Note: All amounts discussed are in Canadian Dollars

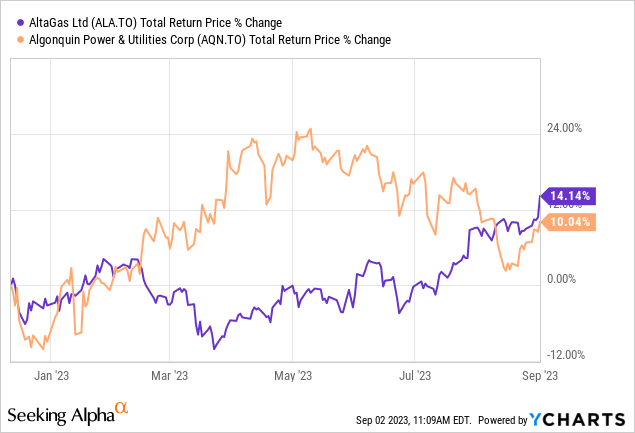

On our last coverage of AltaGas Ltd. (TSX:ALA:CA) we compared it versus Algonquin Power & Utilities Corp. (AQN) and told you why we would buy AltaGas, but not AQN. We concluded our thesis with the following.

We reiterate our buy rating on AltaGas as the stock is truly cheap and remains our top pick in the Canadian regulated utility segment. Yes, the dividend is modest, but safe. We also love that the capex is full covered from cash flow and gives company a lot of flexibility. The company has no crazy ambitions any more about spending massive amounts of dollars to grow. That is exactly the kind of utility you want in your portfolio.

Source: Discounted Utilities With Ominous Similarities

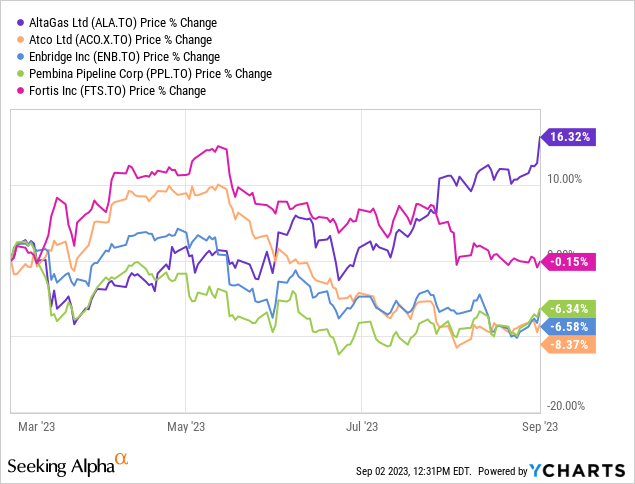

It was an interesting 8 months where AltaGas appeared to be losing badly till mid-March. The comeback has pushed the company ahead once again.

We look at the Q2-2023 results and the announcement acquisition to update our thesis.

Q2-2023

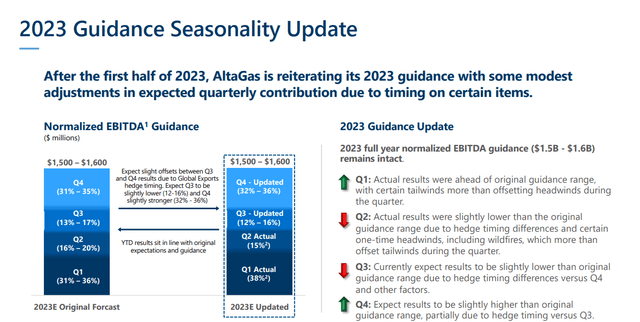

The Q2-2023 results were about in line, with slight timing differences impacting how the first half versus the second half are shaping up. Overall EBITDA guidance remains in line with expectations.

