Introduction

It’s time to talk about the EQT Corporation (NYSE:EQT), America’s largest natural gas producer.

Although I have no position, I like this company a lot, as its investors benefit from a number of strong tailwinds, including higher natural gas prices boosted by favorable fundamentals, the company’s efficient operations, increasing opportunities related to LNG, better pipeline access, hedges protecting the downside, and a very healthy balance sheet.

In early June, I wrote an article titled EQT Corporation: Why I’m So Bullish On This Natural Gas Driller. Since then, shares have rallied 14%, boosted by a breakout in natural gas prices.

After breaking out in mid-June, NYMEX Henry Hub natural gas futures are now in a slow uptrend, which I expect to accelerate – especially if the Northern Hemisphere gets a cold winter.

TradingView (NYMEX Henry Hub)

In this article, we’ll assess the risk/reward of EQT and discuss why I believe the stock has a lot more upside left.

So, let’s get to it!

Where’s Natural Gas Going?

Natural gas prices are extremely volatile and hard to predict. After all, unlike crude oil, the supply situation of natural gas is much more favorable for lower prices.

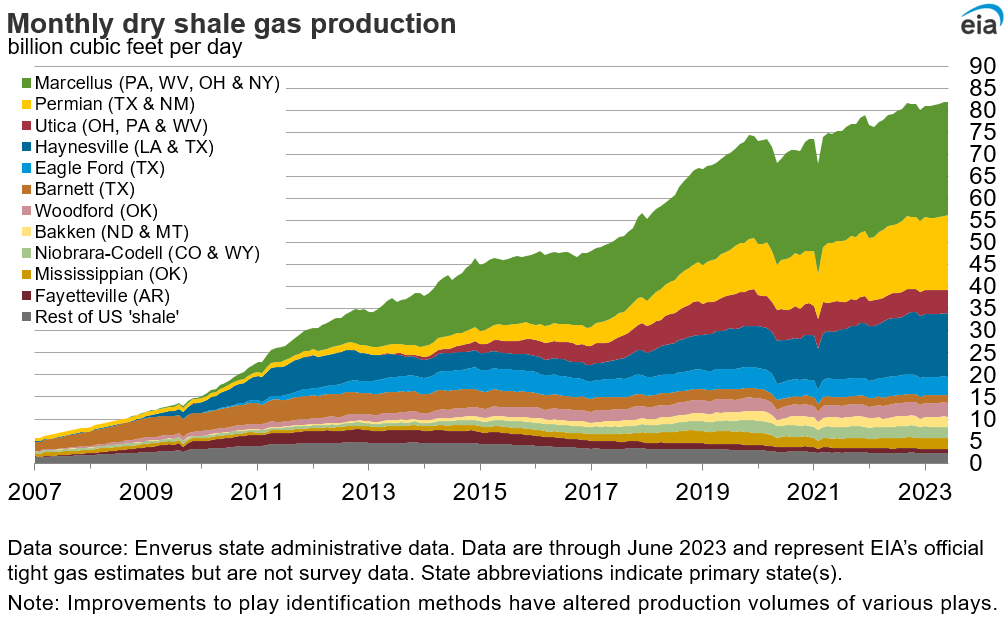

According to the Energy Information Administration (“EIA”), in the first half of 2023, dry natural gas production surged, registering over 102 billion cubic feet per day (Bcf/d), which marks a substantial 6 Bcf/d increase compared to the same period in the previous year.

A driving force behind the growth in U.S. natural gas production in 2023 is the Permian Basin.

Much of the natural gas produced here is associated with oil wells, where the level of natural gas production hinges on oil-drilling activities in the region.

This pattern is expected to persist, with increased oil-drilling activity propelling higher natural gas production in the Permian Basin, albeit with some minor production declines in other major producing areas.

Energy Information Administration

Looking ahead, the EIA believes natural gas production will remain relatively steady for the coming year before showing signs of growth in the fourth quarter of 2024.

