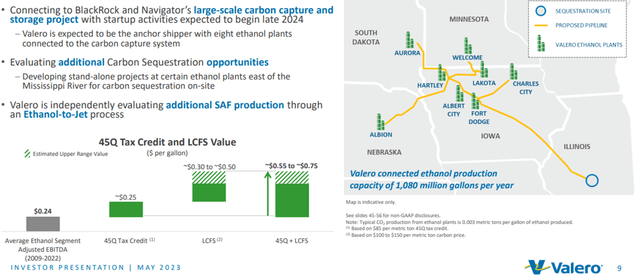

The ethanol group is by far the smallest of the three segments. But Valero has big plans for the small unit, again intending to capitalize on the government’s various incentive mechanisms. It intends to do this via the combination of LCFS credits and by connecting the ethanol plants to a CO2 sequestration pipeline.

VLO plans to connect eight of its 12 ethanol plants to a common pipeline to support CO2 capture. This entitles the company to the 45Q tax credit invoked by the Biden administration. The 45Q tax credit is expected to contribute an additional $0.25 per gallon uplift when the pipeline enters service in late 2024. This credit, combined with the LCFS credits pose to significantly boost the profitability of the ethanol group by roughly $100 to $300 million on a quarterly basis.

VLO Investor Deck

VLO Wrap Up

Given all the above data there is certainly opportunity for Valero to continue to boost overall profitability based on various government incentives. However, given the general size of both the DGD and ethanol segments, this most likely will not be sufficient to sustain the company’s current performance should crack spreads decline as we enter 2024.

Therefore, I believe VLO will face downward pressure in the medium term. This is based on two assumptions.

1. Additional renewable projects come online that reduce the value of government incentives. RBN Energy has a very detailed discussion of this risk in its series, “Baby the RINs Must Fall”.

2. The gradual adoption of electric vehicles will erode demand (or at least hamper meaningful growth) for conventional transportation fuels. This will gradually reduce crack spreads over time. I don’t believe the pace of the EV transition will be sufficient enough to pose any near term risk. I view this transition as gradual, becoming more impactful over the course of a decade.

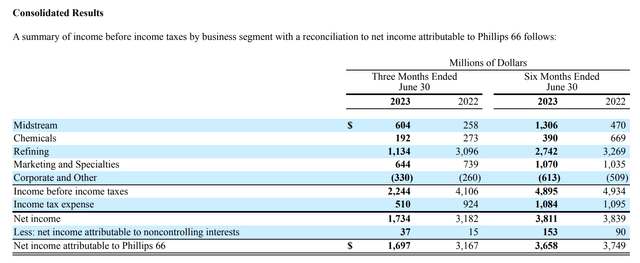

Phillips 66

PSX has a slightly smaller capacity and retail presence than VLO, coming in at just shy of 2 billion BPD refining capacity with around 2,500 gas stations. What I like about PSX is its diversification and not relying solely on refining. In the chart below you can see that refining only accounts for about 50% of its income. The remainder is spread amongst its midstream segment, marketing, and chemical businesses.

PSX 10-K

Natural Gas – The Real Energy Transition

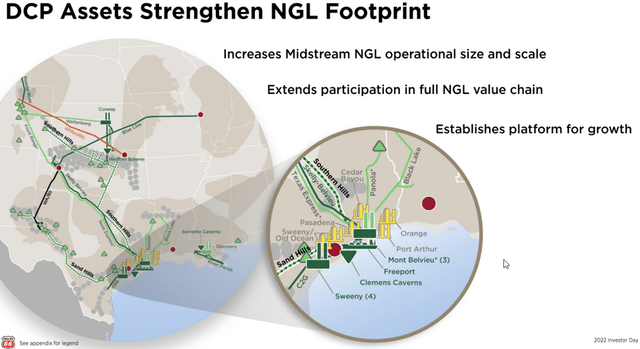

Globally, the transition to cleaner burning fuels centers around the use of natural gas (methane) and/or similar natural gas liquids such as propane, butane, and ethane. Europe and Asia are consuming these fuels at an accelerating rate, with a large percentage of it being sourced from the United States. This is where PSX’s midstream business shines.

PSX recently completed the transaction to boost its ownership stake in DCP midstream to 86.8% at the end of Q2 of this year. Following the DCP acquisition, the company owns or operates 72,000 miles of pipeline to transport products such as crude oil, refined products, NGLs, or Natural Gas to its export terminals. This allows the company to extract profits at every phase of the value chain from the wellhead to the docks, making it ideal for energy producers to transport using the PSX system.