AltaGas Q2-2023 Presentation

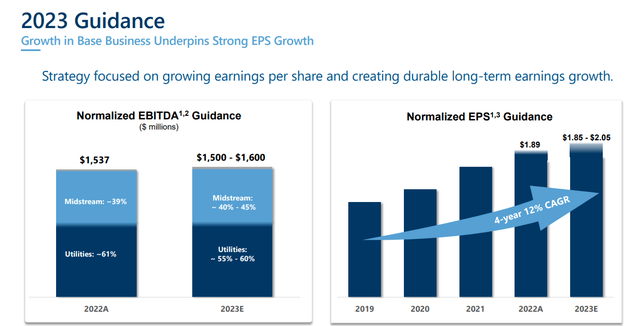

Moving off the strong Q2-2022 base, we can see the modest improvements expected in 2023 numbers versus 2022 for both EBITDA and earnings per share.

AltaGas Q2-2023 Presentation

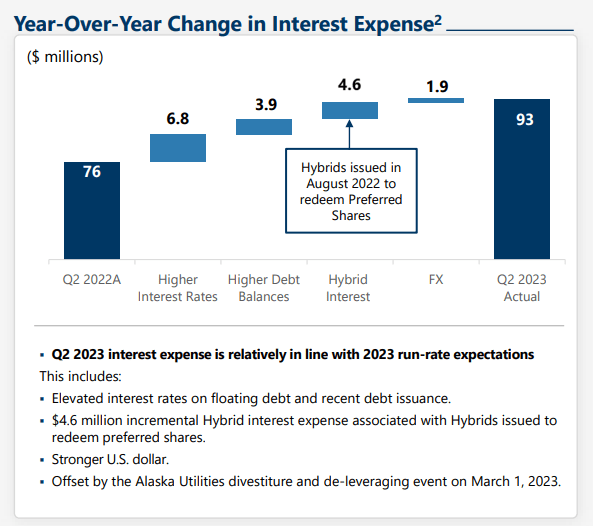

These are not big improvements, but about in line with what you would see for a company with AltaGas’ footprint. The change is still good in light of what is happening on the interest expense front. AltaGas got hit with the trifecta higher rates, higher debt balances and exchange rate moving negatively.

AltaGas Q2-2023 Presentation

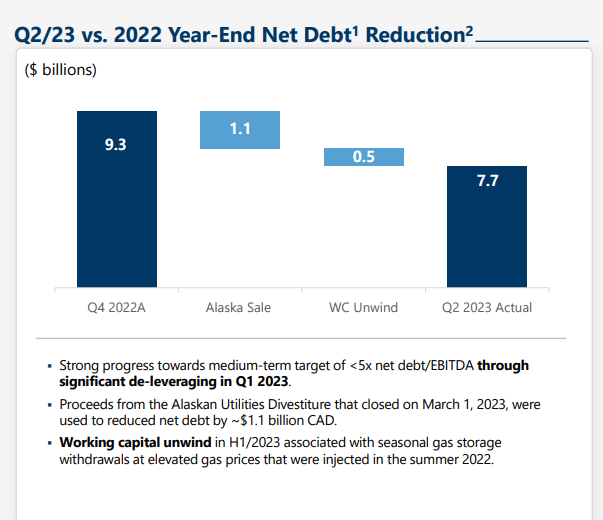

Even though they have a “well-balanced” balance sheet, the interest rate moves of the last 18 months continue to take a toll. While those numbers looked at the delta from Q2-2022, the more important figures here are the changes from end of last year. The big picture here is that of deleveraging. The Alaskan Utilities sale played into that, and AltaGas finally has reached levels of net debt that we can be proud of.

AltaGas Q2-2023 Presentation

This has been a long, long journey post the WGL acquisition, where the debt-load became just too unwieldy in light of the massive overpayment for that transaction.

At present, AltaGas is one of the best positioned from a balance sheet perspective (amongst pure Canadian utilities) to withstand further interest rate hikes or credit spread blowouts in the case of a recession.