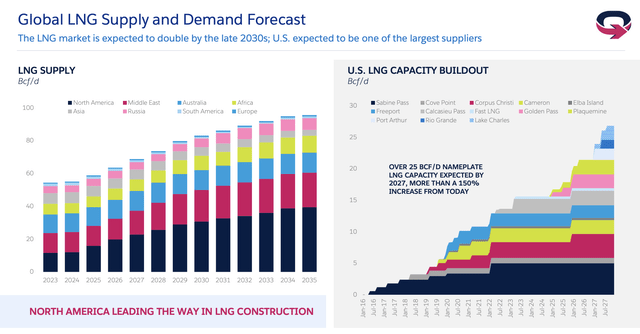

This upswing will coincide with the commissioning of new pipeline capacity and increased demand for liquefied natural gas (“LNG”) feed gas, as two new facilities are set to come online by the end of 2024.

By 2027, total LNG capacity will likely grow by 150% from today’s levels.

EQT Corp.

In light of these developments, it’s fair to assume that natural gas prices continue a (volatile) long-term uptrend.

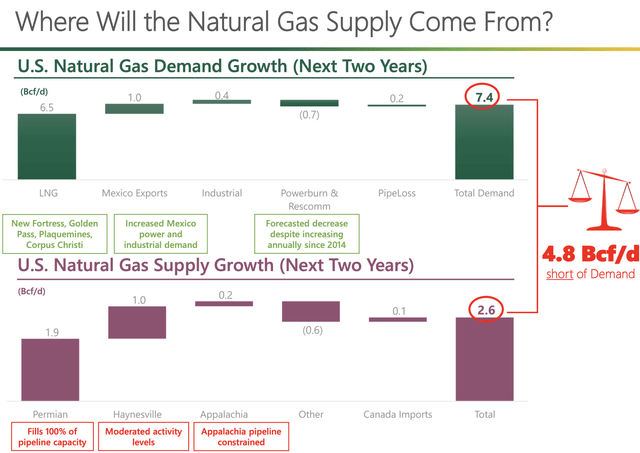

Antero Resources (AR), one of my largest energy trades (not long-term investments), has made the case that over the next two years, demand growth will be 4.8 Bcf/d higher than supply growth. Most of this will be caused by higher LNG demand.

Antero Resources

Supply is expected to be constrained by pipeline capacity in the Permian, as the infrastructure doesn’t support higher natural gas production, moderating production in Haynesville, and constrained pipelines in the Appalachia.

This brings me to EQT.

EQT is A Great Place To Be

The reason why I own AR instead of EQT is that I wanted a more volatile player with more potential upside. After all, it’s a trade, not one of my many long-term investments.

EQT is much larger, less risky, and a better long-term play for conservative investors. Be aware that conservative is relative here. EQT is still highly volatile compared to some of the blue-chip stocks you may have in your portfolio.

So, please keep that in mind!

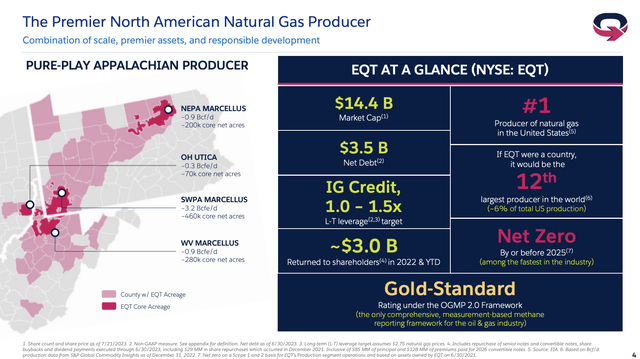

Having said that, EQT is a Pittsburgh-based giant with operations in beautiful Appalachia.

Appalachia isn’t just a fascinating region due to its significance in the coal industry and the massive changes that have come with it. It’s also the place to be when looking for efficient natural gas companies.

I just finished a series on YouTube on the history of Appalachia and the many challenges that come with the steep decline in domestic natural gas demand.

It’s a region I definitely want to visit if I get an opportunity.

Anyway, going back to EQT, the company is so large that if it were a country, it would be the world’s 12th-largest natural gas producer, responsible for 6% of total U.S. natural gas output.

EQT Corp,

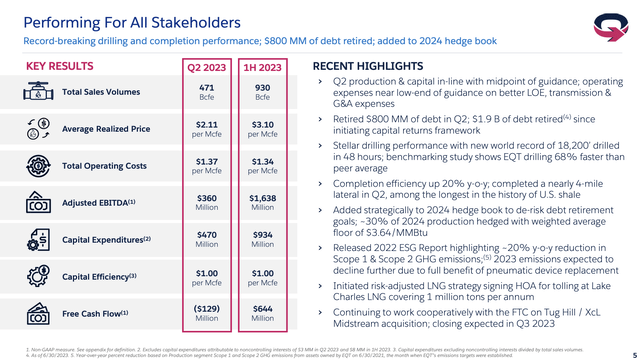

In the second quarter, the company produced 471 Bcfe (the e stands for equivalent).

