Dear readers/followers,

Since I wrote about Old Republic International (NYSE:ORI) last, the company has seen significant outperformance, driving the company to a level that, in my view, isn’t something that the company could maintain for a long period of time.

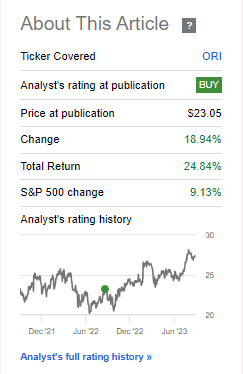

It’s always hard changing the rating for a company like this – the quality is absolutely stellar. I also seem to be the first one of the SA analysts to change my rating for this company. My position in the company was small – around 0.3% – but the growth is still stellar here. Since my last article, this is what the company has been doing in terms of returns.

Seeking Alpha ORI (Seeking Alpha)

So, I’m going to review the results, show you why this particular P&C insurer is on my list for a downgrade, and what I expect on a forward basis.

Old Republic – Plenty to like about undervalued Insurance – not much to like about fairly- or overvalued insurance.

I last wrote about the Old Republic around a year back. The company at the time was clearly undervalued to any conservative valuation the company had typically upheld.

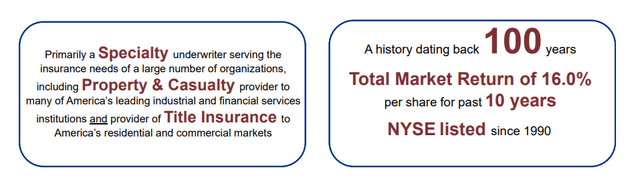

ORI is an 80+-year-old P&C insurance business out of Chicago. It has your typical Insurance holding company structure – with the main company doing underwriting. The insurance itself is done through a variety of subsidiaries in three segments. Income, due to the structure, is not only from underwriting services but also from insurance premiums.

ORI is around 53% general insurance and another 48% title insurance. The company manages an 8%+ net income margin on $8B worth of annual revenues. The company’s margins put it in the upper average on a comparative basis in the insurance sector. The company’s growth in profitability meanwhile, is among industry-leading numbers on a 10-year context.

The company is mostly a specialty underwriter providing services.

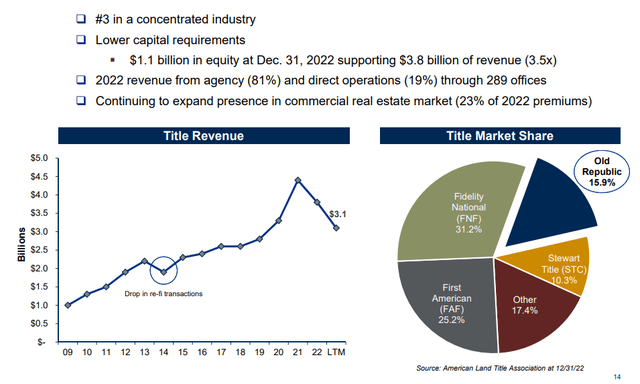

ORI IR (ORI IR)

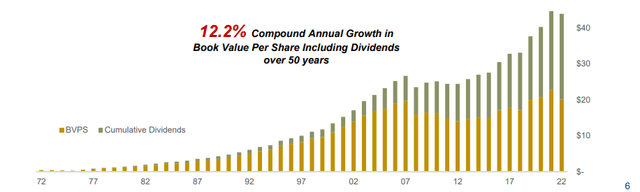

It’s a Fortune 500 member, and it’s also the #3 title insurer in all of the USA. 82 years of uninterrupted cash dividends make it among the leading companies in this context, and annual raises with 42-year history put it just 7-8 years short of becoming a dividend king. This, dear readers, is a very solid company.

At current valuations, the company yields 3.57% and this is a very well-covered yield. ORI also comes with a BBB+ credit rating and a current market cap that’s less than its annual revenues, at only $7.8B. On that basis, it might even seem quite cheap.

The company also brings to the table an unusual insider and employee ownership. Over 8.4% of the company’s SO is owned in this way, and with a TTM ROE of 12.5%, the company is, as I said, above the overall average in this industry.

That Prop insurance is in for changing trends is nothing new. We need only to look at what’s happening on the West Coast, Florida, Louisiana, and other areas to know that insurance companies are watching the markets, the premiums, and where they’re able to operate profitably very closely. While I invest heavily in insurance, I actually view the European and Asian markets as one with somewhat better visibility at this time – but I still invest heavily in NA insurance operations. ORI is at the forefront here, with some superb long-term trends.

