Investment Thesis

If your outlook on gas shipping is bullish and you want to diversify away from USD, you might have considered Avance Gas (OTCPK:AVACF). It has been a good alternative for the divided-oriented gas shipping investor for at least a year. Its ability to consistently deliver dividend yields close to 20% is attractive. While similar to its peer, BW LPG (OTCPK:BWLLF), it exhibits a few characteristics that may appeal to some investors. Most importantly, being a part of shipping tycoon John Fredriksen’s portfolio of companies, the magnate holds close to 80 percent of shares.

Avance Gas reported Q2 earnings of $37 million, the same as its previous record Q1, and “anticipate[s] doing even better in the second half of the year with expected TCE/day in the third quarter in the high $50s compared to an average of mid $50’s in the first half of the year[,]”, said Oystein Kalleklev, CEO, in its latest quarterly earnings report.

Its fleet is likely among the newest in the world, having an average age of 6.5 years, according to my calculations.

In fact, if already announced sales (of 2008-built Iris Glory) and deliveries (two new dual fuel VLGCs in Q1 2024) go forward as planned, its fleet age will be even lower – 6.2 years on average – at the end of Q1 2024, everything else equal.

Unfortunately, its strong share price development during the past quarters has made it relatively expensive compared to its peers. It is about to embark on a new product offering (ammonia cargoes), which may or may not come to fruition, and has taken delivery of two VLGCs this year, further increasing its leverage. It is also running a very high dividend payout, which is not sustainable. However, in my estimation, there is still upside potential in its stock price. For this reason, I am rating Avance Gas as a weak buy.

An alternative could be its peer, BW LPG, which has comparable yields and may have a more considerable upside potential in its stock price (at the time of writing, I have a long position in BW LPG).

This analysis will be divided into three parts:

- In the first section, I’ll review the fundamentals for Avance Gas, focusing on ratios relevant to the dividend investor;

- In the second section, company-specific factors will be discussed, as well as estimating a target price;

- The third and final section will present a current market outlook.

This is the second article in a three-part series I am currently doing on VLGC pure plays BW LPG, Avance Gas, and Dorian LPG (LPG).

Let’s begin by taking a look at the fundamentals.

Company Overview

Avance Gas was founded in 2007 as Stolt-Nielsen Gas and has traded on the Oslo Stock Exchange since 2014. It owns and operates a fleet of 15 VLGC vessels, making it a slightly smaller owner-operator than its peers Dorian LPG and BW LPG. Currently, it has four MGCs on order, scheduled for delivery starting in 2025.

Fundamentals: A Mixed Picture Compared To Its Peers

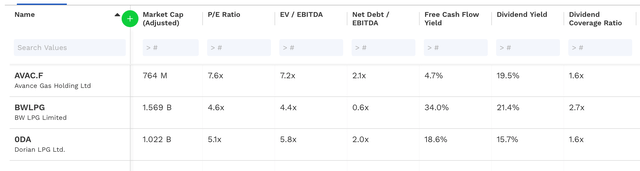

The table below displays a snapshot of some fundamental indicators for Avance Gas and its two primary peers, Dorian LPG and BW LPG. We’ll discuss them one by one, beginning with the P/E ratio.

Fundamental indicators Avance Gas (Finbox)

The P/E ratio for Avance is relatively higher than its peers, at about 7.6, which trades at 4.4 (BW LPG) and 5.6 (Dorian). Furthermore, its EV/EBITDA ratio is close to seven, also higher than its peers. This points to Avance’s stock being relatively more expensive.

