Schrodinger’s (NASDAQ:SDGR) stock has surged this year on the back of AI hype and continued strength in its drug discovery business. Schrodinger is far more than an AI bubble stock though. As the drug discovery business matures, the importance of Schrodinger’s platform is becoming more apparent, and AI only enhances this. While the stock is not as undervalued as it was at the end of 2022, current prices probably represent a reasonably entry point for investors willing to tolerate near-term volatility.

Schrodinger has developed a physics-based software platform that can be used to improve the discovery of therapeutics and materials. This platform is capable of predicting critical properties of molecules with a high degree of accuracy, enabling the discovery of novel molecules at a lower cost.

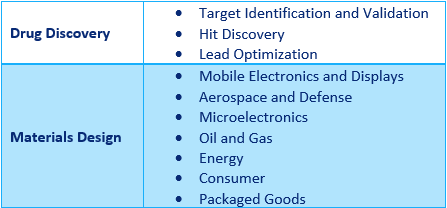

Table 1: Platform Use Cases (source: Created by author using data from Schrodinger)

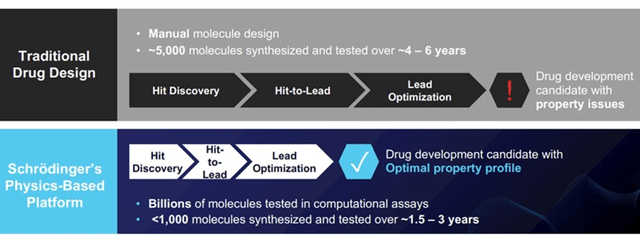

Drug Discovery

Drug discovery is complex, time consuming, capital-intensive and failure rates are generally high. For example, roughly 66% of programs never succeed in delivering an IND. Part of the reason for this is that it is difficult to predict the properties of a molecule prior to chemical synthesis. The traditional approach to drug discovery has been to screen a library of molecules to identify those with detectable activity, followed by optimization of hit molecules to develop a candidate drug. Iterative synthesis and testing are time consuming and expensive though. Candidate optimization must also occur across a range of properties like potency, selectivity, solubility, bioavailability, half-life, permeability, drug-drug interaction potential, synthesizability, and toxicity. These properties are often at odds with each other, making optimization a difficult problem that often doesn’t yield an adequate solution.

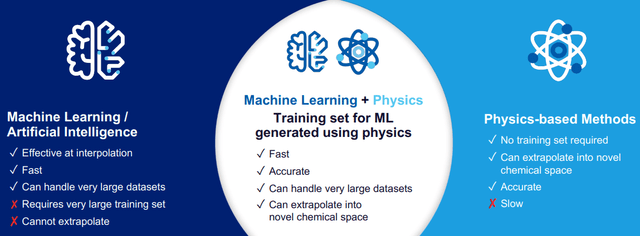

Machine learning can help with this process, but it has limitations. For example, machine learning cannot extrapolate molecules that are dissimilar to the training set. As the design space of potential molecules is enormous and training data sets extremely limited in comparison, machine learning can only cover a small fraction of the total number of molecules.

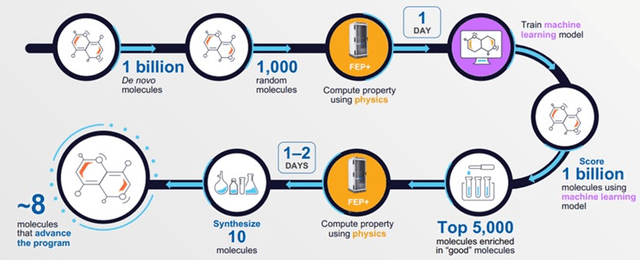

As Schrodinger’s software is based on first principles, it can accurately predict the properties of novel molecules. This is a relatively slow and compute intensive process, but AI can be used as a force multiplier. Rather than trying to model billions of molecules, Schrodinger can model a smaller number of diverse molecules and use this to build training data sets across a wider expanse of the design space.

While Schrodinger’s software allows more of the chemical space to be explored, even if 10^9 molecules are scored using machine learning, this is essentially nothing compared to the estimated 10^60 possible molecular combinations with drug-like characteristics in the chemical universe. It is a clear improvement though, particularly if there is sufficient diversity in the tested molecules.

