Thesis

With the cost of solar panels now lower than all other forms of energy production, we are witnessing a sea change in how we supply our electric grid. As I expect the cost of panels to continue slowly dropping, I am avoiding investing into manufacturers and instead focusing on business models which provide ancillary services. I believe the companies which stand to benefit the most from the widespread adoption of photovoltaics are the ones which can manage to provide value added services to customers.

SunPower Corporation (NASDAQ:SPWR) is a residential solar installer which also provides energy management services. After looking over their financials and valuation, I presently rate SunPower as a Hold.

Company Background

SunPower is a provider of photovoltaic systems and energy management solutions. The company was founded in 1985 by Richard Swanson, and went public in 2005. In 2020, they spun off the manufacturing portion of their business as Maxeon Solar Technologies. In early 2022, they sold the commercial and industrial portion of their business to Maxeon Solar Technologies. They are headquartered in San Jose, California, and primarily offer their services to residential customers.

Long-Term Trends

In the United States, the solar energy market is expected to experience a CAGR of 16.48% until 2028. Globally, the solar panel market has a projected CAGR of 18% through 2030.

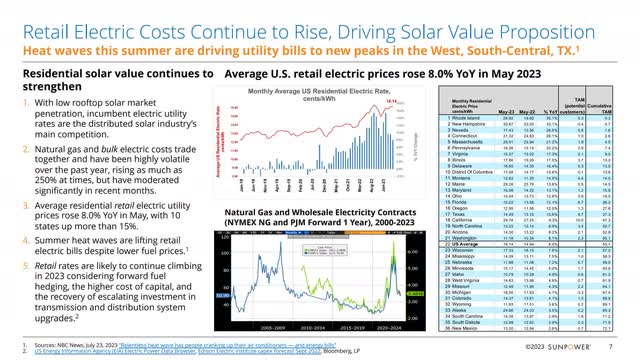

Retail Cost Of Electricity (SWPR Q2 2023 Supplemental Earnings Slide, Page 7)