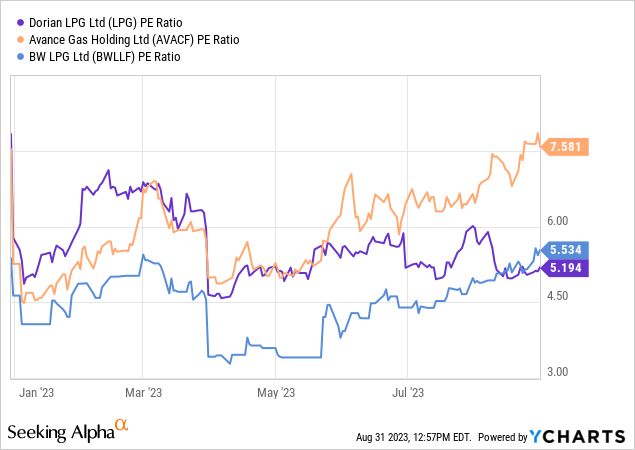

Investigating how P/E ratios have developed year to date shows the following picture:

Avance Gas has traded consistently at a premium to its peers since April. BW LPG has become relatively more expensive during the past few months after consistently trading at a discount relative to its peers.

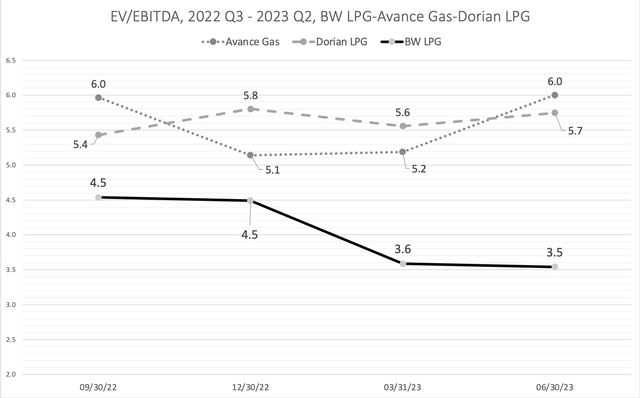

Let’s look at another indicator that can help us gauge the price we’re currently paying for Avance Gas stock, the EV/EBITDA ratio:

EV/EBITDA ratio, Q3 2022 – Q3 2023 (Author’s calculations, see below for details)

After a rather sizeable downward adjustment at the beginning of the year, the EV / EBITDA indicator has since increased and surpassed Dorian LPG’s ratio. In other words, regarding this ratio, Avance Gas and Dorian follow each other closely.

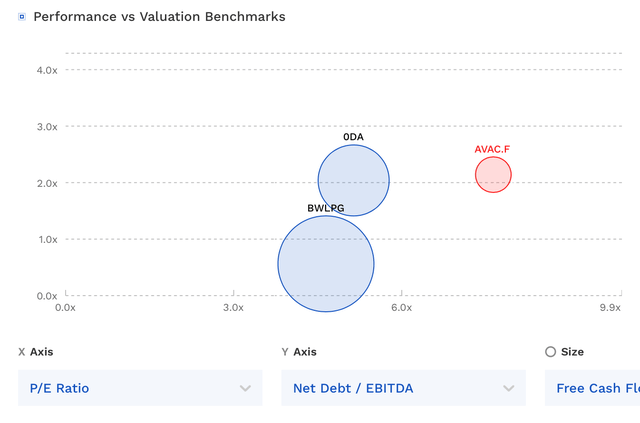

Finally, let’s combine the P/E ratios, the Net Debt / EBITDA ratio, and the free cash flow yield into one graph:

P/E, Net Debt / EBITDA, Free cash flow yield (Finbox)

Based on the review of these indicators, Avance Gas appears more expensive than its peers. Its attractiveness is relatively lower with its somewhat higher leverage and low free cash flow.

Let’s review how it fares in terms of dividends.

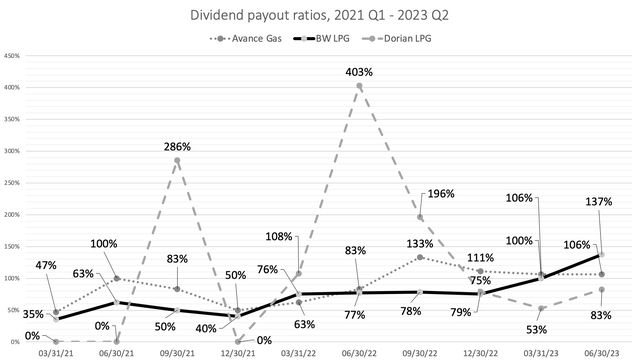

Dividend Payout Ratio: Comparing Peers To Avance’s >100% Payout

Avance has run a payout ratio of over 100 percent for three straight quarters. A ratio above 100 percent is worth investigating, as no company can pay out more than its earnings indefinitely.