These volumes were in line with prior guidance, thanks to strong execution by the drilling and completions team.

Unfortunately, the company noted that operational challenges at Shell’s ethane cracker impacted production, but EQT is taking steps to mitigate future issues.

Operating revenues were $2.11 per Mcfe, and operating costs were at the lower end of the guidance range, resulting in a healthy operating margin despite low natural gas prices.

EQT also noted potential softening in inflationary pressures, including declining steel casing prices.

Hence, efforts to improve efficiencies may lead to lower well costs in 2024.

EQT Corp,

As a result, the company reiterated its 2023 production outlook, capital budget, and operating expense guidance.

We are reiterating our 2023 production outlook of 1,900 to 2,000 Bcfe. Our 2023 capital budget of $1.7 billion to $1.9 billion excluding the pending Tug Hill acquisition and our per unit operating expense in differential ranges. – EQT 2Q23 Earnings Call

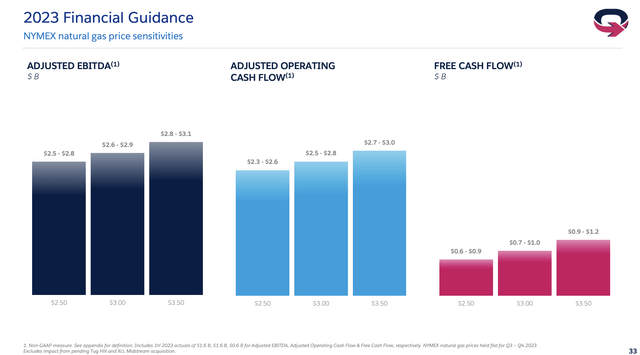

The overview below shows the company’s guidance based on various natural gas prices.

EQT Corp,

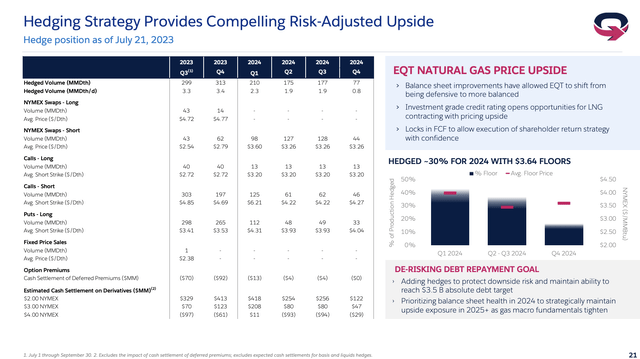

Having said that, the second quarter greatly benefitted from the company’s hedging strategy.

EQT strategically increased its hedge positions for 2024, indicating a proactive approach to achieving its debt retirement goals, as the company is willing to bet on higher prices by refraining from hedging like some players in its industry.

The company believes this move not only accelerates debt reduction but also positions shareholders to benefit from maximum upside exposure to gas prices in late 2024, 2025, and beyond, when most of its hedges end.

Looking at the data below, we see that the company has hedged roughly 40% of its 1Q23 production. It has hedges less than 20% of its 4Q24 production.

EQT Corp,

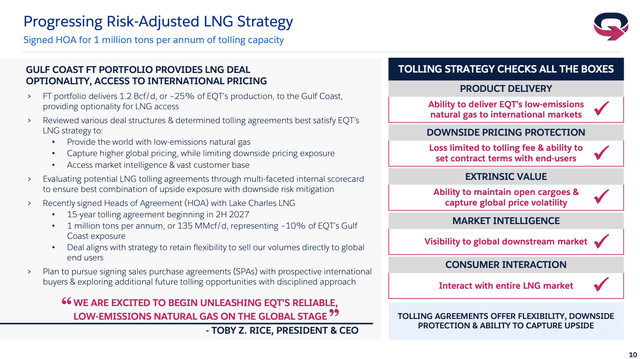

Furthermore, the EQT’s recent signing of a Heads of Agreement (“HOA”) for tolling capacity at Lake Charles marks a significant step in the company’s LNG strategy.