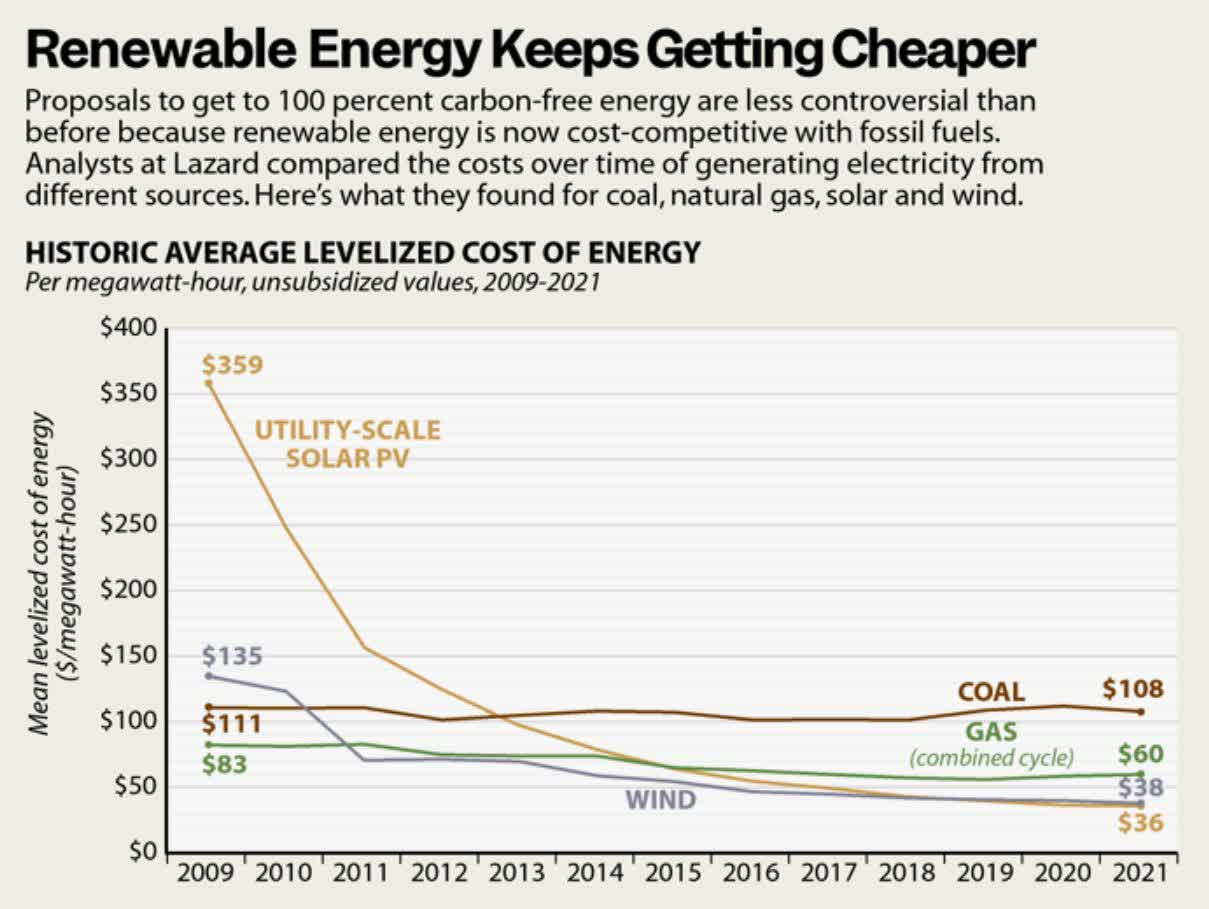

While the retail cost of electricity continues to rise, the levelized cost of energy chart shows that photovoltaics fell below the cost of non-renewables around 2015. As demand forces us to bring new production online, we are now financially incentivized to install new solar systems over all other energy sources.

Levelized Cost Of Electricity (Lazard, Dan Gearino, Insideclimatenews.org)

Guidance

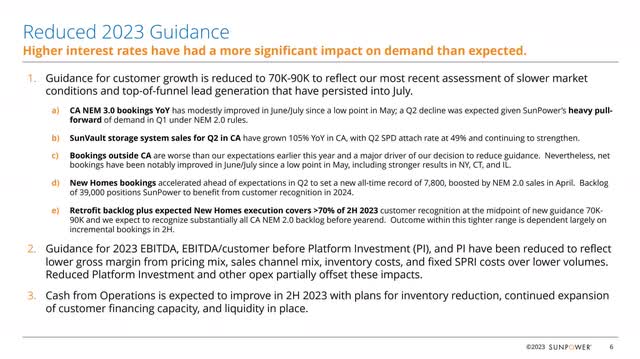

The elevated interest rate environment is causing a slackening of demand. I watch several companies in the industry, and they have all lowered their guidance.

Reduced 2023 Guidance (SWPR Q2 2023 Supplemental Earnings Slide, Page 6)

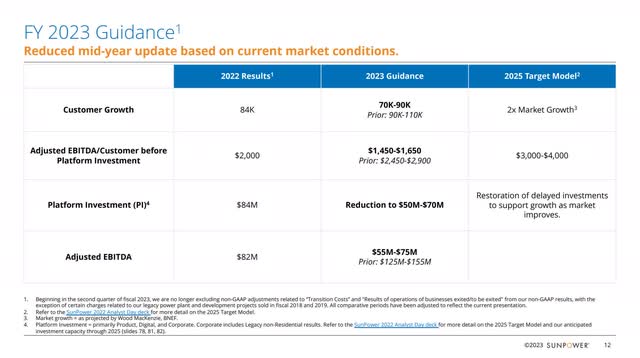

SunPower still projects $55M-$75M in adjusted EBITDA for the full year. This is a downgrade from their previous projected range of $125M-$155M.

2023 Guidance (SWPR Q2 2023 Supplemental Earnings Slide, Page 12)

Although the company should continue experiencing headwinds from interest rates, they also expect the slowdown in demand to allow them to save on equipment costs as the supply chain experiences increased inventory levels over the next 12-24 months. I believe it is possible that this shows up as an improvement in gross margins.