Comparing the payout ratios of Avance and its peers for the past two years paints a picture of three companies with different approaches to dividend payouts:

Dividend payout ratios (Author’s calculations; see below for details)

I will expand on Avance’s and its peers’ dividend policies in the next chapter, and as you’ll see, the payout ratios over time roughly reflect their policies:

- Dorian has paid out significant, irregular dividends, resulting in a graph with large swings.

- BW LPG has tied its payout to its debt level, resulting in a gently sloping graph. A recent change to its policy caused the payout ratio to jump to 137% in the latest quarter. I will explain that below.

- Avance has taken an opportunistic approach to its payout ratio, aiming to increase its dividend as the market has improved over the past two years.

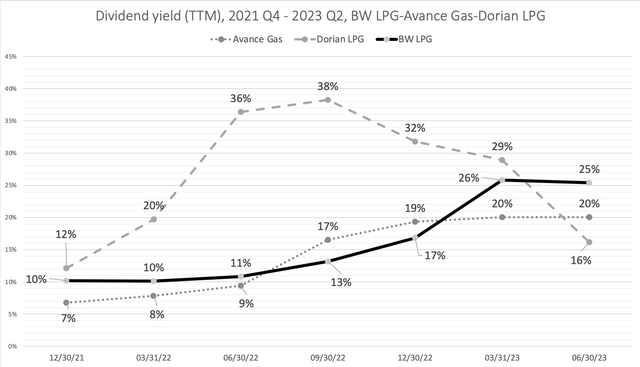

Dividend Yield: Reached A Plateau?

Like its peers, Avance has taken advantage of the strong market during 2022 and 2023 to increase its dividend. However, its relatively rapid increase in share price has reached a plateau of around 20 percent, which is still a very high yield, of course – and about on par with its peers.

Dividend yield (Author’s calculations; see below for details)

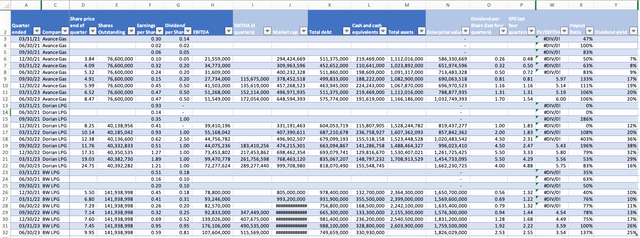

To create the custom charts shown above, containing the EV/EBITDA ratio, dividend payout ratios, and dividend yields, I collected figures from each company’s quarterly reports (found on their websites). I combined them into the following data table:

Data table and calculated ratios (Author’s calculations using quarterly reports data)

Dark blue columns are input, while light blue columns are calculated values. In some cases, a NOK figure has been converted to USD. The prevailing NOK/USD rate on that date (column A), published by The Central Bank of Norway, was used for this conversion.

- EBITDA (4 quarters): Rolling sum of column H.

- Market cap: Column D * column E

- Enterprise value: Market cap + total debt – cash and cash equivalents

- Dividend per share last four quarters: Rolling sum of column G

- Earnings per share last four quarters: Rolling sum of column F

- EV/EBITDA: Enterprise value / EBITDA (4 quarters)

- Payout ratio: DPS / EPS

- Dividend yield: DPS last four quarters / Share price at the end of the quarter

Let’s turn our attention to company-specific factors.