This strategy aims to diversify a portion of its production into international markets.

EQT Corp,

It is designed to strike the optimal balance between capitalizing on upside potential and mitigating downside risk.

EQT believes this move reflects its ambition to expand its presence in global energy markets.

This strategy allows us to creatively structure deals with downside price protection, obtain visibility into global downstream markets and interact with a wide array of potential customers. We plan to pursue signing one or more SPAs with prospective international buyers and have additional opportunities to increase our tolling exposure, though we will remain measured in our approach as we ensure the best risk-adjusted outcomes for EQT.

As America’s largest natural gas producer, we have played a critical role in providing energy security to the United States while driving significant emissions reductions via coal displacement. Our scale, peer-leading inventory depth and environmental attributes uniquely position us to facilitate these objectives, both domestically and abroad, and we are excited to begin unleashing EQT’s reliable low emissions natural gas on the global stage. – EQT 2Q23 Earnings Call

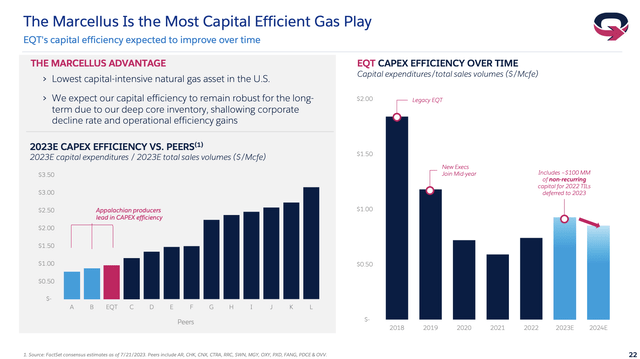

It also needs to be said that EQT is among the most efficient producers, with a top-3 performance when it comes to capital spending in relation to sales.

EQT Corp,

EQT believes its assets are underappreciated by the market, with the potential for significant value creation for shareholders through high free cash flow generation.

As one of the charts above shows, even at $2.50 Henry Hub, the company has the ability to generate up to $900 million in free cash flow, which is 5% of its market cap. At $3.50 Henry Hub, that number could rise to 7%.

I expect these numbers to accelerate after this year as hedges end, and we hopefully see some more production efficiency gains.

Analysts seem to agree, as they expect $2.6 billion in 2025E free cash flow without a steep surge in natural gas prices. This would imply a 16% free cash flow yield!

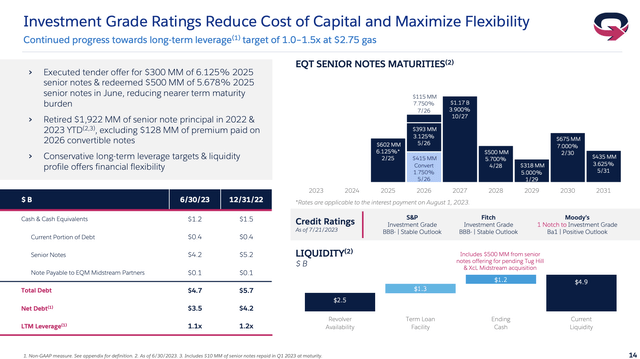

Investors should also expect higher shareholder distributions down the road, as the balance sheet is improving rapidly.

EQT retired $800 million of debt during the second quarter, marking a significant step toward achieving its balance sheet objectives.

They have now retired a total of $1.9 billion of debt since late 2021, reducing leverage and securing investment-grade credit ratings from 2/3 credit ratings.

The company has no debt maturities in both 2023 and 2024 and close to $5 billion in available liquidity. Its LTM leverage ratio is close to 1x (EBITDA).

EQT Corp,

The focus on debt paydown is part of EQT’s strategy to maximize value creation across commodity cycles and provide investors with a strong risk-adjusted exposure to natural gas, which is a very straightforward strategy.

Thanks to a strong free cash flow outlook, shareholders are in a great spot.