The New Purchase

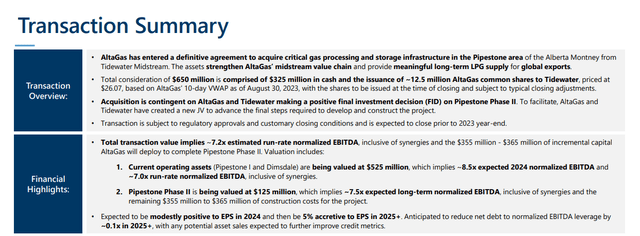

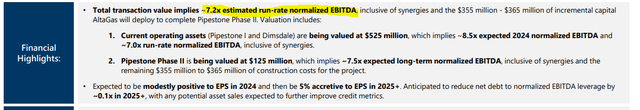

AltaGas just announced that it had entered into an agreement to acquire the Pipestone Natural Gas Processing Plant. This includes the current phase I and the phase II expansion project. In addition, this purchase includes Dimsdale storage facility and the Pipestone condensate terminal. The purchase was made from Tidewater Midstream for $650 million.

AltaGas Presentation

There is one contingent clause here on the final investment decision on Pipestone phase II, but we gather that this is a formality, otherwise we would have not reached this stage.

Outlook

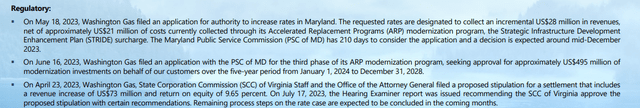

The utilities base business continue to perform has predicted. AltaGas has had no major surprises on the regulatory front, and the more recent filed cases are relatively small.

AltaGas Q2-2023 Presentation

The midstream assets have also performed well, though Q2-2023 was a small outlier. The purchase from Tidewater appears to be at an incredibly low price. It is a head scratcher of sorts that Tidewater sold it for so less. The Dimsdale storage facility is connected to Alliance pipeline systems and to the NGTL system, making it a very valuable long term asset. It also is one where expansion can be facilitated with little additional capex.

AltaGas Q2-2023 Presentation

So this 7.2X normalized EBITDA multiple seems awfully cheap, even in an era of 5% interest rates. Multiple banks raised their price targets in light of this. See here, here, and here. So AltaGas is going along nicely, and we cannot find fault with anything we see in the company’s strategy.

Verdict

One of the only real problems anyone can have with AltaGas is that it is harder to value compared to some of the companies it is usually compared against. It is a perfect midstream/utility blend, and even analysts cannot agree as to which group it really belongs. The problem comes to whether you run an adjusted funds from operations (AFFO) multiple like with other midstream companies, or an EPS multiple like with other utilities. We struggle with this too and unless we have a split down in the middle, it will always be subjective. Even AQN, a company we have compared it against, had a similar issue, though it was a renewable assets-regulated utility blend.

Our rough math here gets us to one important observation. AltaGas while still inexpensive, has become expensive on a relative basis. We find this notable against both groups of assets, especially against ATCO Ltd. (ACO.X:CA), which was extremely cheap to begin with.

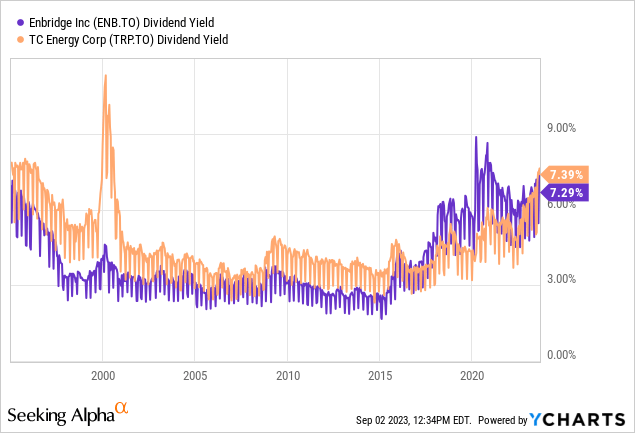

Even the midstream behemoths, like Enbridge Inc. (ENB) and TC Energy Corporation (TRP), are sporting yields that they have not in a long time.

AltaGas has a very small dividend yield (4.11%) in comparison. It just gets us a little circumspect to chase the stock higher, as these banks are doing. Even beyond the midstream/utility comparatives, a lot of rate sensitive issues are now far cheaper than they were at the end of 2022. So we are hence going along the road less travelled here and downgrading it on a relative basis. We are moving from Strong Buy to a Hold. A two notch downgrade is unusual for us, but it fits with our relative valuation framework, where we focus on what is the best security to buy today.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here