Company-specific Factors

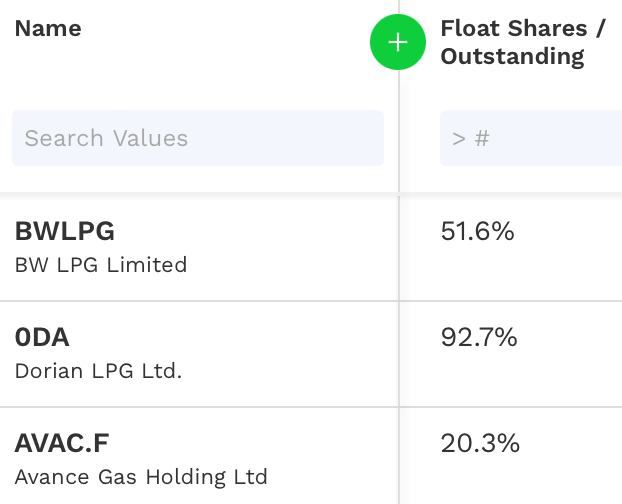

Low Free Float, But Shipping Tycoon John Fredriksen Is The Major Shareholder

Compare free-floating shares of Avance Gas and its two peers:

Free float (Finbox)

While 92.7% of Dorian LPG’s outstanding shares are free float, only 20.3% of Avance Gas’s shares are. Looking at the list of its 20 most significant shareholders, the reason becomes apparent immediately: Hemen Holding Limited owns about 76.7% at the end of 2022. Frontline Ltd, the tanker company controlled by Fredriksen, also owns about 0.6%.

In case you are unfamiliar with Hemen, it is an investment vehicle of shipping tycoon John Fredriksen, owner of the world’s largest tanker fleet. Through his investment companies, his immediate family and himself hold stakes in companies such as Frontline Ltd, Golden Ocean Group, Mowi, and Flex LNG. According to Forbes, the Norwegian-turned-Cypriot citizen is worth about $13.5 billion as of August 15, 2023.

Having one dominant shareholder is not necessarily a bad thing in and of itself, of course. Also, it’s hard to argue against the success of Mr. Fredriksen’s shipping empire. Intuitively, simply following the money of the big players seems like a sound strategy. However, that implies one can follow their timing, which may take work. With almost 8o percent ownership, Mr. Fredriksen can exert an outsize influence on the company, which is probably why you will find few institutional investors on the top 20 list of shareholders (see p. 48) in Avance Gas. Finally, the low free float makes for a more volatile stock.

Dividend Policy: At The Board’s Discretion

The table below compares the dividend policies of Avance Gas and its two primary peers.

Its dividend policy states (p. 66 in the annual report 2022):

Avance Gas’s objective is to generate competitive returns to its shareholders. The company’s dividend policy is balanced between growth opportunities for Avance Gas and cash returns for the shareholders. Whilst it is the intention to pay regular dividends, the level of any dividend will be guided by current earnings, market prospects, current and future capital expenditure commitments and investments opportunities.

Dorian LPG’s dividend policy states (found on F-27 in its latest 10-K):

All declarations of dividends are subject to the determination and discretion of the Company’s Board of Directors based on its consideration of various factors, including the Company’s results of operations, financial condition, level of indebtedness, anticipated capital requirements, contractual restrictions, restrictions in its debt agreements, restrictions under applicable law, its business prospects and other factors that the Company’s Board of Directors may deem relevant.

Following strong market conditions, Dorian LPG has regularly paid irregular dividends in the past quarters. Ted Young, Dorian LPG CFO, commented on this apparent contradiction in his prepared remarks in Dorian’s Q1 2024 earnings call, also summing up its dividend policy in one concise sentence:

While many investors and analysts like to suggest that these dividends are no longer irregular, we underscore that they are indeed irregular and subject to the discretion of our board and the various factors that John previously outlined in his comments. VLGC rates are not regular and thus we don’t think our dividend policy should be either.

Finally, let’s consider BW LPG’s dividend policy. The quote below is from its Shares and Dividend page on its website. However, in its latest earnings report, a change was announced. The board will consider “trading profit” instead of net profits after tax. This non-regulatory press release published in late July also alluded to this change. I will attempt to explain this change in a follow-up article on BW LPG.