According to the company (emphasis added):

Our buyback remains a key tool for opportunistic execution that points in the cycle where we see favorable risk reward potential for generating returns well in excess of our weighted average cost of capital. And finally, sustainable long-term base dividend growth will remain a key pillar of our shareholder return strategy moving forward. – EQT 2Q23 Earnings Call

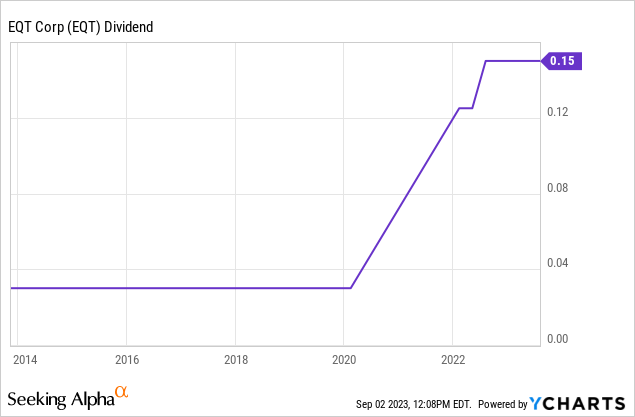

The company has a $0.60 quarterly fixed annual dividend, which translates to a 1.4% yield.

The company also has more than half of its $2.0 billion buyback program left.

Since December 2021, the company has bought back 5.4% of its shares, which shows that we can expect way more buybacks the moment free cash flow starts to soar.

Valuation

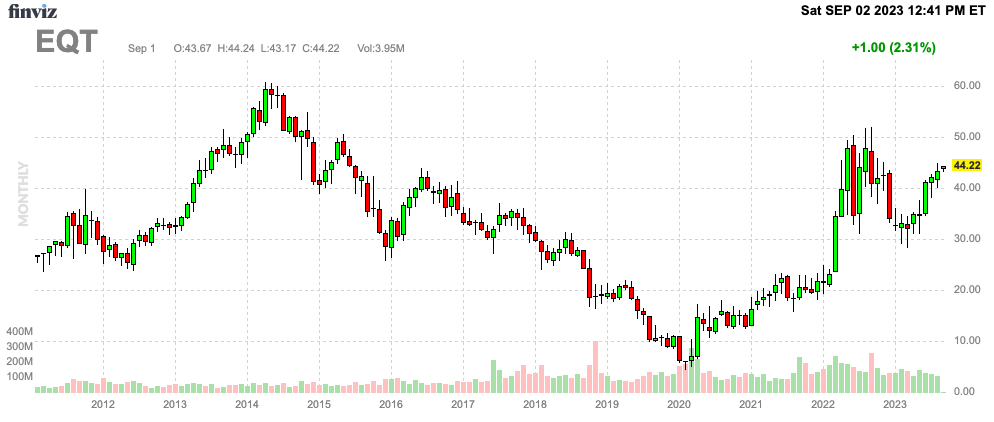

While it’s hard to put a valuation on a stock that tends to move in lockstep with the commodity/commodities it produces, there’s plenty of evidence that EQT is still too cheap.

For example, as we briefly discussed, the company has a path to a high double-digit free cash flow yield in the years ahead, which, to me, is the most important indicator.

Given how well EQT is doing with subdued natural gas prices, I stick to what I wrote in my prior article.

Furthermore, the company has a per share PV-10 value of $52 (net of debt) at $4.50 Henry Hub. The PV-10 value is a calculation of the present value of estimated future oil and gas revenues, net of direct expenses, and discounted at an annual rate of 10%.

At $37 per share, it indicates that EQT is trading well below the value of its reserves in an environment of only slightly elevated prices.

Hence, I believe that EQT has the potential to rise to at least $60 if my longer-term oil and gas bull case turns out to be correct.

FINVIZ

If natural gas prices remain in a longer-term uptrend with additional tailwinds in the winter, I expect that analysts will give the stock $80 to $90 price targets.

The current consensus price target is $48, 9% above the current price of $44.

Takeaway

EQT is a compelling investment opportunity in the dynamic world of natural gas.

With favorable market conditions, efficient operations, and strategic moves into the LNG market, EQT is positioned for significant growth.

While I personally favor more aggressive players, EQT stands as a strong, less risky choice for conservative investors, offering considerable upside potential.

The company’s proactive hedging strategy, focus on debt reduction, and robust free cash flow outlook make it an attractive proposition.

Moreover, EQT’s undervaluation suggests the potential for substantial stock price appreciation in the coming years, especially if natural gas prices continue to rise.

Read the full article here