Figure 1: Impact of Schrodinger’s Platform on AI Driven Drug Discovery (source: Created by author)

Market

Greater access to computing power, more sophisticated algorithms and the growing availability of high-resolution protein structures have opened up the potential of physics-based software in recent years. Demand is also increasing on the back of declining drug discovery ROIs, a phenomenon that has been referred to as Eroom’s Law.

The global drug discovery software market opportunity was estimated to be 2 billion USD in 2020, growing at a 14% CAGR through to 2025. The drug discovery software market includes areas like ligand-based design, structure-based design, LIMS and ELN.

There are thousands of biotech and pharmaceutical companies that could benefit from this type of software, but adoption is currently low. If a significant portion of these companies were to use modelling software at the same level Schrodinger reportedly does internally, the market opportunity would likely be tens of billions of dollars.

Schrodinger’s software faces competition from companies like:

- BIOVIA

- Chemical Computing Group

- Cresset Biomolecular Discovery

- OpenEye Scientific Software

- Optibrium Limited

- Simulations Plus

- Materials Design

- Certara

- Dotmatics

There are also academic consortia that develop physics-based simulation programs for life sciences and materials applications, including:

- AMBER

- CHARMM – commercially available through BIOVIA

- GROMACS

- GROMOS

- OpenMM

- OpenFF

These packages are primarily maintained and developed by graduate students and post-doctoral researchers, often without the intent for commercialization.

While Schrodinger faces a number of competitors, it seems likely that the market will consolidate over time due to economies of scale. Large R&D investments will be required to remain at the cutting edge, as customer purchasing decisions will be driven by the accuracy of the software and the ability to model a broad range of phenomena.

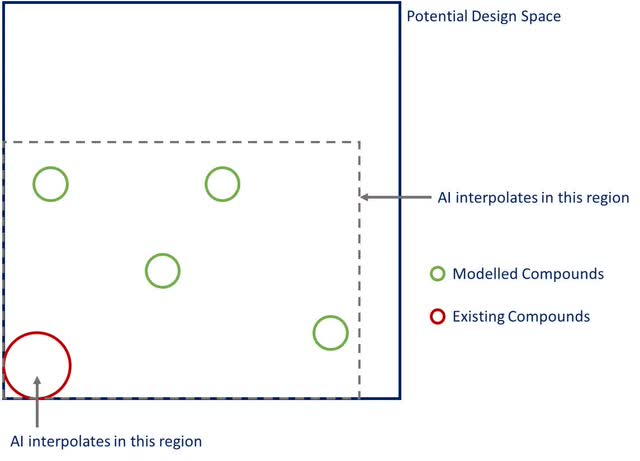

Schrodinger

Schrodinger is a leading provider of computational software solutions that accelerate molecule discovery, design, and optimization. When coupled with AI, Schrodinger’s platform can evaluate billions of molecules per week versus 1,000s per year for traditional drug discovery approaches, greatly increasing the odds of finding a suitable molecule. For example, one study showed that Schrodinger’s platform resulted in an eight-fold increase in the number of molecules with the desired affinity compared to traditional methods.

Figure 2: Potential Impact on Drug Discovery (source: Schrodinger)

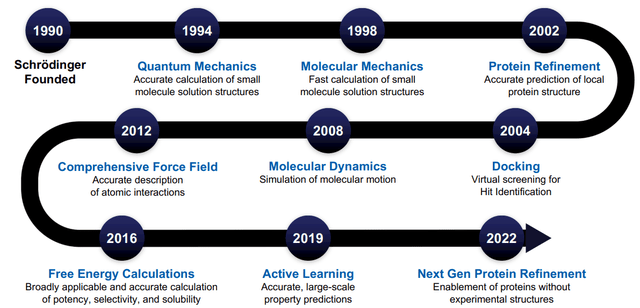

Schrodinger’s software already has advanced capabilities that have been built over a period of more than 30 years, but the company continues to invest in the underlying science of the platform, with a focus on increasing the accuracy of predictions and expanding into new areas.