Anyway, the policy on its website reads,

BW LPG aims for a payout ratio of 50% of Net Profits After Tax (NPAT), on an annual basis, adjusted for extraordinary items, after taking into consideration appropriate levels on leverage, capital expenditure plans and financing requirements, financial flexibility, anticipated cashflows. When net leverage is below 30%, the policy targets a payout of 75% of NPAT on an annual basis; and when net leverage is below 20%, the policy targets a payout of 100% of NPAT.

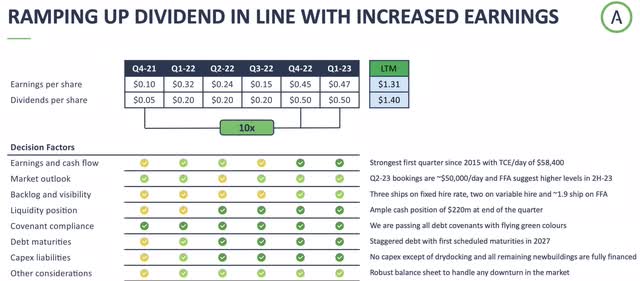

Avance Gas and Dorian are among those companies keeping an open dividend policy. By “open,” I mean not committing to specifics in advance. While Avance’s and Dorian’s policies put weight on flexibility for its boards, BW LPG aims for predictability based on pretty detailed guidance regarding how some of its key indicators develop. However, when one reviews Avance’s quarterly reports, this picture is somewhat nuanced. It uses 8 “decision factors” to decide on its dividend payout:

Avance Gas Q1 2023 Dividend Scorecard (Q1 2023 report, p. 6)

Each factor includes a one-sentence summary, as seen on the right side of the slide above. This visibility into its decision factors allows us to gain more insights into Avance Gas’s dividend policy. Still, each of the eight factors allows for broad discretion on the board’s part.

As I’m looking for predictability and consistency when picking dividend stocks for my portfolio, I prefer a policy such as BW LPG’s, which sets out a target payout ratio.

Avance’s CEO Is Also The CEO Of Flex LNG

CEOs who are managing multiple companies at the same time. Yes, a select few do it. I’m skeptical. I don’t quite get one can fill such an all-consuming role two or more times and still provide each company the necessary attention.

Nevertheless, at least some of those CEOs are, in at least some respects, wildly successful.

Take Elon Musk, for example. While building Tesla, he somehow found the same to revolutionize the satellite and space industries. Then he bought Twitter. Other well-known examples of CEOs managing multiple companies are Warren Buffett, Richard Branson, and Carlos Ghosn.

If Mr. Musk’s dividing his time between companies means that his ability to lead Tesla suffers, he has found competent people to run the organization daily. And, more importantly, develop its people. Look at this article over the WSJ, for example, on Tesla alums having raised more than $26 billion for 30 companies over the past decade.

One could argue that leading more than one large company at a time could be done if the companies in question share similar characteristics, services, or people. Mr. Kalleklev of Avance Gas is also the CEO of Flex LNG, of which just under half of the shares are owned by Mr. Fredriksen.

Mr. Kalleklev visited the Vonheim podcast some time ago (that particular episode is in Norwegian, unfortunately. As a side note: Mr. Kalleklev is a recurring guest, for the most part speaking in English. But I digress.)

In the episode, Mr. Kalleklev talks about his professional environment for the first few minutes. Frontline Ltd, Golden Ocean Group, Ship Finance, and Avance itself are all Mr. Fredriksen-owned or controlled companies located in a small area of Oslo, Norway. According to Mr. Kalleklev, they manage about 270 ships and focus on operational excellence. This concentration of companies sharing a similar structure, goals, and ownership in one place is conducive to creating a culture of excellence, obviously benefitting Mr. Kalleklev and, thus, Avance Gas.

Mr. Kalleklev scores a point by being one of the few C-level executives active on LinkedIn, sharing his insights and knowledge, and commenting on the industry he’s part of. His consistent activity on there makes him worth following on that platform. That’s also an excellent addition to the official investor communication through quarterly and annual reports and press releases.