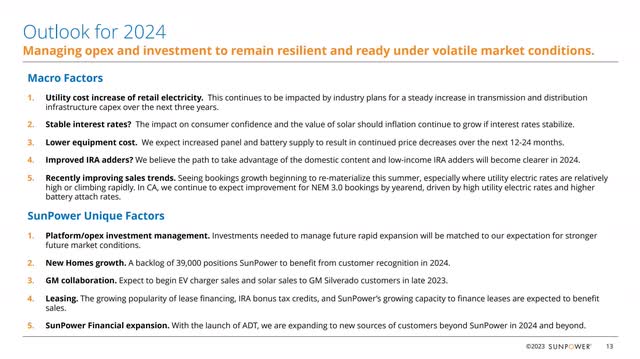

2024 Guidance (SWPR Q2 2023 Supplemental Earnings Slide, Page 13)

Annual Financials

Before I go over their annual financials, I should note that this company reports every January, so for example, the “2022” which appears on the chart spans from January 2022 to January 2023.

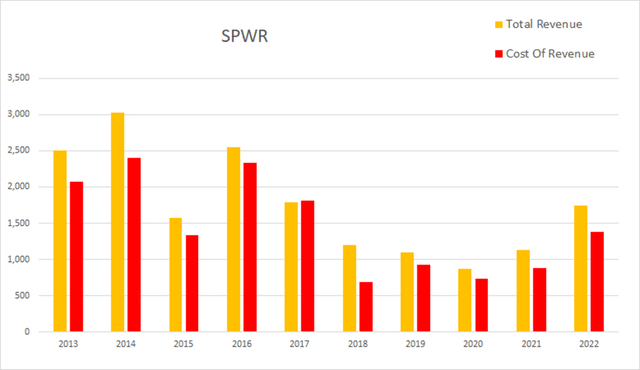

The company appears to have experienced significant variations in its revenue. I am not sure how much of this was caused by the portions of the business which were divested away in 2020 and 2022. When looking at it on an annualized basis, they have been experiencing increasing revenue since its low in 2020. In 2013 they had an annual revenue of $2,507.2M. By 2022 that had dropped to $1,741.1M; this represents a total decline of 30.56% at an average annual rate of -3.40%.

SPWR Annual Revenue (By Author)

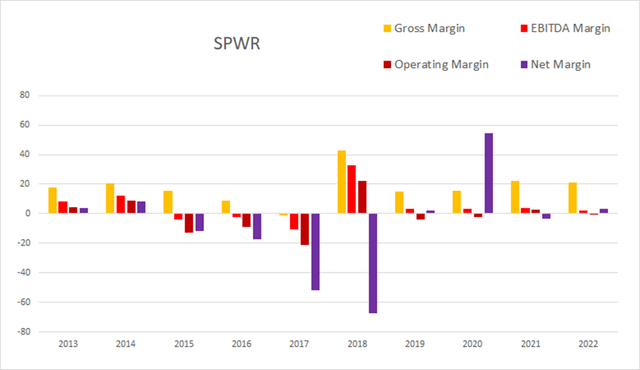

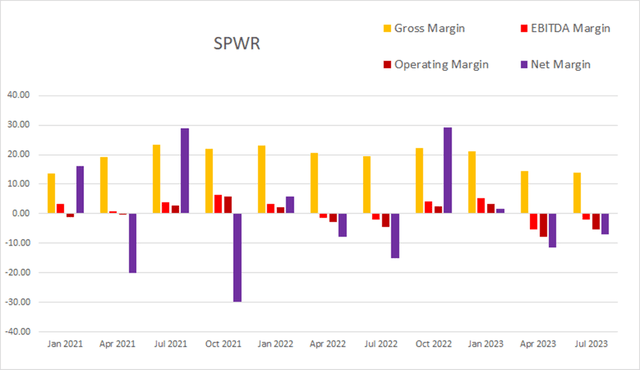

Their gross margins experienced a significant drop in 2017. This was followed by an even larger drop in 2018. They appear to have renormalized into the high teens and low twenties since then. As of the most recent annual report, gross margins were 20.9%, EBITDA margins were 1.98%, operating margins were -0.01%, and net margins were 3.22%.