Figure 3: Platform Development (source: Schrodinger)

Schrodinger is still adding to the number and type of targets its platform can successfully model, with the company eventually hoping to enable structure-based drug discovery for nearly all targets. In support of this Schrodinger is adding to the capabilities of its platform:

- New physics-based methods (metals, quantum effects, hybrid methods)

- New modalities (biopharmaceuticals, protein degraders, molecular glues)

- Materials (energy, chemical reactivity, polymers)

While a number of customers are already using Schrodinger’s platform to advance their biologics programs, this is an area that still needs to be further developed.

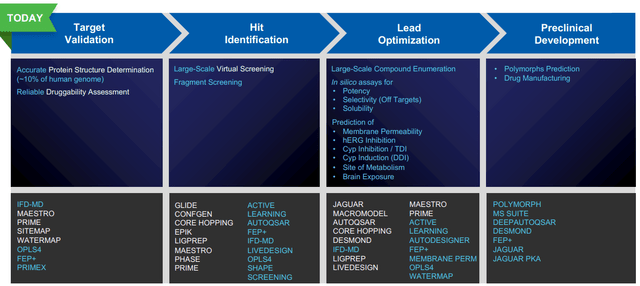

Schrodinger is also adding functionality to its platform which supports the drug discovery process:

- More comprehensive support of ADME-Tox optimization

- Preclinical development and formulations (solubility, excipients, process chemistry)

Figure 4: Platform Capabilities (source: Schrodinger)

The number of targets for which structures exist and are suited to computational methods is still relatively small and this is something Schrodinger is trying to change. Schrodinger acquired XTAL BioStructures in 2022 to expand its structural biology capabilities and support its drug discovery efforts. Computational software requires high-quality 3D protein structures that are obtained from techniques like x-ray crystallography and cryo-EM. XTAL can provide this through its expertise in biophysical methods, protein production and purification, and X-ray crystallography. Schrodinger will combine XTAL’s experimental methods with its own computational methods to scale up production of high-resolution structures. This will help create new targets for Schrodinger’s drug discovery efforts and could also increase software demand by providing potential customers with access to more targets.

Schrodinger is also improving its machine learning workflows for structure-based hit discovery, improving the computational efficiency of drug discovery efforts. While Schrodinger utilizes AI in its business, I wouldn’t consider this a competitive advantage at this stage. There are a growing number of companies leveraging AI in drug discovery and what differentiates Schrodinger is its physics-based platform, which enables it to more effectively assess novel molecules.

Figure 5: Benefits of Combining AI and Computational Methods (source: Schrodinger)

Figure 6: Drug Discovery Workflow (source: Schrodinger)

Schrodinger monetizes its platform through a number of avenues, including:

- Software licensing

- Collaborations

- Proprietary drug discovery programs

Schrodinger’s drug discovery efforts have the potential to create significant value, but they also help to develop and validate Schrodinger’s platform, thereby increasing demand for the software business.

Figure 7: Platform Monetization Strategies (source: Schrodinger)

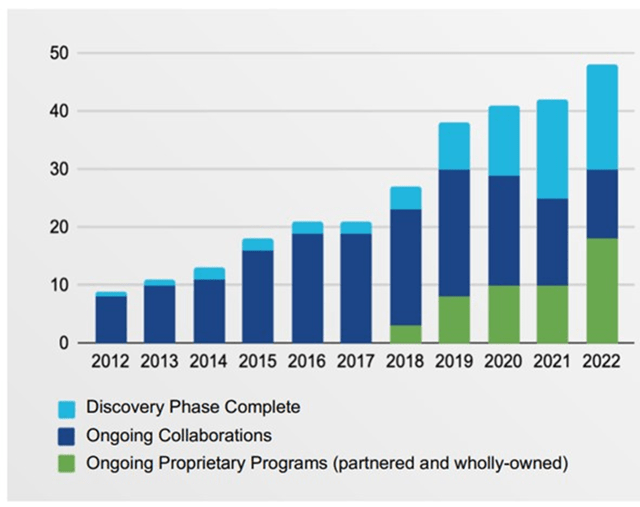

Schrodinger’s software is used by a wide range of biopharmaceutical and industrial companies, academic institutions, and government laboratories. The business is still relatively small though and Schrodinger believes it has the potential to grow substantially. Based on its own usage, Schrodinger believes that even its largest customers are dramatically underutilizing its software. Schrodinger’s internal software usage amounts to something like 5 million USD per program, meaning its very largest customers are only spending enough to optimally enable one or two drug discovery projects. Schrodinger’s software is licensed based on how many calculations can be run simultaneously, meaning the optimal amount of spend is likely to increase over time as the platform’s capabilities allow more chemical space to be explored.