Oystein Kalleklev joined Avance Gas in March 2022 as executive chairman after former CEO Kristian Sørensen (who is set to become CEO of peer BW LPG on Sept 1) resigned. No official reason was given. However, the Norwegian financial newspaper Finansavisen claimed “poor chemistry” with Mr. Fredriksen was the reason for Mr. Sørensen’s resignation.

Taking A Bet On Future Growth In Seaborne Ammonia Trade: Ordered Four Medium Carriers

Avance Gas recently announced it is acquiring two MGCs (40,000 cbm), with an option for two additional vessels for delivery in 2025. The option was declared on August 21, 2023, making the order size four vessels in total.

The vessels will be able to carry both LPG and ammonia and run on dual fuel. The mandatory disclosure cites “The seaborn[e] ammonia trade is expected to grow significantly in the coming years due to the numerous blue and green ammonia projects.” as its main driver for this new build contract.

This is an exciting move by Avance as it departs from its VLGC-only fleet profile and into medium carriers. The ammonia trade looks promising, but only time will tell if those promises follow through.

The Target Price For Avance Gas Stock

The company has recently posted a net income-to-revenue margin of 35 percent (2022) and 38 percent (TTM, Q1 2023 – Q2 2022). I expect the strong freight market to continue, and Avance will continue operating as it does today. It has reported a $265 million in revenues TTM (Q1 2023 – Q2 2022), and I’ll use $275 million as expected revenues for 2024 as a conservative growth estimate for next year. That will mean even higher revenues than in 2022, which allows for an expected net profit margin of 40 percent, which means a net profit of $110 million.

I will presume a more conservative dividend payout ratio, however, as Avance won’t be able to sustain a very high percentage (even >100%) indefinitely. Accordingly, I’ll adjust its payout ratio to 75 percent long-term, as I expect the company to continue returning as much as it can to its shareholders, but I still would like to add some caution. That implies a future dividend of $80 million ($1.05 per share).

Further, I estimated Avance Gas’s beta at 1.1, using two years of historical daily closing prices. Assuming a 12 percent return for the market and 5 percent risk-free interest, an estimated required return rate of 12.7%: 0.05 * 1.1(0.12 – 0.05) = 0.127.

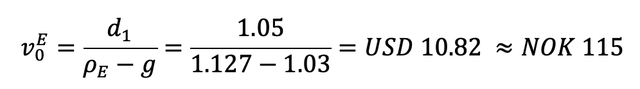

I’ll use expected GDP growth (3%) for the long-term growth rate. Now we have all the necessary input variables into the dividend discount model:

Avance Gas valuation using the dividend discount model (Author’s calculations)

Avance Gas closed at NOK 99.80 on August 21, 2023, indicating about 15 percent upside.

Company Risks

- Problems arising in Mr. Fredriksen’s empire could spell bad news for Avance. Being a relatively minor holding of Hemen, it could be put up for sale at a potentially destructive time. A deal would also sever its ties with its shared business services and remove it from its cluster-like position.

- With the order of four medium-sized ammonia carriers, Avance is changing its fleet composition from 100% VLGC to about 20% MGC and 80% VLGC. In itself, this move adds complexity to its operations. In addition, ammonia trade volumes are expected to increase. It remains to be seen if volumes increase as much as expected.

Let’s focus on the final section: the market outlook.

Market Outlook Remains Strong For VLGC Pure Plays

Avance Gas reiterated its positive outlook in its Q2 earnings report.