SPWR Annual Margins (By Author)

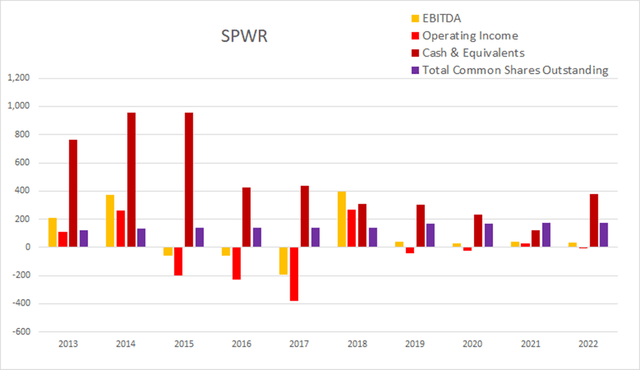

Although the dilution is at a fairly stable pace most years, they experienced a significant dilution event in 2019. Total common shares outstanding were at 121.5M in 2013; by the end of 2022 that rose to 174.3M. This represents a 43.46% increase in share count, which comes out to an average annual rate of 4.83%. Over that same period, operating income fell from $109.5M to -$0.2M.

SPWR Annual Share Count vs. Cash vs. Income (By Author)

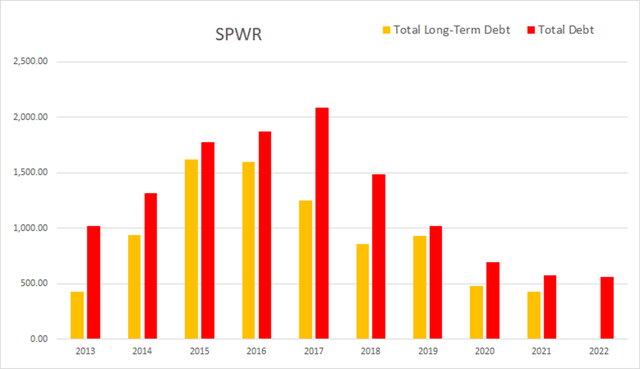

They are in a far better debt situation than they were previously. As of the 2022 annual report, they only had -$18.4M in net interest expense, total debt was $559.2M, and long-term debt was $0.3M.

SPWR Annual Debt (By Author)

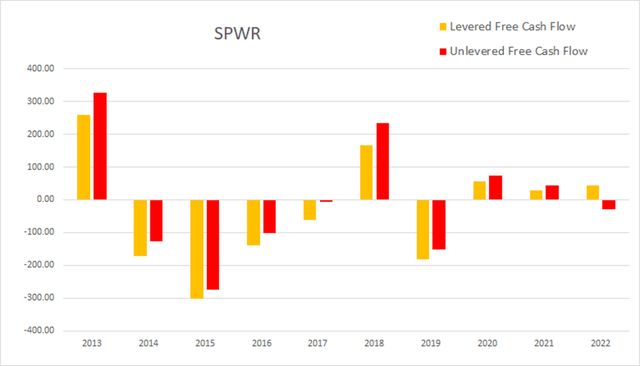

Their cash flow varies significantly from year to year. As of this most recent annual report, the value of their cash and equivalents was $377M, operating income was -$0.2M, EBITDA was $34.4M, net income was $56M, unlevered free cash flow was -$29.30M, and levered free cash flow was $42.80M.