Schrodinger has stated that the nature of discussions it is having with customers is changing, with a clear interest in scaling up. This is likely on the back of the progress that Schrodinger has demonstrated through collaborations and its own programs.

Schrodinger’s drug discovery organization brings together experts across protein science, biochemistry, biophysics, medicinal and computational chemistry, and discovery scientists with expertise in preclinical and early clinical development. Schrodinger has the capacity to run something like 25 discovery programs and has been adding to the early-stage program team.

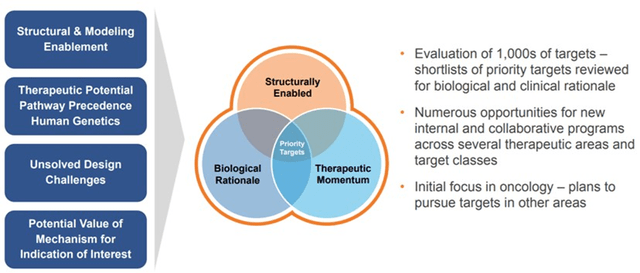

The company’s early focus was on oncology, but Schrodinger is now expanding into other areas, including immunology and urology. Schrodinger also believes that its platform could provide a competitive advantage in neuroscience. In support of this Schrodinger is investing in developing the ability to make accurate predictions about key properties required for successful drug development in this area, such as the ability to penetrate the blood-brain barrier.

Schrodinger has entered into collaborations with a number of biotech and pharmaceutical companies. Collaborations are generally monetized through some combination of

- Research fees

- Pre-clinical / clinical milestones

- Royalties

- Equity stakes

While it is difficult to assess the potential downstream value that Schrodinger is exposed to through milestones, royalties and equity stakes, the company has already had a number of significant successes. Most recently, Takeda acquired a Nimbus subsidiary for 4 billion USD cash and up to 2 billion USD in commercial milestone payments. Nimbus’ subsidiary was developing a selective allosteric TYK2 inhibitor which had shown positive results in a Phase 2b trial for psoriasis. Schrodinger cofounded Nimbus Therapeutics in 2009.

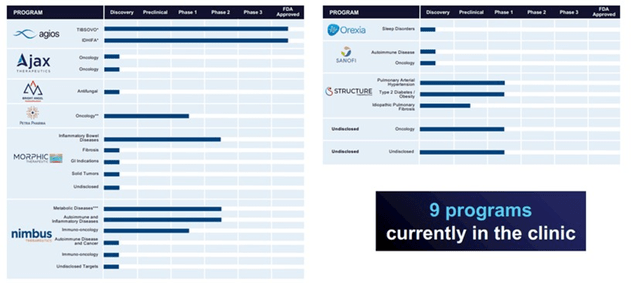

Figure 8: Schrodinger Collaboration Programs – October 2022 (source: Schrodinger)

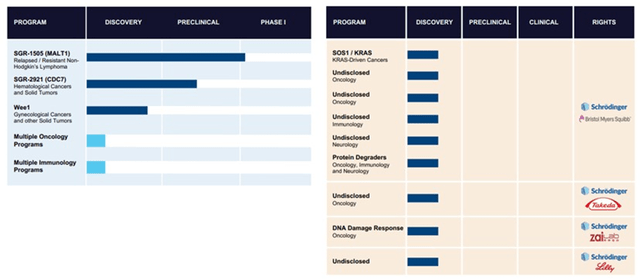

Schrodinger also has a growing number of proprietary programs, some of which are progressing towards or are in clinical trials. Schrodinger appears to be shifting focus from collaborations to proprietary programs.

Figure 9: Schrodinger Proprietary Drug Discovery Programs – October 2022 (source: Schrodinger)

Figure 10: Schrodinger Programs (source: Schrodinger)

Schrodinger doesn’t believe it is appropriate to take risk on biology as this is not where its competencies lie. As a result, the company tries to select well understood targets that present a specific design challenge.