ORI IR (ORI IR)

I view any decline here as very unlikely. The company showcases very strong operating earnings, with over $1.6B of net premiums and fees on a quarterly basis. The combined ratio is significantly above many European peers, but a 92.6% is still better (remember, lower is better when it comes to combined ratio – a ratio of below 100% means the company is making an underwriting profit) – yet the company still saw good development in book value, and on a segment basis, improvement.

The combination of a capital-heavy general insurance operation with 65% of business, with a capital-light title insurance operation makes almost sure that there is stability here because of how in opposition to one another such operations are. General insurance operations are low-expense but high-loss operations, while Title goes low-loss but high expense. The title is RE-market influence, while General Insurance is exposed to P&C trends.

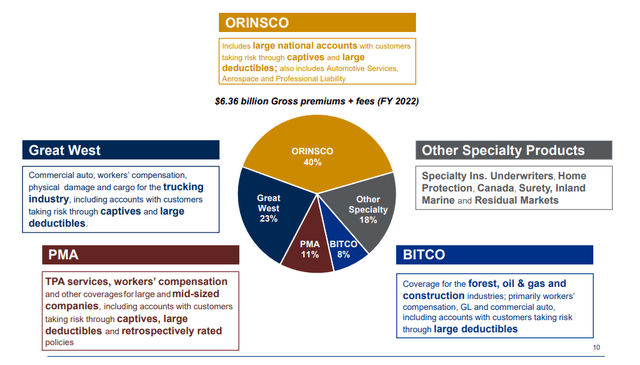

Here is how the company is currently structured.

ORI IR (ORI IR)

The general insurance segment enjoys extremely high retention ratings and far less commoditization, which will serve the company well in this business cycle. Speaking of cycles, the general insurance segment is also far less cyclical with more consistent growth due to how agreements are structured. The company has a real moat here because ORI provides admin and underwriting services that are very difficult and capital-intensive to replicate.

The split in this general segment is heavy towards commercial auto – mostly trucking – at 40%. So correlation would be towards trucking – but it also includes worker’s comp at 21%, liability, inland marine, home insurance, and auto warranty. Home insurance is less than 9% of the mix though out of those total 65%, the company is far less exposed to some of the risks we’re seeing in many other climate-exposed insurers. That’s also why the segment growth looks like this.

ORI IR (ORI IR)

And, as I try to always remind you when I’m talking about these businesses, many of these segments have reinsurance protection – the company’s property-cat exposure is very low.

Top-tier European insurance operations have far better-combined ratios than ORI could seemingly dream of. The company hasn’t gone below 88% since at least before the GFC, while Sampo (OTCPK:SAXPF) for some years had combined ratios below 84%. Even the company target here is 90-95%, and on that basis, the company does quite well. 2Q23 saw no real declines or worries here.

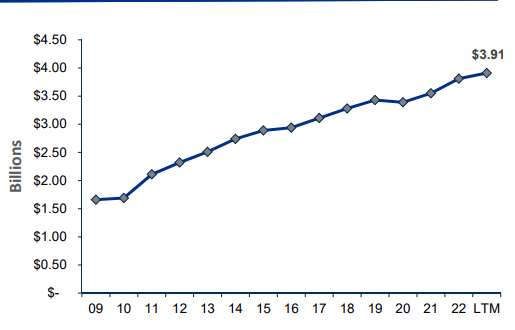

Title insurance, meanwhile, looks completely different – and is in a downward cycle at this time.

ORI IR (ORI IR)

Not bad given the massive COVID-19 growth, but it’s definitely going down now. The company can boast impressively low loss ratios, which only confirms the positives from 2Q23 – and the stability. The company isn’t going up significantly – but is it going down.

ORI is as conservative as some of these operations get. As of the latest results, the company manages a very conservative balance sheet with very strong reserves. Its investment portfolio is bonds and stocks – that’s it. ORI has also been pushing its share price level with buybacks for the past few months – over $600M has been bought back in the last 12 months alone, and with a market cap of less than $8B, that is a significant amount of the outstanding shares.

ORI is really one of the more conservative options on the market out there today in this segment. However, it’s also one of the least appealing insurance investments currently available from a valuation standpoint.

What makes me say this?

Old Republic’s Valuation puts the company at a disadvantage to a relatively cheap overall segment

When I view the insurance sector, it’s an international market with plenty of outstanding possibilities for investment. What’s more, they are usually cheap. ORI isn’t expensive per se, but it sure as heck is no longer cheap.