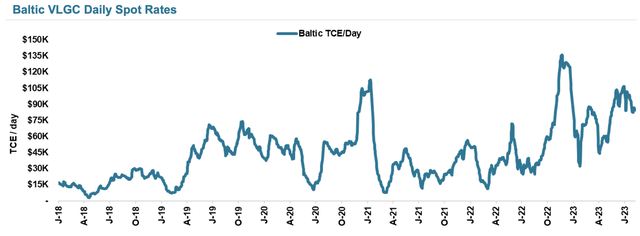

Freight rates have remained strong through the second quarter and into the third. After hovering close to $100,000/day for much of May through July, rates have slipped to about $78,000/day, Fearnleys Fearnpulse reports. Looking back five years, this is a robust day rate for this period of the year, as can be seen from this graph (Dorian LPG’s August 9 Investor Presentation, p. 22):

Freight rates, 2018-2023 (Dorian LPG Investor Presentation, Aug 9, 2023, p. 22)

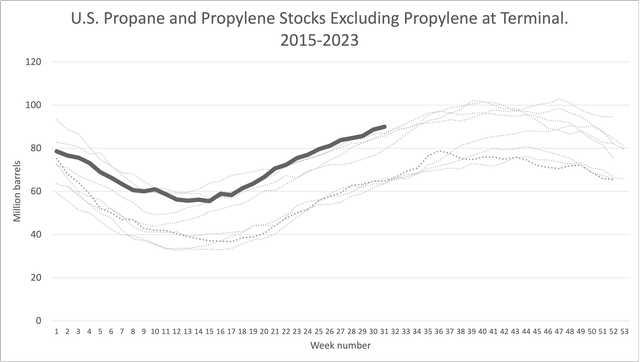

Largest U.S. Propane And Propylene Inventories In 8 Years Supports Exports

The U.S. is the largest producer of LPG, and extensive inventories are conducive to exports. Using EIA’s publicly available data, I compiled the graph below, which shows that stocks have remained high for much of the year.

U.S. propane stocks (EIA data)

The thick black line represents 2023, while each gray line represents the remaining years in this period. As of August, 90 million barrels were stocked, marking the largest stockpile over the time horizon.

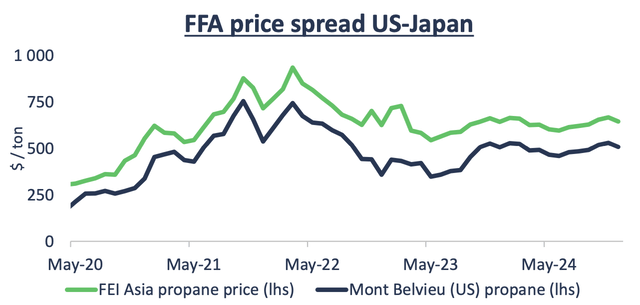

East-West Price Arbitrage Continues

The US-Japan price spread remains elevated, even in the forward agreements extending 2024. The east-west arbitrage is a driver of liftings between exporters, such as the U.S., and importers, such as Japan.

In its Q1 2023 presentation, Avance Gas offers this illustration:

Price spread, US-Japan (Avance Gas Q1 2023 presentation)

An article on FreightWaves titled “Panama Restrictions are Rerouting LPG Shipping Flows” sums up the status quo:

Spot rates are heavily driven by arbitrage: the difference between the price of LPG where it’s produced, in the U.S., and where it’s sold, in Asia. “As of today, LPG is super-cheap in the U.S., driven by very high inventory levels … while demand is strong in Asia,” said Kalleklev.

The price of LPG is currently $275 per ton more expensive in Asia than in the U.S. The transport cost is $175 per ton. That leaves $100 per ton. The average VLGC holds 45,000 tons, equating to a profit of $4.5 million on a single voyage.

“It’s immensely profitable to move our cargo from the U.S. to Asia — and that means you can also pay higher freight,” said Kalleklev.

Large Markets China And India Have Seen Increased Year-on-Year demand In 2023

In its August 9 investor presentation, Dorian offered Y/Y growth rates for the China and India markets. Chinese imports grew 21.9% year-on-year, while Indian imports grew 2.4% year-on-year. While PDH plants drive Chinese demand, Indian demand originates from the residential sector.

As these large markets contribute to demand exceeding available production in the region (Middle East), their continued demand growth increases ton-mile demand. Ultimately, this benefits VLGC shippers.