Figure 11: Target Selection Strategy (source: Schrodinger)

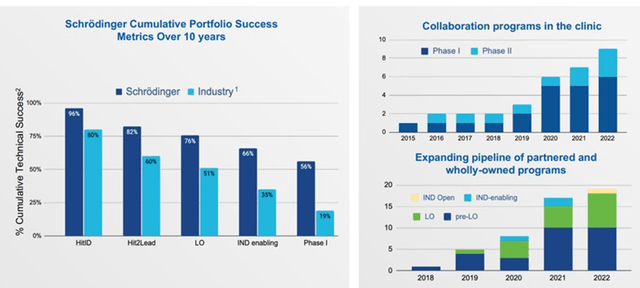

The promise of Schrodinger’s platform is that it increases the probability of successfully discovering new drugs, while reducing discovery costs and timelines. Early data certainly appears promising, with a growing number of collaboration programs in clinical trials and Schrodinger’s programs demonstrating higher pre-clinical success rates than the industry average.

Ideally this would be causing demand for Schrodinger’s platform to increase, but there is limited evidence of this at the moment. It should be noted that the current macro environment is not conducive to customer spending though.

Figure 12: Schrodinger’s Drug Discovery Track Record (source: Schrodinger)

Schrodinger’s platform is also suitable for material science applications in fields such as aerospace, energy, semiconductors, and electronic displays. This includes things like designing batteries, electrolytes, polymers, and organic light emitting diodes. Adoption in material science applications is increasing but it is not clear how material this is at this point.

Financial Analysis

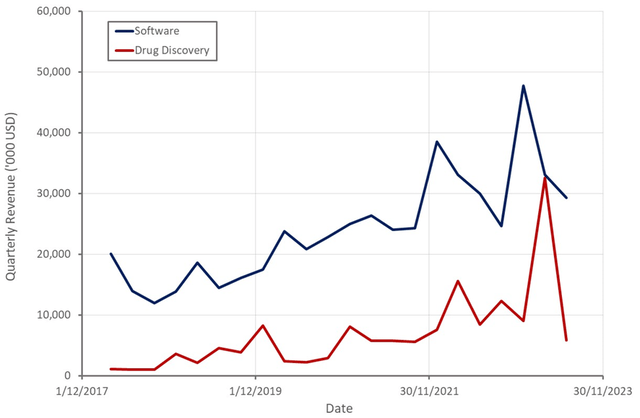

Schrodinger has had a volatile multi-year period with the pandemic likely providing a boost as customers turned to computational methods when lab access was restricted. Tight monetary policy now appears to be dampening demand though as biotech and pharma companies look to preserve capital, and commentary on the most recent earnings call suggests that spending caution is spreading. Weakness in the second quarter was reportedly the result of a lack of renewal opportunities to drive growth.

The drug discovery business is progressing well, although revenue is likely to continue fluctuating significantly from quarter to quarter. The second quarter was the weakest quarter for the drug discovery business in several years. Schrodinger also lowered full-year guidance, although this appears to be the result of shifting timelines rather than lost revenue.

Figure 13: Schrodinger Revenue (source: Created by author using data from Schrodinger)