PSX Investor Slide Deck

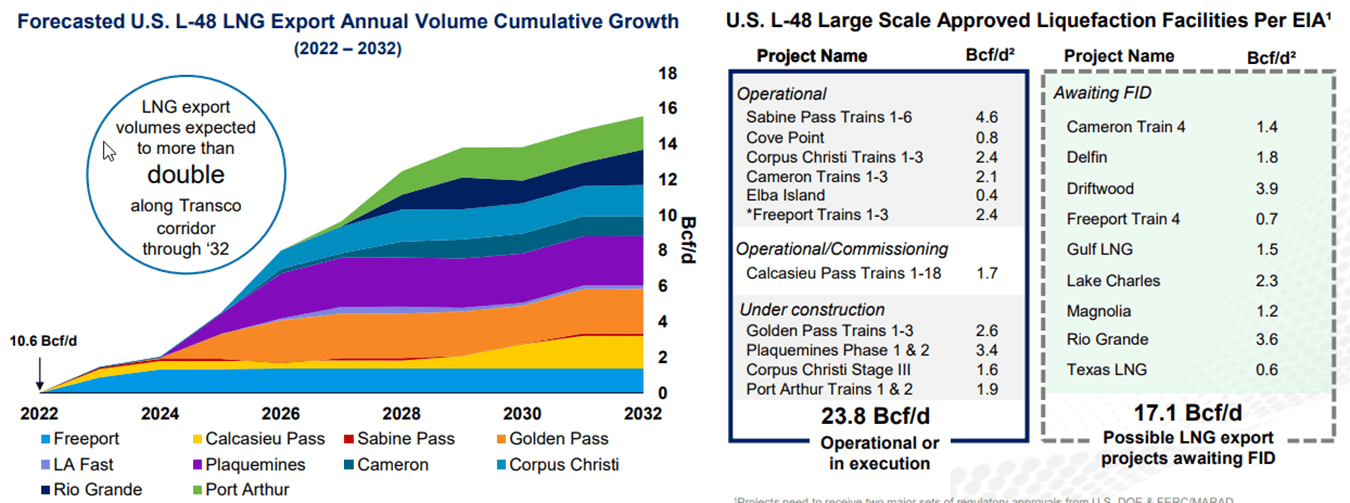

I am extremely bullish on LNG and NGL exports beginning to ramp significantly over the next 12-18 months. An additional 7.6 BCF/d of export capacity for liquefied natural gas is expected to come online by the end of 2024 with additional projects still in the pipeline. This initial wave of projects accounts for nearly a 75% increase in US exports.

Increased demand for midstream services will allow for margin expansion. This will enable PSX to have a thriving secondary business that provides solid and dependable cash flows. More importantly, since midstream businesses are generally fee based with only slight commodity exposure, they can hedge against declining refining margins.

Williams Company Earnings Presentation

Refining Growth

In the first quarter of 2024, PSX is expected to start up the Rodeo Renewed unit which is a conversion of the original refinery into a renewable diesel unit. As mentioned earlier, in the current market this carries significant potential for high margin production. PSX targets an annual EBITDA of $700 million from this project once it is operational.

This project will be important for PSX to meet its stated projection to return $4.5 billion to $6.5 billion to shareholders by the end of 2024. In my previous analysis on PSX, I showed that even taking conservative numbers for the Rodeo Renewed project and factoring in a 40% decline in refining margins, PSX should still be able to beat the high end of their return package guidance.

PSX Wrap Up

PSX has overall less exposed to pure refinery risks than VLO. This is mostly attributed to the presences of its midstream business in DCP which provides a powerful diversification tool.

Additionally, PSX is on track to complete an extremely large renewable diesel project in Rodeo Renewed. As mentioned earlier this has the potential for very high margins in the near term. As with VLO, I do feel the renewable diesel industry may see margin contraction due new supplies coming online.

Balance Sheet Comparison

Another important comparison point would be the overall health of each company’s balance sheet. The table below shows a stark difference in debt/cash profiles between the two.

PSX clearly will have some debt obligations to tend to over the next several years that could rob meaningful cashflow unless refinanced out into the future. Conversely, VLO is sitting in a very solid position, with more than enough cash on hand to meet all debt obligations for the next three years with ease. VLO certainly has the edge in this regard.

| Maturities | VLO | PSX |

| Due 2024 | $167m | $1,100m |

| Due 2025 | $441m | $1,975m |

| Due 2026 | $672m | $992m |

|

Cash Balance |

$5,075m | $3,029m |

Source: VLO/PSX Quarterly and Annual 10-K reports

Risks

Obviously, the common risk to both of these companies is declining crack spreads. With several incremental projects coming online in the next several quarters it is possible crack spreads drop in response to the supply increase. In this scenario, the overall profitability of both companies would drop back to more historical levels.

I believe PSX’s current business structure helps preclude much of this risk by having alternative forms of income from its midstream business that is inherently stable. Further, the midstream business focuses on natural gas resources that is in high demand around the globe. This attribute is key to my thesis that PSX is a more stable long term investment than VLO.

A secondary risk to both companies is declining government incentives to produce renewable diesel as several new projects come online. A reduction in incentives will clearly impact these high margin products as they are not economically viable without this aid due to high feedstock costs. Due to the relatively small volumes of renewable diesel, neither company has sufficient exposure at this time to dramatically alter the course of the business. However, any anticipated growth aspects would be muted in this scenario.

Summary

In this article, we reviewed the operational differences between VLO and PSX. Despite both being large scale refiners, their business structure is significantly different with VLO almost entirely focused on refining and PSX diversified with midstream, and chemical segments. However, VLO does have an upper hand in its balance sheet and near term debt requirements.

The BoA thesis surely has merit, but is more applicable to VLO than PSX due to the latter’s diversification from refining. This diversification provides for a safety net should crack spreads drop over the medium to long term. I therefore, in spite of the comparably inferior balance sheet, find PSX to be a more desirable long term investment than VLO. Further, PSX should have sufficient cash flows to manage its near term debt obligations. I previously included PSX in my “Dividend Investor’s Oil Playbook – Part 2” for a look into how I view its purpose in a dividend portfolio.

Read the full article here