Asseco Poland (OTCPK:ASOZF)(OTCPK:ASOZY) is a terrific company but there are some concerns as the situation with inflation and higher interest rates continue to evolve in their markets. Inflation in the costs is requiring the company to control costs on things that drive revenue growth, including labour. The management is managing to make decisions that drive profit growth, despite some revenue deceleration, but further down the income statement is the issue of higher financing costs. While the company is excellent, their scope to grow earnings is going to be hampered for a while by deceleration in end markets and the rate situation. This goes for most of the economy, and investors need to keep this in mind before it becomes obvious once maturity walls start to get hit in 2024 and onwards.

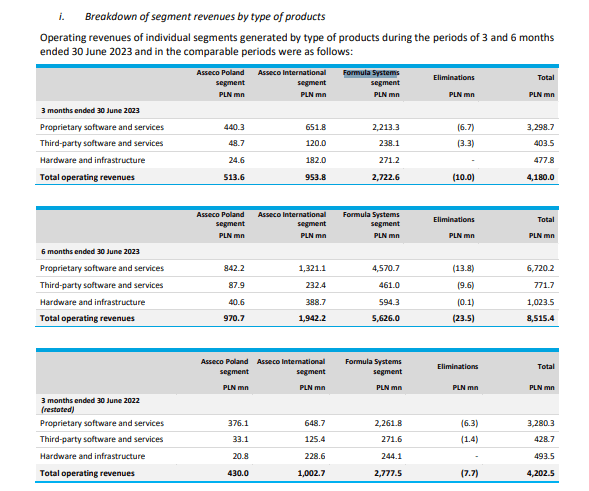

Asseco Poland H1 Breakdown

To note quickly, Asseco Poland is a technology consulting company in the Baltic and Balkan regions, and has achieved phenomenal profit and revenue growth for a decade now. They pay a higher dividend than international peers, and it is because their valuation is much lower than international peers. They have a lot of exposure to the banking and finance technology world, but also quite a lot of exposure through their Israeli subsidiary, Formula Systems (FORTY) which is a consolidated minority-controlled entity, to high tech governmental security and cybersecurity software for the Israeli government. We discuss FORTY in some more detail here.

Revenue growth has been decelerating in the Q2, while it was still strong in Q1. H1 results are coming down, and run-rates are probably not that vigorous on the revenue side. The drivers of declines are their businesses outside of Poland, which is Asseco’s resident market, and in the FORTY businesses which are composed of Tel Aviv and NASDAQ listed tier 2 tech companies. We cover Sapiens International (SPNS) and Magic Software (MGIC) here on SA, which form part of FORTY.

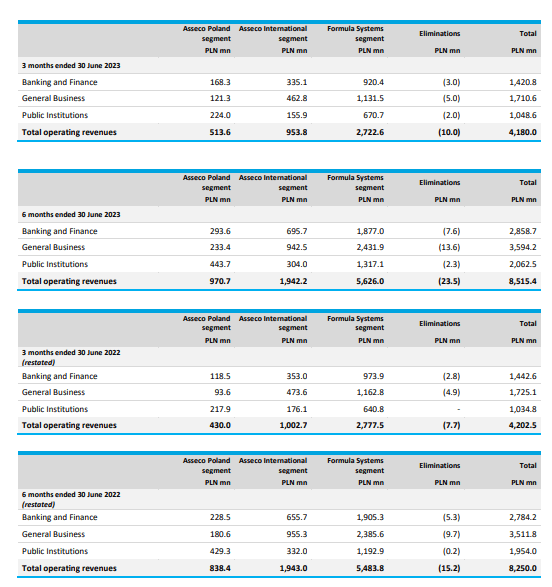

Segment Data (H1 2023 Report)

We note that the declines are being shown in banking and finance on a segment basis. In particular, this segment is especially weak within FORTY, which also works with US institutions. As a tier 2 player and given the banking situation as of March 2023, it makes sense that the slowdown would be concentrated here, and would be the most remarkable in FORTY which is otherwise among the higher tier and higher tech exposures in the Asseco portfolio, since it’s focused on the US market which is going to be more discerning than the Baltic and Balkan markets.

Segment Data (H1 2023 Report)

This may be somewhat temporary, although we are worried about tier 2 banks still int he US. At least the company has been managing the COGS well, which in Asseco’s case is driven by labour costs as it is a consulting company.

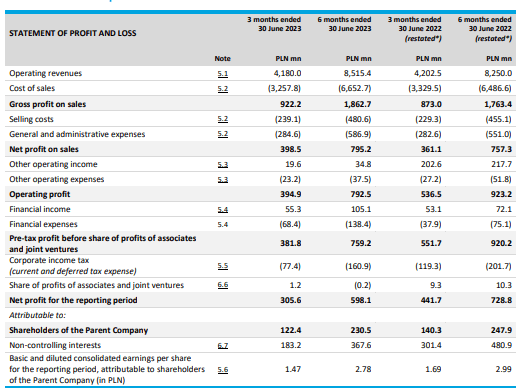

IS (H1 2023 Report)

COGS has come down meaningfully to trump the absolute declines in revenue and actually grow the gross profit YoY. Similarly net profit on sales is up 10% despite inflation in the fixed cost base. This is impressive, as inflation is going to be a pressure on results, even if it is slowing, since revenue growth will be hard to maintain at the previous pace.

Bottom Line

But the bigger and less speculative issue is on the bottom line because of financial expenses. Across all its exposures, there is going to be higher rates putting pressure on results. EUR denominated and USD denominated debt loads, as well as a substantial debt load in Shekels, exposes Asseco to higher rates in all these regions. Quite a lot of the debt structure is fixed at below 4% average interest rates. While there is some collateral for these debts that could in principle pay off the debt, those have fallen in value as well as interest rates rise. It is assured that as fixed debt become variable in some hold-out places, the net income is going to fall further. Current PE is around 13x TTM, but the struggle to grow earnings henceforth makes the absolute valuation uncompelling, even if the relative valuation remains highly attractive compared to peers on international markets, likely enjoying a premium that is not afforded to Polish companies despite the fact that Poland is absolutely a developed and high-tier European economy. 13x PE doesn’t offer sufficient earnings yield considering where risk-free rates currently are. Also the banking and financial exposure is not ideal.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here