Long Waiting Times In The Panama Canal Reduces Spot Vessel Supply

Wall Street Journal published an article on August 18 titled “The Panama Canal Has Become a Traffic Jam of the Seas.” Those interviewed for the article are Oystein Kalleklev, CEO of Avance Gas, and Tim Hansen, CCO of its peer Dorian LPG.

This paragraph, in particular, illustrates just how much the drought in the Panama Canal affects a company like Avance Gas:

Oslo-based Avance Gas, which operates 17 vessels, has rerouted about three-quarters of its ships moving U.S. exports of butane and propane. Now vessels carrying those products to customers in Japan, South Korea and China sail through the Suez Canal or around the Cape of Good Hope.

“Waiting time is one thing, but it’s also the uncertainty,” said Øystein Kalleklev, the company’s chief executive. “It’s risky to fix a ship with no firm itinerary because you can lose the contract if the wait is too long.”

Longer waiting times in the Panama Canal support freight rates in two ways:

1. Reducing spot capacity in the market, as vessels are trapped in the canal, having no choice but to wait;

2. Increasing ton-mile demand, as operators skip the canal and take the longer route around Cape of Good Hope or the Suez Canal.

This situation mainly affects gas carriers because they are usually booked on short notice. Container vessels may book their transit a year in advance, leading to priority in the canal over vessels such as gas carriers.

For further reading about Panama Canal delays, I recommend the FreightWaves article referenced in the previous section.

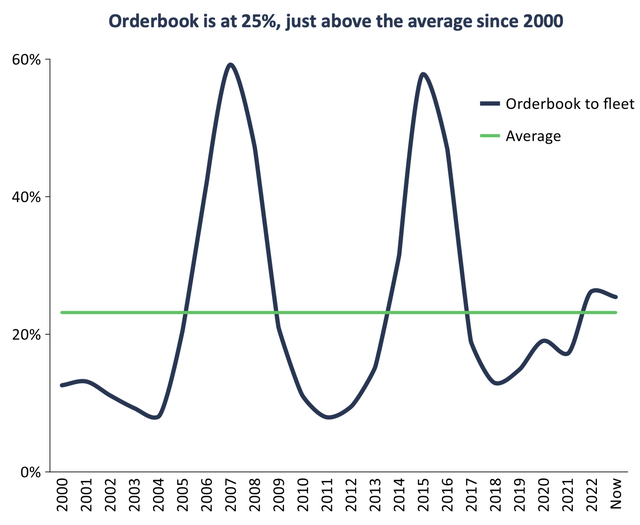

Global Orderbook-to-Fleet Ratio Remains Stable, Signalling Only Small Capacity Increases

In its investor presentation, Dorian LPG notes, “Orderbook-to-fleet stable at ~18%” (p. 24). In June, Avance Gas held a presentation for the Marine Money Conference. In it, it noted a ratio of 25%, shown below. In any case, an 18 or 25% order book-to-fleet ratio is just north of the average.

Orderbook to world fleet, 2000-2023 (Avance Gas Marine Money Conference presentation, June 2023)

In addition, yards are reportedly sold out for at least another year. There are a few signs that owner-operators will “build-out” of this cycle.

Market Risk: What Could Make The Market Outlook Worsen?

The factors mentioned above work to support the current beneficial outlook for VLGC shipping. However, there are many possible ways for that to change. Examples include:

- U.S. inventories depend on domestic demand and production capacity. A colder-than-expected winter, or production disturbances, could reduce inventories enough to lower the propensity to export by raising prices.

- Panama Canal could experience above-normal rainfall, thereby reducing wait times, or the canal could see the number of vessels with preference (e.g., container vessels) drop, freeing up capacity for other dishes.

- As seen in the order book-to-fleet graph above, the cyclic nature of this ratio was broken in 2020. I don’t expect this new pattern to represent a new normal. High new build prices combined with attractive freight rates will make smart players find ways to tap into that possible payoff.

- In the medium to long term, a resolution to the Ukraine war could make Russia, a large gas producer, return to the world stage.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here