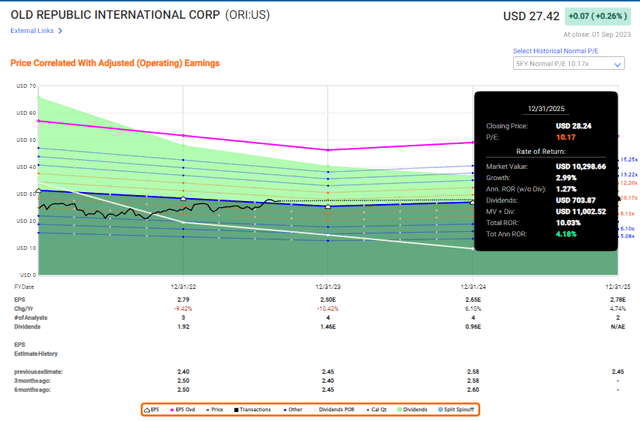

The company tends to trade at around 8.5x P/E, but currently commands 10.5x. That’s overvaluation.

Based on this very simple estimate, we could use the forecasts we have today, averaging around 2-4% annualized growth until 2025E, and see no more than 4% growth per year, and that’s with the company’s dividends. For this sort of company, that is abysmal.

ORI Upside (F.A.S.T Graphs)

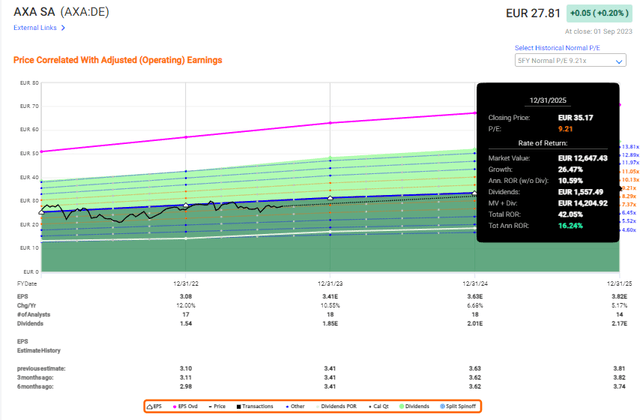

Just as a fun comparison, here is what you could make conservatively by investing in French company AXA (OTCQX:AXAHY), one of the largest insurance businesses in all of Europe with a market cap almost ten times that of ORI- and a yield almost double that of ORI.

AXA Upside (F.A.S.T graphs)

And I wouldn’t necessarily even call AXA “cheap” here. It’s just buyable. ORI, to me, clearly is not.

ORI’s current share price trends are a result of good quarterly trends and significant amounts of share buybacks coupled with being a very conservative operator. There is nothing wrong with this – but as investors, we should be looking for upside. ORI does not provide us with enough upside, even if the company were to perform better than expected. And just as a small point, the company does miss estimates negatively 1/4 of the time.

I could say more, but in fact, I believe that this makes my thesis for the company for me. Because I keep a very close eye on almost every insurance company with a respectable size or exposure in the EU and NA, this one is constantly on my watchlist. Not that long ago when the SEK/USD FX crossed 11 SEK/1 USD, I sold off my position and reinvested that 0.45% in a mix of Euro stocks and SEK stocks. The company is absolutely superb fundamentally, but nothing makes up for this sort of overvaluation for what is usually a volatile sector.

Old Republic is, as it happens, a very underfollowed business both by analysts as well as by the market as a whole. I’d love to buy it even cheaper – like when it was troughing close to $20/share back in June/July of 2022 – but at the time, I was busy buying other companies.

My last share price target for the company was a conservative $24.5/share. I see no reason to change this target here. At $27.4, the company has fulfilled every hope I had for this investment, and I believe it’s time to look elsewhere.

This is a late alert for some of you, but I still believe it’s a decent time to decide whether to rotate or “HOLD” the company. At the very least, I no longer believe this company is a “BUY”.

S&P Global give the company a range of $29-$31, with a $30/share average, and 1 out of 2 analysts at a “BUY”. However, these companies tend to overestimate this company’s ability and pricing, based on a $27-$30/share price for the past few years.

I say it’s time for a rating change.

Here is my thesis on ORI.

Thesis

I would structure my thesis for Old Republic International as follows for the time being.

- Old Republic International is a slightly undervalued business with excellent fundamentals. It has a well-covered yield and low debt, and the results are promising.

- The company’s 20-year history shows a bit of volatility for extended periods of time – but the company has righted and adjusted since, and overall I view the company as “safe.”

- The company is now overvalued. I stick to my PT of $24.5/share, which makes it a “HOLD” here. I have rotated my position in the stock.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them:

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic conservative upside based on earnings growth or multiple expansion/reversion.

It’s no longer cheap, and it’s no longer at a high enough conservative upside. I say “No” here.

Read the full article here