SPWR Annual Cash Flow (By Author)

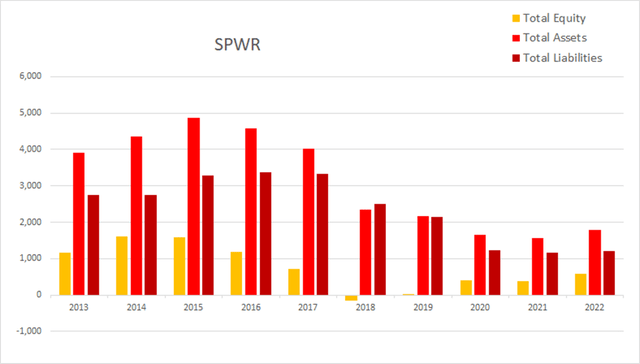

Their total equity went negative in 2018, but has been increasing since then.

SPWR Annual Total Equity (By Author)

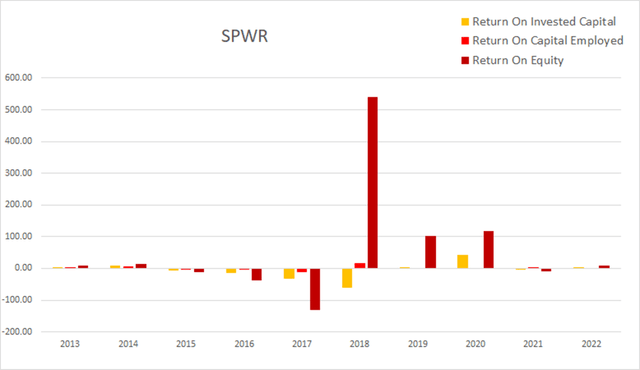

This may be able to change now that they have shed portions of their business model, but SunPower has yet to consistently produce attractive values for return on invested capital. As of the most recent annual report, ROIC was 4.93%, ROCE was -0.02%, and ROE was at 9.73%.

SPWR Annual Returns (By Author)

Quarterly Financials

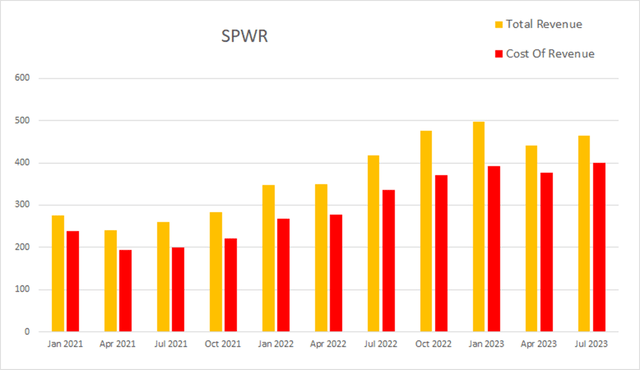

With the two most recent quarters out of line with the established trend, their quarterly financials show a slacking in demand. Eight quarters ago, SunPower had a quarterly revenue of $260.8M. Four quarters ago that had risen to $417.8M; by this most recent quarter that had grown further to $463.9M. This represents a total two-year rise of 77.88% and an average quarterly rate of 9.73%.

SPWR Quarterly Revenue (By Author)

Their gross margins appear to be in decline. As of the most recent quarter, gross margins were 13.82%, EBITDA margins were -2.13%, operating margins were -5.41%, and net margins were -7.14%.

SPWR Quarterly Margins (By Author)

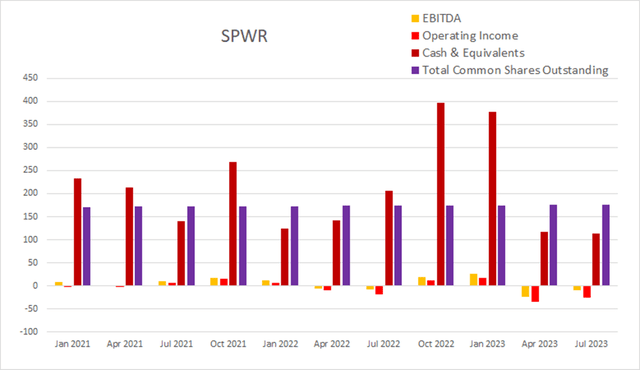

Their dilution rate continues to stay small. The sum of their last eight quarters of dilution comes to 1.38%; over the last four quarters, this has dropped to 0.63%.