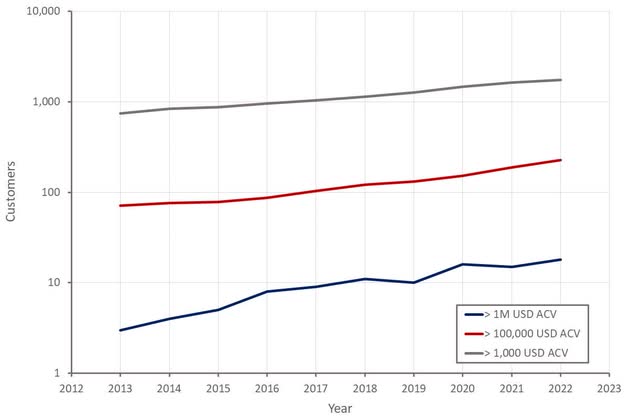

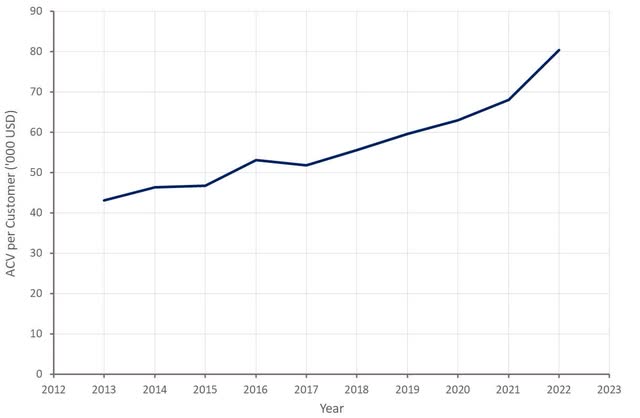

Schrodinger’s customer base is slowly expanding, and customers are spending more on the platform over time. It has been suggested that there is a shortage of computational chemists to run Schrodinger’s software, which could be limiting customer adoption. Schrodinger’s customer retention rate for customers with ACV over 100,000 USD has been hovering in the high 90% range over the past 5 years.

Figure 14: Schrodinger Customers (source: Created by author using data from Schrodinger)

Figure 15: ACV per Customer (source: Created by author using data from Schrodinger)

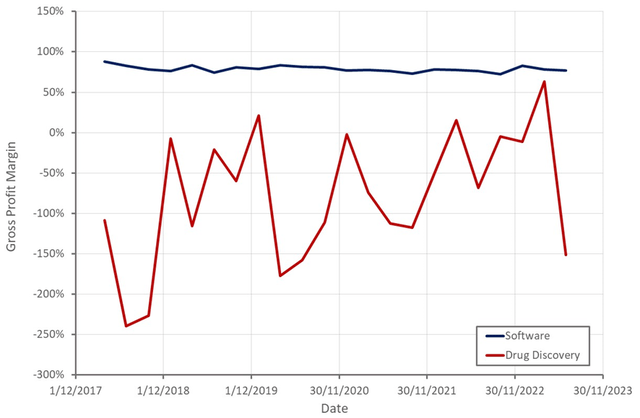

Software gross profit margins have been fairly stable in the mid to high 70s and drug discovery margins have slowly been improving over time. The drug discovery appears to be close to breakeven on a gross profit basis, although margins are highly dependent on the timing of revenues.

Figure 16: Schrodinger Gross Profit Margins (source: Created by author using data from Schrodinger)

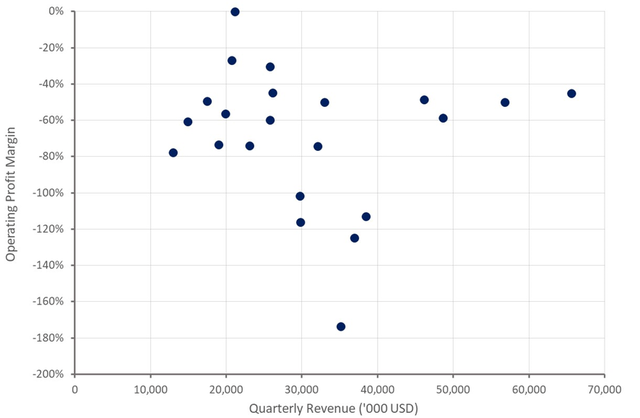

Operating profit margins are still highly negative, particularly in the second quarter of 2023. This is a reflection of Schrodinger’s continued investments in its platform, and increasingly its drug discovery business, and should resolve itself as Schrodinger’s pipeline matures.

Figure 17: Schrodinger Operating Profit Margins (source: Created by author using data from Schrodinger)