SPWR Quarterly Share Count vs. Cash vs. Income (By Author)

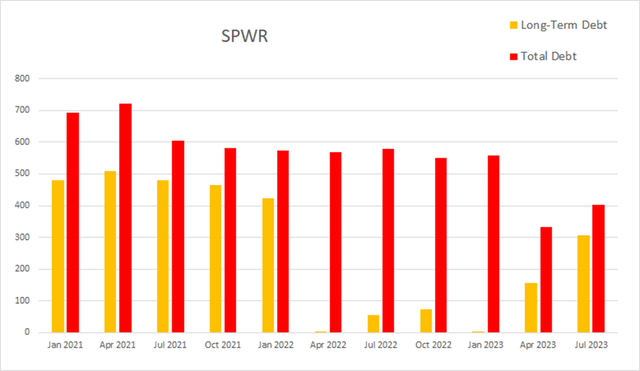

Although they appeared to have paid their long-term debt down when looking over their annual financials, their quarterly reports are showing that they recently took on new debt. This most recent quarter, SunPower had -$5.5M in net interest expense, total debt was at $403.5M, and long-term debt was at $305.7M.

SPWR Quarterly Debt (By Author)

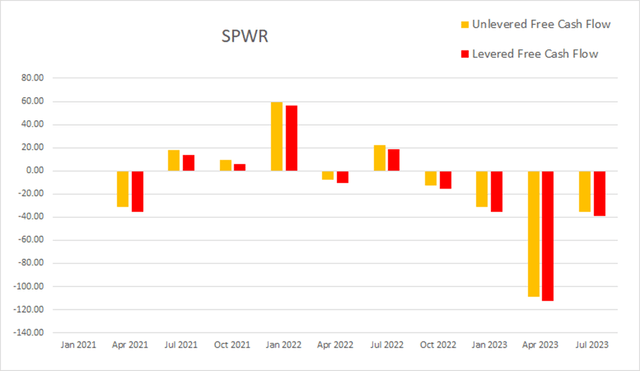

So far, the slowdown in demand is hurting their cash flow. As of the most recent earnings report, cash and equivalents were $114M, quarterly operating income was -$25M, EBITDA was -$9.9M, net income was -$33.1M, unlevered free cash flow was -$35.70M, and levered free cash flow was -$39.3M.

SPWR Quarterly Cash Flow (By Author)

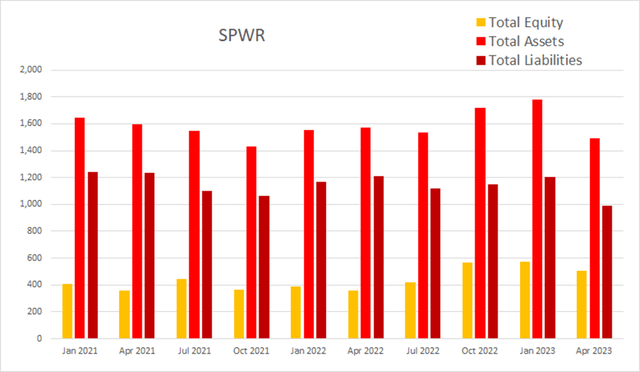

When look at their total equity on a quarterly basis, it appears to be slowly rising.

SPWR Quarterly Total Equity (By Author)

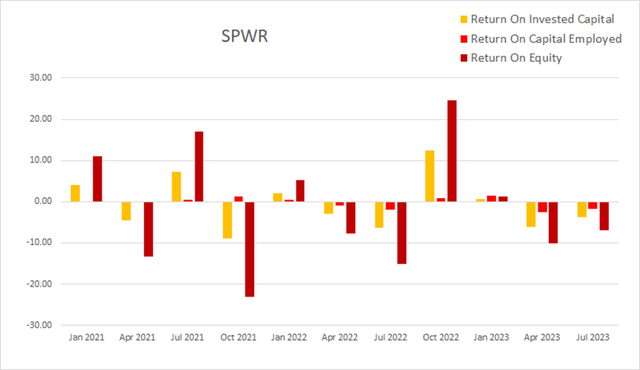

Their returns continue to stay unimpressive. As of the most recent earnings report, ROIC was -3.76%, ROCE was -1.70%, and ROE was at -6.93%.