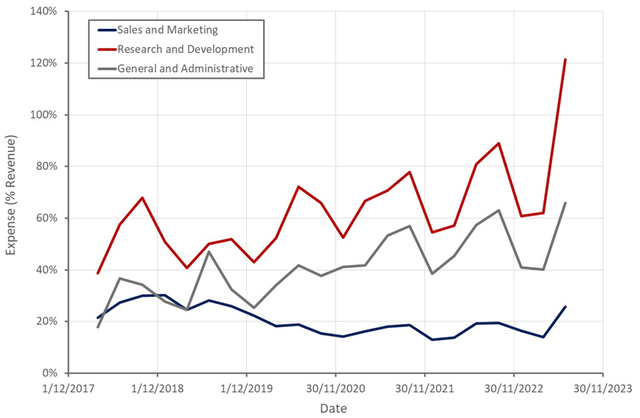

Schrodinger’s operating expenses are largely driven by R&D investments, which are increasingly related to the drug discovery business. R&D expenses are rising on the back of increased headcount to support new programs and the advance of existing programs into trials. CRO expenses also increased YoY, driven by the progress of existing programs and the addition of new programs. Sales and marketing expenses are primarily related to the software business and are reasonable given that sales cycles can be as long as nine to twelve months.

Figure 18: Schrodinger Operating Expenses (source: Created by author using data from Schrodinger)

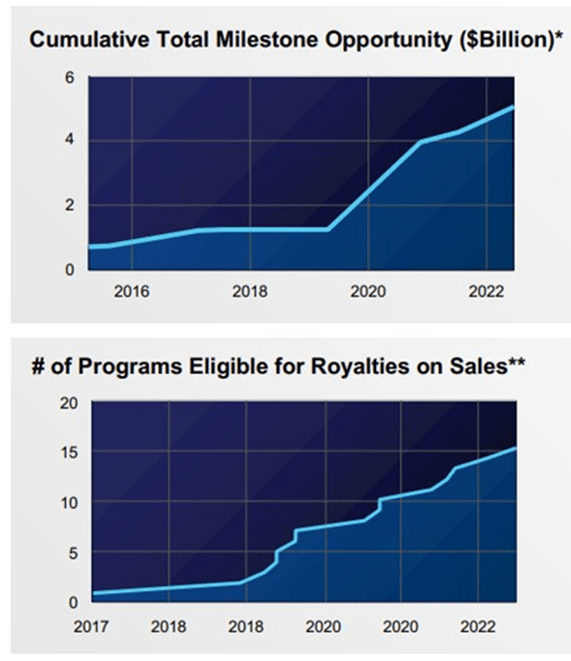

Valuation

Valuing Schrodinger is difficult given the company’s mix of software revenue, milestone and royalty opportunities and equity stakes in other companies. Schrodinger’s market capitalization is only around 2.7 billion USD and the company’s cash balance, equity stakes and risk-weighted downstream revenue opportunities are probably worth something like 1.5 billion USD. This is difficult to assess, particularly based on publicly available information, but Schrodinger’s recent track record suggests it will continue to realize significant downstream value. It should be noted that Schrodinger is still burning cash, and hence a substantial portion of this value will be used to finance the business in the future.

Figure 19: Schrodinger Downstream Value Potential (source: Schrodinger)

The market is therefore only placing something like a 1.2 billion USD value on the software business, Schrodinger’s proprietary pipeline and future drug discovery growth. Assuming all of this value is attributable to the software business only values it in line with comparable design and simulation software.

As another point of reference, Dassault Systèmes acquired Accelrys for approximately 750 million USD in 2014. In the prior year Accelrys generated 169 million USD revenue and grew 4%.

It therefore appears likely that the market is significantly undervaluing Schrodinger, particularly if the company can continue to grow its drug discovery business and efficiently move drugs towards market.

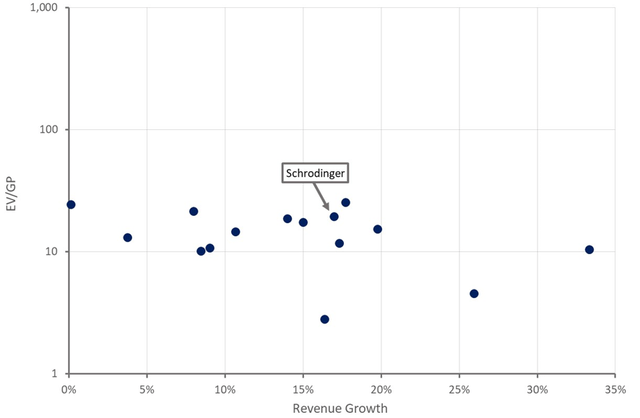

Figure 20: Schrodinger Relative Valuation (source: Created by author using data from Seeking Alpha)

Read the full article here