SPWR Quarterly Returns (By Author)

Valuation

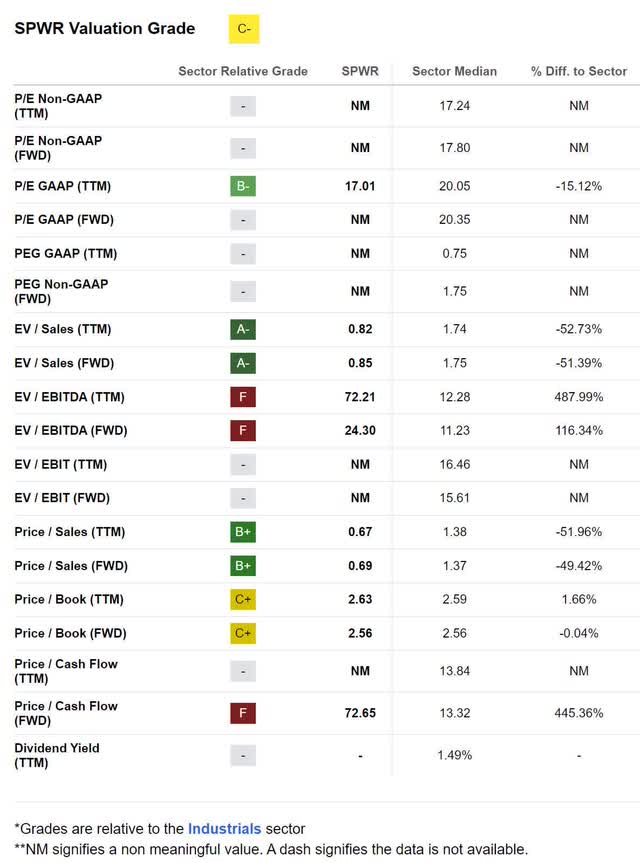

As of September 1st, 2023, SunPower had a market capitalization of $1.25B and traded for $7.29 per share. They do not pay dividends. Seeking Alpha does not list a forward P/E, but they do show a trailing P/E of 17.01x. Unfortunately, their EPS Long-Term CAGR is listed at -4.0%. They currently have a forward EV/Sales of 0.85x, an EV/EBITDA of 24.3x, a forward Price/Sales of 0.69x, a Price/Book of 2.56x, and a Price/Cash Flow of 72.65x. Considering their poor cash flow and negative values for long-term EPS growth, I currently view the company as overvalued.

SPWR Valuation (Seeking Alpha)

Risks

SunPower is currently dealing with headwinds which are caused by elevated interest rates. If inflation were to begin going back up, the Fed will likely have to raise rates even further. The company also faces a risk from the possibility of the Fed having to leave rates elevated for a longer period than expected.

The soft landing the Fed has been aiming for may not materialize. With rates currently elevated, and the bond market inverted, I am operating under the assumption that we will enter into in a minor recession within the next year or so.

Catalysts

When rates lower, it will provide a boon for investments into solar. When this happens, the industry may even experience a glut of pent-up demand, which has been delaying their installation plans until the rates come back down.

The incorporation of cheap storage into our grid will improve the total amount of solar it can efficiently support. I expect that the adoption of iron-air and other new battery types will produce strong tailwinds for the photovoltaic industry.

Conclusions

Before SunPower spun off their manufacturing division in 2020. I refused to even consider them. The current version of the business is more lean than it used to be and has the potential to evolve into one which might be able to find additional profits through providing value added services to consumers.

As I expect the Fed to leave rates elevated for several more months, SunPower may experience a significant decline in both demand and valuation over the coming quarters. With the long-term demand for solar expected to continue rising, I believe significant enough dips should be viewed as buying opportunities. Even if the company never evolves into a long-term compounder, it should still experience a valuation rebound from any lows it reaches during a recession.

Read the full article here